1+1=chicken

When cuts don't make sense

Going forward, I’m going to bring the report back to its original purpose: delivering charts, VWAP insights, and a technical trading focus. The aim is simple—strip out the noise and double down on what creates real trading value.

To do this, I will cut the macro and calendar section. I will be sharing Comittment of traders data that we analyse with our propritary software. This is of strong value to any market participants. This week, Im going to leave this open to all and any who want to see what this all looks like, before we put thisd behind a paywall going forward.

The format is now

Views- a short abbreviated dialogue on what I am generally thinking about for the markiets for the week.

Articles-curated macro and market pieces worth your time

Trade – actionable charts and VWAP-based trade hypos

The simple reason is, I don’t want to look back at my reports and time spent, and see that I have amplified the noise around markets. It is irrelevant. What is important is price action and the setups.

I will still maintain the articles section as a curated type of macro section.

Let me know your feedback…no really, send me a message!

Views

The data for Q2 was good. Markets took strength from that and will continue to. There is NO SUCH THING as bad data until we get to the 17th September FOMC. Powell is expected to cut. Insanity, but he will most probably bow to the Trump pressure. It would be amazing if he did the prudent thing and hiked, however it’s a group vote. Trump is making inroads with filling out the board of governors with Doves.

Articles

Stock market’s fate comes down to the next 14 trading sessions

Economist Warns Fed Could Hike Interest Rates Despite Trump Calls for Cut

Replacement Migration- REPLACEMENT MIGRATION: IS IT A SOLUTION TO DECLINING AND AGEING POPULATION? A UN paper-MUST READ.

GDP grew faster in the second quarter than initially estimated

AMERICAS Inflation update tests Fed doves

Trade

ES

Commitment Of Traders

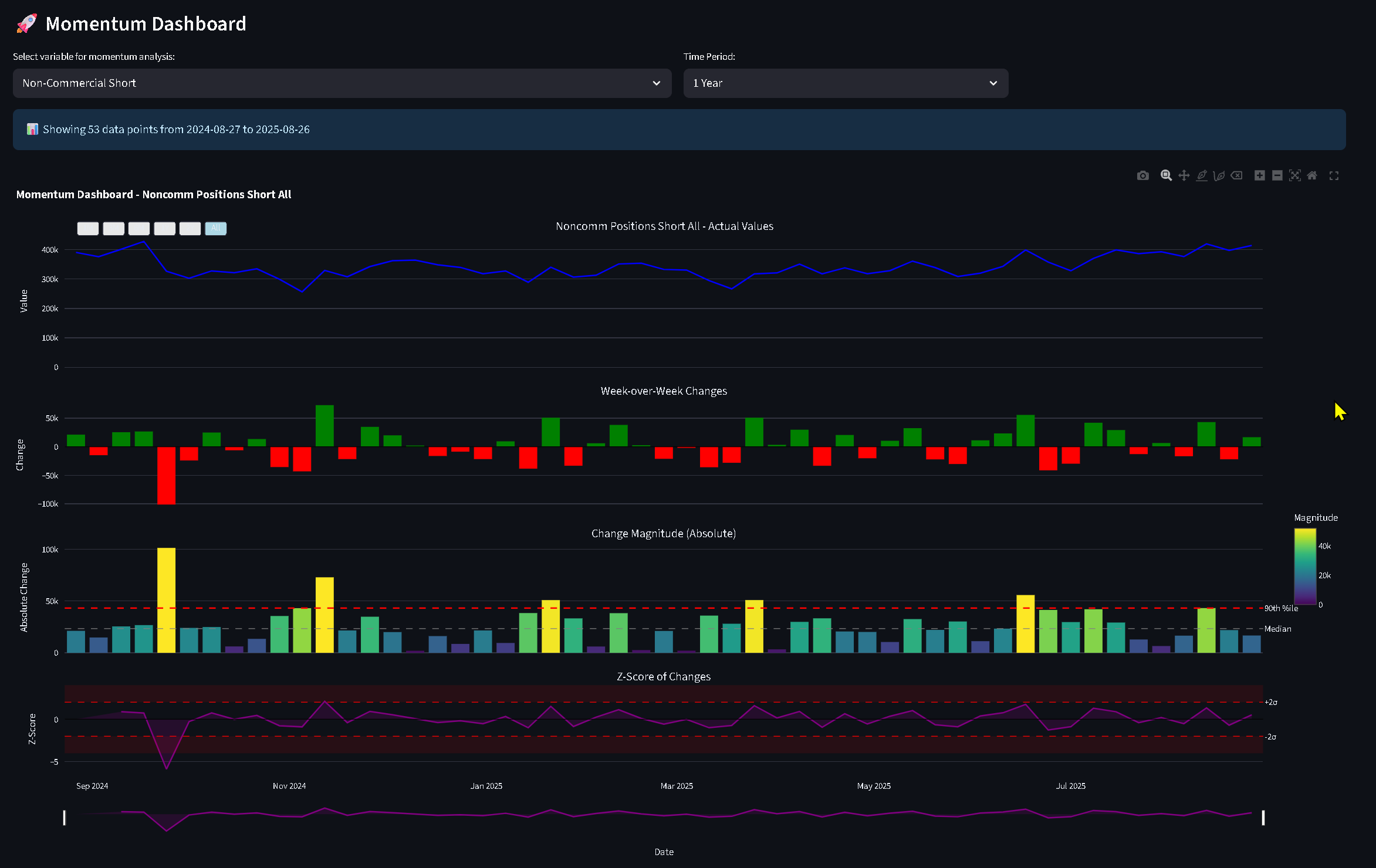

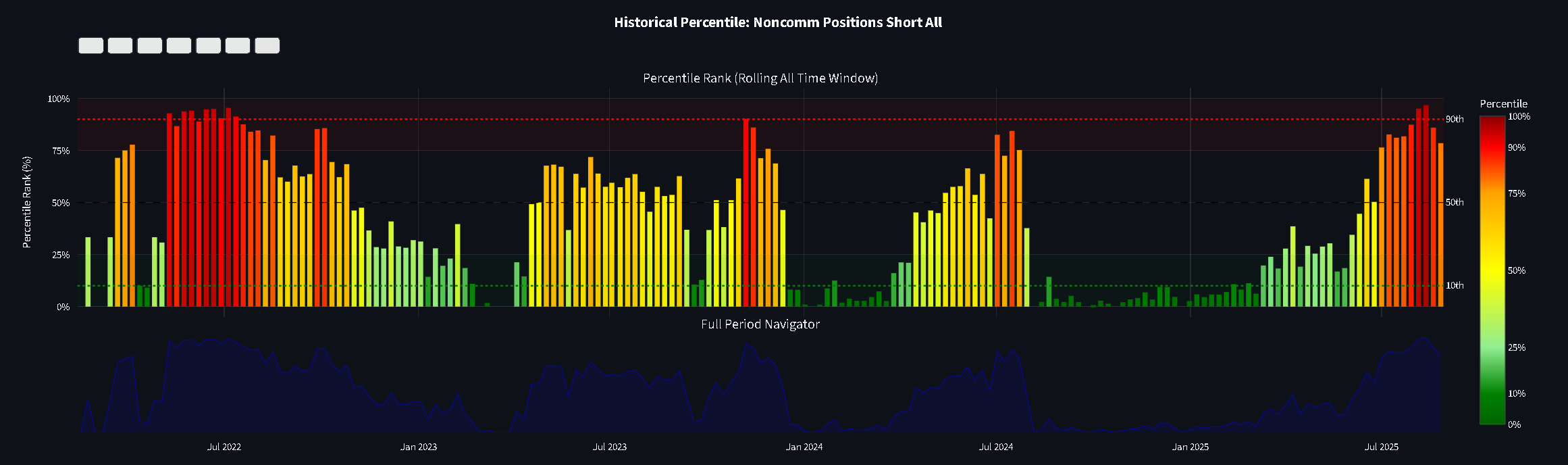

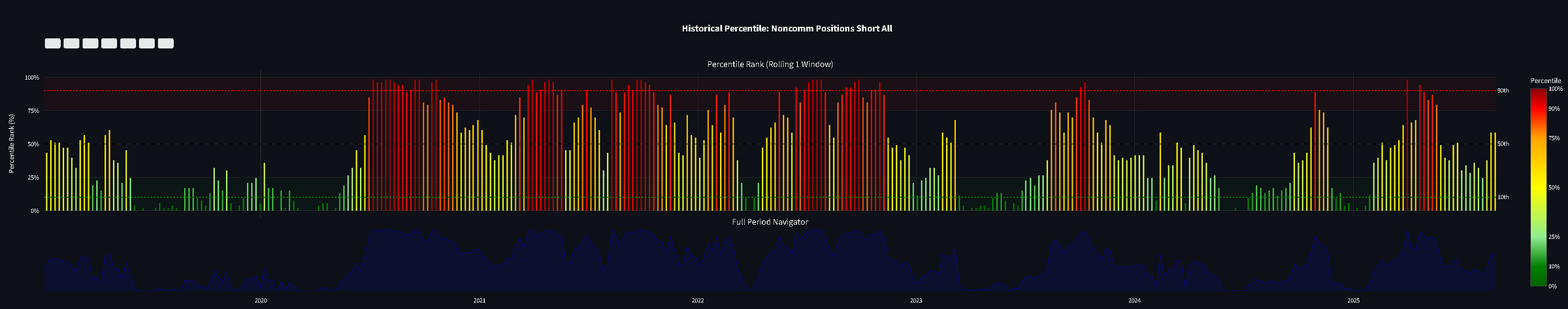

Non-coms continue to sell into these higher prices. Note a massive change on June 17th just in the middle of the 12-day war with Israel which saw a WoW increase of 55,754 in non-com shorts.

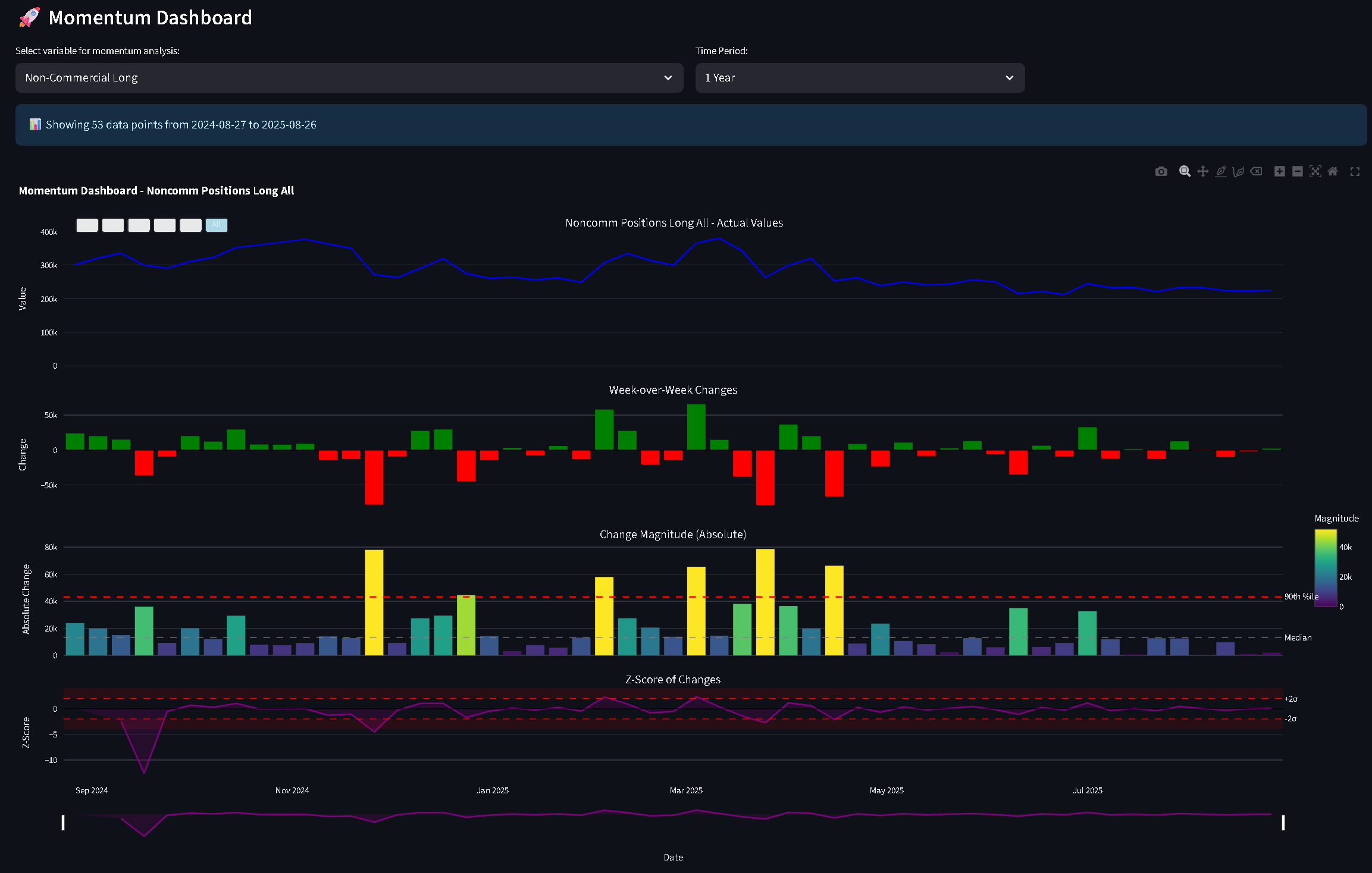

On the long side, light participation. The ‘‘sophisticated money’’ i.e Non commercials -indeed is selling the entire rally. It is only now that as we face NFP this Friday and the FOMC 17th Sept, that things are starting to look like they might pay out. Will they stay liquid throughout?

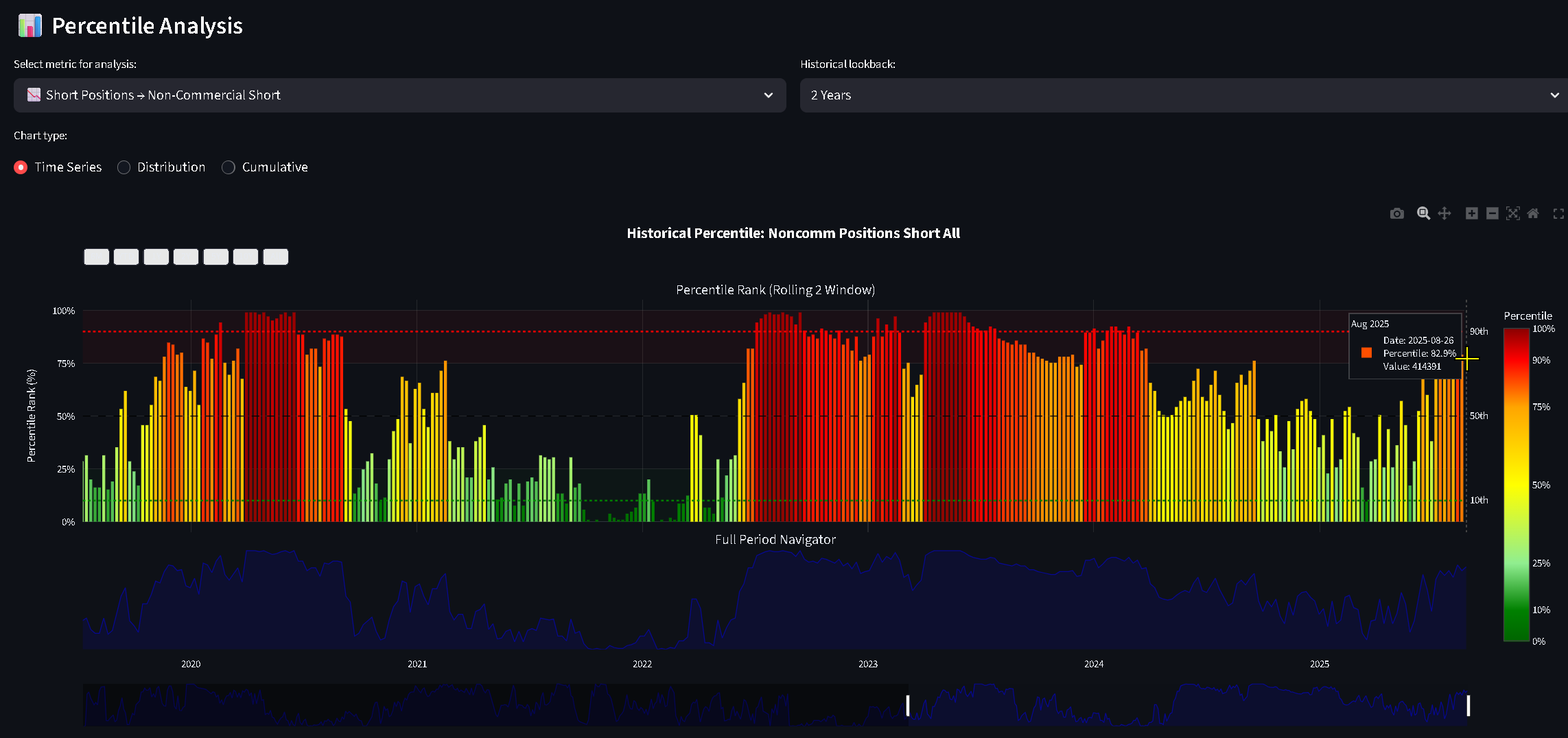

Crowding wise, Non coms shorts are only at 83rd percentile. So they could be more short.

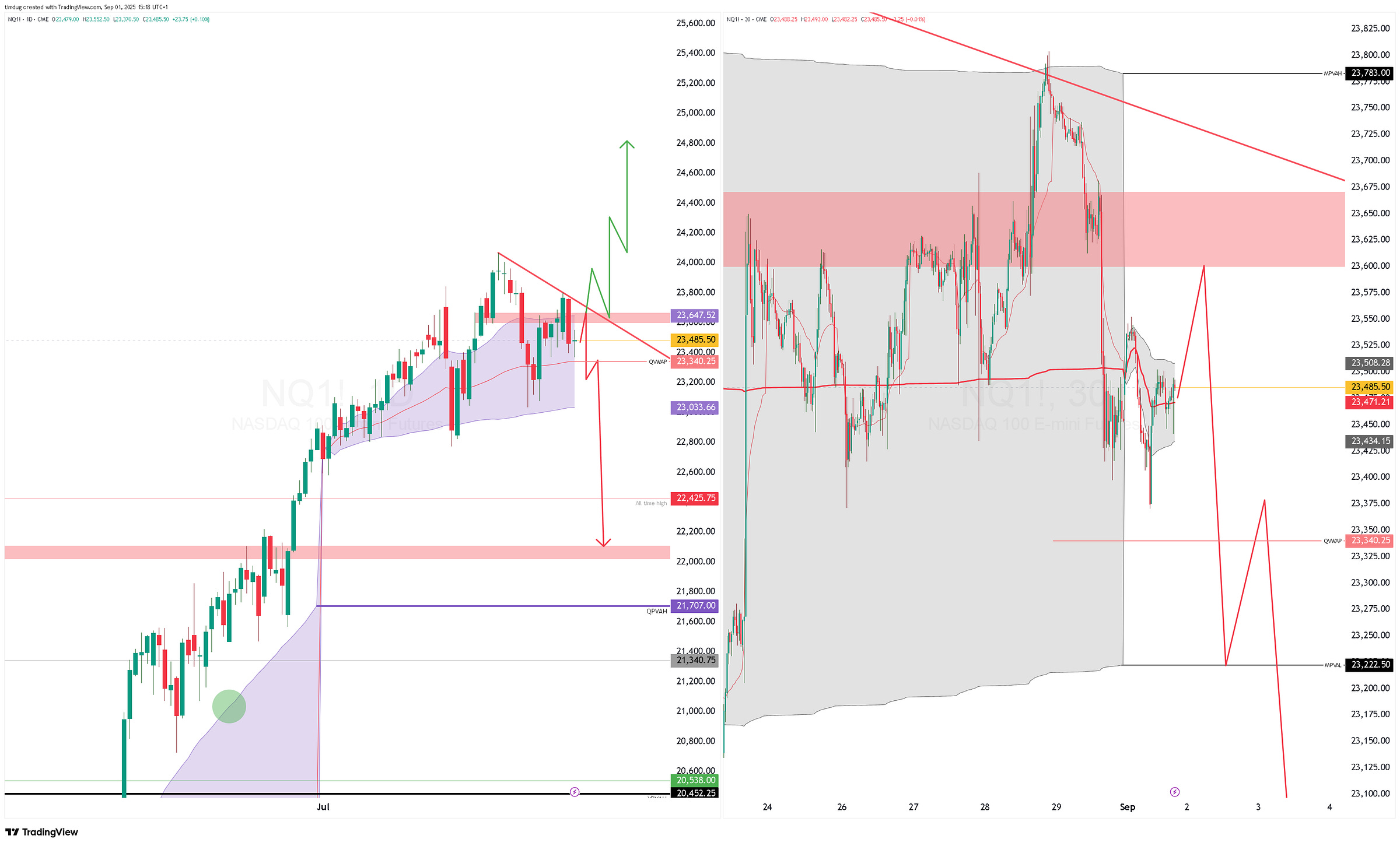

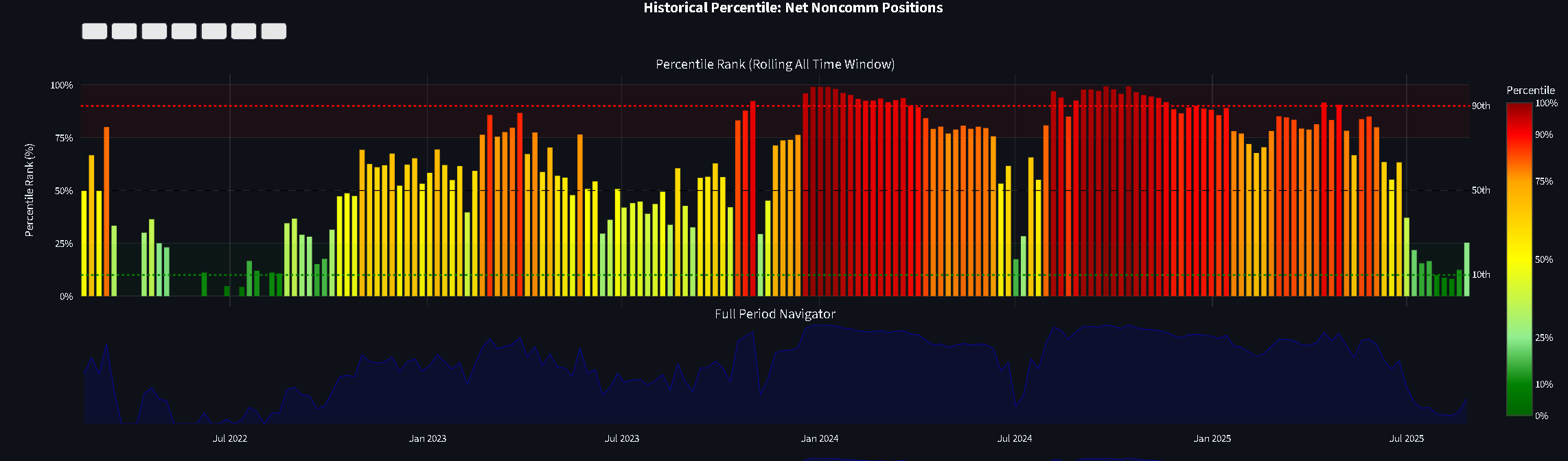

NASDAQ

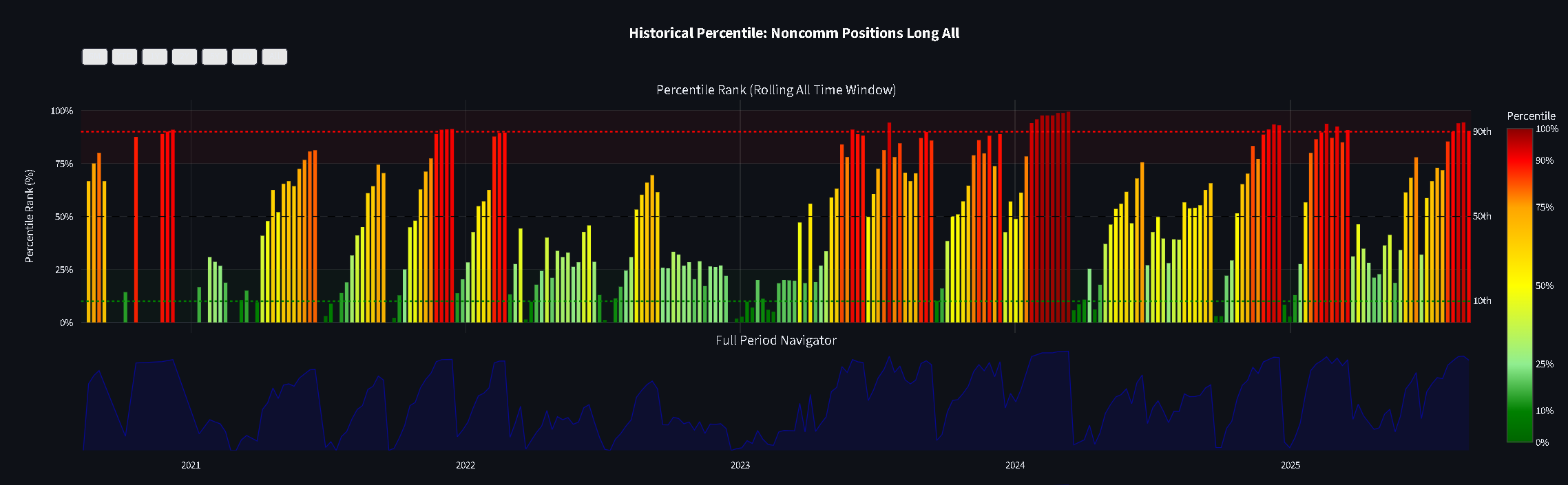

Non-com longs here into the 90th percentile. They have been a lot longer, like in early 2024. I suspect all the equities can have a sideways to up approach into the September FOMC. There are no real signs of weakness out there AT THIS TIME.

There are some great higher timeframe levels to work off of, but this is a beast of volatility.

Open interest actually dropped WoW -9143 contracts. 8000 of which were longs.

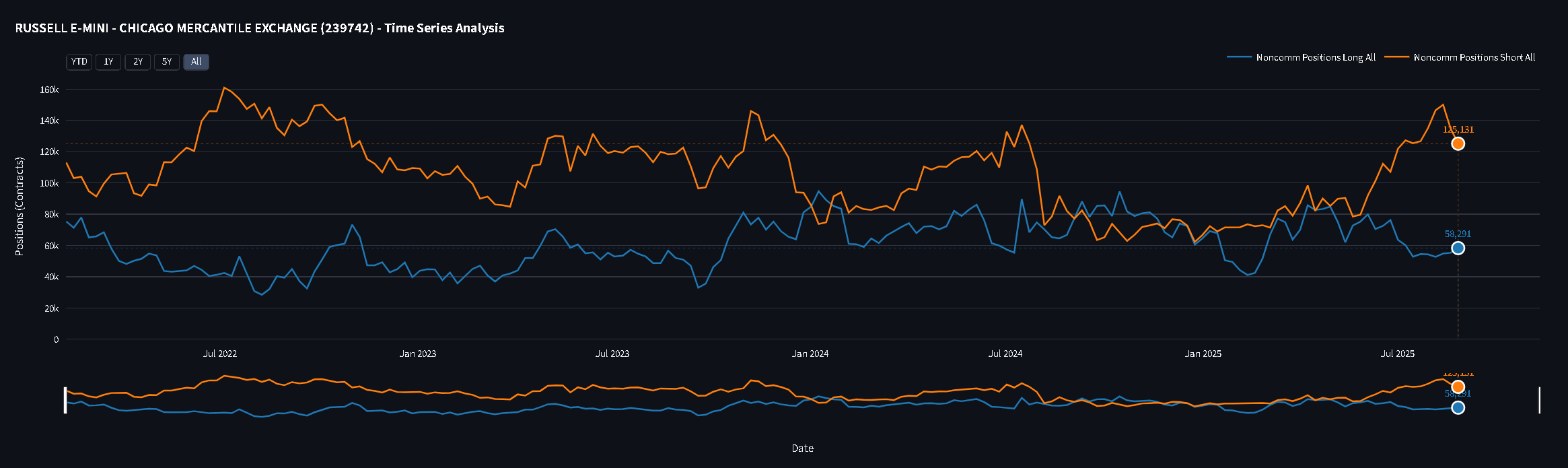

RTY Russell

Interesting that the Non -coms net position open interest increased from 12.4% the week prior to 25.3% WoW change. All time observations. A 100% increase WoW. Non-coms are building up their long position in the small caps here a small bit, as we face deep into the headwinds of NFP and FOMC.

Clearly this was a flattening of shorts as pictured below with a small increase in longs. This tells me that the hedge to the big caps is gathering momentum on the long side.

GC GOLD

It’s a full on breakout. The risks are compounding now. A fed that is going to cut into poppy inflation that has massive upside risks. An overheated tech sector and a DXY that is on fire. I’m not even going to get into the potential for Trump and Bessent to revalue gold. From a technical point of view, these breakouts are mostly followed by a few days counter move. I’m looking at Monthly PVAH to bring back the buyers.

Non-coms seem to be selling in the last 2 weeks into these highs, This is going to hurt. Only about 6% of all trading activity in this market is spread i.e Delta neutral-(less prone to large moves in the front outright)

C.O.T has not been a great indicator on gold at all through this power drive the last 12 months. Central banks making up the lions share of the scramble for physical bullion will not show up here.

SI Silver

Back to the futures! 1980 High $41.50 trading - Monday. Yehaww! Can it continue? Lets see.

When the horse bolts, dont chase it. I hold very little optimism this will pull back anytime soon to MPVAH $39’s. But if it does, I like that price for longs. However, as long as commercials keep selling into the market, price will facilitate higher. See below.

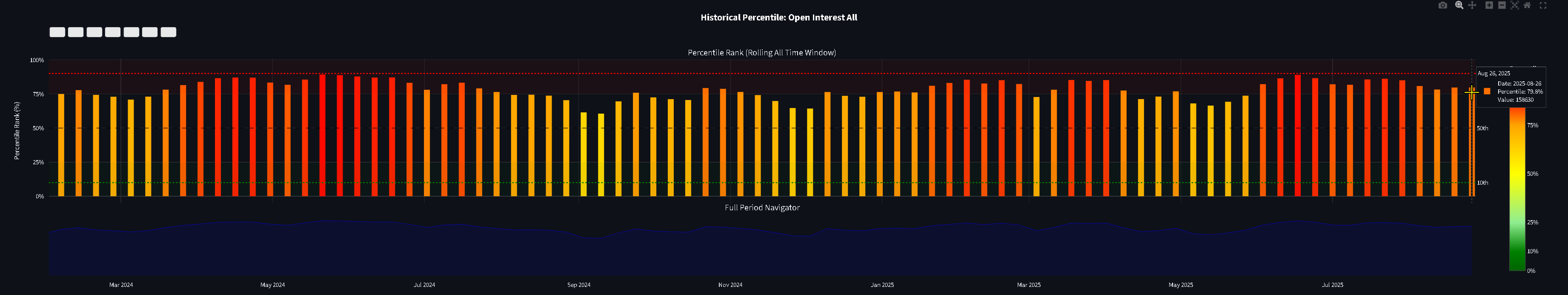

Silver open interest not even that crowded as per last weeks C.O.T report. 79.8% all time observations.

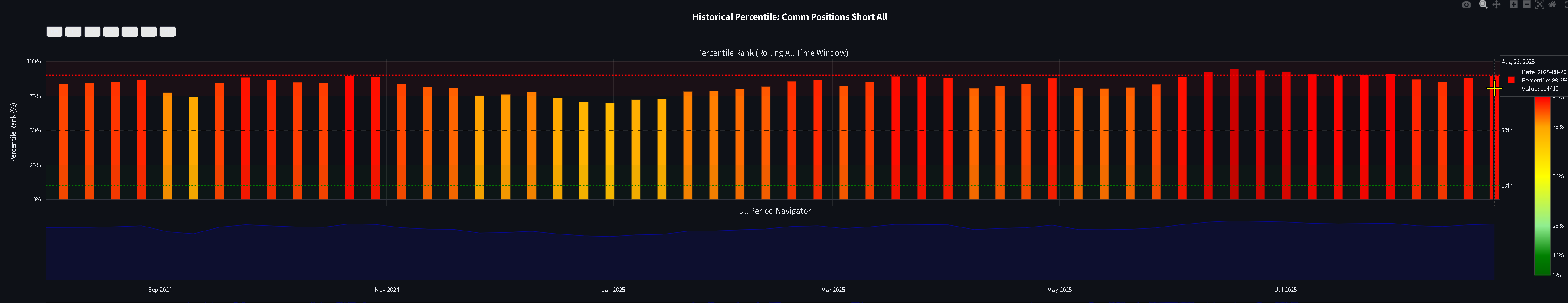

On the commercials side, they are locking in future delivery prices, selling here at the 89th percentile all time levels.

A canary in the coal mine here, is that we should be really attentive to when commercials start to retrace on their selling. This will make it harder for non-coms and small specs to continue the rally.

Alright folks. To wrap this up, I think we are entering a turbulent time for the markets.

This week’s NFP print will be pivotal. A significant miss could trigger a brief dip, but I’d expect markets to rally as traders price in potential FOMC easing over the next two weeks.

If that dip fails to get bought and losses extend toward - say -12% from the highs, the Fed would almost certainly be forced into rate cuts—regardless of the risk of overheating and runaway inflation, raising echoes of the 1970s. The deeper the pullback, the more pressure on Powell.

On the other hand, if equities rally despite a weak data print, Powell may be emboldened to hold rates steady and attempt to rein in frothy valuations.

Its a game that changes the type of ball and pitch each and every day.

We will be watching.

Be good.

Tim