Next level up

A new animal

Key events last week

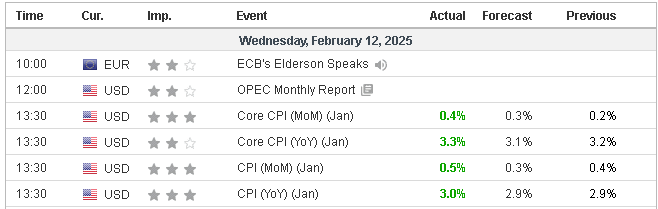

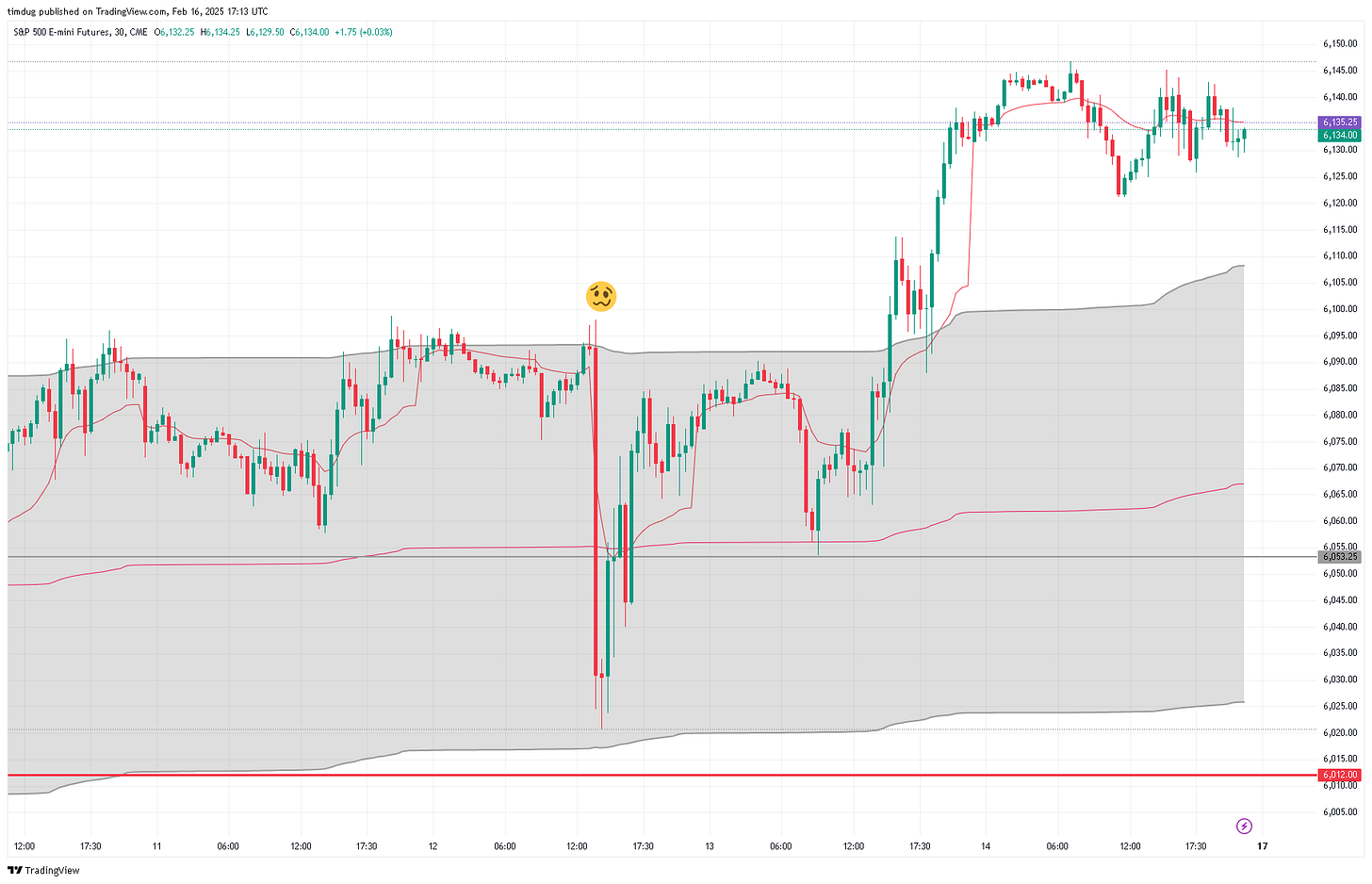

CPI’s came out Wednesday a beat, with a shock to the downside across the equities complex and supported strength into the DXY. The rally after the dip sets down a new normal given that 1. it pushed rate cut expectations squarly to the far reaches of 2025 if at all and 2. Set a new standard of how strong the animals are in equity health in US stocks. The new sheriff has the confidence of the markets.

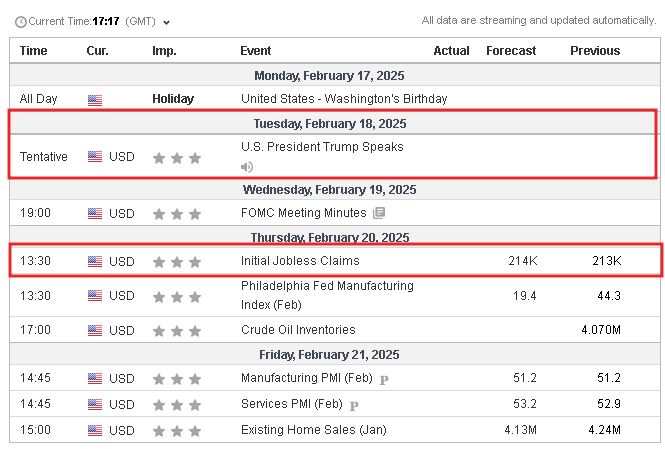

Calendar

US market holiday Monday- Presidents day will see reduced volumes. Trumps speech Tuesday will be no exception to the others. Expect more on DOGE progress and who is next for an audit, a broadening scope of tariffs globally, Ukraine peace deal updates and much more. The jobless figures are now one to watch as layoffs spread across government divisions, with Washington property listings rising 20% in Feb. Any guess as to why? The lobbyists are running.

Earnings this week

Energy heavy Tuesday, only Oxy is the big hitter OXY 0.00%↑ , WMT 0.00%↑ , BKN 0.00%↑ , Full list here

Articles

There are interesting notes from the IEA and OPEC+ monthly reports on The Oil Report

Berkshire Hathaway exits S&P ETF’s, trims bank holdings

Auto loan delinquency rates highest in 14 years

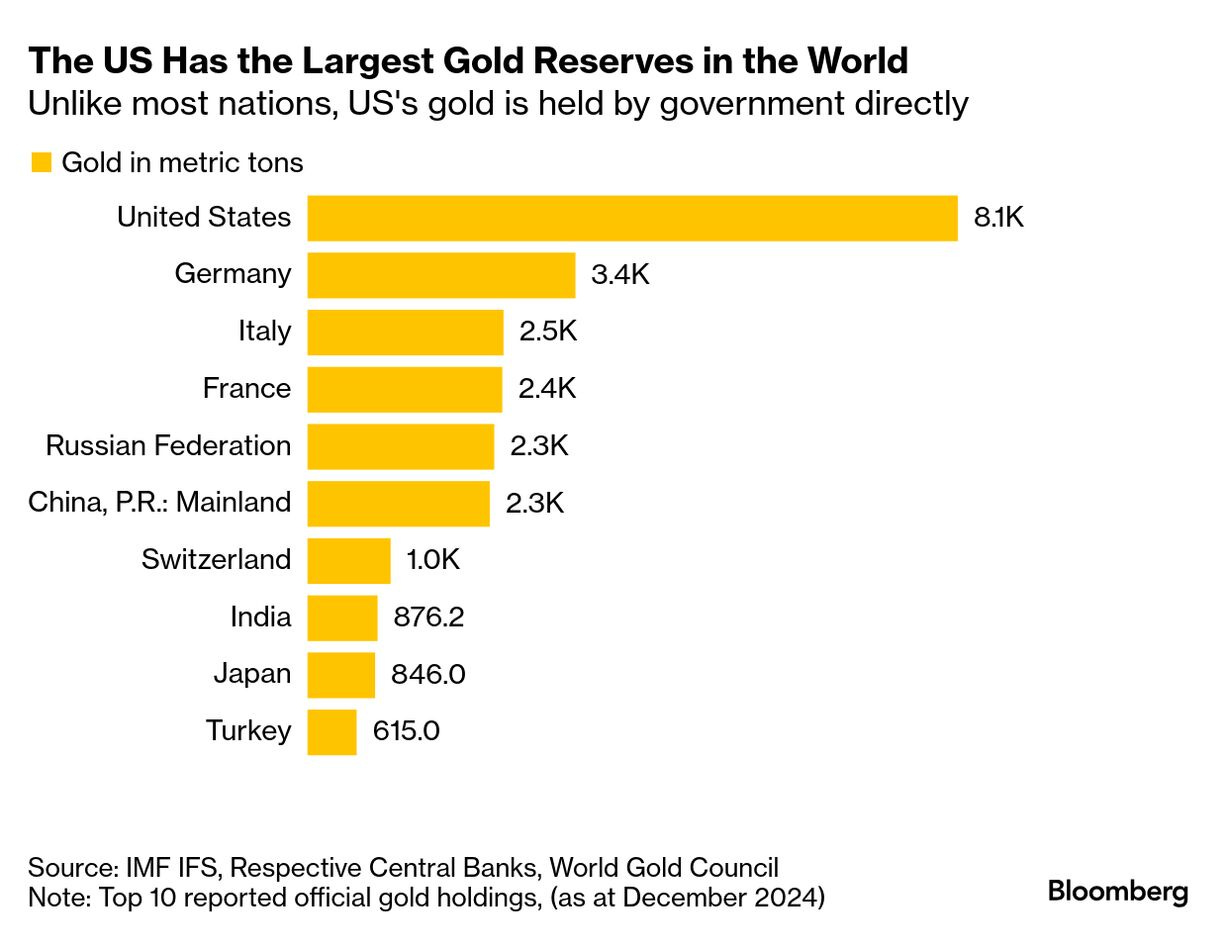

Bank of England Stammers Through Gold Withdrawal Delay Explanations— More on this to come. There is something historical at play here that deserves a special report and podcast. At least 72 overseas central banks maintain gold accounts with the Bank of England, including:

Germany: Holding 438 tonnes of gold

Austria: Holding 208 tonnes of gold

Switzerland: Holding 224 tonnes of gold

Belgium: Holding 200 tonnes of gold