Last of the bull dips

cut expectations are finally real

The calendar published on Sunday contained the data calendar for NEXT week and not this week. I have now updated the calendar of economic data releases for this week as below. My sincere apologies to everyone. The focus this week will hang on the FOMCs meeting minutes this evening at 19:00 (7pm) GMT/ London time.

Once again we have a Thursday Friday kind of week ahead. I get it that people are looking at stochastic initial jobless numbers over the last 4 weeks. A peak of 249k and trough of 227k.

Over the last 2 weeks, Jason Shapiro and I have both been chatting about the market, the dip, the expectations for the cut and positioning. For me, The dip that we just saw at the start of August, may have been the last great dip opportunity for the market until new all time highs or The Fed Cut. It is important that we not lose ourselves in narrative however, my focus on these reports is to cut the narrative noise and only extract what is tradable information

Why Aug 2nd was the last dip:

We now face the 18th September FOMC meeting where the expectation is a cut of 0.25%. There is a 46% priced in expectation of a 0.50% rate cut which I do not believe in at all.

Once we get there, I think that the market will be a shooting match. The expectation is that the market will be sold down on it. I now think that popular consensus is so heavily leaning towards a sell off on the cut, that we will more than likely make a new high on that day, flush out weak sellers, and then roll over and potentially dip below the Aug 2nd Lows in ES. Anyways, there is time until we get there. Let's get into the charts.

ESU24

Our guidance as of the week of Aug 4th was to wait for a dip to ES Yearly VWAP, then be long out of there. Here is what we were looking for

And here is what we got.

I am proud to say a couple of my mentees bought this mega dip and are still in this trade, sitting on 73:1 return on a very tight risk of 5 points. I'm like a proud parent to be honest. I have a long term relationship with my mentees, some having been with me for 6 years. IIt is great to see the training and edge work out like this. These are not small trades and they are not easy to get tight risk on, but if you have a good edge and know how to manage risk, the world is yours. 3 Month Alpha VWAP course.

For this week ahead:

I think we are in for some form of pullback from the last 6 days of up on ES. You will note the line in the sand where we are currently testing on ES. The blue area. The low of the area is the high of the 19th June 2024 $5588.00. The high of the area is the high of the 31st July 2024 $5600.75. On Friday, we had a good discussion to finish out the week, talking about holding long through this area or facing a potential sell down from here back to the Q-PVAH $5412.00 to pick up more buyers and then keep going up above the LIS (Line in the sand)

I really don't see any risk in these markets unless we get a really weak GDP on Thursday coupled with a hot PCE on Friday. So that being said, we are looking for a small dip to levels on the chart below, before moving higher towards new all time highs! If you want to sell spooze and think we are too toppy, I think a breakdown of the support areas in green in the below chart are areas you will want to be a seller at, even a failure of the market to get above this LIS is a great short spot.

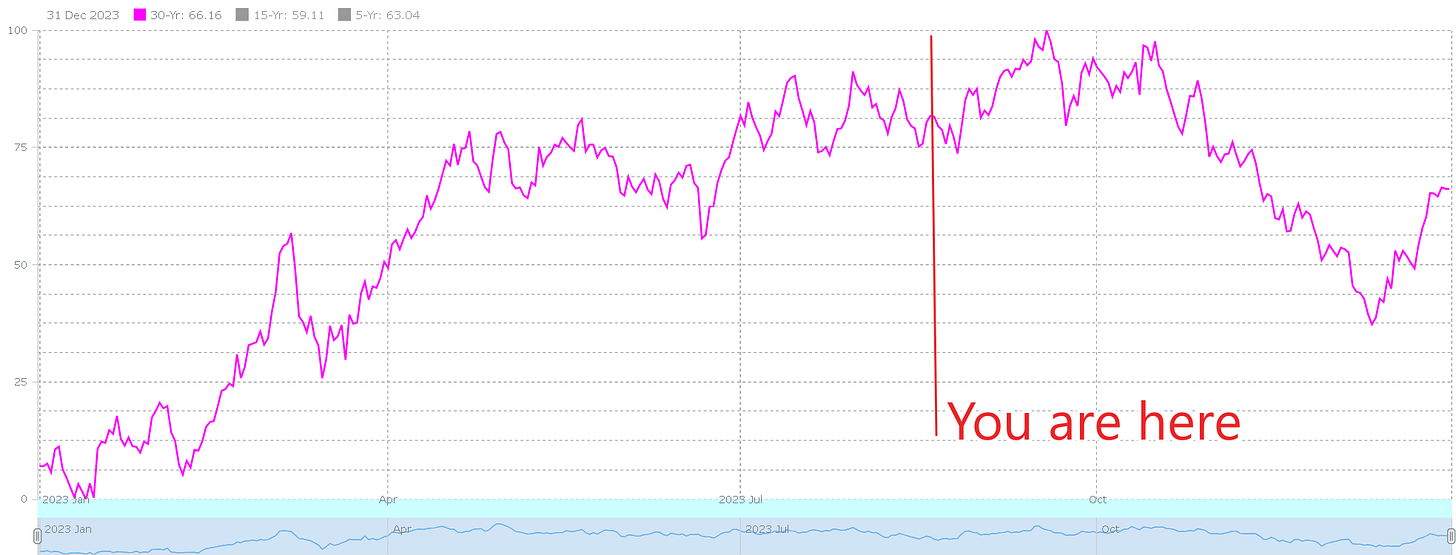

Before we finish on ES. Have a look at the last 30 years of trading data on the spot contract here. You can see a rip further to the upside is not probable. Pull backs are more probable at this time, then we get to September and continue with the rip.

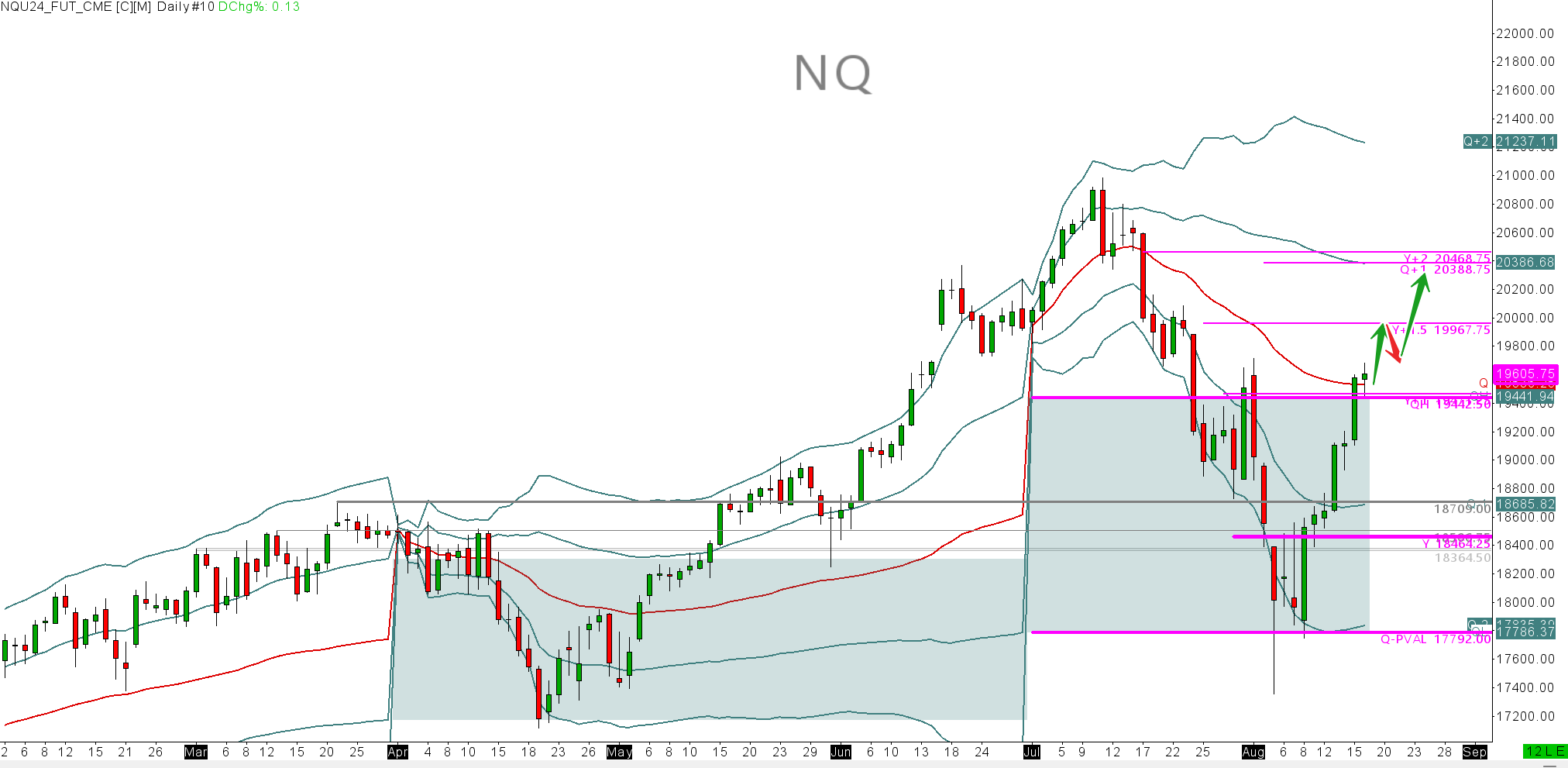

NASDAQ NQU24.

The NQ is looking strong from the held high levels on the week last week. For that reason, the setup as per myu edge is to go long with the imbalance up on the Quarterly prior value high. Its a pretty simple one shot or done. Good RR. Target 1 will be Y+1.5 $19967

Here is the monthly vwap.

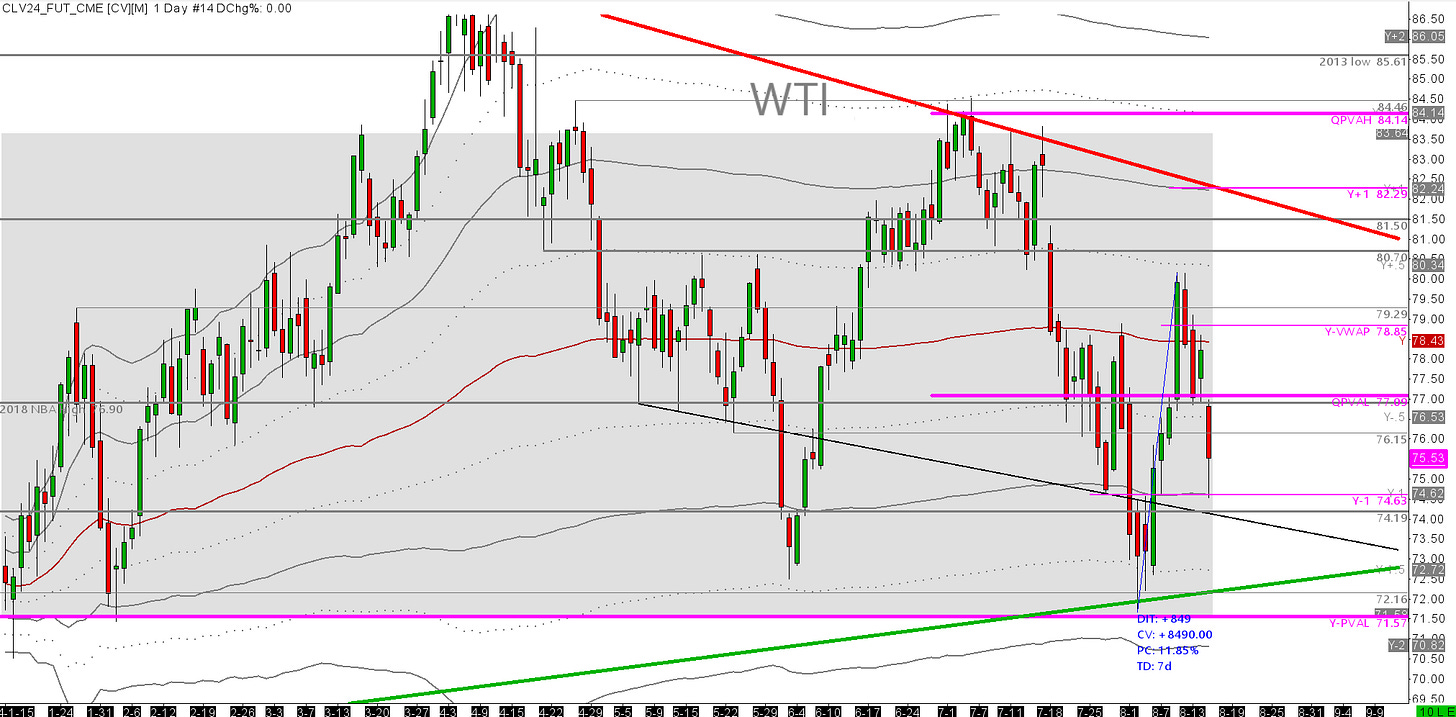

CLV24 Oil futures.

The oil action has been fantastic the past 4 weeks. With dips being bought from the lower areas we identified in this report as of 28th July.

This is what we were expecting.

We got A lift of 11.85% or $8.49cent. To put that into perspective. Thats $8490.00 per single contract traded. So, if you want to learn how to trade with this level of edge on any market, please reach out info@duggancapital.com 4 Week Alpha Pro Course. 4 Weeks intensive learning.

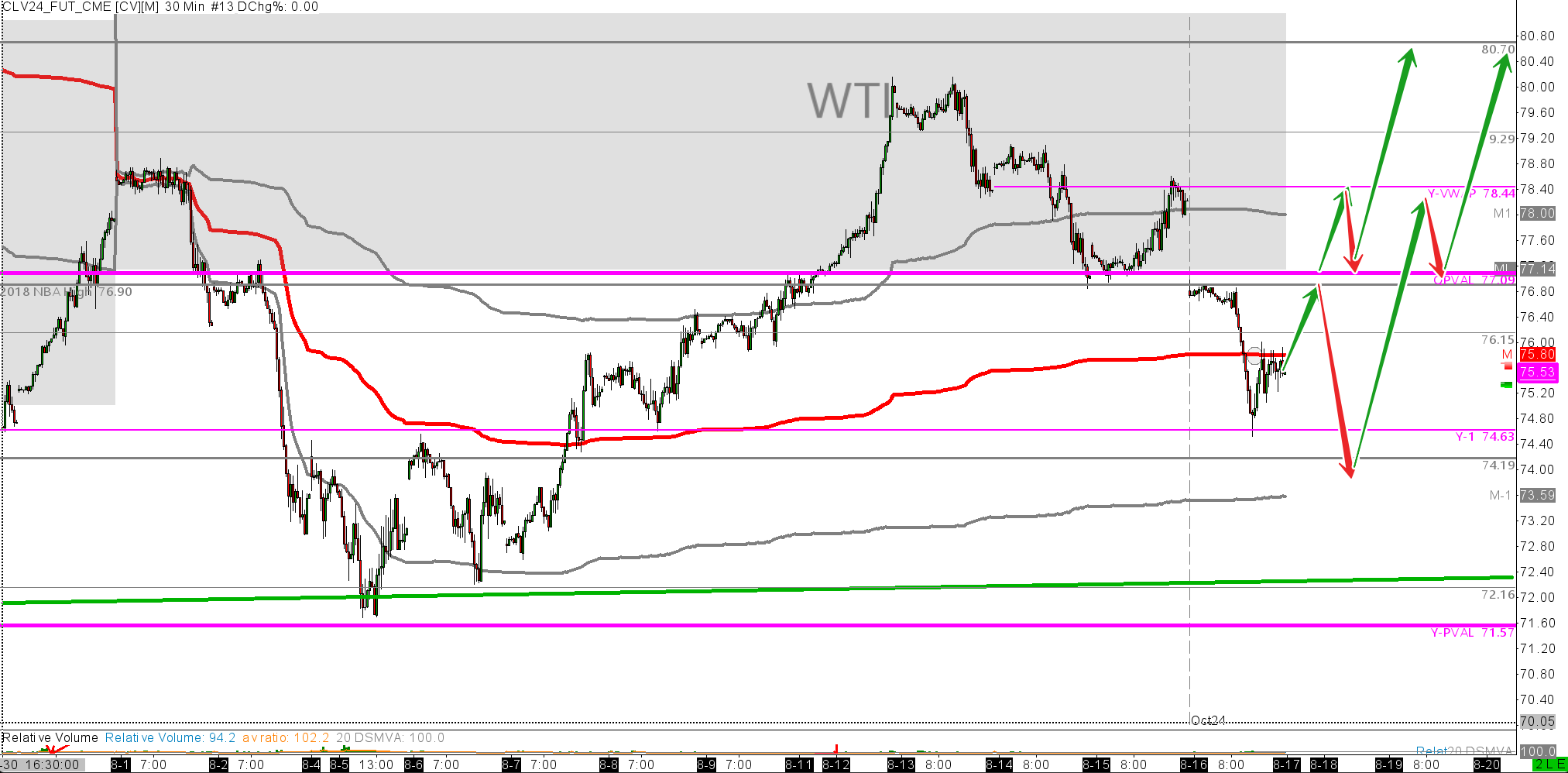

What we are looking for this week. The buying from the lows of 4th Aug have been expected and strong. That week's buying was also helped with protests and fires at Libya's largest oil field -The Al Shara. This last week, these tailwinds dissipated with security restored, protests stopped and fires put out. I think that it is always impossible to tell how much of this type of news actually contributes to the price action, however it does fit the price narrative.

I expect more upside to come, however we must look to back test data to see what is expected. I do believe that the market has to remain relatively cheap over the next 2 weeks until refiners will get back to the market and be buying in droves for final year supplies before the doldrums we traditionally get from october through to end of year in oil.

You will note that we are on the nadir of a small range area, before we start to rally into what can be the high of the year in September. The last dips normally coming in around 28th October. So tread carefully getting super long oil until then and always be aware of which contract you are trading should you want to hold the trade for a long duration.

Okay folks. Thats all for the week ahead. It has been a great August so far. It has been a pleasure to have Jason Shapiro over in Ireland the last few weeks. Some great chats and exciting things ahead. Watch this space. One of the things we discussed was traders who make it and dont make it. We will no doubt come back to this topic in a recoded session soon, but what we agreed on is that traders who struggle, often get comfortable in the struggle and cant get themselves out of the bad place. They end up in this bad place until they simple give up trading. Whats worse is that they cant really pin poiunt what exactly it was that went wrong. For me, I see a lot of traders who have been in the markets for a few years and I get to work with them to get them on a better path. Most of the time, traders have shit edges. They dont realise that the simple shit they learned is simply not enough. Then after this, the number one killer is poor risk managment. If you dont truley understand waht risk managment means, then you need to do 2 things straight away and then stick to them come hell of high water.

What is the amount of money I can loose in a day? Make sure this is 1% of your account for small accounts and less than 3% if big accounts. This 1% can then be divided into say 3 trades for the day or just 1. Its up to you.

What is my target? This needs to realistically be 3x your risk per trade.

With targets, you need to make more than 2:1 realistically, as you also have costs to cover.

With targets, you also need to know what are you daily, weekly, monthly targets. Once you know them, you know where you have to hit and then you can be done. You can say, I did my job today!

Knowing this, you then know your risk profile. Then, you either stick to it- thus manage the risk. Or you dont. If you dont, well, you dont make the chopper!

3 Month Alpha VWAP course. 3 months at £275 or £825 one of.

12 Month Alpha Edge Course. 5 days free trial £250per month or £3000 one off.

4 Week Alpha Pro Course. 4 Weeks intensive learning.