Monday 24th November 2025

Shaken not stirred

Overview: Covering Nat Gas, S&P500, Gold C.O.T, Dax, Bitcoin, Bund.

Oil market is covered in depth weekly on The Oil Report.

Selection criteria at bottom of report. Note dynamic levels, ie.vwap levels can and will shift intraday across all timeframes.

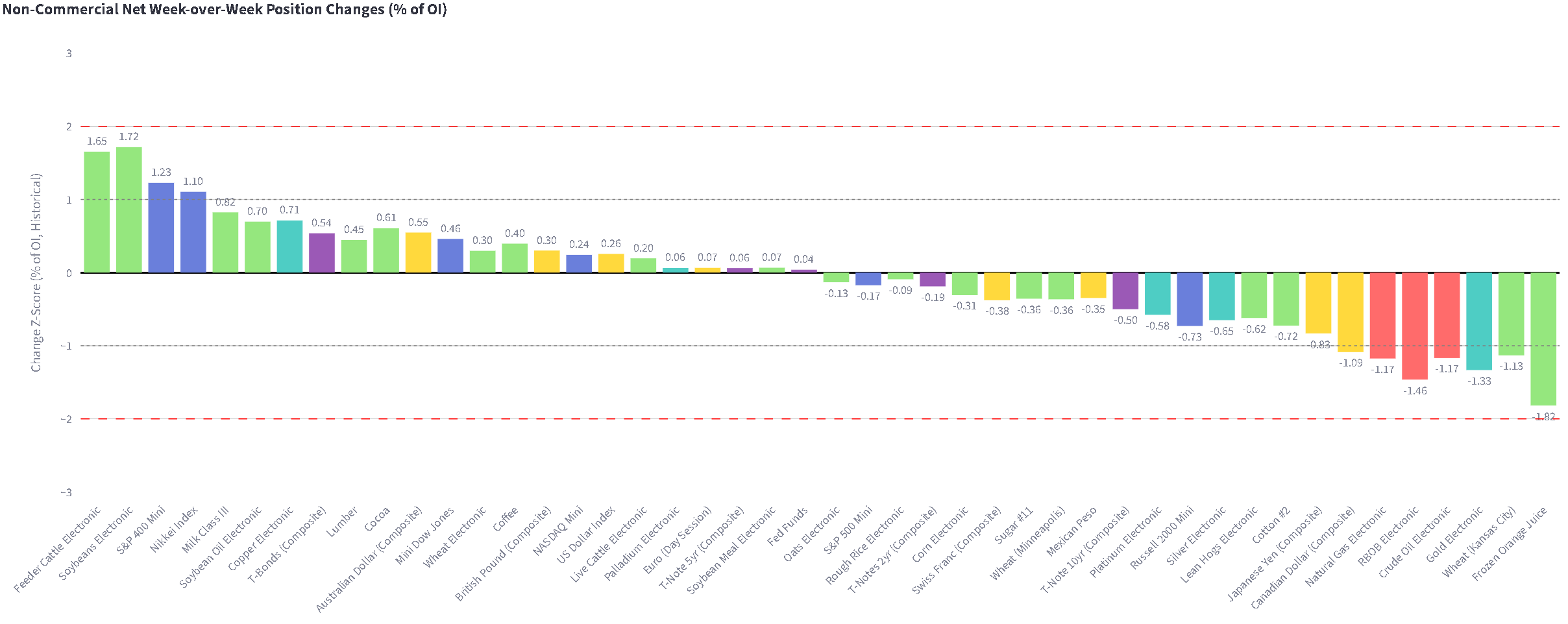

General notes: A top level snapshot from our C.O.T (Commitment of traders) analysis tool. This chart shows the changes in open interest since our last C.O.T data on September 30th.

Notes from COT.

Gold Spec longs appear to be building again, but not at crowded levels at all. Next week I think will be interesting from COT here given the max fear going into Fridays close.

Market 1: Nat Gas

Symbol: NGF26

Structure: IB Up

Setup type: IP Long ETH VWAP or IPB Long to electronic opening range Monday. Not an easy one.

Bias: Long above MVWAP.

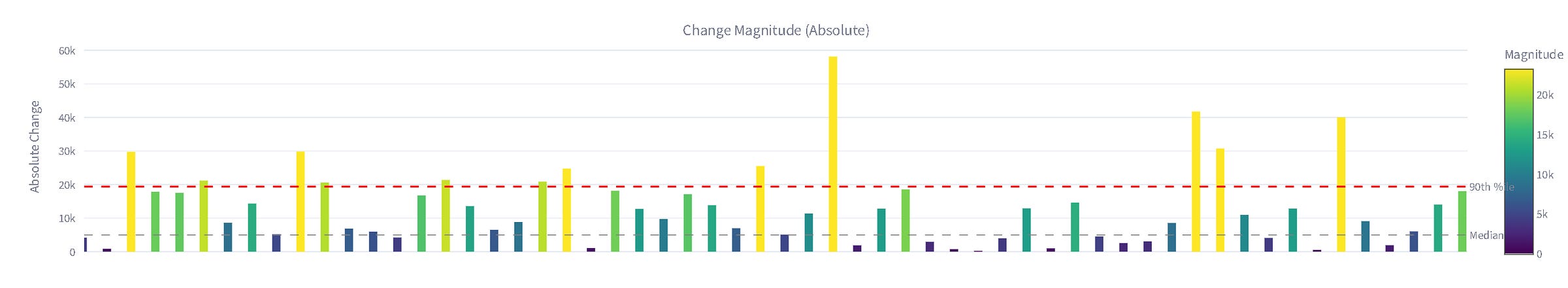

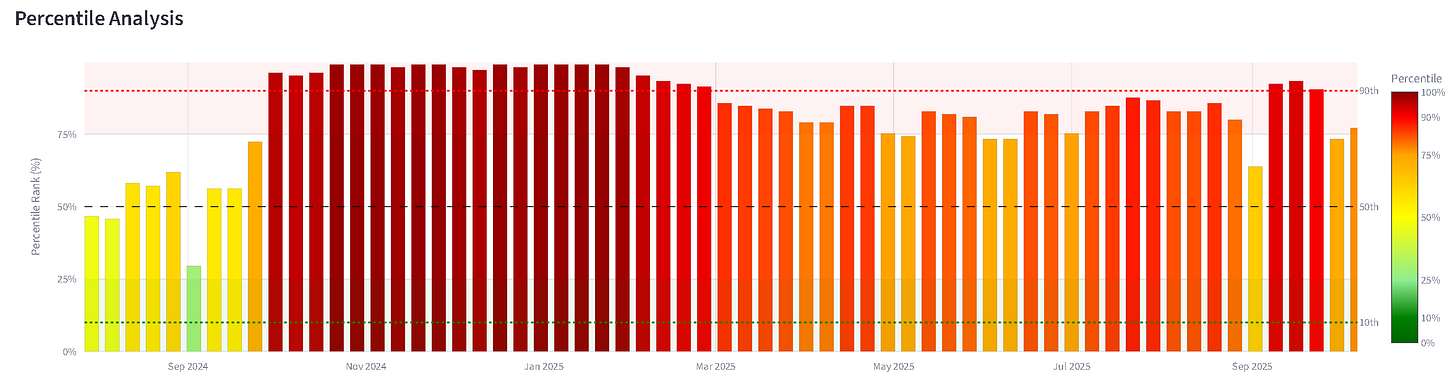

Notes: Spec Shorts are coming off crowded high levels over September (above 90th percentile). Given that we have no data in October, we can imagine if they stayed that short, they would have been ripped with the Gas rally. I think seasonally we are due a pullback in Gas as we move into trading the Jan 26 contract (last week we rolled on volume).

On our momentum table, we can see they added +3389 long contracts to + approx 600 shorts. I think we go up again in Natty. I think there will be a ton of people who want to step in front of this train, so while seasonality say we got to start selling off, that can wait until we hit some of these big upside targets. Added to this, Specs are increasing longs. I’m not going against them. As always, buy it as cheap as you think it will get .ie no chasing at the tops or chasing at the bottoms.

If this market needs to retest Q+1, It may come under fires and be a signal that the top of this rally is in for now. I would turn bearish below MVWAP.

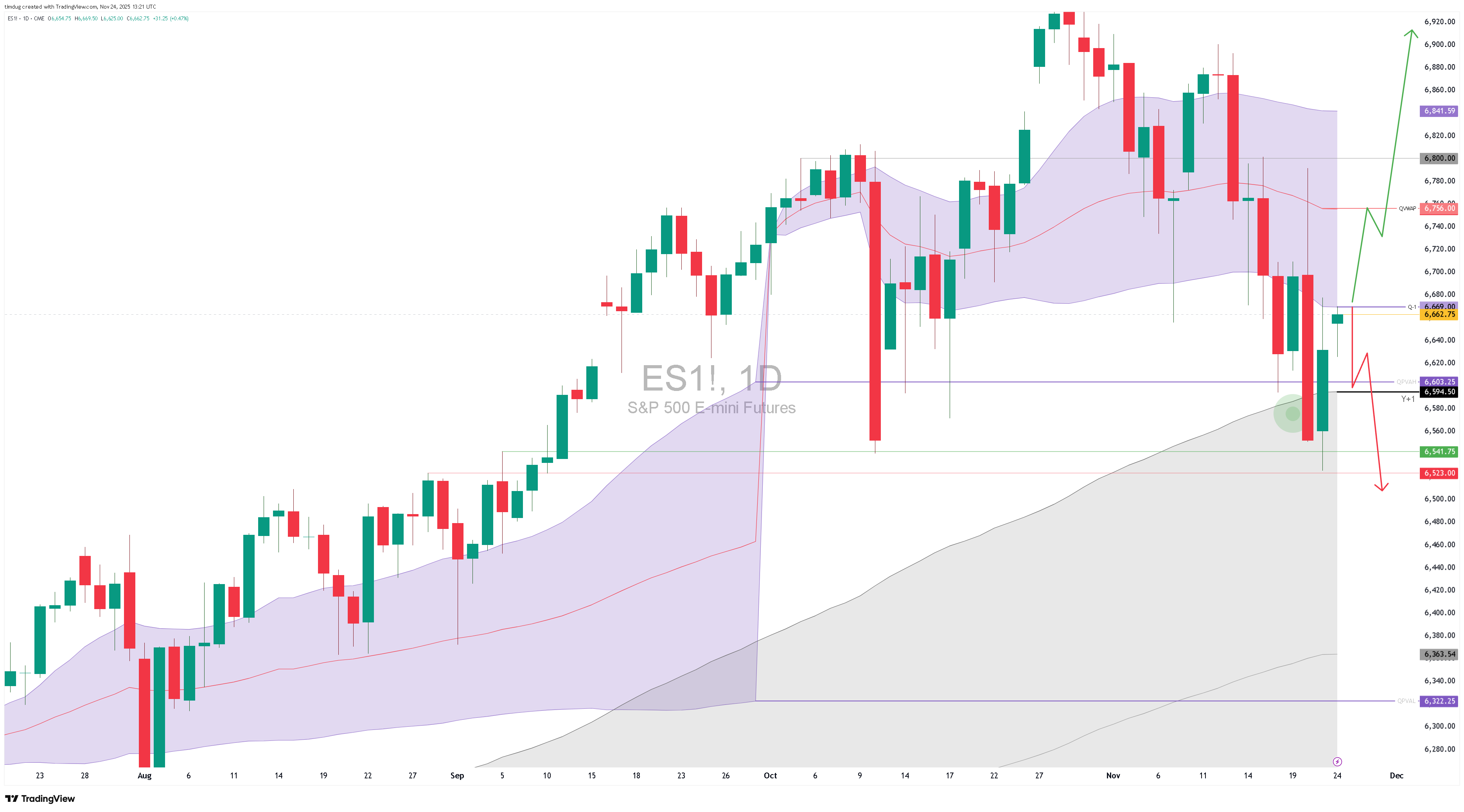

Market 2: S&P500

Symbol: ESZ25

Structure: Imbalanced up on Year and Quarter. IB Down on Month.

Setup type: Breakout pullback short on Month’s area.

Bias: Short

Notes: This may lift above MPVAL.

Market 3: Dax

Symbol: FDAXZ25

Structure: IB Up on Year. IB Down on Quarter.

Setup type: bpb sHORT qpval confluent with

Bias:

Notes: The strongest stock indicies globally all year. This may be a canary in the coalmine. A test of QPVAL here in my view will be sold.

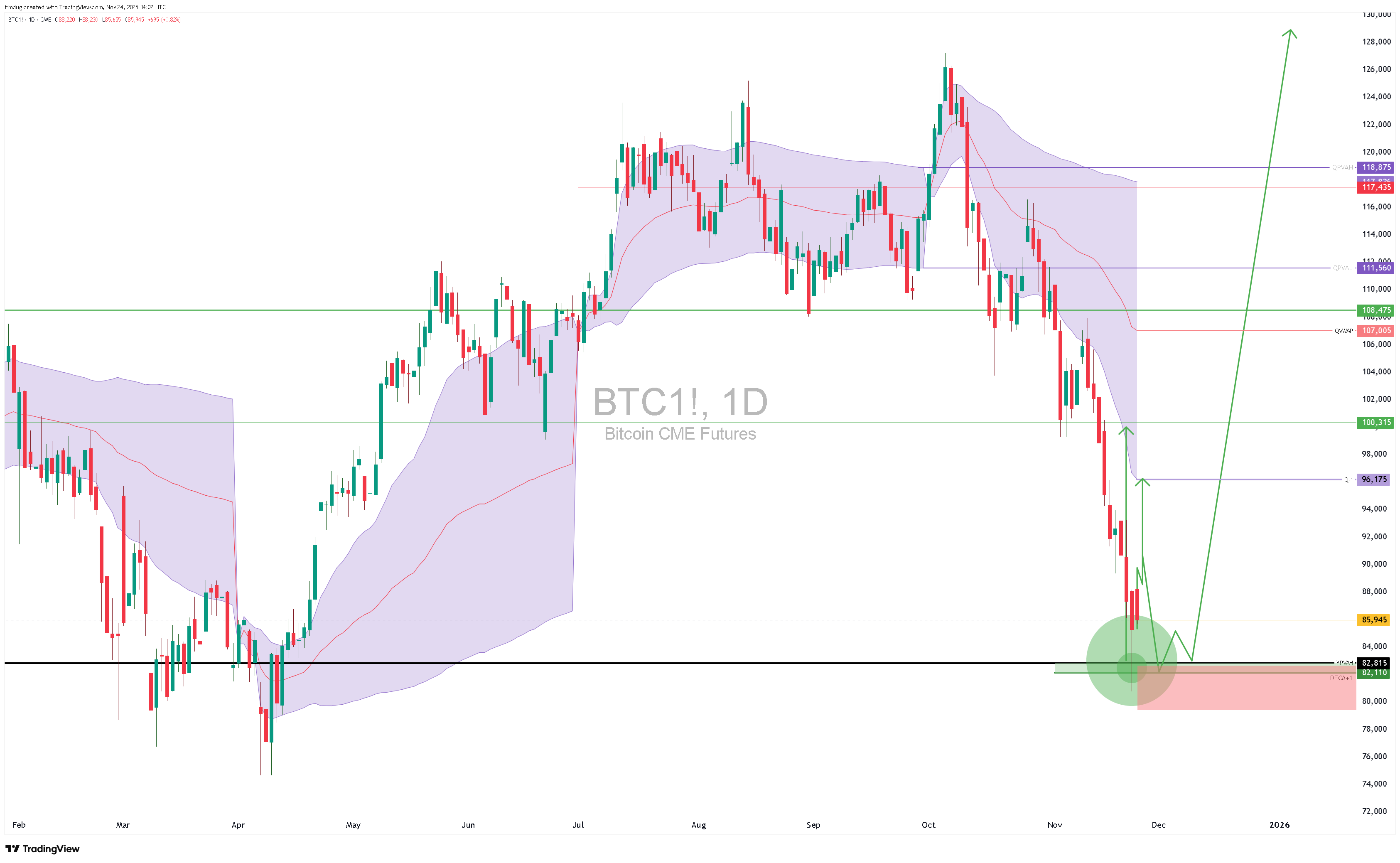

Market 4: Bitcoin CME

Symbol: BTCZ25

Structure: IB Up on Decade and Year. IB Down on Quarter. IB Down on Month. Balanced on Week.

Setup type: BPB Long PVAL CONFLUENT with WPVAL.

Bias: Long.

Notes: Market must stay closing days above YPVAH / Decade+1

Market 5: German 10year BUND futures.

Symbol: FGBLZ25

Structure: IB Down on Year. Balanced on Quarter. Balanced on Monthly.

Setup type: Pattern shift long M-1/ Pullback long QPVAL

Bias: Long.

Notes: Market must stay closing days above QPVAL

Have fun out there.