Dip & Drive?

Can equities turn this week or wait for Trump?

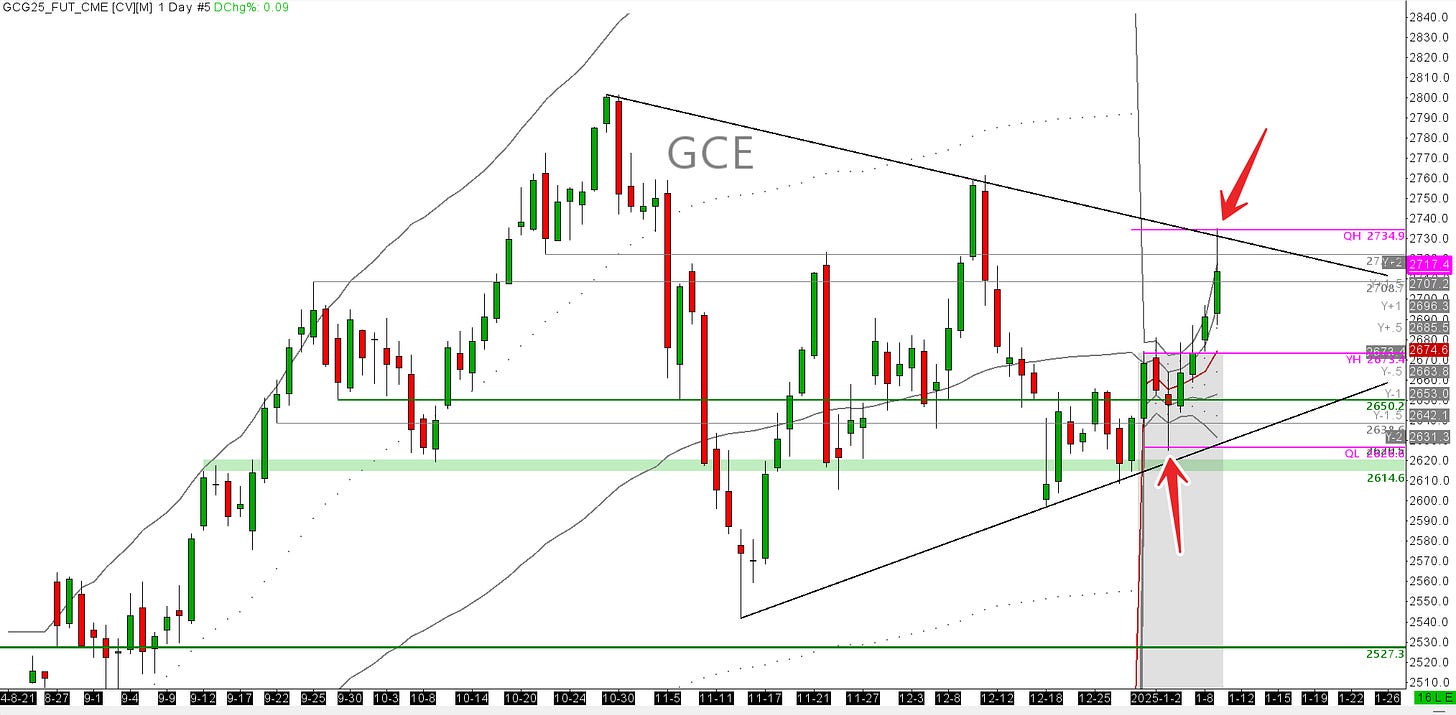

In this report: DXY, Gold, ES, YM, NQ, BITCOIN, NG, NRT.

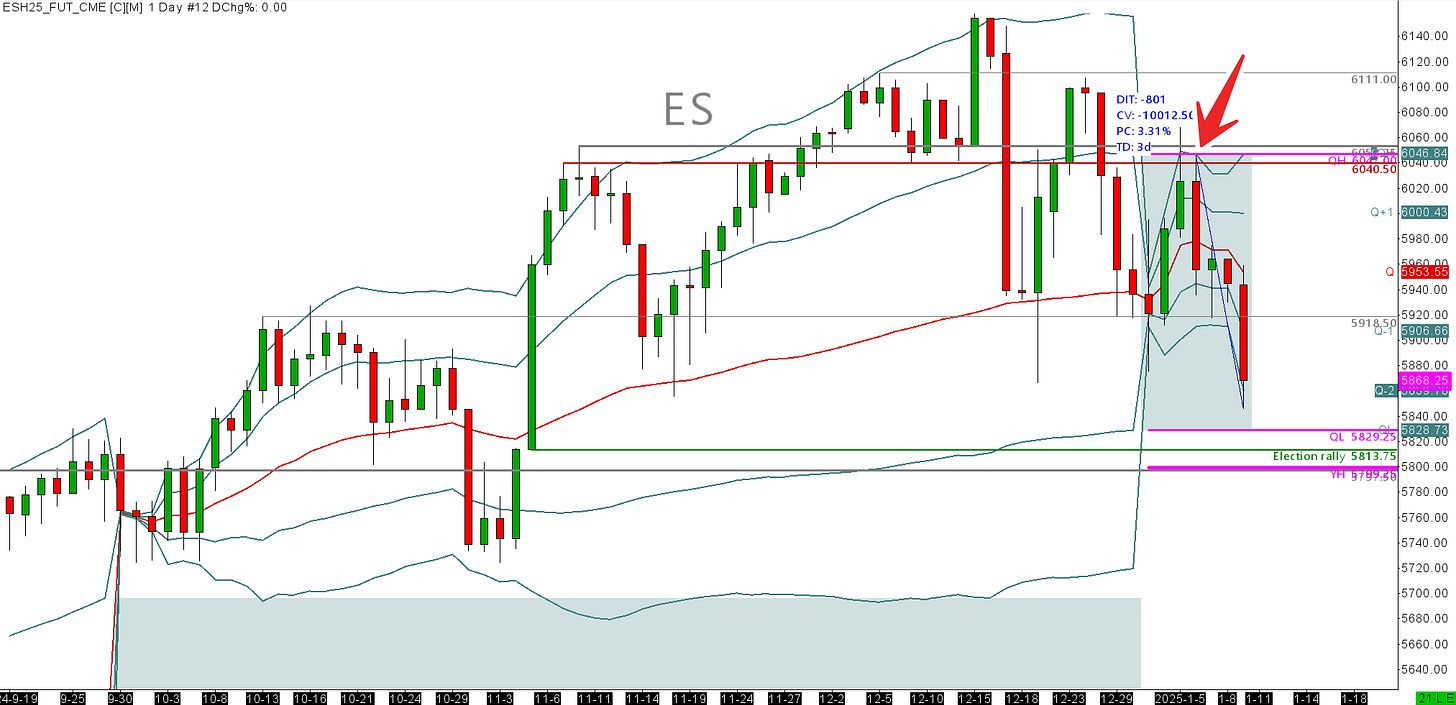

Last week was a pretty strong week for downside on US equity indices, and a strong acceleration in oil prices. Largely driven by Friday's strong NFP data, however we had already sold down -2% on ES before we got NFP. Once we got the strong beat NFP data, ES came off another 1.27% from the electronic open.

On Friday, we discussed in the DC discord about an hour before the data that a strong number was going to bring in more downside for equities. A strong number was going to motivate the Fed away from more cuts and more easing. Markets now price only 2 cuts staring in October this year. If the economy can put up such strength at current rates, why ease further and risk introducing more heat?

Last week's report and trade setup analysis had an incredibly strong performance in the week that followed. See below. This is what you get for the price of 4 cups of coffee a month.