Big wave

Dont become fish food

We have a monster data docket this week with US elections on the way Tuesday night into Wednesday morning. Here is a good timing list from CNN. On the last 2 elections I have stayed up and traded through it. These were in my pre children days. So this time around I'll be tucked up in bed with my coco and my current book ‘The Price of Time. By Edward Chancellor.

We will have the interest rate decision on Thursday also, with the 25bps now fully priced in, the markets will stutter and find it hard to rally further should Jerome not talk the bulls love language of more cuts at the next meeting or even the promise of another 50bps on the near horizon. I think he will let the market down on this front and the market will reprice further down, back to load up the buy low sell high traders ie. The smart ones.

The smartest of 'em all, Buffett has been doing just this. Something to be aware of has been Buffetts selling 25% of his Apple position. Earlier this year Warren sold a large chunk of Bank of America. Bringing the Berkshire cash pile to a whopper of $325.2Billion now. What does WArren know? Well it's pretty simple, buy low, sell high. And Equities have been high. In an election year, it simply makes good Buffett sense to take money off the table when we fly high in overvalued territory and buy on the next panic. It's as simple as that.

ES Z24

The marekt moves I am looking for here are actually quite conservative. I think that if we get a Trump election, the pullback could be pretty shallow and temporarily overshadow anything dower from the Fed. This would be a test of Q-PVAH $5696 and go..up. If it is a Kamala win, I dont think she has done enough to assure the markets she has a good financial policy or plan in place, therefore we would have a lot of downside risk in which only deep value buyers would get involved, so a move at the least back down to Q-PVAL where buyers should hangout. Over the coming quarter however, I dont see ES Not testing the greater downside with at least a 10 to 15% correction putting us nearer to the $5000 marker. Ill mainly be pplaying the bull market still on Trumps election and playing the short side and hard landing should KJamala get it. Thats about as political as I can get.

Oil CLZ24

I talked a little here about the China demand situation and how big a deal it is for global oil prices. It is a difficult time for oil traders. Our catalysts are seemingly well focused on geopolitical Iranian risk. Iran are making threats or are being threatened. Should their oil and energy facilities get hit, this would cause a major blow to Chinese imported stock as they are one of the larger buyers of supposedly sanctioned Iranian oil. This is why the markets pause when Iran's name is mentioned. Stay vigilant to this, however Israel has stayed true to their commitment to not attack Iranian energy targets.

With this in mind and NOT happening, oil will remain weak and we are imbalanced down on YPVAL $71.58s and now Q-PVAL 69.90s. Technically a seller's delight. However given the knife edge of catalysts, hedge funds have been quick to unwind large short positions they had on several times this past quarter.

So technically, Ill be looking at shorts on pushes into Y-PVAL $71.58 or QPVAL $69.90 areas once we breakdown M-PVAL $69.08. The breakdown of MPVAL will be a nice show that buyers are not thinking of doing much at the moment, so a pullback up after that break will offer up an expensive market. This all must happen in a vacume of any new catalyst that involves Iran getting fired upon or fireing upon someone. Should risk remain high or gather a new catalyst, I will be looking at longs MPVAL area. Seasonally however, I think we can easily go sideways for the month.

GOLD GCZ24

Gold is having the time of its life with upside crushing continuously this year. Are we going to get an opportunity to buy this at the Q-PVAH $2593? We may not, but it's the trade I am looking at until I spot one of the intraday trade ops running across my screen. It is difficult for me to break down in a short note what that would be, but essentially if we test a higher timeframe dynamic level intraday in what I call too far too far move, I tend to fade these and exit on the fading momentum. This is like a scalp hybrid with a position trade. Some are worth holding for a number of days, most are only worth holding for minutes to a few hours. It all depends on the overall market dynamic and correlations. The trick is in figuring out which one you are in and I certainly don't always get it right. The guys in our discord know that. We have lengthy conversations about some of these types of trades. These chats are one of the most valuable parts of trading in a group. You get to see things in a broader perspective and have traders who trade the same edge as you reflect back things you may be blissfully ignorant to, just because you have a great position.

Anyways, Gold! I would like to buy value ie. much lower. Who knows what this election will bring. But we should get a ton of volatility this week.

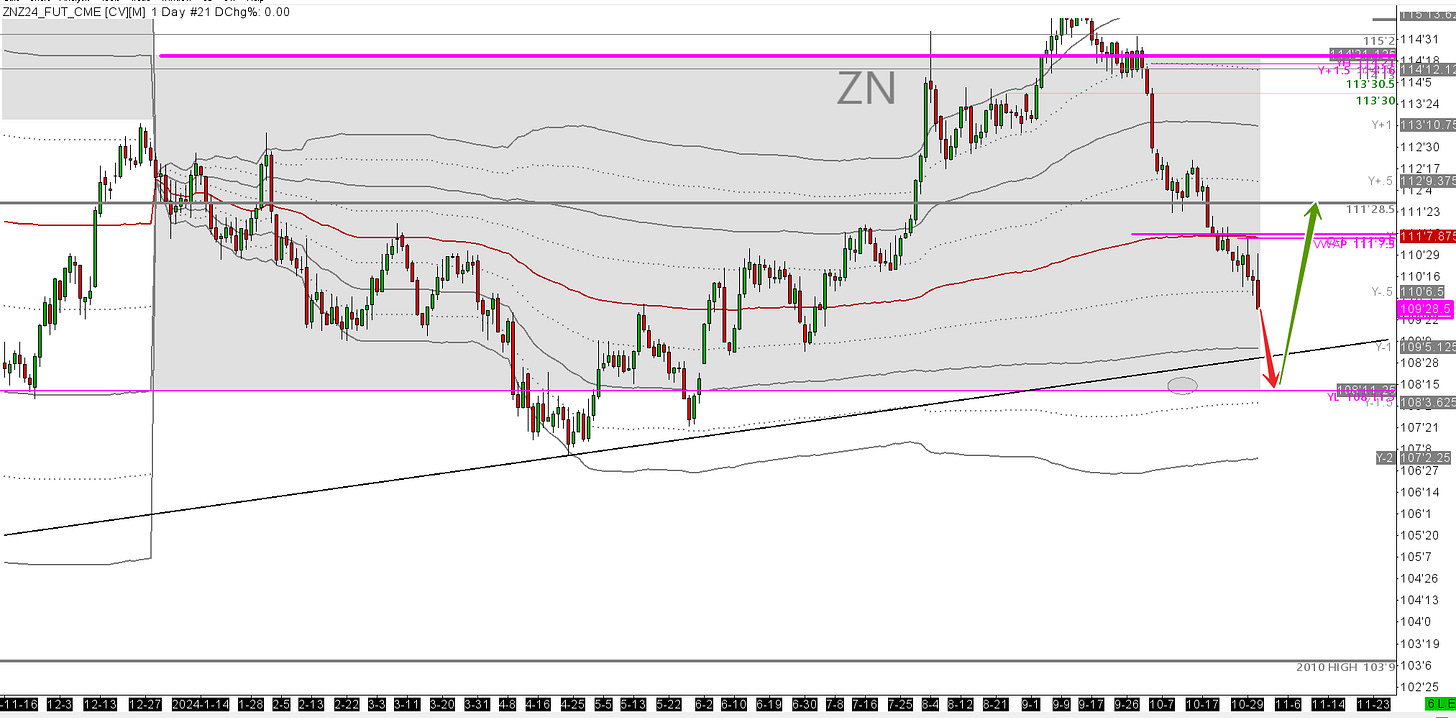

US 10 YEAR

Shes going down. Coupon rates will risse a lot this week, price on bonds will go down, then we should rally from around Y-PVAL $108’11.25. Getting long bonds at this levels makes a goos trade on futures, but a terrible trade on holding for duration given we have had much better coupon rates in September. Ultimately I would like to see the 10 year breakdown on the ypval in a big way and test the 2010 highs of 103’9s. But thats whishful thinking as The US Fed could simply not withstand interest rates at that level. A lot of things would break, including the US Government.

Okay that's it from me. This will be a great week to sit on hands and sit back with the popcorn. There will be some awesome intraday trades offering up value, however over this volatility most of these intraday trades will require you to exit with profits quick. I won't be sitting too long in trades. I'm calling a Trump election here. No bias, just looking at the numbers. Lets see.

Feel free to get in touch should you want to take some training or have a mentoring session with me to talk about your trading. I like to chat with traders.

Trading is Waiting

Waiting is Trading.