Debt Destruction tool

How governments nuke debt

In this report: Inflation is fiscal violence, the demographic problem, wealth inequality, US Debt, Historical examples of inflating away debt.

In Summary:

This report explores how governments quietly reduce their debt burdens through inflation — a process that benefits sovereign balance sheets but punishes savers and the middle class. From post-WWII America to present-day policy under Trump and Bessent, we examine the tools of financial repression, the demographic time bomb facing developed nations, and the widening gap between asset owners and wage earners. Inflation may be silent, but its impact on wealth, policy, and society is anything but.

Articles

Under Pressure: The Squeezed Middle Class

What Does It Mean For The Government To Inflate Away Debt?

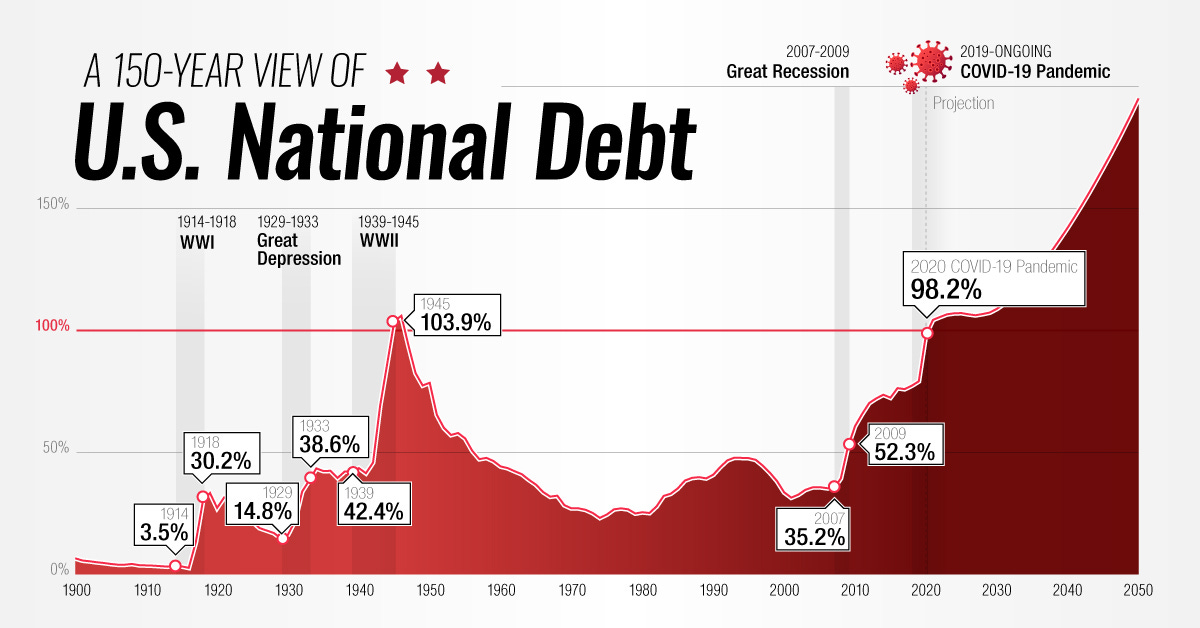

Timeline: 150 Years of U.S. National Debt

World inequality database

Does Gary Stevenson understand economics? Inflate the debt away

NOMINAL =actual amount i.e $10 is always $10. REAL = adjusted for inflation.

If you locked $1,000 in a safe in 1950, its face value would be unchanged today — but its purchasing power would have shrunk by over 92%. In contrast, if that same $1,000 had simply kept pace with inflation, it would be worth $13,029 in today’s dollars — a powerful reminder of what inflation silently steals, but for the biggest debtors, it is a silent miracle.

As inflation rises, the amount of debt owed stays the same, but its real value goes down, the same way $1000 cash in 1950 could buy a car. Today it buys you a phone. That’s because inflation reduces the buying power of money, making each dollar/Euro/Pound worth less over time.

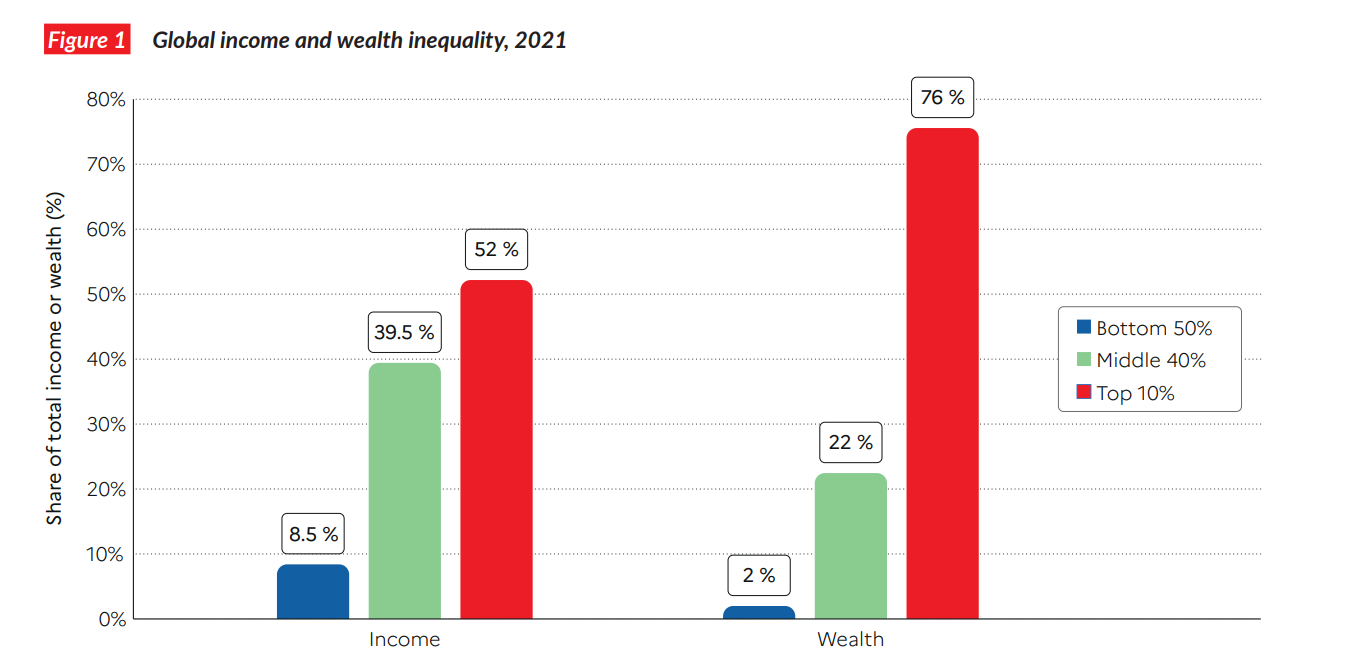

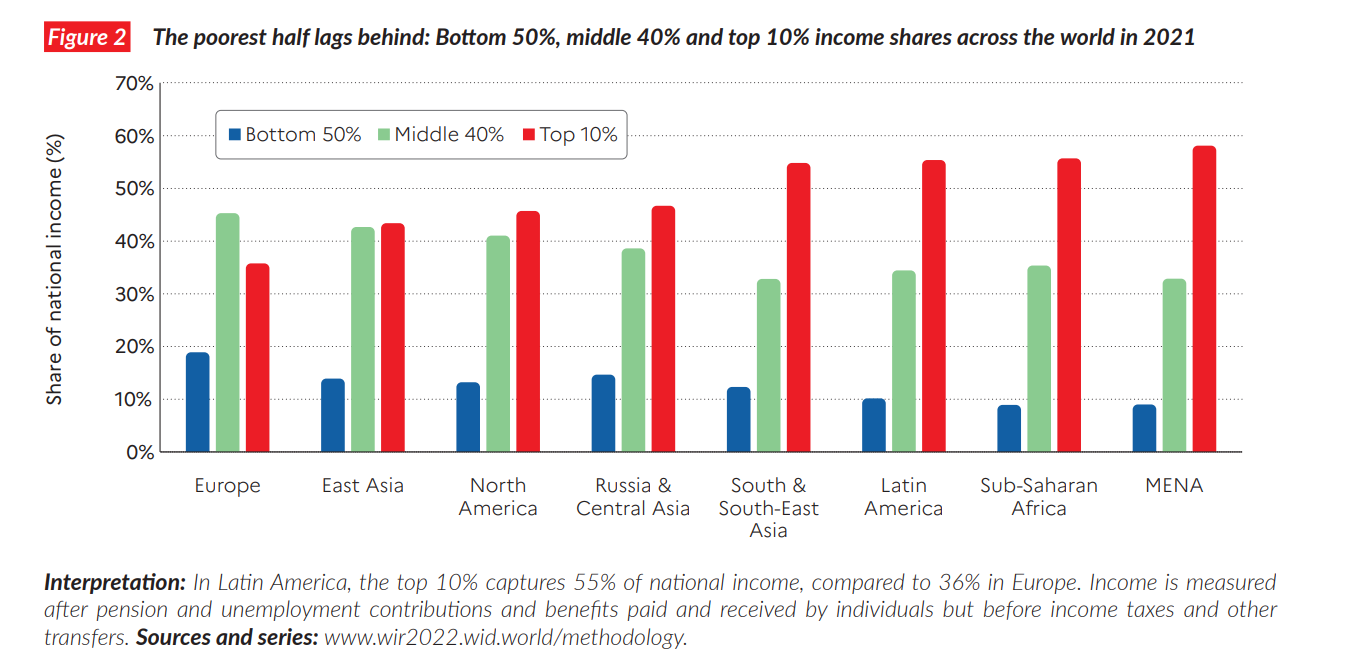

This also means governments can pay off their NOMINAL debts with REAL money. Inflation helps reduce the burden of debt without changing the amount owed. At the same time, you get an increase in income inequality and a flattening out of the middle classes due to the decrease in buying power. Wages do not increase inline with inflation, though they should.

For the wealthier, their assets track (and in most cases actually far outperform) inflation, so they see less/no nominal money destruction- their $10 today, will be $11 next year- getting wealthier as inflation moves up. People not invested in inflation tracking or inflation outperforming assets, get the short end of the stick. Their wealth decays.

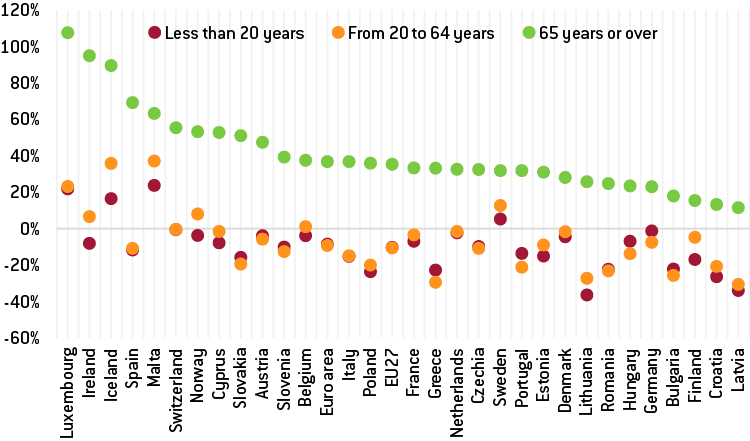

The demographic issue

This has caused a number of governments to look at mandatory pension schemes in in order to protect its citizens against inflation but also to ease the burden on sovereign finances as global populations everywhere are aging. If we study this chart from Bruegel, we can see that by 2050, in Luxembourg the 65yrs+ cohort will grow 110%, while in Greece the 20 to 64 cohort will drop by 20%. For the EU27, the 65+ cohort will increase 40% while 20-64yrs cohort will decrease by about 10%. The problems in the ‘developed world’ are stark. An aging population and not enough finance to cover the states social responsibilities. We need a new baby boom! Luky for the world, there is Sub Saharan Africa

‘‘The ongoing episode of high inflation reverses the standard way of thinking about pension indexation. In the short term, due to falling real wages, price indexation has become more favourable for pensioners than wage indexation. But it is more costly than initially anticipated for public finance or pension providers more generally’’ -OECD Pensions at a Glance 2023

This is why money in the mattress is as good as money in the fireplace, also known as capital decay. If you locked $1,000 in a safe in 1950, its face value would be unchanged today — but its purchasing power would have shrunk by over 92%. In contrast, if that same $1,000 had simply kept pace with inflation, it would be worth $13,029 in today’s dollars — a powerful reminder of what inflation silently steals, but for the biggest debtors, it is a miracle.

Wealth inequality

There are some popular commentators at the moment such as Gary Stevenson who are making lots of money riffing on this topic of flattening out of the lower and middle classes, with very little to offer in the way of solutions, other than parroting the chant of ‘Tax the rich’. Simultaneously, he will tell you that he is a billionaire and is/was the best trader in the world. He is or ever was the best trader in the world. I don’t think so, by any stretch of imagination. I don’t disagree with taxing the rich, but I do have issues with the idea that it is that simple. If there are not people in our society that take risks to build businesses, innovate and create value and employment, there would be significantly more unemployment.

Stevenson is a charleton of our economic times. A soothsayer to the financially strained or the economically curious. Lite on substance, heavy on shouting. If the UK government wanted a fiscal psy op, it would be Gary Stevenson.

This is not a post about solving the issues of our time. This is simply a post about where governments really sit on the topic of inflation and sovereign debt. If readers would like me to get into the financial flattening out in societies, let me know. Lets look at debt deflation below.

Deflate the debt- a history

After WWII, the U.S. reduced its debt-to-GDP ratio from 106% in 1946 to 23% in 1974. While economic growth played a role, studies indicate that surprise inflation and financial repression were significant contributors to this debt reduction.

Edward Chancellor on Financial Repression

In The Price of Time, Edward Chancellor discusses how governments have historically used financial repression—keeping interest rates below inflation—to erode the real value of debt. He refers to this as a "sneaky, protracted debt jubilee."

Weimar Germany's Hyperinflation

Between 1919 and 1923, Germany experienced hyperinflation that drastically reduced the real value of its debt. While this alleviated debt burdens, it also led to severe economic and social consequences. arXiv

Argentina's BONEX Plan (1990)

Facing hyperinflation, Argentina forcibly converted bank deposits into long-term bonds, effectively reducing immediate debt obligations but at the cost of public trust and financial stability. Wikipedia

Financial Repression Post-WWII

From 1945 to 1980, many countries, including the U.S. and U.K., maintained real interest rates below 1% for extended periods, effectively reducing debt burdens through financial repression. Wikipedia

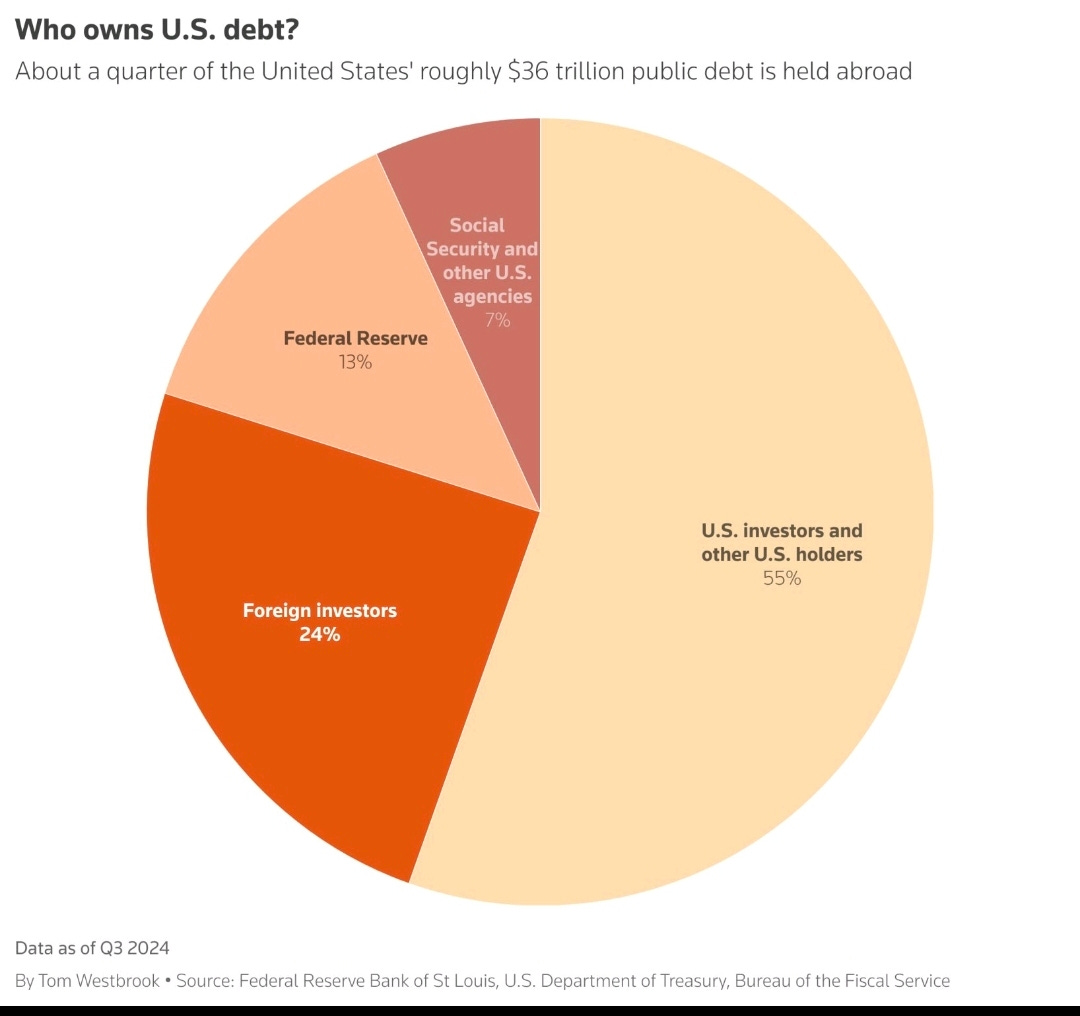

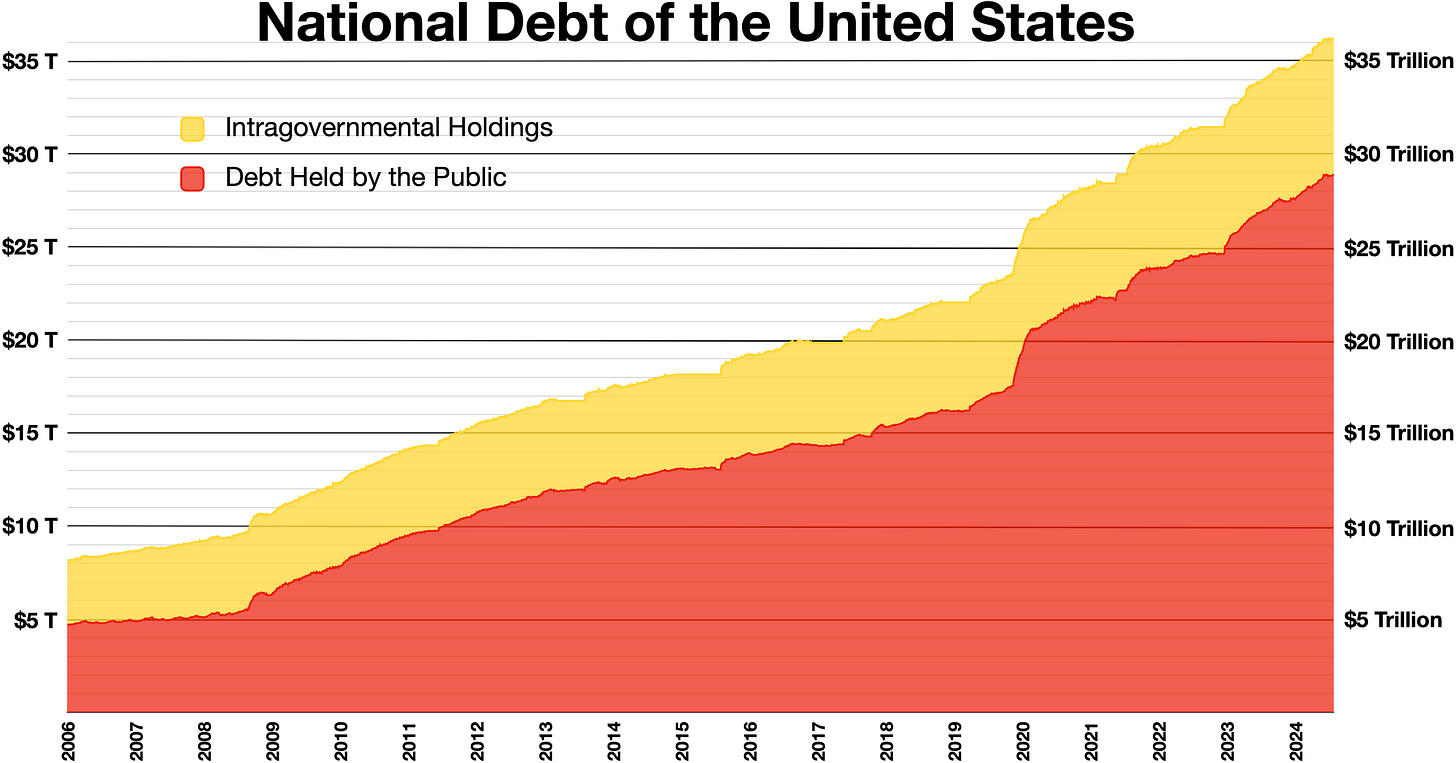

Context: US Debt

As of April 3, 2025, the US gross national debt is $36.22 trillion. This includes $28.96 trillion in debt held by the public and $7.26 trillion in intergovernmental debt. Compared to one year prior, the total debt has increased by $1.61 trillion.

I wont attempt to characterise this debt or offer any solution, as this is well above my pay grade. I am interested in commenting on how inflation is the friend of a heavy debtor as highlighted above.

Trump and Bessent are staring down the barrel of a $36 trillion debt pile — a burden inflated by years of low-rate borrowing, COVID-era stimulus, and decades of trade deficits. The problem isn’t just the size of the debt, but the rising cost to service it as inflation lingers and bond yields climb.

Their solution? Inflate it away strategically. The playbook is to weaken the dollar, drive manufacturing back onshore, keep rates structurally lower than inflation (financial repression), and rebuild a domestic industrial base that can grow GDP without needing global supply chains. In short, they’re trying to engineer a controlled reset of the debt-to-GDP ratio — without outright default or austerity

Pitfalls & Dangers.

As highlighted as above, the path of debt destruction via financial repression i.e rate controls, FX controls and foreign policy is dangerous. Just look at how paralysed the US markets are right now. 7% down, 9% back in a couple of days? Buy the dip at your peril. There is more at play than buying the dip. Go get inflation tracking places to put your money. 2% at the post office won’t cut it.

In Conclusion:

Inflating debt away is not a new trick — it’s a well-worn path walked by governments when the numbers no longer add up. While it may quietly ease the burden on national balance sheets, it comes at a visible cost: eroded purchasing power, growing inequality, and a slow squeeze on the middle. The playbook is subtle, but the consequences are structural. If you’re not positioned for inflation, you’re positioned to miss out.

Tim

Interesting stuff Tim. Well researched and thought provoking. How long would a government need in order to do this? Squeezing the lower and middle classes in order to implement such a plan can be fraught given a US government usually has a small amount of time before midterms; if Trump loses either the House or Senate his policy agenda will be stalled out.. you can only do so much via executive orders.

Good tweet commentary here on inflating away debt. https://x.com/SpencerHakimian/status/1917276113111306567?s=19