Monday 17th November 2025

Covering SP500, NASDAQ, BITCOIN AND GOLD.

‘‘Rumours of my death have been greatly exaggerated” Mark Twain

Folks, if you like this content, please do smash the like button. You could even go wild and hit the share button. All would be much appreciated.

Overview: There is a small amount of deleveraging that we are hearing reports about across the AI tech sector- Palantir etc. While this may be fact, we have not seen the traditional elements of any wholesale selling .ie Deleveraging. I think a further dip will bring us into major algo triggering levels, where we can easily drive higher from. The market anticipates another 25bps rate cut next month.

Meanwhile, on Thursday we get the anticipated September NFP data release. The market seems to be repricing into this event. Sell the rumour, buy the fact!

Oil market is covered in depth weekly on The Oil Report.

Selection criteria at bottom of report. Note dynamic levels, ie.vwap levels can and will shift intraday.

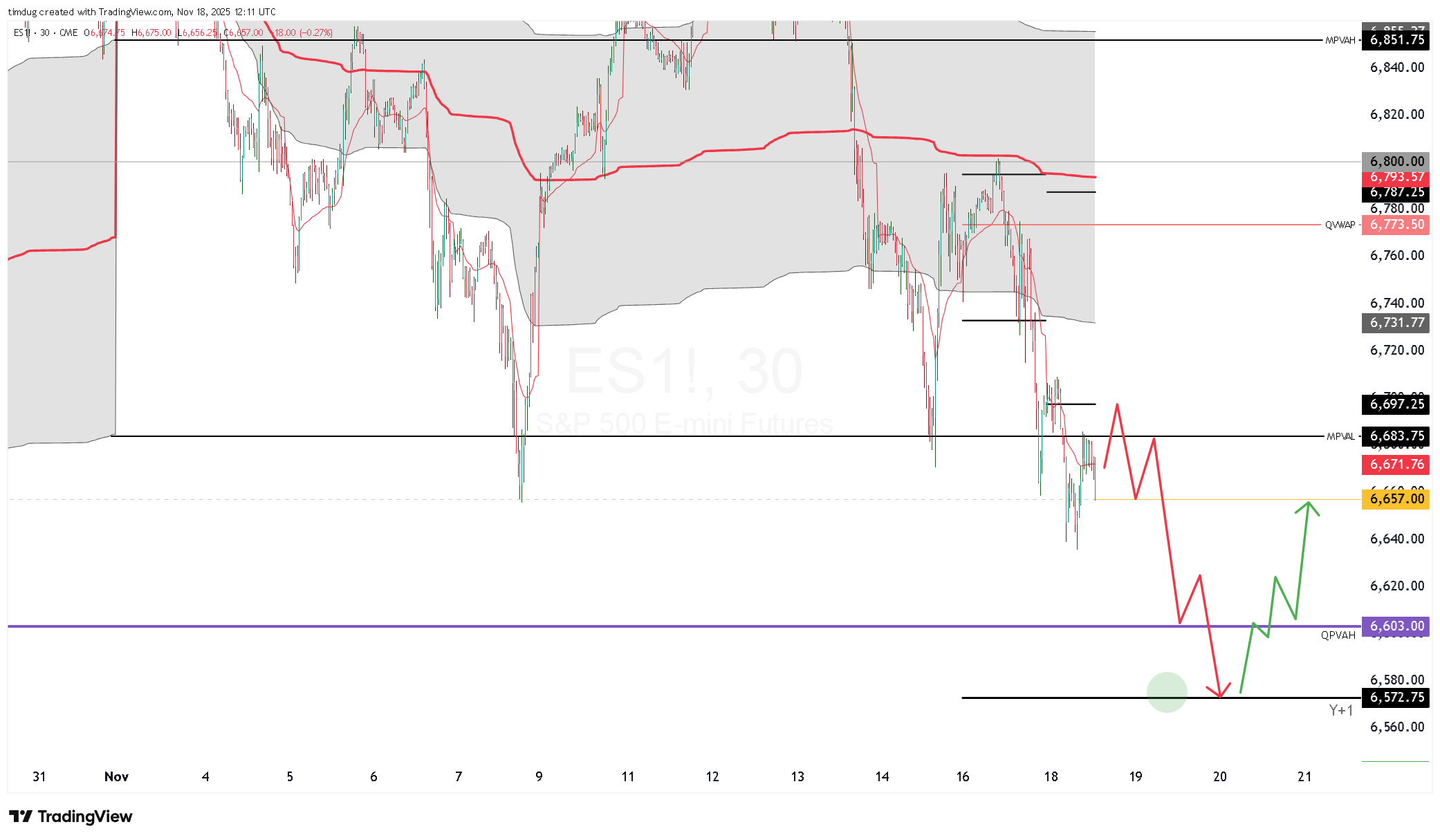

Market 1: S&P500 Futures.

Symbol: ESZ25

Structure: IB Up on the year and decade. IB Down on Monthly & Weekly Value.

Setup type: IPB Long Y+1.

Bias: Intraday short to Y+1. Position trade: Long Y+1.

Notes: The long price action must lift this market back above Q-PVAH $6603.00 rapidly. If not, bears will utilise this level as an area to sell. So a buy the dip op will present itself. Monitor through the lens of Monthly value and averages.

Deleveraging seems to be now set into some of the AI big names, with Google being the exception, on the back of Berkshire Hathaway’s recent entry. The selling this week and last is grossly over talked and participants are fearful.

Market 2: NASDAQ

Symbol: NQZ25