CPI Cometh

Wait for it

In this report, ESM24 & CLM24.

Earnings of note to come: Home Depot, Cisco, Walmart.

https://www.tradingview.com/markets/stocks-usa/earnings/

Data Calendar

Monday- FOMCs Mester Speaks

Tuesday - OPEC monthly report, US Core & Headline PPI, Powell speaks

Wednesday - IEA Monthly report, EUR: GDP QOQ, YOY, US Core PPI & headline, US: CPI Headline & Core, Retail sales, , retail sales, Business Inventories and Department of Energy data.

Thursday US Jobless figures, Phili Fed manufacturing, Industrial production, FEDS Barr speaks, FOMCs Mester & Bostic speak.

Friday - EU Core & Headline CPI, FEDS Waller speaks,

Personally, it has been a difficult week off the desk with family matters and I really didn’t get much of a chance to trade, but I did want to catch the jobless number. The days were long and quiet data wise apart from a weak initial jobless data rising. As I talked about at length in last weeks report, there was the expected dovish reaction from the market and ES/equities traded up with Gold also moving in tandem. This week, we have a good calendar of events. The focus of volume this week should be for Tuesday and Wednesday.

EQUITIES

Not much in the status quo has changed from last week. The FOMC/ Fed remain vigilant towards cracks in the economy, thus standing-by with the cutting block should the wheels start to rattle in jobless figures, NFPs. However, this concept remains only sound should the CPI figures continue to print within the variance of 3.5 (recent CPI data) Range for 2024 is 3.1% to 3.5% YOY headline.

In the face of these slightly higher CPIs, we must remember the market is not going to be too sensitive given the strong US economy. Have a read here from Apollo Academy research. The Fed however have a problem on their hands now. It is the dreaded spectre of da da daaaaaa Stagflation! Cue scary music. So let’s get out our checklist.

1. Inflation rising again- check!

2. High unemployment rate - mmmmmmm might check!

3. Slow growth- no!

Stagflation. This is the ghoul that the media will continue to roll out over the coming weeks to scratch the backs of the bears.

But as we go forward, if we start to see this hard landing i.e. a slowdown of economic growth i.e. lower GDP AND another steady month of rising in jobless figures with a negative GDP, then there is reason for selling. But until then, bulls will bull!

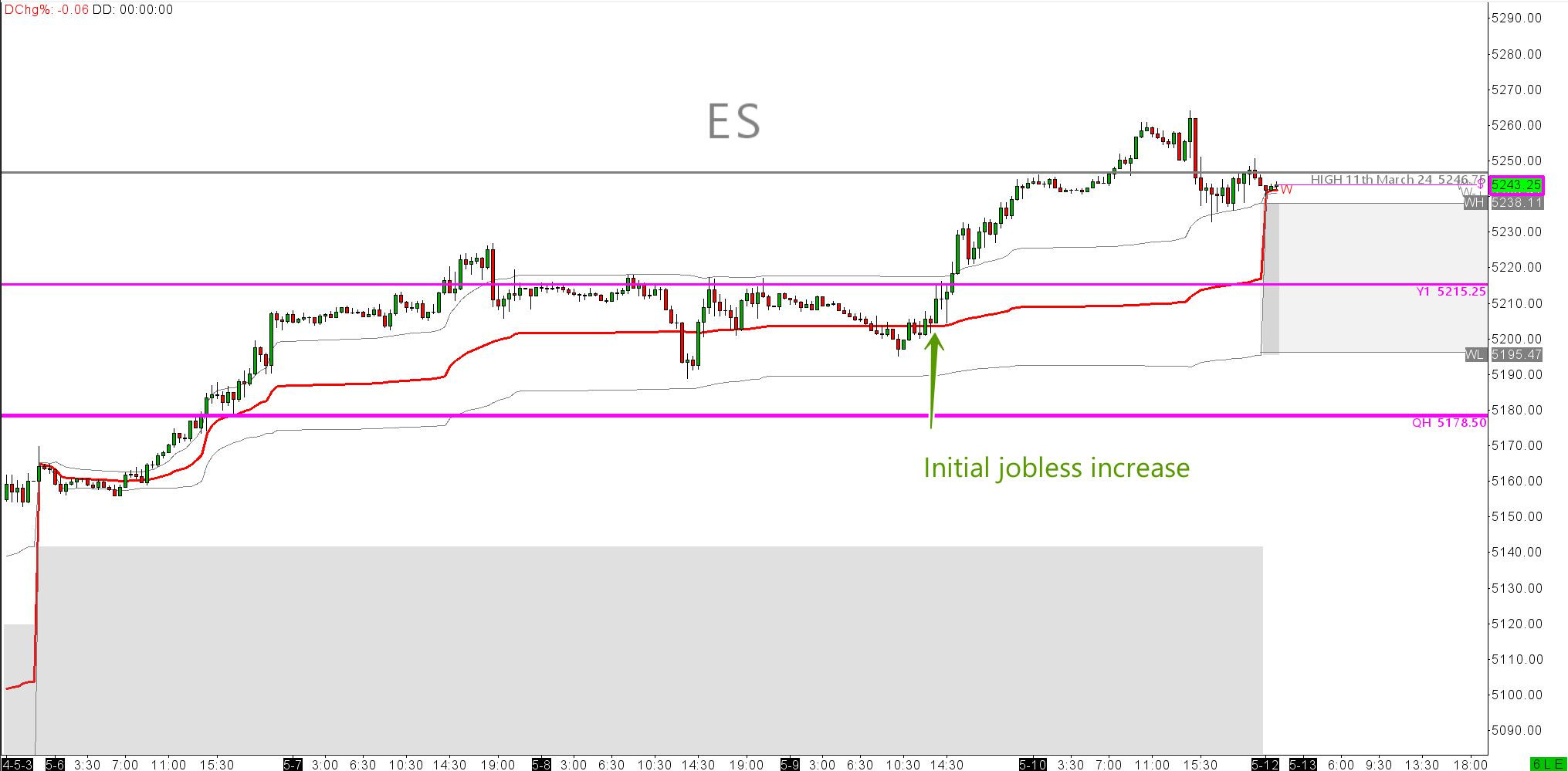

ESM24

Last week the market moved relatively quickly on Tuesday to the resistence point of the Yearly+1 Deviation $5215.25 and pretty much camped out there until Thursdays data. The bulls be running! We then hit an upside resistence point of 5246 High of 11th March 2024. This is where we basically trade arounds the reopen now on Sunday evening. With a slew of CPI and jobelss data to come, the market will be hard to read should we get another rise in CPIs Wednesday, however the bulls are here and they are not afraid. I would prefer to trade this 30 mins after the open so as to not get washed out over a false move to the downside. MNy base case is that buyers will let sellers have a go at a hot number and then take control back to where we started and rally to what may turn out to be new all time highs either this week or next.

We can utilise the weekly vwap and prior value area/ auction area in order to stay on the right side of the market. Long above PVAH 5238, Short below. I like leaning on this $5246 level also for long above, short below. We will then utilise the actual moving weekly vwap itself to get in and out of trades or most of the time, to stay with trades..

ENERGY

Energy Spreads.

For those that are interested in spread trading energy, oil, heating oil, nat gas etc, trade calendar spreads with some tasty seasonal spreads coming up with entries set for 23rd of May this year.

Please understand that in oil until June under the presumption that OPEC+ Will extend their cuts through to end of year if not at the least for another quarter. When we get to the actual meeting week, we will revisit the landscape. If you trade oil and or the broader energy landscape, you MUST MUST MUST subscribe for free to John Kemps newsletter. He is the Senior market analyst specializing in oil and energy systems at Reuters. Subscribe here.

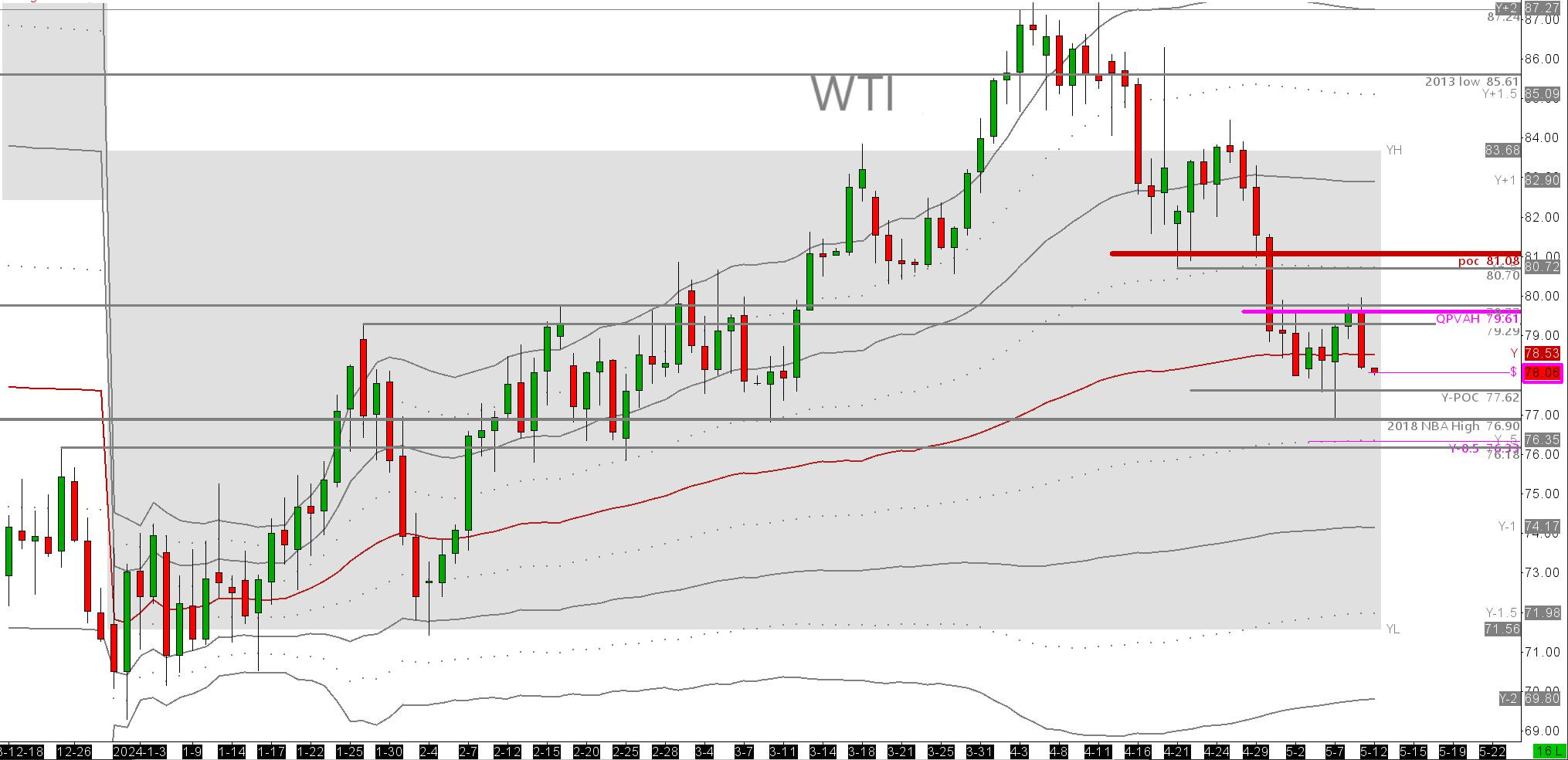

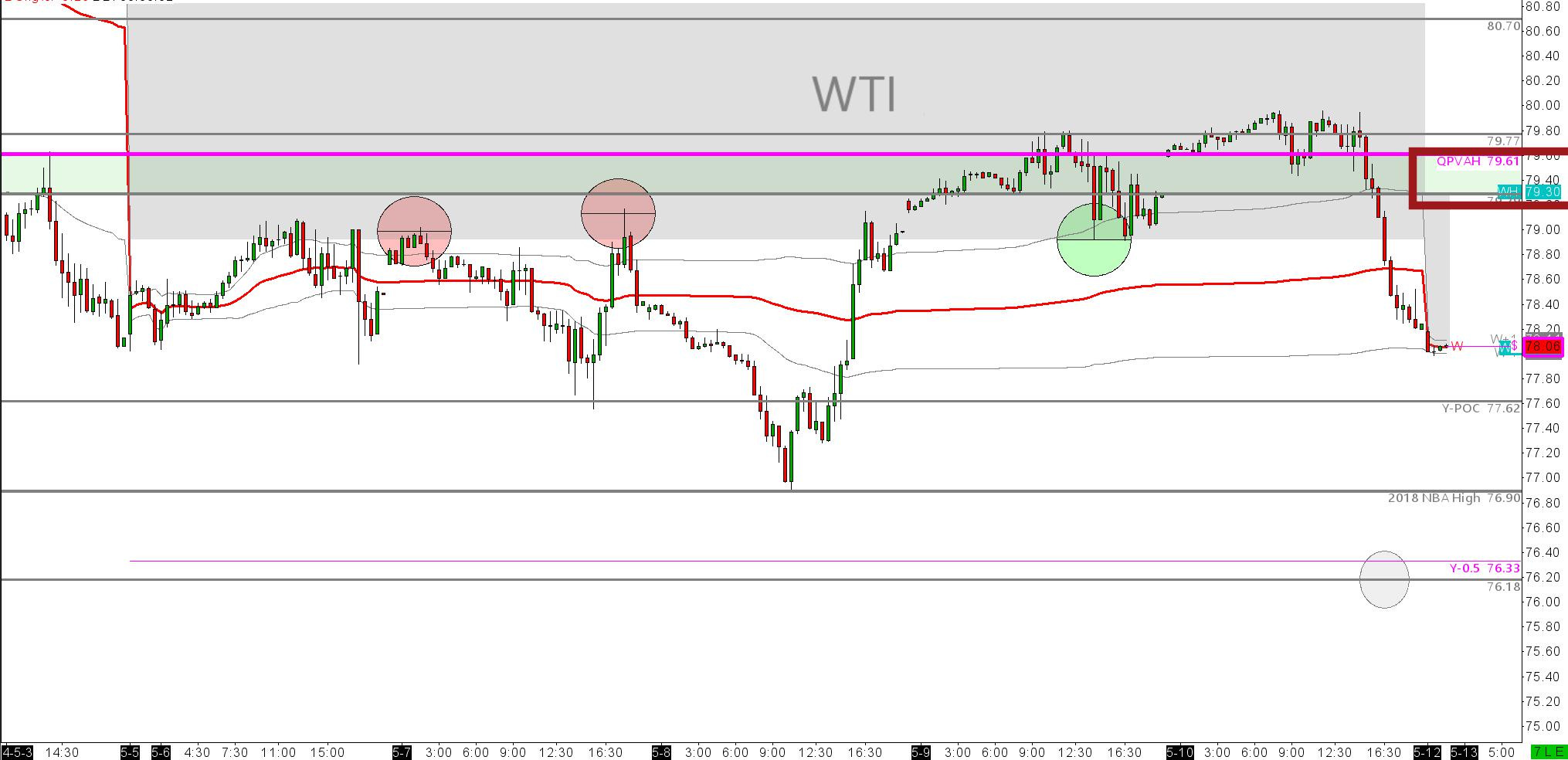

It has been a tough week for the bulls to say the least. I’m seeing resistance at QPVAH 79.61s and WPVAH 79.03s. Support at $76.18s. There was incredible buying to the tick at the 2018 non back adjusted high of 76.90s. I have had this on my personal and streaming charts for a while however it was not on these reports charts last week. I cannot claim to have traded it as I was off the desk for most of the week. Considering this, should we need to retest down there, I don’t think the buyers will reload it. We may spend some time there, if we do, we should still auction down, like supports that were just not holding at the yearly VWAP- approx. $78.50 2 weeks ago. We got there, consolidated, limped out some tiny, short rallies, then failed down. Watch out for this on last week’s lows should we get back there!

We seem to be setting up nicely is an auction inside last week’s value area- as shown below. High $79.30 low $78.04. I have also highlighted areas where I would normally look to execute longs and shorts against the W-PVA Weekly prior value area. The oil market has flushed out the war risk premium now. It can certainly rebuild one should the conflict take a new turn. If this does not transpire, we are auctioning down from the Quarterly PVAH $79.61. A retest from there should attract heavy selling without a macro catalyst getting in the way. This should be worth riding down.

This way of looking at markets might be familiar to some, alien to others. There are some trading gurus out there that gate keeps a lot of this information and how the market can be traded utilising this edge. I recommend that you not spend large amounts of money with a lot of them as once you understand VWAP and auctions, this can be extremely simple. Just read this report and setup your charts. What is difficult- is when your brain stands in the way and tells you to do something out of blind blind blind emotion.

As always, keep it tight out there. Trading is waiting. Waiting is trading!