Section 899

Section 899, Bond Cracks & the Quiet Housing Unwind

If you like this report, PLEASE do like and share. GO ON! Give it a click!

In this report: How section 899 is a dangling sword, Swiss deal now ‘stalling’, bond cracks, housing market imbalances.

June Book recommendation: The Fearful Rise of Markets: Global Bubbles, Synchronized Meltdowns, and How To Prevent Them in the Future. by John Authers

Articles

U.S. foreign tax bill sends jitters across Wall Street

Nvidia shares surge as earnings beat despite chip export restrictions to China

US Goods Trade Deficit Narrows -19.8% -largest drop in history

Home sellers now outnumber buyers by half a million: Redfin

US-China tariff talks 'a bit stalled,' needs Trump, Xi input, Bessent says

It Might Actually Be 20 Times Easier for Quantum Computers to Break Bitcoin, Google Says

Trump lashes out over viral 'TACO trade' meme. What does it stand for?

Source: The Real Economy Blog

View

Back in 2014, I tore my Achilles while living in Houston. Very very painful. But I lucked out — my surgeon turned out to be the staff surgeon for the Houston Ballet. I’ve yet to buy a tutu. Before surgery, he ordered a CAT scan to map the tear and plan how to stitch me back together.

After the op, as I lay there bandaged up, I asked if he’d take another CAT scan to see how things looked post-surgery. He just shook his head and said,

“Tim, I’ve reattached the two torn ends of your tendon. Its practically bionic, but It’s a total mess in there right now — everything’s swollen. But trust me, it’s fixed. We don’t need to go looking at a mess.”

And that’s exactly where we are with ‘The Grand Plan’. It’s a mess. A tangled, inflamed, torn, bureaucratic quagmire of tariffs, pauses, retaliatory taxes, and uncertainty.

But policymakers are waving it off and saying, “Trust us — it’s fixed.” My achilles though has indeed been solid since, running a marathon less than 12 months later.

In short, the section 899 provisions will now act as a MAJOR headwind to international interest in U.S. Investments; curtailing earnings, dividend payments, rents etc earned. If you sell or earn in the U.S. from abroad, your tax arrangement just ramped up against you.

The presumed outcome would be downside in U.S. assets, diminished interest in U.S. Bonds and generally in the market as a cash machine for foreign investors and companies. U.S. Exceptionalisms price tag just got bumped up at a rate of 5% per year. Tell me how this won’t break the bond markets! Jamie Diamond thinks it will cause a ‘crack’ in bonds.

Personally, I am in Gold bullion, Oil production and pipeline companies and very heavy in Nat Gas $NRT.

Calendar

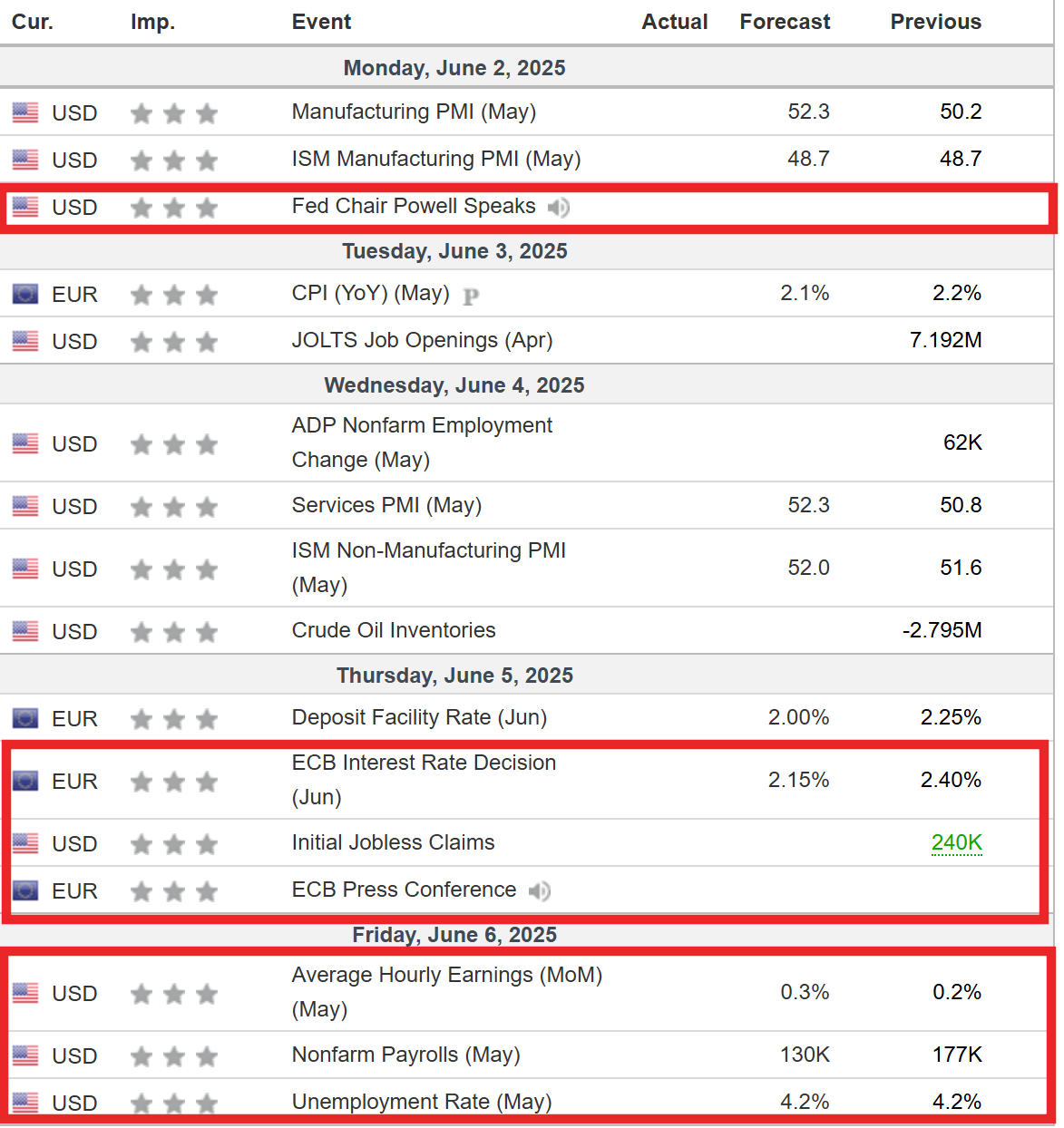

Highlights include US NFP, ISM PMIs, ECB, BoC, EZ CPI, Canada Jobs, Swiss CPI and Aussie GDP.

Focus will be on Friday’s NFP jobs data as the market continues to be vigilant on liberation day tariff impacts. Be mindful that cracks in the economy will start showing up in the initial jobless claims (Thursday) faster than elsewhere.

Earnings

Dollar General, Dollar tree, Crowd Strike, Nio, Lulu Lemon

Macro

Section 899 Key Provisions: