Deepseeking questions

A.I Economics just got redrawn

In this report. Nvidia value, Deepseek, auction market on Nvidia, stock concentration and venture capital in A.I and why Meta is scrambling ‘War rooms’.

Nvidia

DeepSeek has rearranged the economic furniture of A.I investments, calling into question the technical foundations of tech companies heavily invested in this area. The Mag 7 (Apple, Microsoft, Google, Amazon, Meta, Tesla, Nvidia) have committed significant cash and indeed their futures to A.I and LLMs (large language models) that drive their A.I.

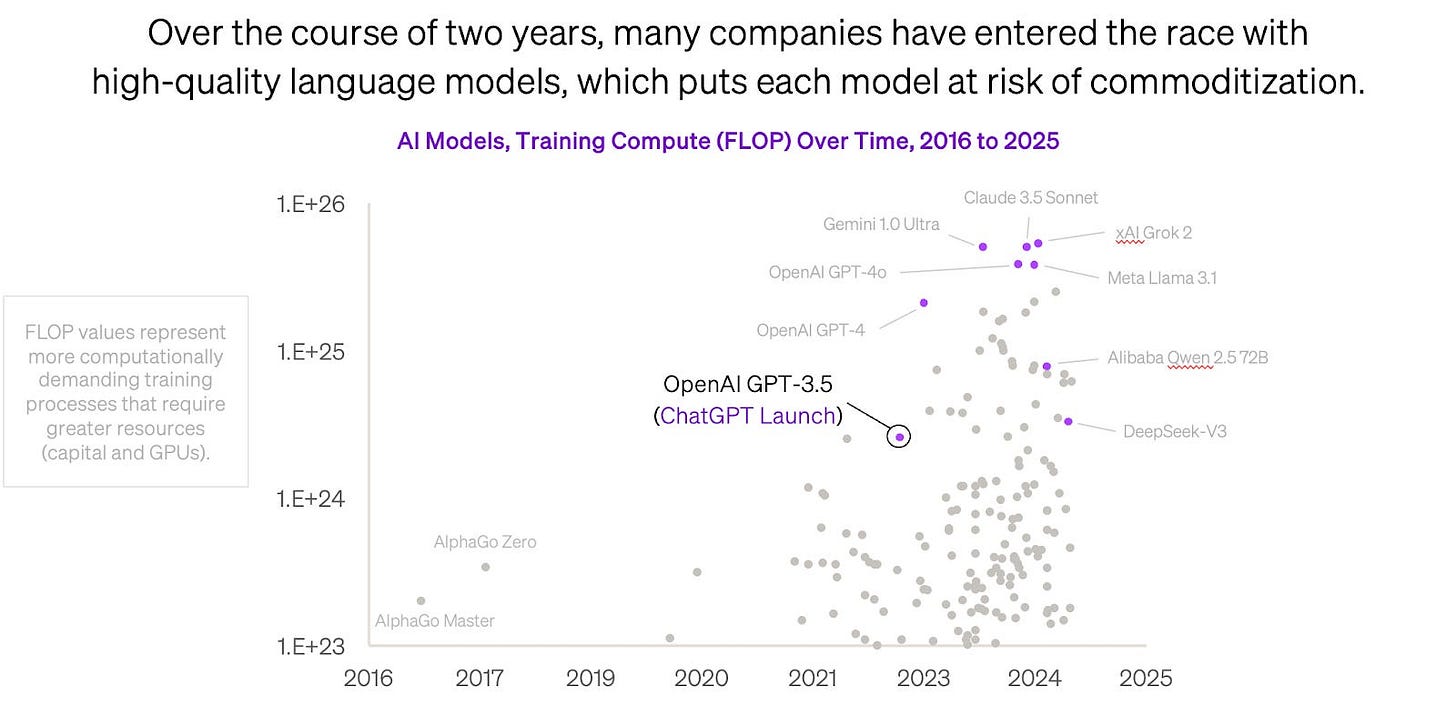

DeepSeek has essentially come to market with an LLM that runs on the same Nvidia chips 95% more efficiently than any of the LLMs out of North America and Europe.

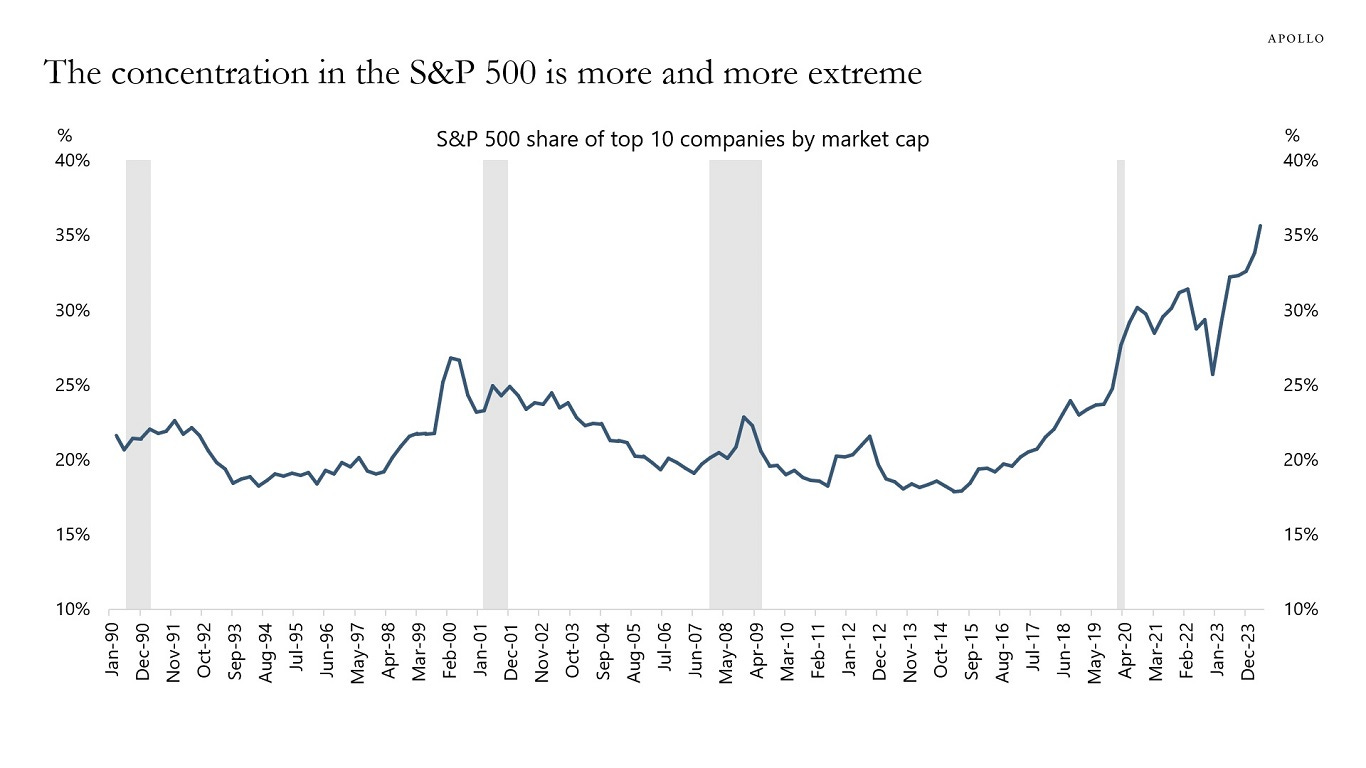

The stock markets have been on a power train pump, pricing in the new A.I future. But it has been based on LLMs that are 95% inefficient. The concentration effect has been a concern for at least the last 18 months, where the Mag 7 represent 35% of the SP500.

With this level of concentration, it is easy to see that the ship is overbalanced and how selling across these companies will contribute to a broader market correction. I think there are two ways to look at this:

S&P500/Nasdaq will want to reprice its A.I Power pump and wait to see what a couple of earnings look like through 2025 for these companies. Maybe even will wait to get Q1 or Q2 revenues to see what impact, if any occurs. Markets tend to not hang around this long, however.

We have selective selling amongst the Mag 7 and have already started to see this. The Monday after DeepSeek went public with their finding, Nvidia was down 17%. No bounce. There were however green shoots of dip buying across the cohort. By the end of the week, dips were bought on all Mag 7 EXCEPT Nvidia. To me, I think this is going to reverse, with dip buying in Nvidia making more sense. While Meta, Google, etc will come under pressure and be forced out through this broader trade war volatility. For now, its not time to buy anything. There are the companies that can act fast and make up the 95% efficiency gap, and those that can not, we will be watching.

Either way, it would be logical for markets to want to reprice down and probe for liquidity/buyers. Essentially price will auction down until it is supported by former areas of value. Auction market theory at work.

Ancillary services that have been committing investments around A.I are not immune to shock here.

How are we going to power the next gen of data centres? Nat Gas. Some say that Nat Gas has been on a hot run due to Chevron investments towards gas plants to serve A.I data centres. The rally we saw over the last 2 months in Nat Gas has little to do with this, but it does add to the picture going forward. From my seasonal data, there was a seasonal demand move due, coupled with 2 cold snaps and lower than 5 year average stocks ready to draw.

Nat Gas is THE transitional fuel, bar nuclear (nuclear has pretty bad street cred). More on energy in this weeks Oil Report here.

There are many questions, but here are the key ones that I would be trying to think more on.

How does this effect NVIDIAs future?

Shovels. There were only really 2 major winners out of the California goldrush. Levi Strauss and Samuel Brannan. Both making exorbitant amounts of cash selling clothing and equipment. In one story, Brannan, bought equipment for $0.20c and resold it for $15, making £35,000 a week at his shop. Other winners were the bars, brothels and casinos. Think brokers, money managers and financial advisors. Lols.

Point being, NVIDIA sells shovels and they work. DeepSeek is built and trained on NVIDIA H100’s. The shovels are good and will get even better.

Net net, NVIDIA still has value, however their shipping numbers may get a large dent as the rest of the AI market figures out how to implement efficiencies. The last NVIDIA earnings call warned of efficiencies coming, causing a potential slowdown in orders. It sold off 5% on that and the dip was bought.

We are now below those price levels on the stock. NVIDIA may need to reprice further down. Re the chart below, I’m not in the prediction game. I'm only showing you the contextual pickle that the price is now in, with prices balancing below its YPVAH $126.70 area. This attracts sharks with the cheap/expensive meter now saying NVIDIA is expensive in relation to all trade last year. If price holds above this level, it remains cheap in relation to last year’s prices. Keep an eye on average price for last year $100.80 approx. On par as they used to say in 1920. Big up to Jessie Livermore. You're my boy Jessie! I'm pretty sure Jessie would be sitting on the side-lines. Actually, come to think of it, if Jessie lived today, he would be trading every fart meme coin going and making a killing. More on this another time.

How does this impact the broader swath of companies in the AI space? The miners down the mines.

The assumption is that YES, the chips work, but you can do a lot more with a lot less as proven by DeepSeek. The full research paper here. Bottom line. It is 95% more efficient than its counterparts LLMs. So if you have US companies that have modelled their finances on 95% underperformance- you have a problem and the financial model must be redrawn. The miners just got shovels that now do 95% more digging, jeans that last twice as long. You get the idea. What do they do with the 95% of spare capacity? Do investors call back some cash? Hardly, but the rug of value has been pulled out from underneath the ‘western AI’ landscape.

Open AI, Microsoft, Google, Meta, Anthropic will have to get to work and implement the efficiencies… if they can. If they can’t, this poses existential risk. Meta has already got 4 war rooms at work as of this weekend.

Venture Capital

EY have put out a good article on VC in the A.I space. The highlights are that investment is booming in this space. $45 billion invested in 2024 up from $8.7Bln in 2022. The focus is shifting hard away from the horizontal general A.I models and more to the vertical A.Is with industrial applications. So the VC world is really going to get a lot more bang for its buck with these new efficiencies exposed by DeepSeek. For any large tech company with money already invested in models, investors will want to be reassured that the efficiencies are found and delivered ASAP.

Here is a link to a free paper from Pitchbook sponsored by J.P Morgan, Deloitte and others. The stand out is that there is extreme concentration in where the VC money is flowing. A.I Hyperscalers - data centres, cloud infrastructure etc. With US company Core Weave and Elon Musk's xAI more widely known as Grok. Alone these two companies took $14.6Bln of the $46bln invested globally in 2024.

There is no doubt that this space is THE growth area not only in markets but for civilisation. We are crossing the sleepy river. Moving from human led thought capital, into the brave new world of artificial intelligence. At this early junction it is easy to see where intelligence, critical thinking and a wide spectrum of human work will now become commoditized. The horses are to be replaced with engines. Please put on your seatbelt.

Check out the Shekels & Shamrocks podcast with Market Wizard Jason Shapiro.

#Nvidia #DeepSeek #AI #StockMarket #Investing #TechStocks #ArtificialIntelligence #VentureCapital #Trading #MarketAnalysis