Everything is up!

Dont fight it

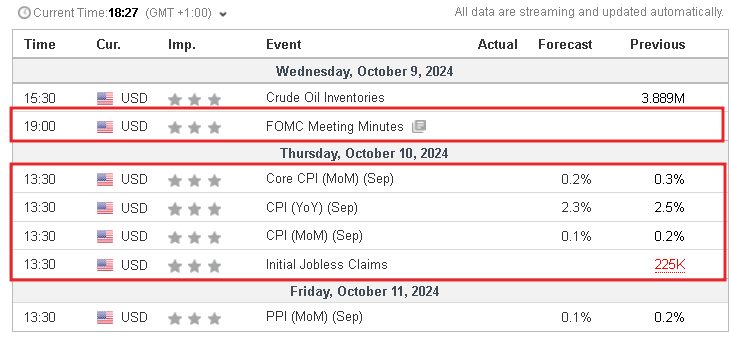

This week the calendar is focused towards FOMC Minutes Wednesday evening. We will keep an eye towards Thursdays CPIs and Initial jobless, however the market will be interested to have some colour from the last FOMC meeting and try to interpret if the committee will be motivated or even in the headspace for another 50 bps cut.

Given the great beat that we got on NFP jobs numbers, (which is what we were expecting in the last report), the market has slashed bets on a 50 bps cut in November and has it now priced for only a 25 bps cut. I have no qualms with this- makes sense. I think there is going to be a widening chance that they leave rates unchanged. Either way, it is pretty much a non tradeable event, let alone that interesting if it is one or the other.

We have the perfect definition of a goldilocks scenario at the moment.

Jobless data is remaining low.

Inflation is beaten and low.

Jobs additions are looking great.

GDP Holding positive.

Fed have the luxury of having a ton of cuts in their back pocket.

So what is there to stop you just letting the longs ride?

Im not going to try to grope around and try and find any reason. Things are great. Stay long.

What can cause a mispricing/ pullback/ shake in confidence are

Increased war risk with Iran engaging fully and/or the involvement of Russia or China in current tensions.

The Longshore mens association strike.

Lets have a look at the port workers/ Longshore men association strike. It is easy to not take into consideration just how much impact their strike would have on the US economy and the global economy. But just have a look at some of the words out of the president of the association here.

They went on strike for 2 days last week, but they came to an agreement with the US Government that they would postpone the strike action until Jan 15th. This is a big near miss for the economy and the markets. So we don't have to think about this until then.

Lets go to the markets. In general I see oil, equities and metals all s staying bid over the next 4 weeks with no doubt some shakes in there. Most probably the biggest shakeup will be further war escalation. But apart from that, we are buyers on dips, not seller on rips.

BITCOIN BTC X24

On Thursday last week, we had a beautiful pullback test of the Y-VWAP $60.422 on Bitcoin. A nice trade that is currently nicely onside. I see this test holding for the buyers for some time. In conjunction with this, we had Fridays NFP beat send the DXY back to the upside around 0.65%. This stronger dollar did little to sway bitcoin long holders. For these longs to hold, we must hold YVWAP.

I think we now head straight to Q-PVAH $64,635. The market will have a bit of a hard time now however getting out of the M-PVAH $63,339. Look for a failure of buyers/ booking of profits on longs here on the first touch of this area.

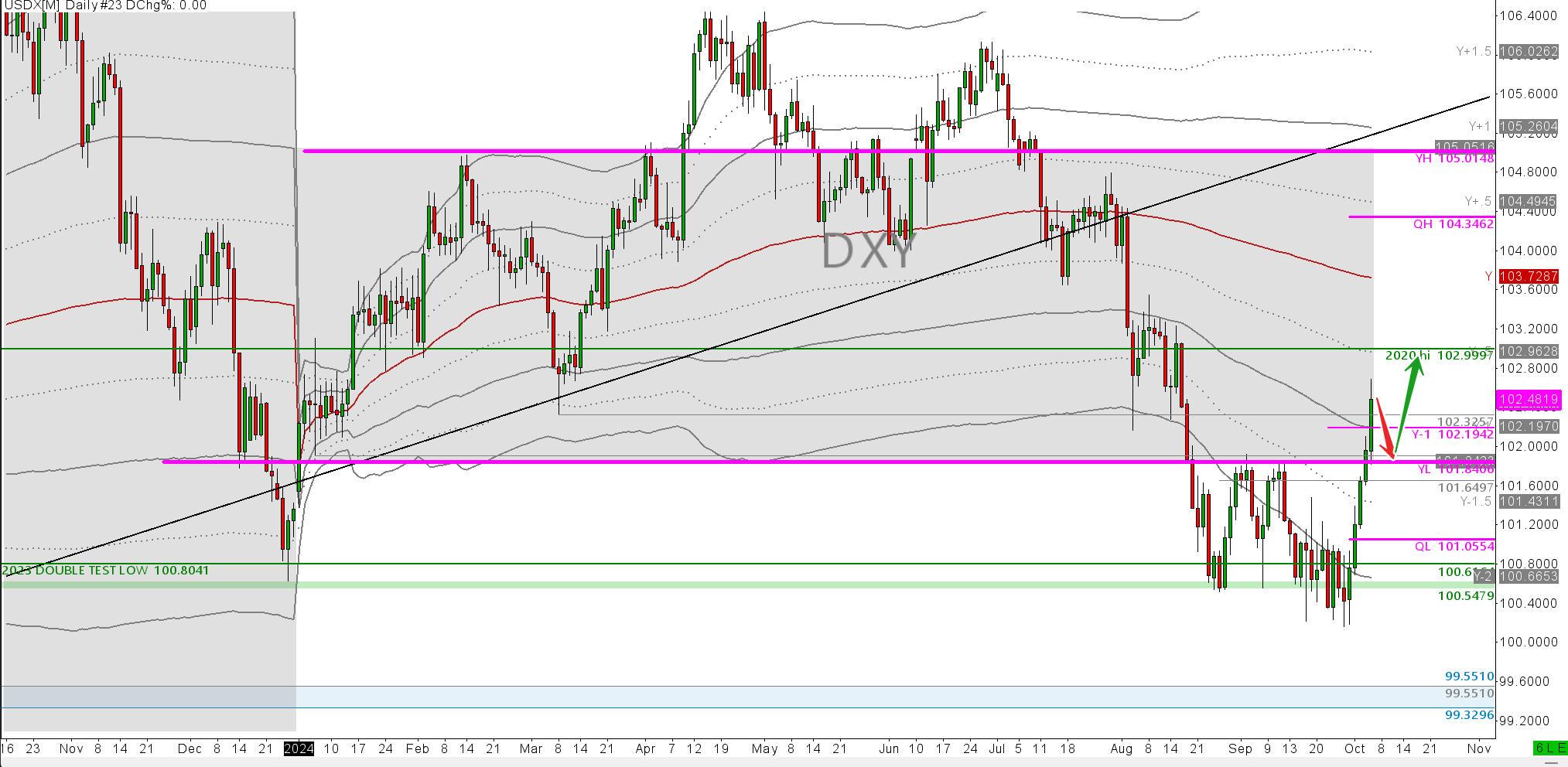

DXY

The shot in the arm DXY needed was strong jobs figures. It was looking extremely poor trading below Y-PVAL, where the imbalance down looked set to continue. IO see us pulling back to test Y-PVAL as support now, then more upside. Diamond hands this one

SP500 ESZ24

Spooze is perfectly protected by so many factors that any major dip is just such a nice value purchase. We are imbalanced up and pullbacks as deep as Y+1 $5573 are still extremely technically sound purchases. I think that if we do get a pullback it won't be that deep and the test of Q-PVAH $5696.50 are completely sound areas to get in late to the party.

Please do note the massive bear flag pattern that we are in however. You can only see the top and mid trend lines of the flag in these charts.

See the 30min chart for how I think the market can lay out that pullback.

WTI Oil CLX24

There were several caveats to my scenarios in the last 2 reports, in that I explicitly said I expected the downside to continue UNLESS Iran and Israel started to get heavy. And well, shit got heavy! We moved up 13.93% $9.24c IN 3 DAYS in oil over the war risk with Iran firing rockets at Israel. I don't see this situation calming down to any great deal to where we could imagine getting net short on oil. The imbalance down on the prior years structure of value has failed to hold the imbalance down.

The massive shorts we noted 2 weeks ago have officially been handed sick bags and they are hurting. I think that if there is no immediate clear and present new warfare from Iran, we can slowly trade back to Y-PVAL $71.58s now as support rather than resistance. There is a beautiful confluence at the moment with M-VWAP and Y-PVAL. So my keo trade area is to buy a PB to $71.58s this week.

I have taken a new step with my trading. I have started studying for my CTA licence ( Commodities Trading Advisor). I have taken a nice break over the last 3 years in order to enjoy having 2 kids and to move to the country. This ment cutting my trading day in half. Only trading the US session. It has been a nice move and an incredible experience for Shelby and I, if not challenging. I have had to adjust my approach to trading a great deal, given that sometimes I will be at my desk with only 3 hours sleep from babies crying, puking, or a run to the hospital here and there. If this happens, it's an instant freeze on the account for the entire day. Anything less than 5 hours sleep and I'm not trading. In a nice way it has caused me to be a lot more relaxed and stoic about my trading. I'm just at the mercy of my environment. Rather than get frustrated and negative about this, it is better to simply flow with it, embrace it, the new norm and stop holding on too tight which only breeds frustration.

Some interesting opportunities have presented themselves to me during this semi-retired time, however none were strong enough to take me away from the kids. I simply wouldn't do it for any amount of money. Time is the most precious commodity in the world. You can not buy 1 more minute of time, no matter how much money you have.

Now the kids are getting a little older and are both in creche, its time to look to the next summit. So stay tuned over the next year for what I hope will be interesting developments and my coming out of semi retirement.

For now though, let's see what this week brings. I suspect not too much from the economic perspective. The war front is a whole different ball game!

Trading is waiting

Waiting is trading.