QE Lite

Largest bond re-purchase in U.S. history

PLEASE, FOLKS, GIVE THIS A LIKE AND A SHARE IF YOU ENJOY THIS REPORT. It means a lot.

In this report: The quiet QE- Treasury buyback $10bln, U.S. Housing in trouble, Inside the NFP Jobs report, Trade charts - silver roaring into life.

Views

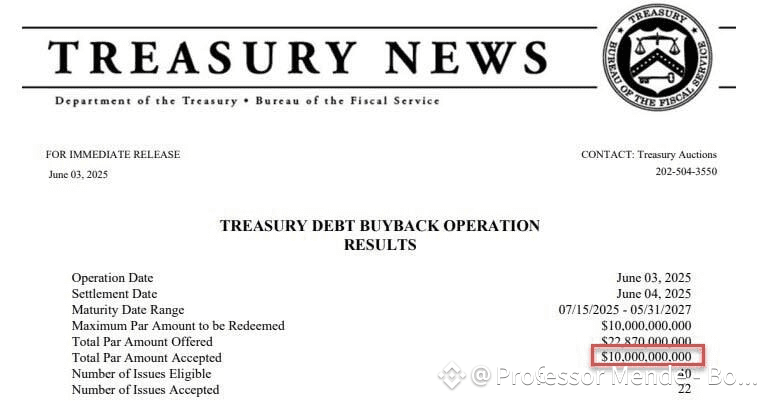

QE (Quantitive Easing) Lite-The Treasury, on Tuesday last, stepped in and bought $10billion. (Confirmed source) Thanks Scott Bessent. The largest bond re-purchase in its history. There is another $10bln scheduled in repurchases Monday 9th June. Effectively, Bessent is delivering easing that Powell is not ready to do. This is easing and massive liquidity. I am very surprised that main stream media has not picked up on this at all. I had to go hunting for the verified source on the Treasury website. Expect markets to be underpinned by this liquidity. This got very little coverage last week in the fog of expectations around NFP. Make no mistake, this is uber bullish. If the markets are to have a wobble at this point, you are looking at a massive dip buying opportunity. By the same token, if the markets can not rally this coming week this is quite the news failure that would put U.S. markets in a dire situation.

There’s nothing to fear-except blind faith in U.S. exceptionalism. The A.I. rocket is still in its initial burn. April 7th was a discount. Since then, the market’s gone vertical-just as a tick up in jobless claims and a headline beat on NFP hit the tape.

But dig deeper. The labour data is deteriorating under the hood: four straight months of downward revisions, rising short-term unemployment, and a pullback in federal and manufacturing jobs. Details in the macro section below.

Magnificent & Exceptional 7

It is more than disconcerting to look at how skewed the U.S market is right now. To trade ES futures, you are really only trading Mag 7 companies Apple, Amazon, Google, Meta, Microsoft, Nvidia, Tesla. The S&P 500 has added $7.5 trillion in market cap since the April 7th low. The Magnificent 7 has accounted for +54% of this increase, gaining $4 trillion in value. This means the Magnificent 7 has contributed 9.1 percentage points to the 16.8% return of the S&P 500 during this period. Tesla's, $TSLA, and Nvidia's, $NVDA, share prices alone have surged by 53.6% and 42.6%, respectively. It’s an A.I. bubble and this is the start, not the closing stages, of its growth. As long as A.I growth is sustainable and not shocked by another DeepSeek rumble, we can continue higher.

Articles

Treasury steps into Fed’s shoes: Bessent fires $10 billion bazooka to calm bond market’s tantrum

US economy shows signs of 'paralysis' as new data reveals hiring slowdown, activity contraction in May

USDA redaction of trade analysis causes concern about report integrity

Why some economists are worried about U.S. inflation data

Home Listings Hit Record High As People Struggle To Sell

How the feud between Elon Musk and Donald Trump exploded over 72 hours

Calendar

Highlights include US CPI, China inflation and trade data, UK jobs, GDP and spending review

MON: Japanese GDP R (Q1), Chinese Inflation (May), Chinese Trade Balance (May), EZ Sentix Index (Jun), US Employment Trends (May)

TUE: EIA STEO, UK Jobs Report (Apr), Swedish GDP (Apr), Norwegian CPI (May)

WED: ECB Wage Tracker, US CPI (May), UK Spending Review

THU: UK GDP (Apr), US PPI (May)

FRI: French/Spanish Final CPI (May), EZ Trade Balance (Apr), University of Michigan Survey (Jun), Quad Witching

Earnings

Light earnings schedule from U.S. with GME, ORCL & ADBE.