Monday 1st December 2025

Rotating money into 493. Bad China data.

In this report: S&P500, S&P 493, Nat Gas, Soy meal, NVIDIA.

Articles

Asia markets open December mixed as China factory activity weakens unexpectedly

Polar Vortex Watch: A large Polar Vortex core is about to dive into North America, bringing snow and cold weather to last

Overview: Oil market is covered in depth weekly on The Oil Report.

Selection criteria at bottom of report. Note dynamic levels, ie.vwap levels can and will shift intraday.

Notes on last week’s ES selling spots.

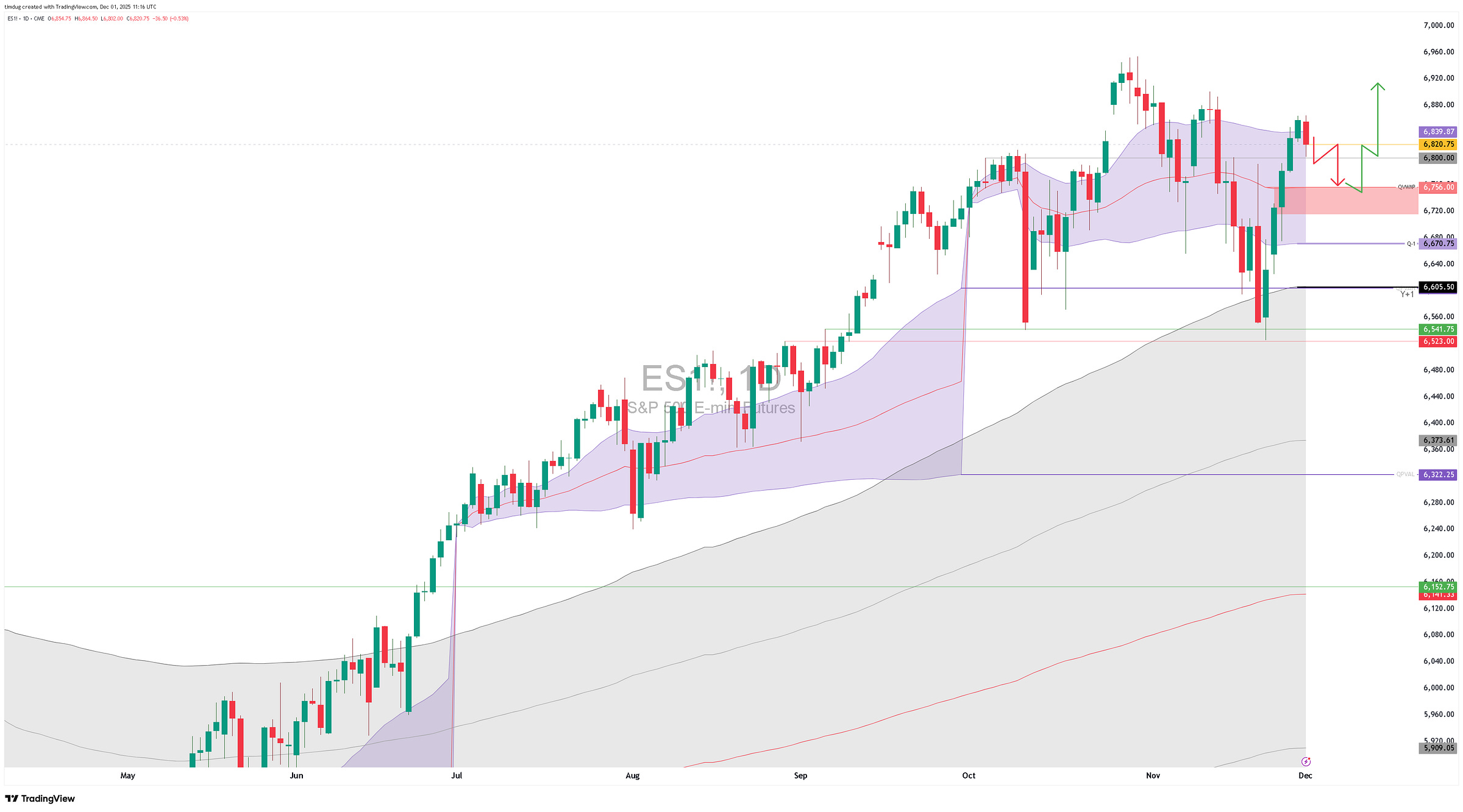

Market 1: ES Futures

Symbol: ESZ25

Structure: IB Up on Year, Flat on Q. Balanced to rotational down on Month.

Setup type: Short MPVAH on retest, short vwap.

Bias: Short intraday to QVWAP. Then looking for longs at or above $6756.00 QVWAP

Notes: The poor Chinese PMI data is weighing on markets this morning. This has to be factored into the observed pattern that if they sell in electronic, they buy it up ion the US session. Let’s see if this plays out today. I have seen days like this before, where poor overnight Chinese data can drag on the US markets for the entire day. So be open to how the market digests this.

Market 2: Henry Hub Nat Gas

Symbol: NGF26

Structure: IB Up on Y & Q. Flat to rotational on Decade.

Setup type: RPB Deca +1/ $4.949

Bias: short after trade above $4.949.

Notes: Natty is seasonally cued up for selling on the F contract, however weather dynamics hold prices firm.

Market 3: Soy meal futures

Symbol: ZMF26

Structure: IB Up on year failing. ie. Y+1 getting sold. Rotational of prior years value.

Setup type: IPB Long QVWAP. Confluent with YPVAH $308.8

Bias: Long once we trade QVWAP.

Notes: Seasonally to stay bid through to end of Dec.

Market 4: NVIDIA

Symbol: NVDA 0.00%↑