Front of the Skis

Trade Truce under pins raging bulls

Calendar

Earnings

View

After the market closed Friday, Moodya came out with a US credit down grade, moving from AAA to Aa1. This is no small headline.

Moody's cuts America'spristine credit rating

Last week, I laid out a bearish thesis, hinging on the assumption that the U.S.–China talks in Switzerland would yield little material progress. That view was swiftly invalidated when Treasury Secretary Bessent announced a 90-day tariff pause early Monday, triggering a sharp rally and catching bears off guard.

However, by midweek, the rally appeared to lose momentum. Monday's London session provided a strong lift, but Tuesday's CPI miss failed to attract significant buying interest. While the rally remains intact, the enthusiasm seems to be waning. I'm not inclined to fight the tape, but I'm also not a buyer of equities at these levels.

My personal thoughts on the Swizz/ Sorry, Swiss deal are that China is in the hurt locker. Having fired the post COVID-19 stimulus bazooka, they are yet to yield dividends or get stimulation. The trade war in all reality would nuke about 14% of exports, which could be made up elsewhere. However, why lock in that loss now and make hard work of the post-covid recovery when they can play ball with Donald and save face all the way. It really costs them more to not bounce the ball.

As for the inflation beast that is yet to be seen or heard? CPI came in a flop-which is good- but no heat whatsoever!

Have a look at the detail we got within a second of the data breaking.

Newsquawk’s premium real-time audio news. Subscribers to The VWAP Or The Oil Reports get a deep free trial period and large discount on their first month.

Articles

Why is the Fed quietly buying billions in bonds — and hoping nobody notices?

US and China agree to drastically roll back tariffs in major trade breakthrough

Dogespierre Has Left the Building

MUST READ-The UK just trained a health AI on 57 million people to predict disease

Global EV sales up 29%, China, Europe led growth

Macro

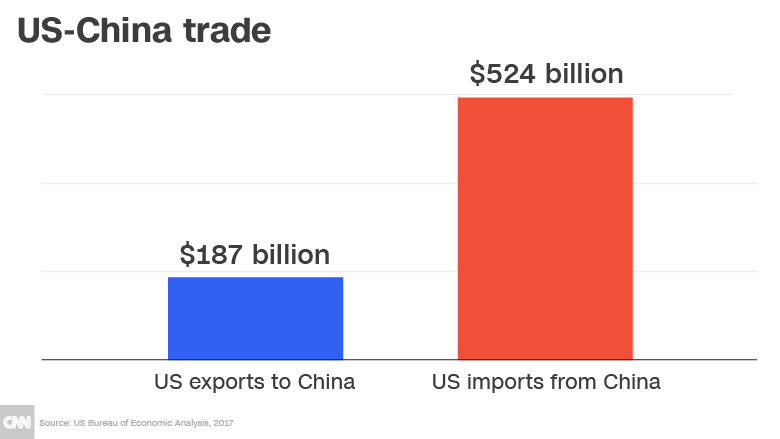

The 90-day tariff reprieve between the U.S. and China has temporarily eased trade tensions, reducing U.S. tariffs on Chinese goods from 145% to 30%, and China's tariffs on U.S. goods from 125% to 10%. This development has provided a short-term boost to market sentiment.