CPI Heating up

Inflation bubbling on the stove

As always, a share, like, comment is always appreciated.

In this report: Inflation seedlings sprout as CPI and PPI run hot, yet markets keep buying dips. The Putin-Trump Alaska summit ends with no deal, Zelenskyy pushes back, and we chart setups in DXY, YM, DAX, Bitcoin, and Gold.

Views

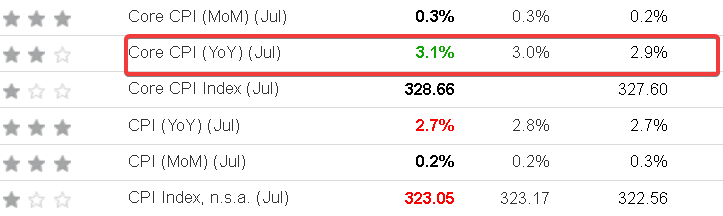

The green shoots of the inflation seedlings, planted on Liberation day, are staring to sprout. Core CPI (excluding food & energy) rising at the fastest annual pace in 5 months- see below. The market however DOES NOT CARE. Tariffs and resulting inflation is NOT a concern to speculators. CPI & PPI run hot, buy the dip. Powell to get sued by Trump-moderate dip-buy it. Tariffs up to 100% on pharma-buy more. I’m trying to learn as much as possible from some great mentors who have been in the markets for up to 40 years, and they all come back to the same sanguine spot- It’s going up! Stay with it or don’t short it- nothing more. You can talk all you want about this and that, at the end of the day, ‘don’t fight the tape’ is all you need to know.

It was/still is my thinking (and that of many others) a few months ago that once pre tariff stocks had run out, it would be a matter of 30 days before inflation would start to show up on the ‘high frequency data’. This includes CPI, PPI, Retail sales, prices paid, PCE etc. Well we are now 5 months on from April and I think we have until mid to late September for the data to crack up the heat . The ‘Frog is getting boiled’.

The question now is more about, where does this leave The Fed? Why would Jerome Powell cut now? Markets are running hot, but the area where The Feds mandate sits is in jobs. And if you haven’t been around for the last NFP, jobs are looking terrible. Again, the market shrugged. Jobless and claimant counts are holding up pretty well. However, the fed is looking at PCE data for signs. An analyst during the week commented,

‘‘If you are waiting for jobless numbers to print up, you are already too late.’

Bottom line- IT IS HAPPENING. And they are buying all dips on it! We are yet to see any great level of dipping, however, the bulls have yet to get any real test.

PPI came in Friday, confirming the inflationary picture also.

As highlighted last week, U.S. indices are trading the tech A.I. boom story and the top 10 companies in America-not the broader index. This is starkly obvious when you compare YTD performance of the SP500 Equal weight to the S&P500. It’s easy as a market participant to get wrapped up in this swan song of American exceptionalism. But if you wake up, you get to see that growth in Germany’s DAX +21.26% and UK’s FTSE+11.31% are far outperforming the U.S. Year to date. SP500