Monday 22nd Dec 2025

Bitcoin, down but not out. Silver, Gold.

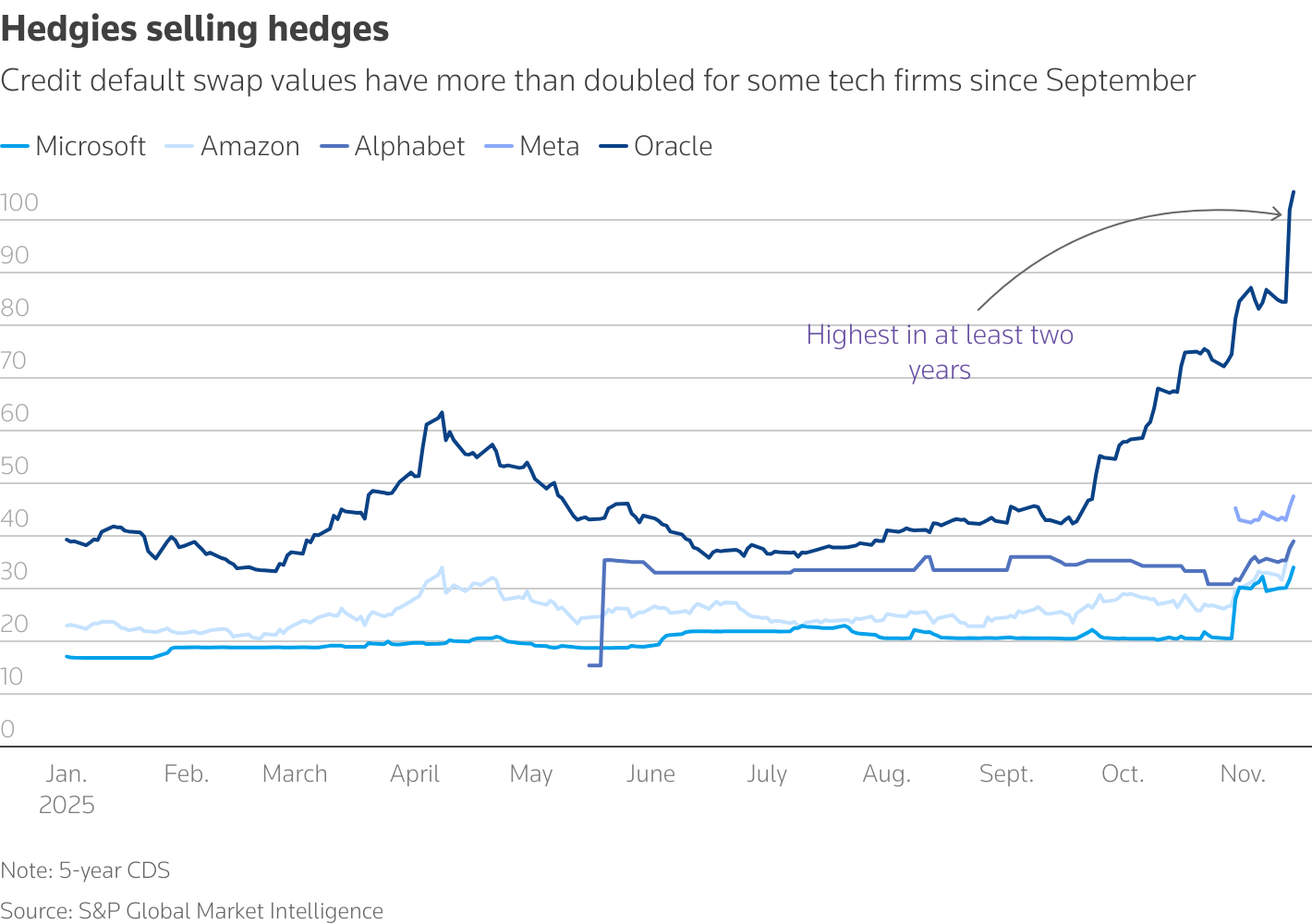

Notes. Credit default swaps on The Mag 7 are ripping higher. Basically, it’s a scramble for default insurance. We all remember The Big Short.

Articles

Video: Fed cut momentum builds again as oil softens and metals tighten | Dec 25

Overview: Oil market is covered in depth weekly on The Oil Report.

Selection criteria at bottom of report. Note dynamic levels, ie.vwap levels can and will shift intraday.

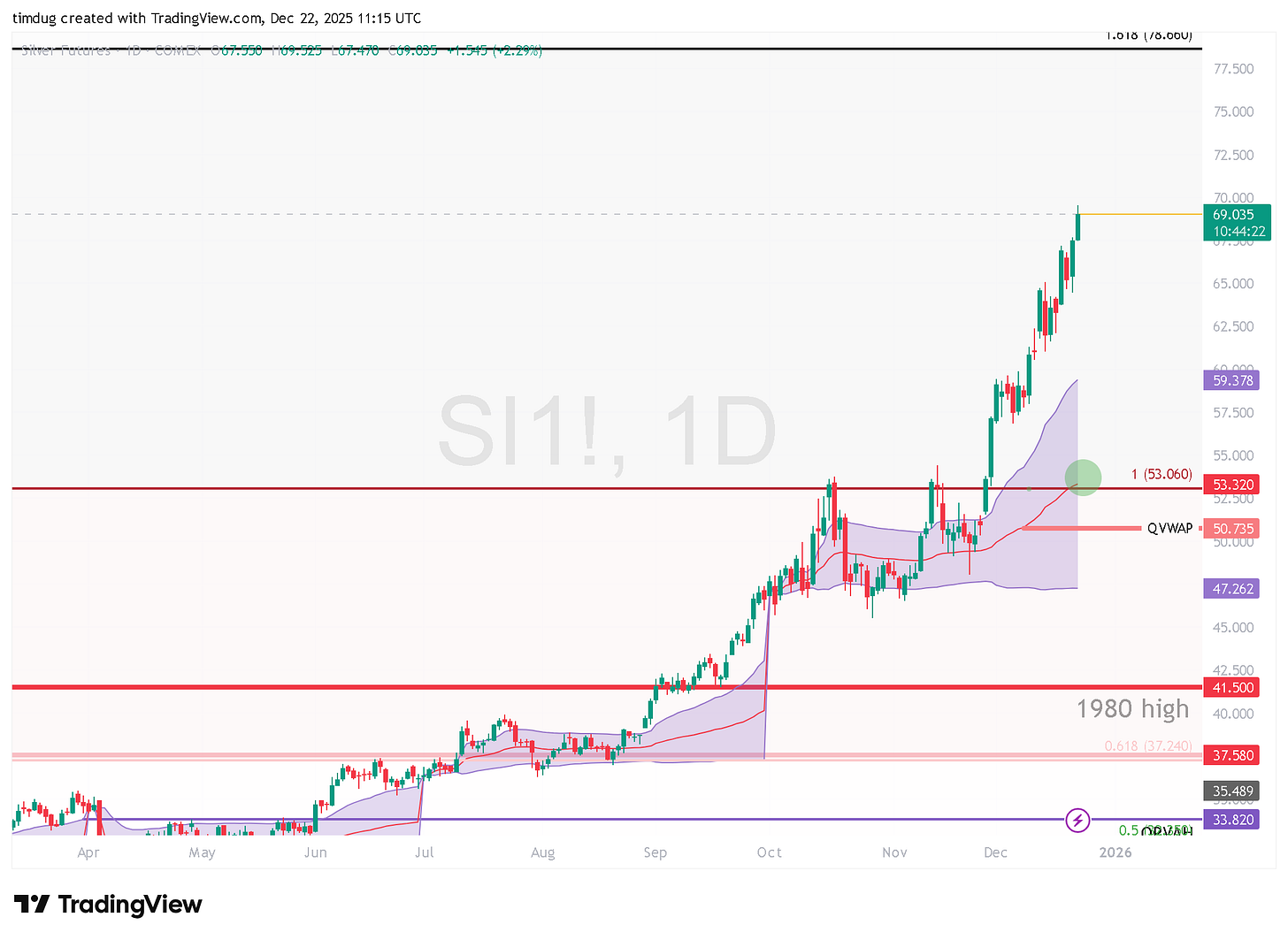

Market 1: Silver

Symbol: SI 0.00%↑

Structure: IB Up as fuck!

Setup type: IPB Long W+1

Bias: Long.

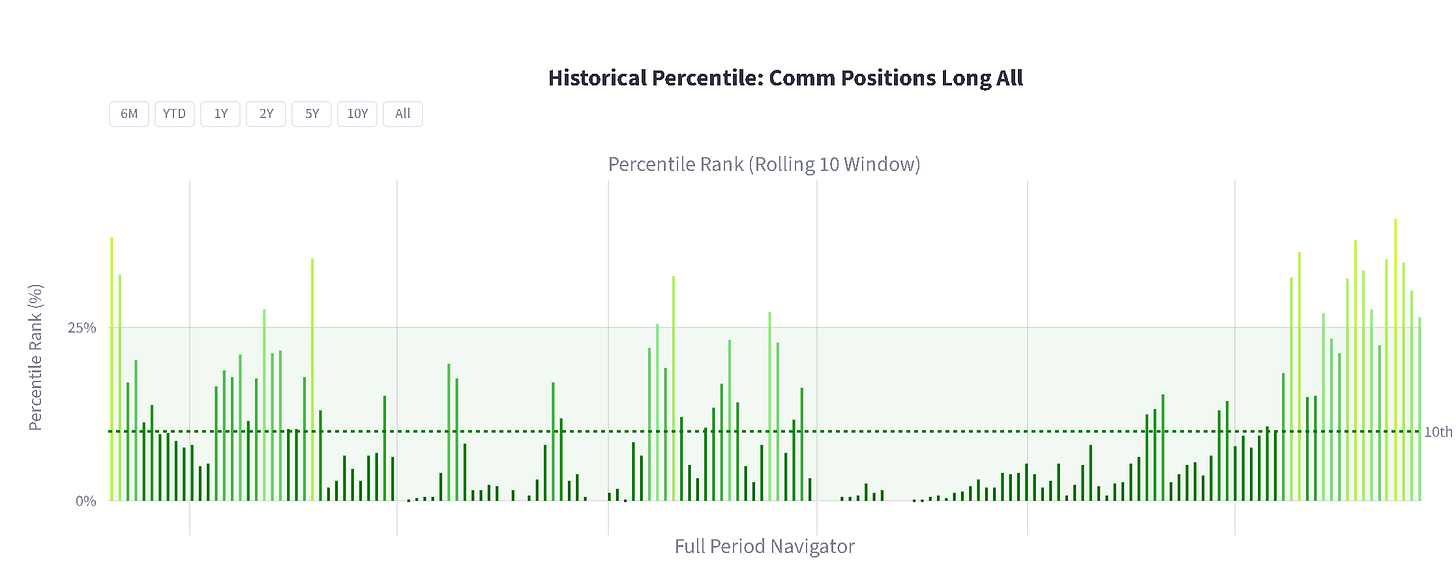

Notes: C.O.T analysis below as of Dec 2nd. COT will not be fully back up to date until 31st Jan. All charts are from the Duggan Capital proprietary COT analysis software.

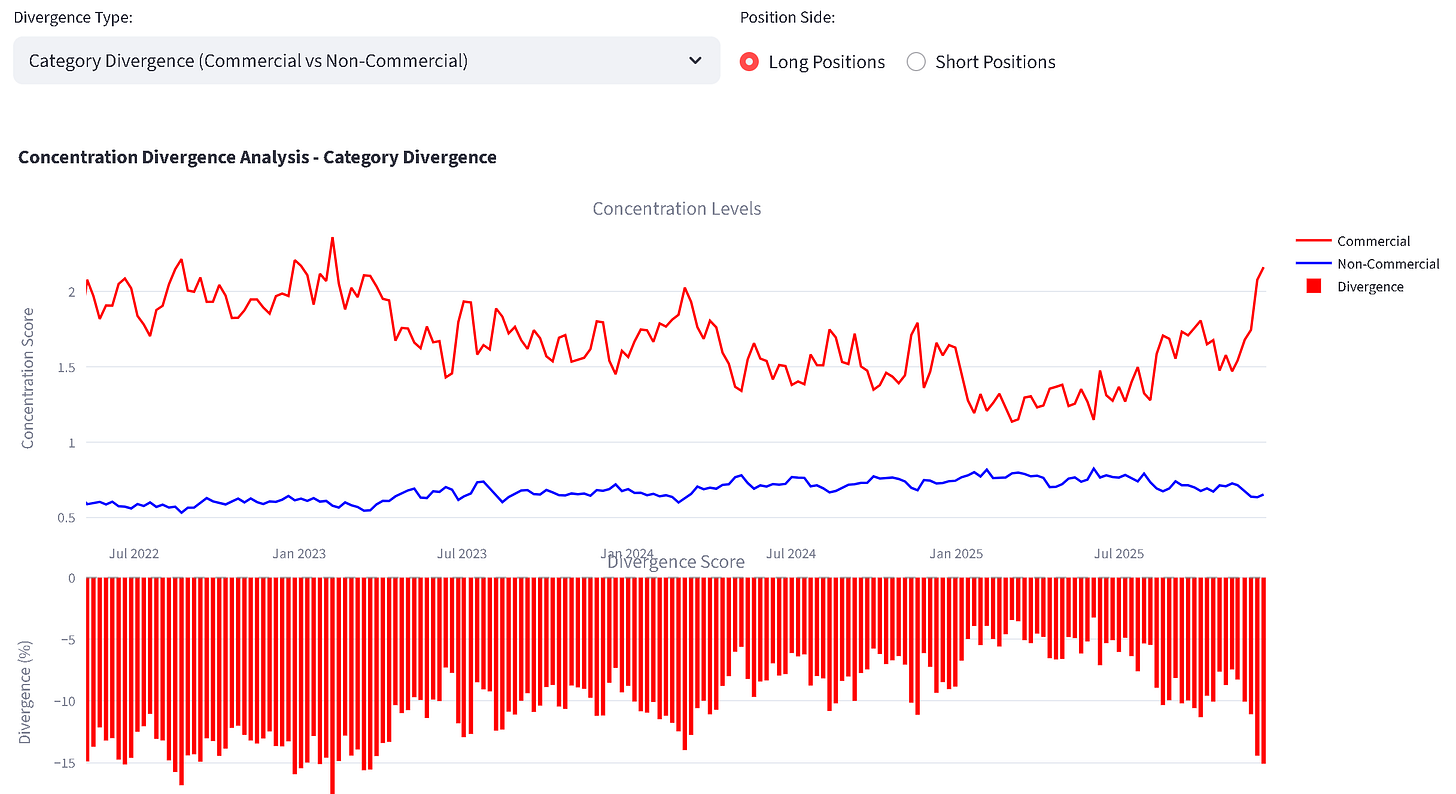

Specs .ie managed money are NOT on this bull move. This is good for further upside. Once they start stepping in on the long side, the upside move will become even more unstable. What you want to look out for is when the commercials stop buying this and actually go net seller. Commercials will sell the lock in current prices. See below for current commercial selling levels.

Commercials are only at the approx 25th percentile of their all-time long positioning. So this can run A LOT MORE TO THE UPSIDE.

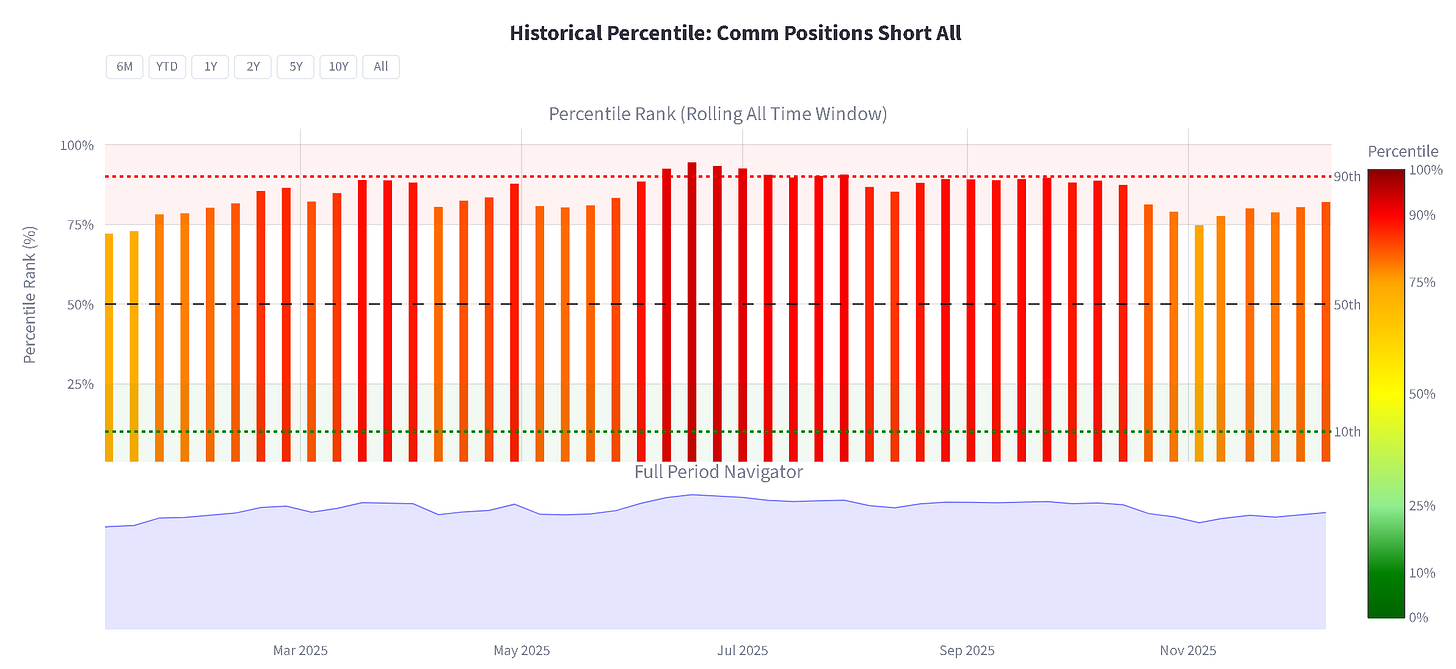

Here is the commercials short side all time observations. Currently at 82nd percentile. So yeah, not max levels at all.

Market 2: Gold

Symbol: $GC

Structure: IB Up