#boughtthedip

2nd shallow dip likely

This post has moved to The Oil Report.

Last week we were looking at the seasonality of oil. There is a rhythm to oil demand each year. This can be charted and a regular pattern that occurs each year appears. One that is 40 years old. So this pattern is what we refer to as seasonality. This is essential to spread trading any commodity. This is also how we can essentially estimate when volumes can come back for demand of barrels and also monitor for when that demand will not be there. My view is that we were incredibly over sold both coming into the OPEC+ meeting and even more so in the 2 days after.

To use a Paul Tudor Jones term, the market got way out over the front of its skis selling.

So we got a lift and the sick bags have been handed out all last week. A +6.41% move/ +$4.30

It is the role of financial media to be given a donkey (what happens on price) and they have to find a tail to pin on it (why price moved). Its not enough for them to say, oh, look at that, oil is up $4. Well who would have thought it.

So trading on the back of news pundits and what is said in the media is bullshit. We trade on what is happening on price and what has happened.

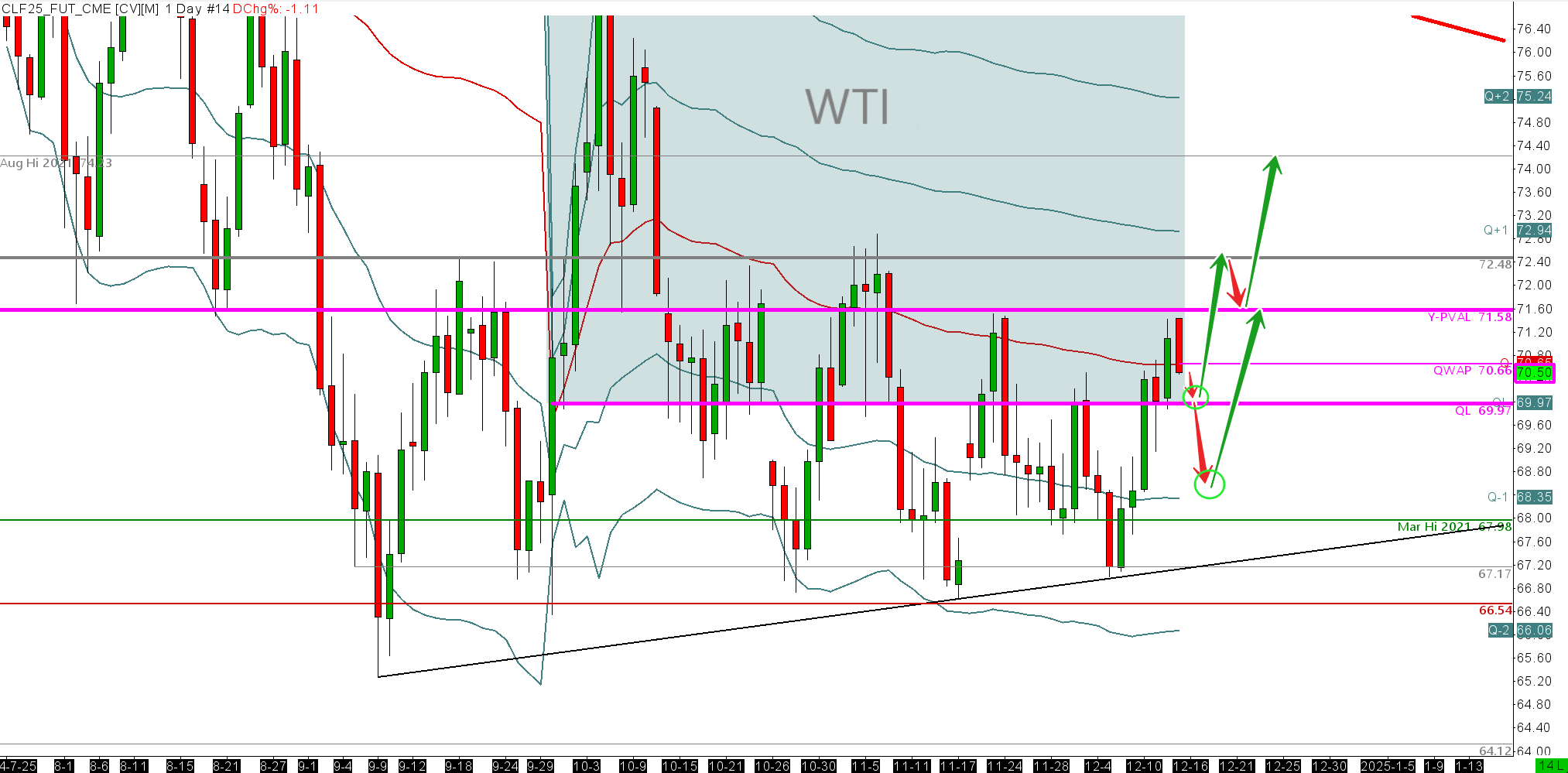

Here is the chart I posted in last weekends report.

Here is what happened

I cover this in a spread trading course that I teach to interested traders. This is not listed anywhere. Please get in touch if you are interested in spread trading commodities and want to learn. Four senior traders have gone through this in the last 12 months.

So what can we now point to that is bullish i.e what are the donkey tails?

The main one that seemed to beat the bull drum was that the IEA has revised their 2025 forecast from a surplus of 300k bpd to now a 100k bpd deficit. For most of this year, IEA and OPEC+ have been at odds over forecasting the outlook for 2025. With OPEC seeing a deficit and IEA shouting a surplus.

Well we now have alignment.With OPEC+ postponing the production restart and stretching it out across 2026, this makes them right. They kinda stacked the deck, but none the less have swung things back to the bullish side of the table. The only thing that can hurt everyone in the oil patch however is if Trump pushes another 3 million bpd production out of North America during his upcoming term in office.

A note on this drill baby drill Trump mantra.

If the drillers in north America do push production hard, there will be a lot of concern that production will simply not be sustainable at vastly increased levels. In short, the reason for caution is that fracked wells have a steep production decline curve

There is also caution being talked about in the oil patch recently. But in my limited experrience, as long as oil is above $60, Drillers will keep drilling. The new Taylor Sheridan series ‘Landman’ sees Billy Bob Thorntons character talking about the simple dynamics of north american shale oil.

I wont go on as I dont want to add to noise. Some weeks in The Oil report I will have a lot to discuss, other weeks there will be little change to discuss, like this week.

TRADE

CLF25

There are 3 probable areas for strong buying to continue to lift oil. I only want to play longs this week. The market has shown that it wants to go imbalanced up over the MPVAH $71.24 but currently volumes are low and there is no follow through. I think the trade at M+1 $70.07 will be the spot we have to monitor for strong imbalance to continue. If this does not transpire, I will be less inclined to be a buyer until we trade MVWAP $69.07. This is currently the average volume price for the month. I don't think I would like it long from here, but rather wait for it a bit cheaper at MPVAL $68.50, which will be the cheap price relative to the full prior months trade.

The overall bigger move up in oil I estimate still needs clarity and for us to get to April. Until then I think we are range bound under $80, above $68s.

Here is Oil on a decade long VWAP. You can see the average price this decade so far is $68.06 This currently holds.

3 Month Alpha VWAP course. 3 months at £275/ £825 one off.

12 Month Alpha Edge Course. 5 days free trial £250per month or £3000 one off.

4 Week Alpha Pro Course. 4 Weeks intensive learning.