Crosswind

Macro turbulence

"If you are shorting bonds, I think you are on the wrong side of the bet," he added. "There will be less debt needed as we stop wasting taxpayer money on crazy things."- Elon Musk

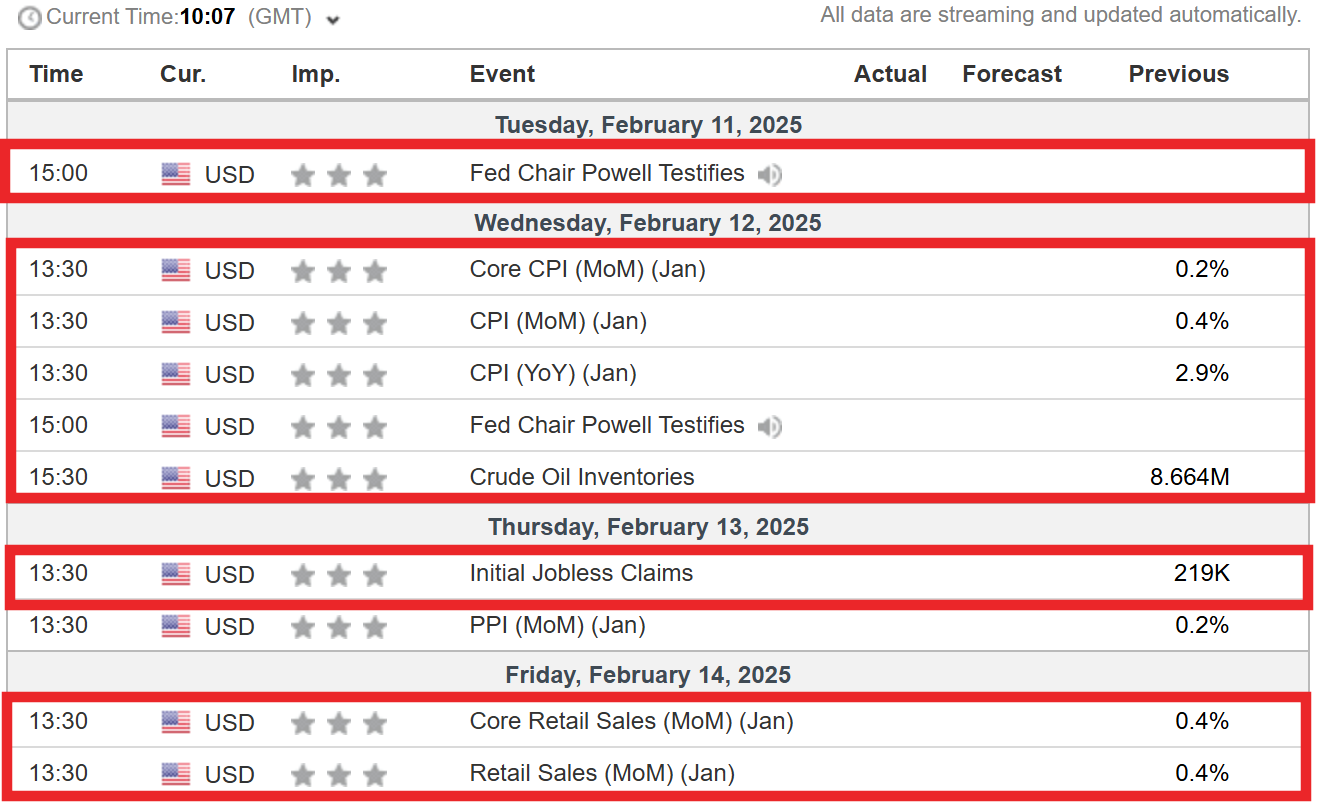

Calendar this week is packed with points of volatility. From the previous FOMC meeting, focus remains on the jobs market and more rate cuts seem to be a distant shout now, with Fed funds futures pricing in a 43.1% probability of a 25bps cut in the 30th July meeting which should get priced more and more out towards the end of the year. Fed speakers during the week had no motive to change anything based on the data, CPIs, PPIs, jobless figures, NFP, GDP are all pretty good. Goldilocks! Not too hot, not too cold. The takeaway, the markets are going to run, run and run and dips will be bought. I dont think there is anyone out there that is talking about weakness, major cracks or systemic risks. All we have to fear are tariffs as discussed in last weeks report. This is when things get uncomfortably comfortable.

Earnings this week from MCD 0.00%↑ , KO 0.00%↑, AIG 0.00%↑ CSCO 0.00%↑ and MRNA 0.00%↑

Catch-up

Where to start? It has been a whirlwind since Jan 20th and there are no signs of stopping. Since the last report the highlights are:

OpenAI and others seek new path to smarter AI as current methods hit limitations

How Trump’s Tariffs Aim wrecking ball at the economy of the Americas

Trump put Canada and Mexico on 30 day probations regarding tariffs. 10% tariffs deployed on China.

Musk given full control over USAID shuttering the office. Stemming unchecked flow of funds and corruption. I will be writing a special report on thsi during the week as I have experience of raising finance from USAID in the past. There are some things that have to be discussed. The Department of education is now next on the chopping block, with members of congress stopped at the door of the department on Friday. Whilst this headline is shocking, the panic of democratic senators at the door speaks to a more interesting question. What is being hidden? Interesting critical read here

‘‘Currently, federal contributions account for approximately 8 percent of funding for elementary and secondary education, with the remaining 92 percent coming from state and local sources’’

Trump pre-recorded an interview with FOX news that will air during the networks pre-game show Sunday 9th Feb. One to watch for trade next week. Who the hell knows what could have been said

Trump says that Gaza will be handed over to Israel and issues sanctions on International criminal court .

White House enacts fresh sanctions on Iran in efforts to curb nuclear capability development. Return to ‘maximum pressure’ policy of his 1st term.

On Bonds

Reference the chart at this top of this report- I’m sure this is fine.

One thing here doesnt make sense. If you are short the bonds, then you are -at its basic form- long the stock market! If the bonds supply and yields are to contract due to less government spending and a strong stock market, this means bond prices go up and your short = loosing money. This bond increased short positioning makes no sense as a trade, but nothing in the futures/ commodities space makes sense most of the time. Just an observation.

Macro

Anthony Crudele put it the best. ‘‘Markets are caught in a crosswind here’’.

The stick rather than the carrot manufactured the actions Trump aimed for on Monday/ Tuesday with the expected market reaction or a roundtrip of mild proportions across US equities and the DXY. Sell the rumour, Buy the fact! Markets will tread carefully over Feb/ the probationary period for tariffs on Canada/ Mexico.

Earnings from last week

Full list here

PLTR 0.00%↑ : EPS BEAT 0.14 on 0.11 /REV $827.5B BEAT on $778.17B

GOOG 0.00%↑ : EPS BEAT 2.15 on 2.12 /REV MISS $96.47B on $96.7B

AMD 0.00%↑ : EPS BEAT 1.09 on 1.08 /REV BEAT $7.7B on $7.54B

DIS 0.00%↑ : EPS BEAT 1.76 on 1.45 /REVS INLINE $24.7B

QCOM 0.00%↑ : EPS BEAT 3.41 on 2.97 /REVS BEAT $11.67B on $10.93B

ARM 0.00%↑ : EPS BEAT 0.39 on 0.25 /REVS BEAT $983M on 946.8M

AMZN 0.00%↑ : EPS BEAT 5.32 on 5.3 /REVS BEAT $$187.8 on $187.33

Cracks

I broke down a top level technical analysis on each company in a separate report here. If we are going to trade S&P500 Index, it is imperative that we monitor what 35% of the concentration is trading like. The Magnificent 7 are starting to show some cracks. DeepSeeks arrival on the block was the first of shots fired in what may become a longer, real test of true value across the tech group.

The narrative

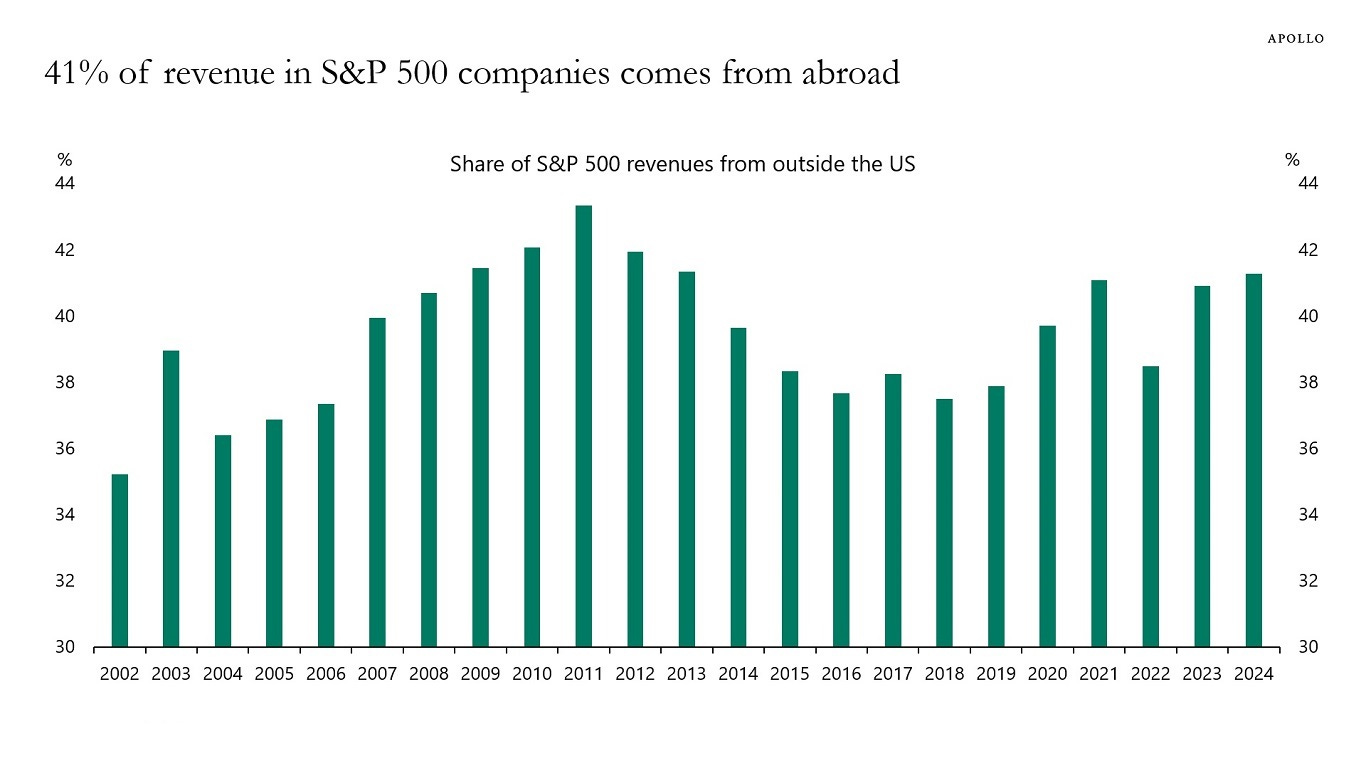

Torsten Slok's recent Bloomberg appearance following the Non-Farm Payrolls report highlights a crucial point. While we are in a Goldilocks era of the economy, the ongoing trade war, characterized by escalating tariffs, casts a shadow on growth over the current market optimism. While the 'Trump-town, markets-to-the-moon' narrative prevails, the delayed impact of US-China trade tensions shouldn't be underestimated. It would be imprudent to dismiss the impacts. The high frequency retail sales data will be closley watched.

DXY SPOT

The FX markets remain 100% wild at the moment with ‘cross-winds’ blowing a gale.

Look for resistence seen last week to hold and for DXY to trade lower. More tariff tennis= higher dollar. Step back from tariffs and negotiations = lower tests to $106.56

S&P500 ES H5

We closed at MVWAP for ESH5 on Friday. There will be a level of buyers in here, but given the context is that we are auctioning down from the MPVAH, We may see those buyers forced to puke and re-enter at MPVAL $5927.25

Dow Jones index YMH5.

Looks like the Dow may offer up yet another dip buying op on a reversal into YVWAP $41,796. What a v shape recovery looks like.

NASDAQ

Given my analysis on the Mag 7, it is a non zero chance that we have a tech driven dip, auctioning NASDAQ Down to YPVAH $20,445 to then restart the imbalance up picture for the rest of the year. I am in no way bearish tech, but I am a firm believer in the auction process. This is simply the pullback I see possible.

Quite a move to come either way. The close at MVWAP $21,575 should have found buyers on Friday. As this didnt happen, I am sceptical they will come in on the reopen this evening.

10 Year US Treasury bond.

Now auctioning inside of YPVA (Prior years balance auction). I expect buyers to keep defending YPVAL here. See above for the short squeeze that is about to unfold.

Okay folks. In fashion with the year so far, its going to be an interesting week. Checkout the podcast from Market Wizard Jason Shapiro and humble degen self. Shekels & Shamrocks.

Please follow the report on instagram, tiktok or X.com to stay up to date.

Keep it between the ditches out there!

Tim