Monday 15th December 2025

Covering XLE, ORACLE, Ouster, Eco petrol

Overview: Covering XLE, ORACLE, Ouster, Eco petrol

Notes: I’m going to be looking at longer dated plays in the report. Think more swing and position rather than intraday. There is market liquidity from The Fed coming back into markets. We can NOT stand in front of this with selling.

The Fed Is Buying Billions in T-Bills. Just Don’t Call It QE.

Oil market is covered in depth weekly on The Oil Report.

Selection criteria at bottom of report. Note dynamic levels, ie. vwap levels can and will shift intraday.

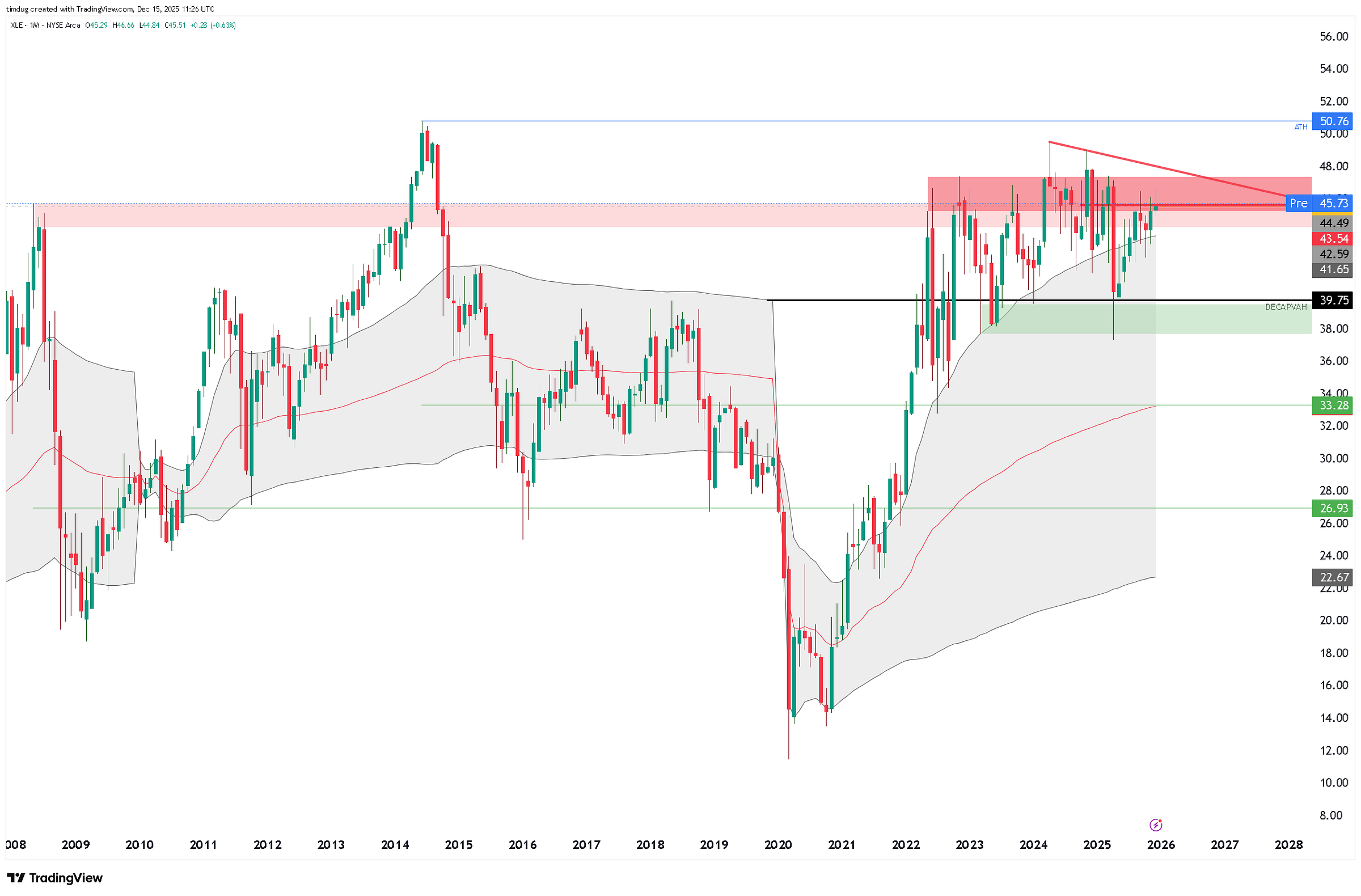

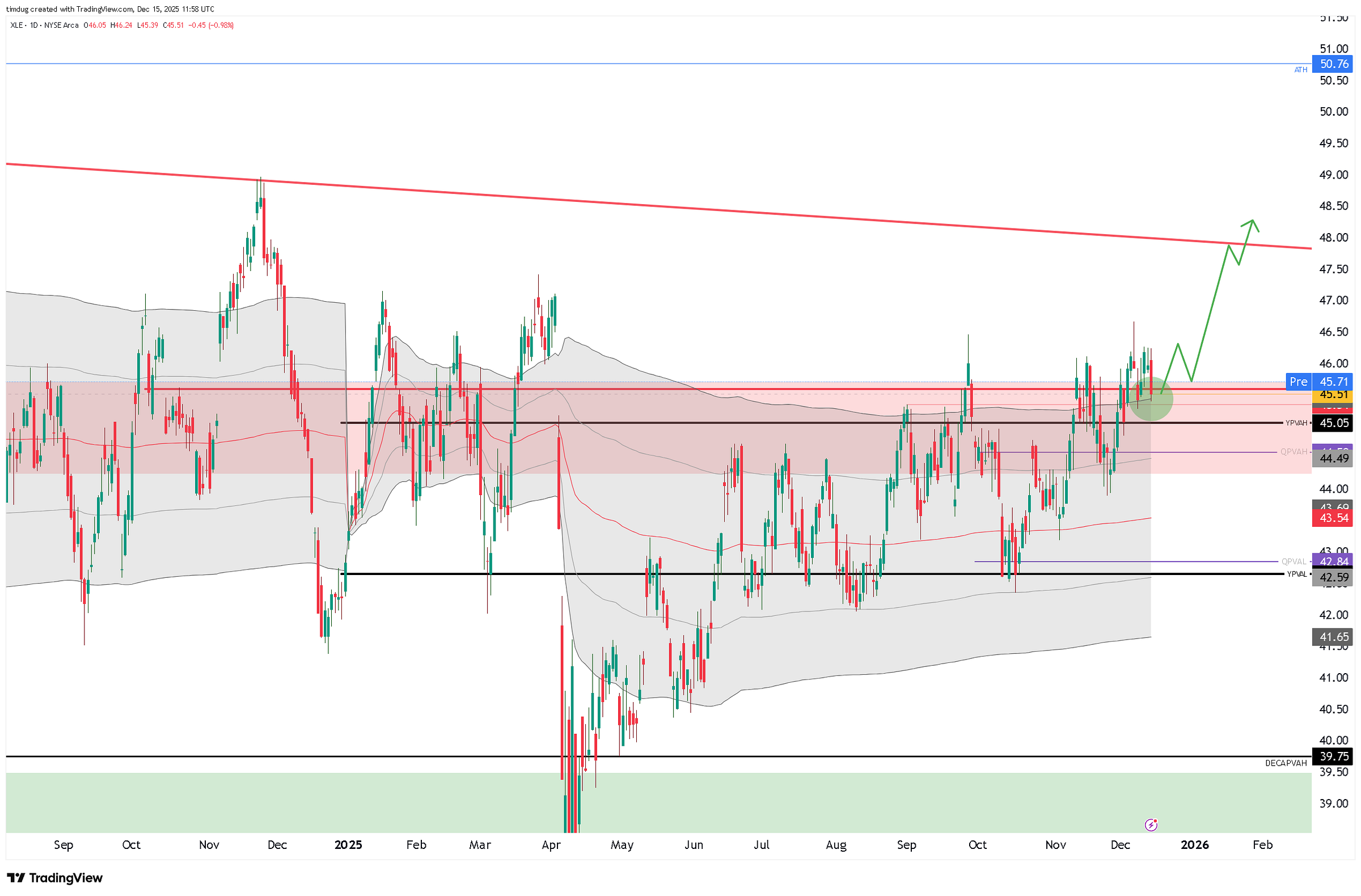

Market 1: XLE - Energy EFT of S&P500

Symbol: XLE 0.00%↑

Structure: IB Up on Decade and Year.

Setup type: IPB Long Y+1 $45.50

Bias: Long and willing to double down on pullback to Decade VWAP $33.30s

Notes:

In summary-This is now an AI energy needs and build out correlated play.

I’ve traded XLE 0.00%↑ a few times this year, all from the short side, and ended up roughly flat. The last stopped-out put spread was the tell: the usual linkage between crude and the $XLE complex has broken down. The trade stopped making the sense it used to.

The reason is the AI build-out. For the last three years, I’ve been vocal about being long the energy side of AI’s power demand. That theme is now getting priced: XLE components are being bid on future energy requirements and the cash flows that come with them. Layer on top a Fed that’s effectively re-opening the liquidity taps, and I see XLE outperforming over the next 12 months.

I’m not excited about chasing the move here, but any market shakeout that pulls XLE back offers real value. Ideally, I’d like to start building size around the decade VWAP, roughly $33. With fresh Fed liquidity in play, I doubt we get that gift in the near term, but my bias is still for XLE to grind higher from here and ultimately take out all-time highs.

I see this pullback being a strong deep value play, but I am going to start tip toeing into XLE here. Oracle has extended its 2026 build out cap ex to $50bln (12bln in a single quarter, mostly on GPUs and data centre kit. The market does not like this spend level. Oracle is 45% down from its highs, while XLE 0.00%↑ IS UP 3.35% for the same period. This tells me that the delta correlation is low.

Market 2: ORACLE

Symbol: ORCL 0.00%↑

Structure: IB Up on the decade. IB Up on context only on year.

Setup type: IPB Long DECADE +1 $191.71 AND/OR BPB Long YPVAL $167.89

Bias: Long

Notes: In summary, Oracle are positioning for dominance of the AI infrastructure space with this new level of Capex. I think the market it spooked, however The Fed are coming in with more liquidity to the market with Bond purchasing back. This will cause further inflation of risk assets.

Oracle is front-loading a massive AI datacentre push(+$50bln in 2026), jacking FY26 capex and lease commitments to eye-watering levels and driving deep negative free cash flow on top of an already heavy debt load, which is starting to worry credit markets. A big chunk of this spend is effectively pre-building capacity for a small set of AI customers (notably OpenAI/Stargate), creating concentration and utilisation risk if demand slows or shifts. At the same time, Oracle faces real-world execution bottlenecks (power, labour, build timelines), so it’s plugging the funding gap with a mix of bonds, long-dated leases and customer/supplier financing. Net-net, it’s a huge, leveraged timing bet: cash and risk are front-end loaded, while the AI revenue that justifies it is still largely back-end and unproven.

Market 3: Ouster

Symbol: OUST 0.00%↑

Structure:

Setup type: IPB Long Decade VWAP.

Bias:

Notes: I like this company from a technology POV and its current runway. Technically, this is well positioned to go aggressively imbalanced up. This is what average price tells me. Buyers have clearly come in to support Decade VWAP at $18.96s. I see this general support continuing. It’s another 270% up to resistance at $78.

Market 4: Ecopetrol SA

Symbol: EC 0.00%↑ TTM Dividend yield 10.19%