Santa rally underway

Do we need to reload below?

In this report Ill have a look at ES, DOW, Gold DXY and ZN US 10 Year bonds.

For oil coverage, please see The Oil Report. I have split this out for two main reasons. First being that this report can get quite large/ clogged up, if I include everything I have to say about oil. The second reason is that I do want to share more detailed and product specific notes on oil some weeks. Sometimes back tested seasonal and outright data, changes to the outlooks etc. Like this week. We are seasonally meant to put in the bottom of what is usually a 2 month weak period. It will be a significant and violent price move if we don't turn this week.

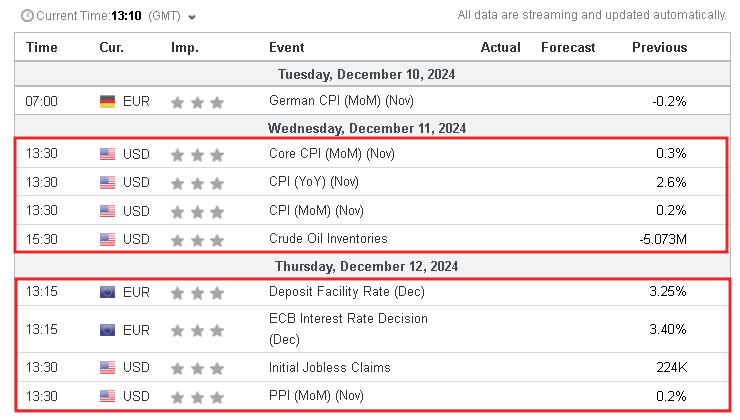

A relatively quiet week ahead.

Wednesdays CPI from The US and Thursday ECB rate decision and US Initial jobless to come.

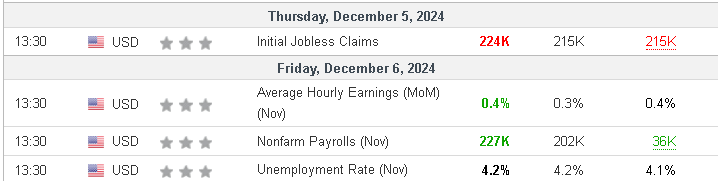

In the week gone by, we saw a mildly strong NFP reading 227k beat on 202k forecast. Average hourly earnings are also strong with unemployment unchanged. However Initial jobless data on Thursday showing a weakening labour force claims at 224k on prior 215k.

We can jump around the figures, with a lot of analysts talking about inside the NFP data where there were big losses of full time roles, slicing and dicing the data certain ways. The net outcome is the market traded on the headline figures.

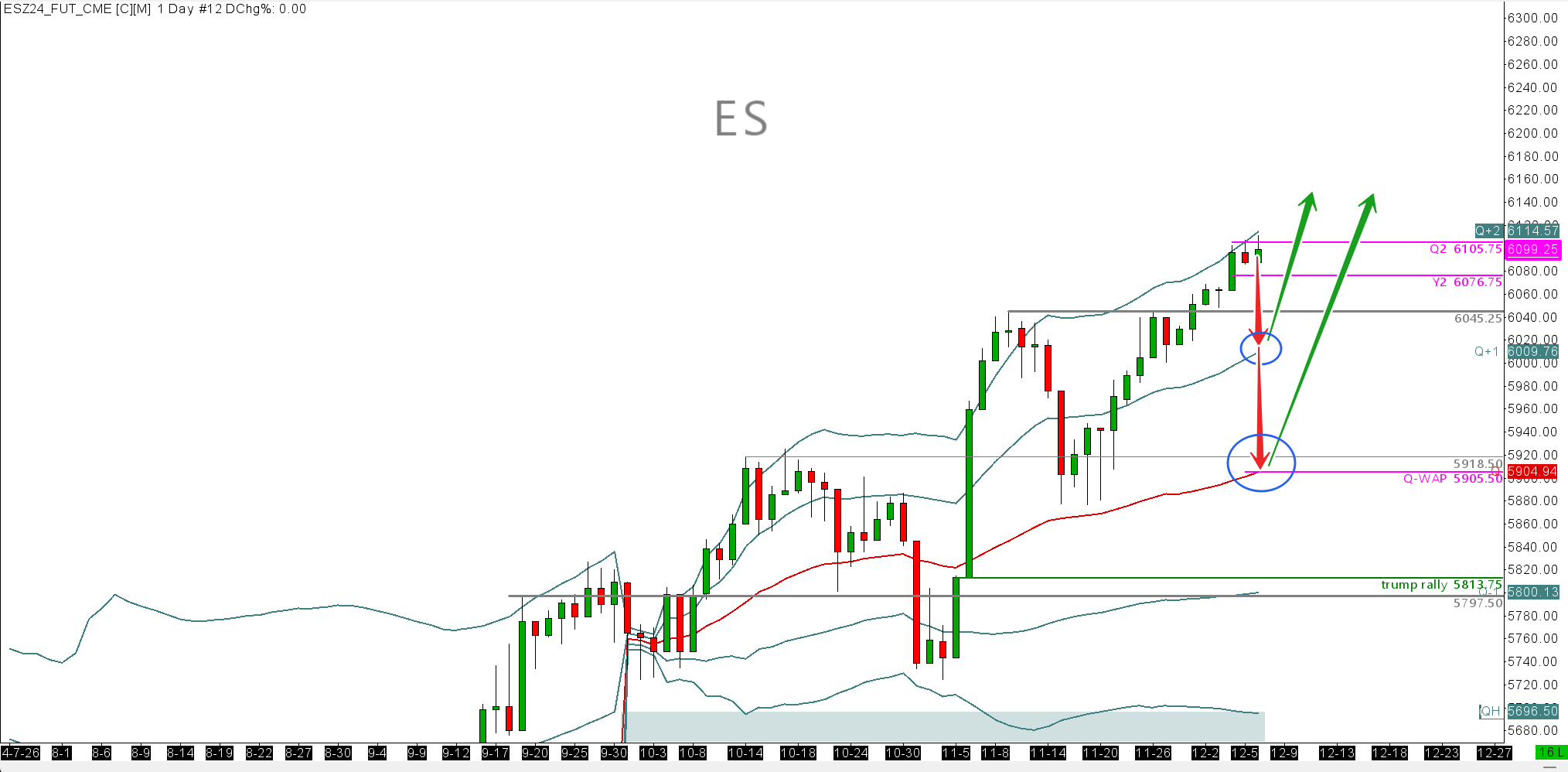

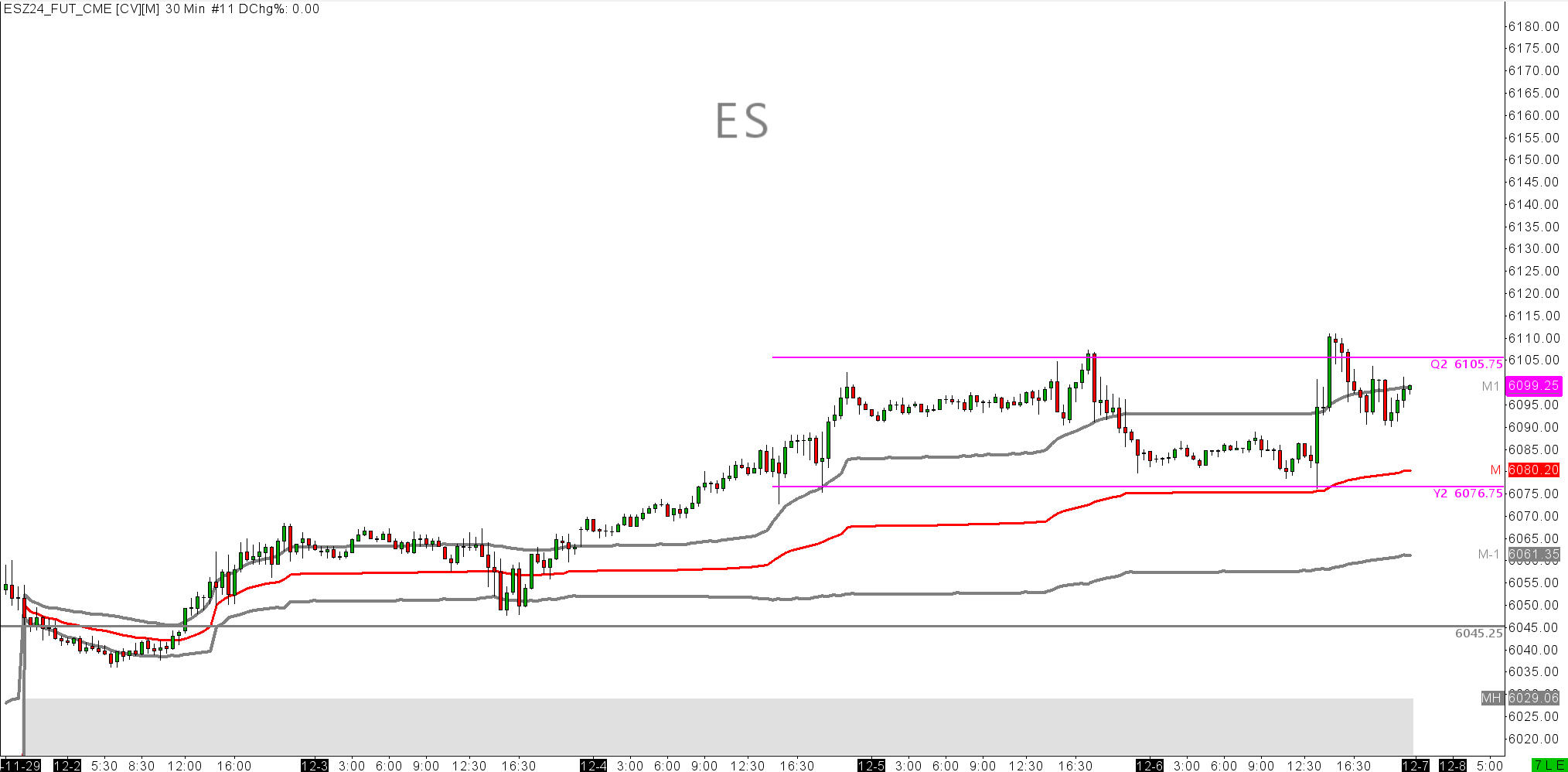

SP500 ESZ24

Buyer on dips, not the environment to be seller of rips. HJistorically, the SP500 is practically never negative on December. You dont wantr to fade those stats, nor would it make any technical or macro sense at all.

DOW YMF24

United Health UNH 0.00%↑ constitutes 8.38% of the Dow jones weighting. The 2nd largest weighting.

The assisination of the United Health CEO was a wildcard and tragic event that happened last Thursday morning. The initial reaction (60mins) was a steady ship while details and the story was confirmed. United peaked at 2.1% approx that day and as the news filtered through, finished -0.92%. The following day/ Friday, sellers were at work. This was enough for me to sell pops in YM through the session against MVWAP, however the breakdown didn't come through until almost exactly after I left my desk. United Health finished -5.07% on the day, dragging YM down -0.36% on close. I suspect there is more selling to happen here in UNH, enough to drag DOW lower and into interesting value areas like Q+1 $44300 where dip buyers will get interested.

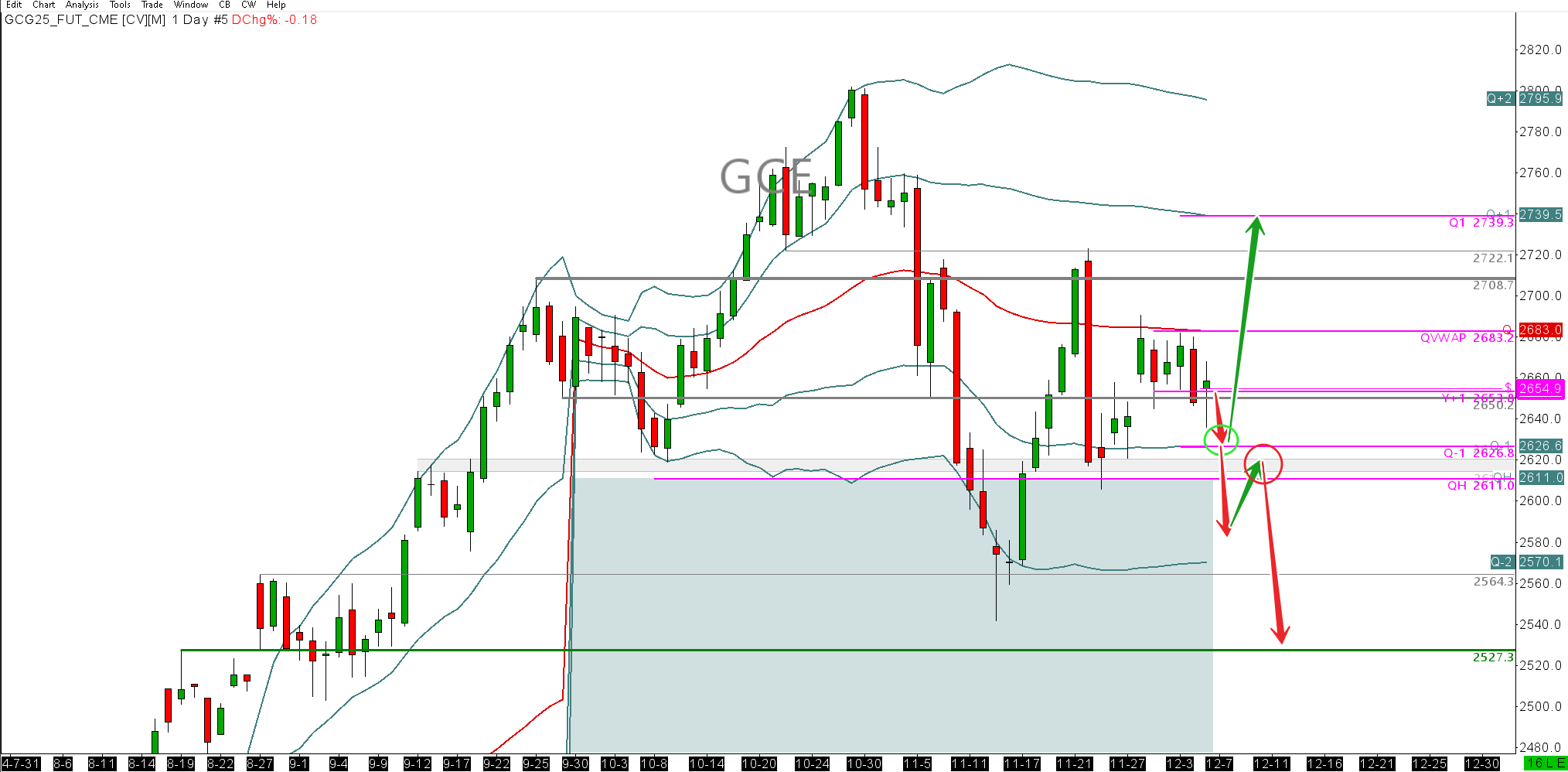

GOLD GCG25

Stuck in a tight rage, Gold has been a tricky trade for most of last week, with a nice long op on Monday from the $2650 support. II was expecting QVWAP to test and be broken early on, but no cigar. Bonds were mixed and hovering around YVWAP on the 10 year, so it was not entirely surprising there was no lift. Over NFP, T-Notes then started to lift and hold over YVWAP, yet gold couldnt get out of bed.

I expect the best buying ops on gold either come straight on the reopen Sunday evening, or after a deep pullback to Q-1/ MPVAL area. Ultimately I'm going to stay loose with Gold this week and stick to the areas I want to be involved in, as per the charts here.

I’m putting in a chart that shows the narrow window of execution that I have for my intraday trades. Sometimes I intraday trade into multiday positions. I'm only at my desk to trade for 3.5hrs (210 mins) each day. IBefore I had the babies, I would also have 2hrs in the morning to cover the European opens, and I hope to get back to this next year.

I am not here to watch every tick, jump on every move or keep myself busy and my broker lazy. Im here to spot for my edge setups within high volume hours only. I know a few traders out there struggle to normalise the working day of a trader, so I thought it would help to share this. I have traded in firms in Europe when I was younger where it was extremely different. Trading European market opens from 8am (GMT+0) through to 10am, then opens on ags, softs and energy from 1pm through 2pm. Then equities opens 2:30pm through to 3:30pm, and then closes across all those products through to 9pm GMT. Sounds a lot and it was. A 13 hour day with a couple of 2 hour breaks in there. This is high performance in a futures prop firm. While profitable, it's also life consuming. But the point is, it works too on the basis that we had an extremely well defined process to the hours we would be ready to trade and not. We knew our hours and our breaks. Mainly based around volatility and volume. All other hours to trade were dead. Of course you are going to miss certain things, but at least you have a system and a lot happens in the hours that you work that system.

So try to stop sitting there riding every tick, squeezing every cent.