Sharpening the knife

News failure across the board

Sunday 1st September 2024.

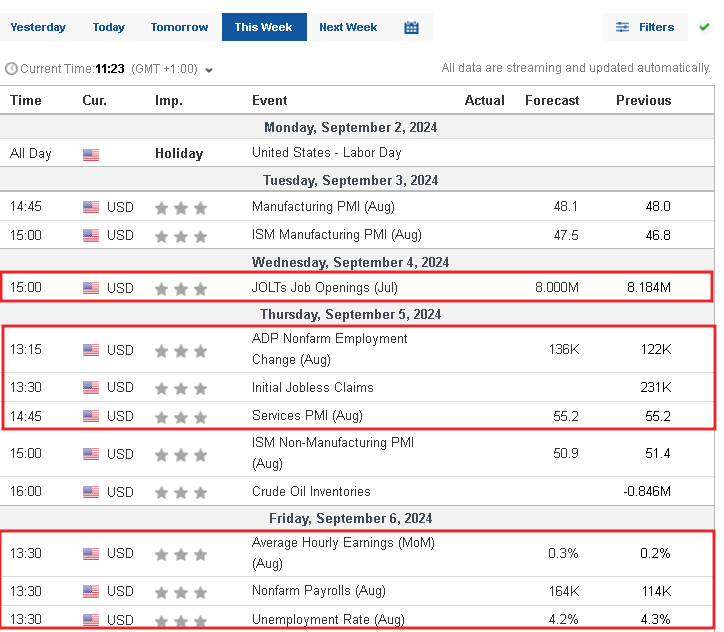

This weeks highlights. Monday market holiday for Labour Day, Wednesdays JOLTs job openings, Thursdays ADP and initial jobless claims. Fridays NFP and unemployment figures out of the US.

Please feel free to comment, share, and interact with me here. It is always good to get comments or questions from people. Sometimes it can feel like I am doing this in the blind so to speak. So reach out, hit a like button, leave a comment, share the report on socials or with others. It would mean a lot.

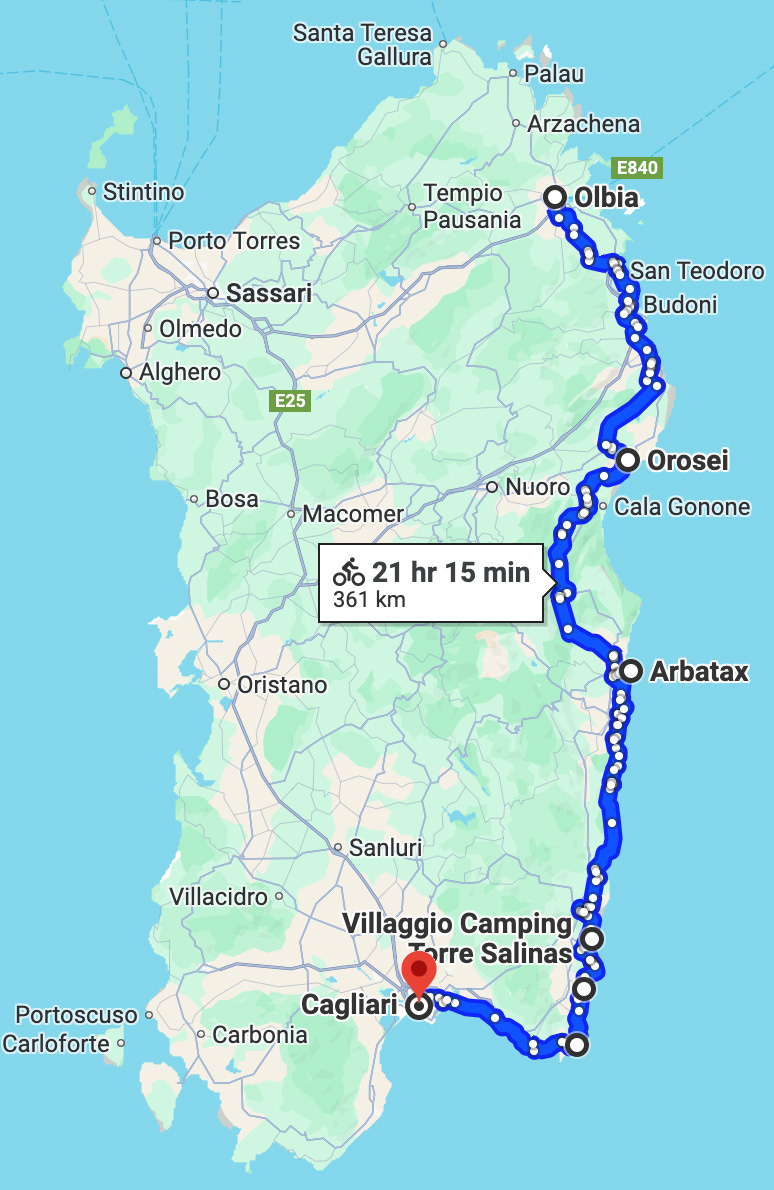

I can never say that I welcome September and the change of season, but a recent burst of great weather here on the Island of Ireland has helped. I'll be attending a friend's wedding in Nantes, France this coming weekend, then off to Sardinia to bike my way from Oblia in the north, 361km south to Cagliari in the south over 5 days. Then back at my desk in time to prepare for the FOMC statement on the 18th BOJ meeting on the 19th and quad witching the 20th.

Last week was primed as a week of interesting economic data. There was anticipation that it would all be pretty good and that the markets would have no other reaction but to continue the rally stemmed by the great value lows offered up by the BOJ/ Yen carry trade wave. It was sort of a pitt stop you might say. GDP Good, PCE another drop, personal spending strong, initial jobless figures small drop, $NVIDIA earnings did not disappoint - however the Donkey that the market wanted to pin the tail to, was weak forward guidance on earnings and the post market on NVIDIA sold down 8%.

No big deal you might think, buy the dip and carry on. However what we saw was a lethargic $NVIDIA that could not rally and it finished the week lower.

On Thursday, it was clear that the market did buy the overnight diop on NVIDIA and equities in Euro session had rallied quite well. We opened in the US and markets moved a small amount higher, then stalled. From that point into the close the next day (Friday), equities have bar coded the range on the week on RTY, NQ, ES and YM. Not indicative of the enthusiasm we have seen over the last two weeks. NVIDIA closed down -7.73% for the week.

With all this said, I see the broad market reaction this week as a news failure. NVIDIA, Earnings good, guidance not terrible. We should finish higher. Goldilocks economic data, leading into a presumed fed cut on 18th September? Oil- Libyan oil production offline by 1.1million BPD and we dropped? Où sont les acheteurs - Where are the buyers??

Given this is an NFP week, market reaction is about as easy to predict as putting up a tent in a hurricane. You know what is should roughly look like, you have a set of instructions, but then……..everything goes all over the place. So in the hurricane of these markets, let's at least look at good spots to put the tent, using average pricing and what the market has done!

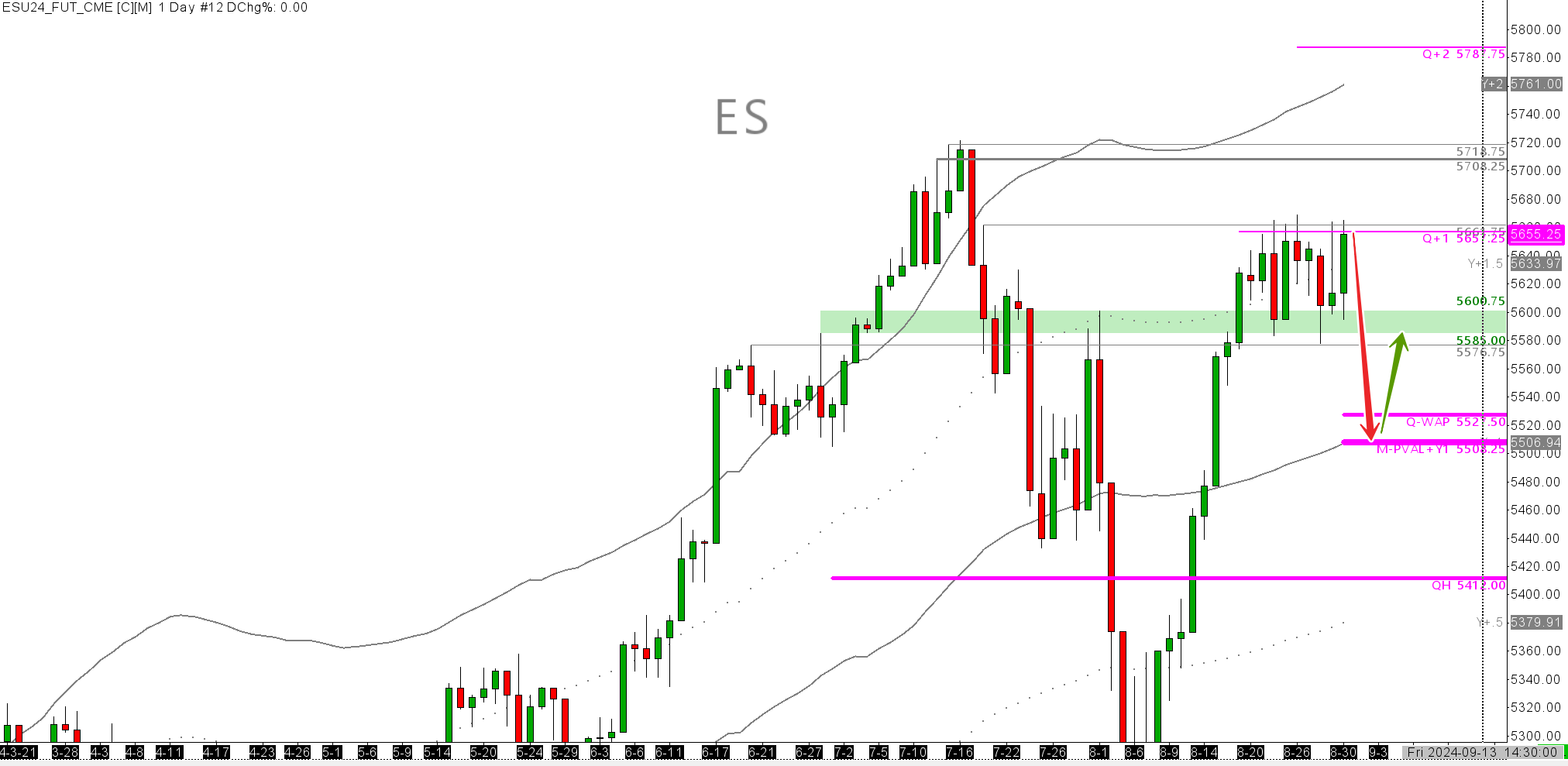

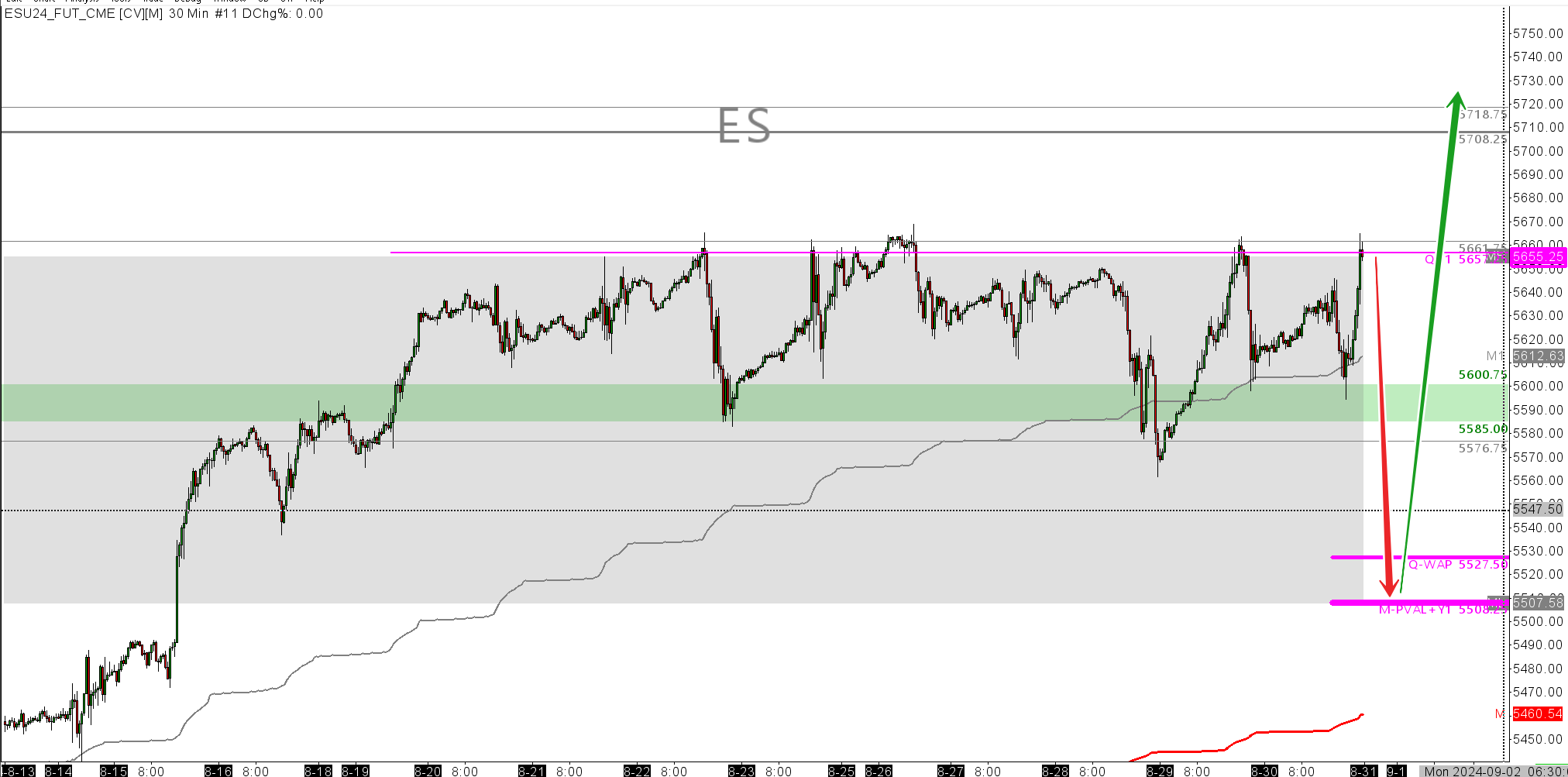

S&P500 ESU24 - Roll over date to Z is on 16th Sept.

This market has shown it can not continue to rally above the Q+1, i.e The +deviation of average price on the Quarter - also known as Dynamic value high on the quarter. When we have this as resistance- we are ‘‘Within Value’’ i.e at the high price for the Quarter. Above is considered ‘‘Above Value’’ i.e expensive on the Quarter. Given that buyers have given a lot to this market in the shaded green LIS $5585 - $5600, The play for upside breakout has so far been hobbled. So if they are asked again to reload from the LIS (green band), I think they will step off the book and wait until we get to the FOMC on the 18th. We will also get BOJ the very next day 19th and Quad witching the day after 20th.

So I see a safer place to hang out looking for a value long in ES is #1 is Monthly PVAL confluent with Y+1 $5506. #2 QVWAP $5527.50 currently. However even at the Q-VWAP I don't currently like it that much as a return ultimately to Q=P[VAH $5412 would be the best value swing long potential. I just don't think we will get the level of selling to bring us down there before the FOMC. Keep it on your radar though please as these are futures markets and literally anything can happen.

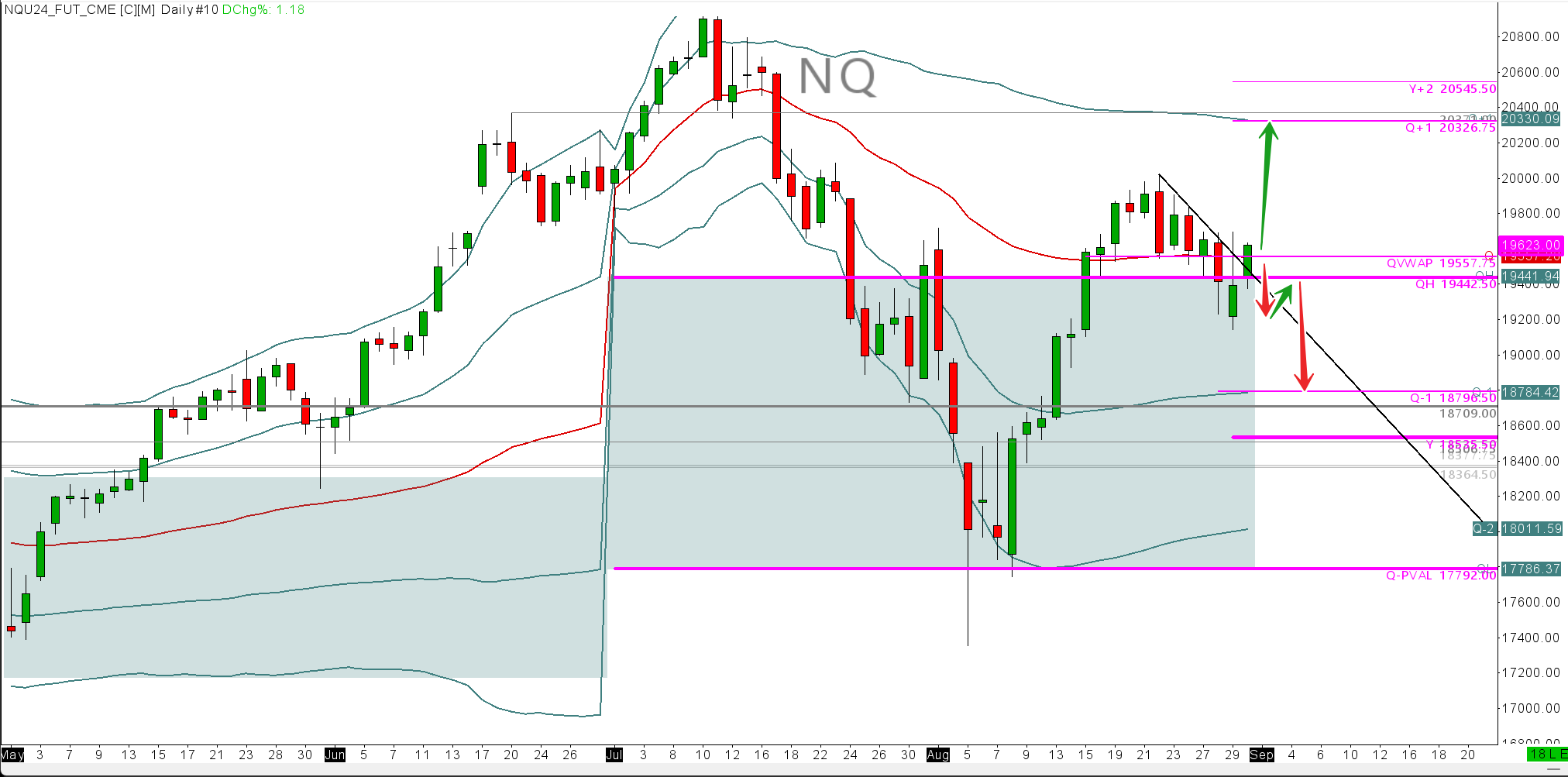

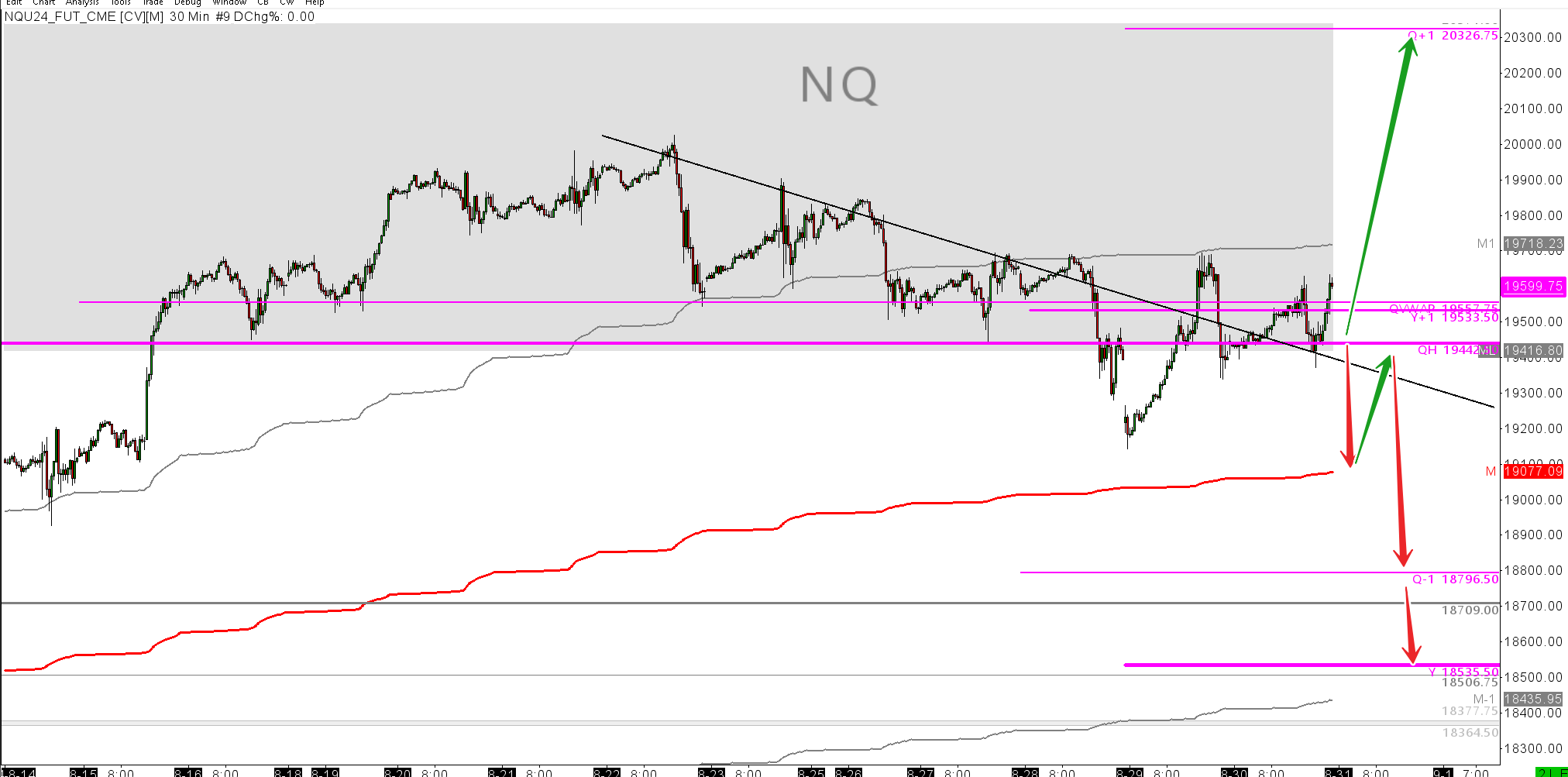

NASDAQ NQU24 Roll to Z contract also 16th September.

Essential to see where the tech boat wants to take markets in the short term. Nasdaq spent the best parts of 2 weeks ago supported by the Q-VWAP and there were some amazing intraday longs from the Q-PVAH. We call this acceptance above. The more of it we get, the stronger the case for direction of trade - if its acting as support, then we should continue to rally. If it is acting as resistance, there is a stronger case for downside.

I said last week and the prior week that should we fail to hold daily opens and closes above Q-PVAH, this will indicate that the market is slowly breaking the acceptance that it has shown above Q-PVAH $19442.50 and that we should watch for this. Well we have now gotten this breakdown - the market has done nothing with the great acceptance it had.

Watch out for only temporary buying at the M-VWAP, Let the market come down to lower/ deeper value Y-1 $18535 or if you want to be short, look for rejecting on a retest from below of the M-PVAL confluent with Q-PVAH $19442.5

GOLD GCZ24

Gold has had an incredible year and I think it will continue to do so. It is simply a case for me that we have spent so long, very expensive, that we need to offer a bit of value up to the market to continue to rally to significant higher highs. So a reasonable pull back 2 weeks ahead of FOMC would be interesting. Y+1 $2464 with stops below Quarterly VWAP Is a nice swing trade for me. I think I would even be interested in $2391 at the Quarterly Prior value high.

On the 30 mins chart, It is clear to see that we are accepting back inside the +1 on the M period. It is therefore part of a pattern shift trade for me to look to short this area back to target #1 M-VWAP $2503. As with everything in markets, direction is easy, timing and size are what kill you. So I will be picking and choosing my monet to get involved here on what is a volatile back end of the week. Target #2 will be Y+1 confluent with M-1 $2464 and close enough to the Q-VWAP $2456

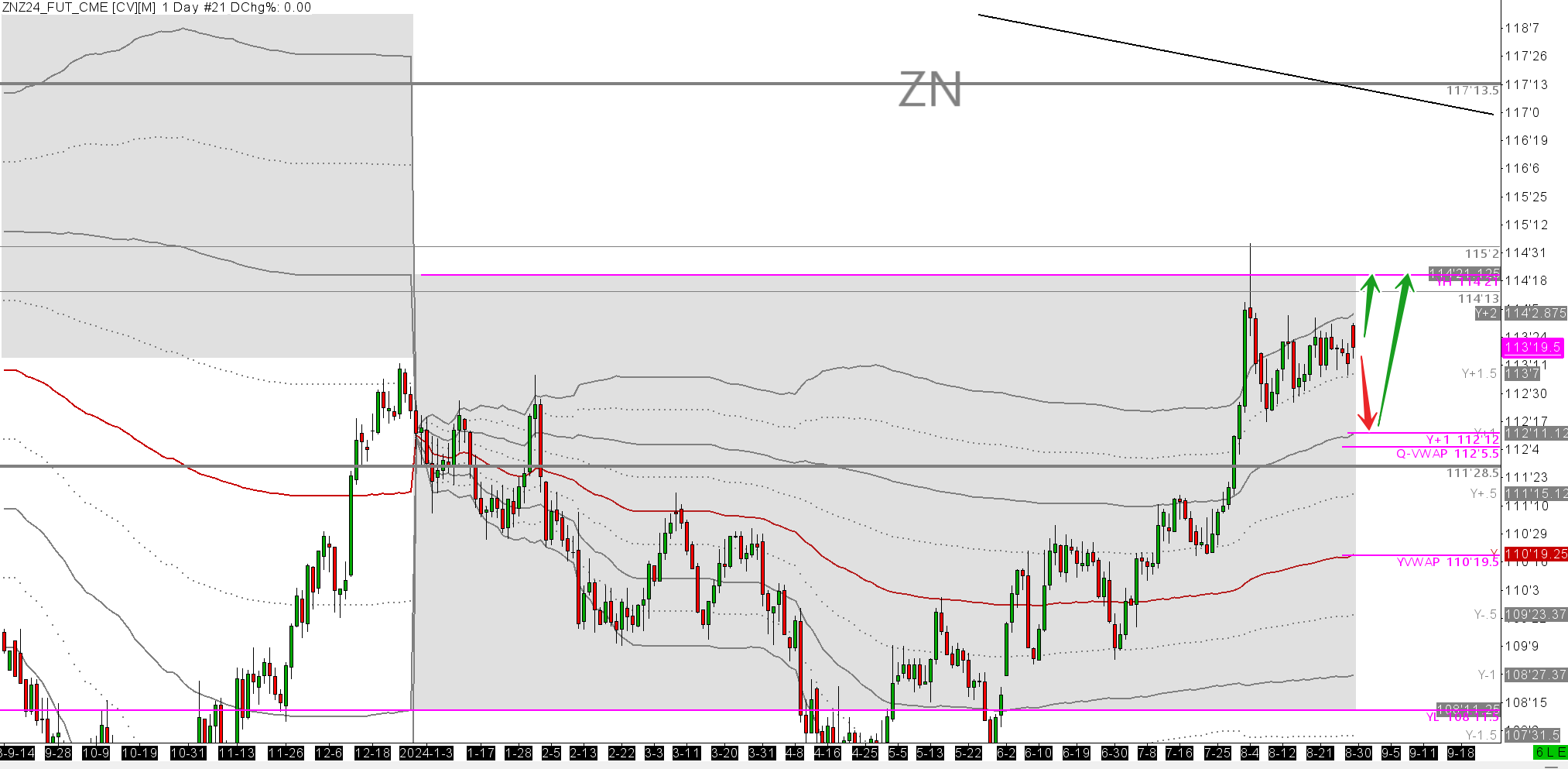

US 10 YEAR BOND ZNZ24

Us 10 Year Bonds have always been a risk barometer for me. What is the broader market thinking? Can I see risk on and risk off in the bonds? Well this has been a great place to watch for correlation moves in Gold. Gold should move inverse to the real yield, so therefore it should move directionally during the day with ZN.

If I'm taking trades in gold, I want to be able to see if ZN is leading it at all. If I see the two in dissonance, I will stay clear of Gold. If I see both say imbalance up or down, I will look to execute at my edge defined areas. While I see that ZN has some more business to do on the upside to hit the swing target of Y-PVAH $114,21s, I see that it may want to load up the buying boat back down at Y+1 or more likely Q-VWAP. This is why I like the shorts in gold. Then, when we get down there on ZN, I can look for a turn both on ZN and Gold if the acceptance is holding positive.

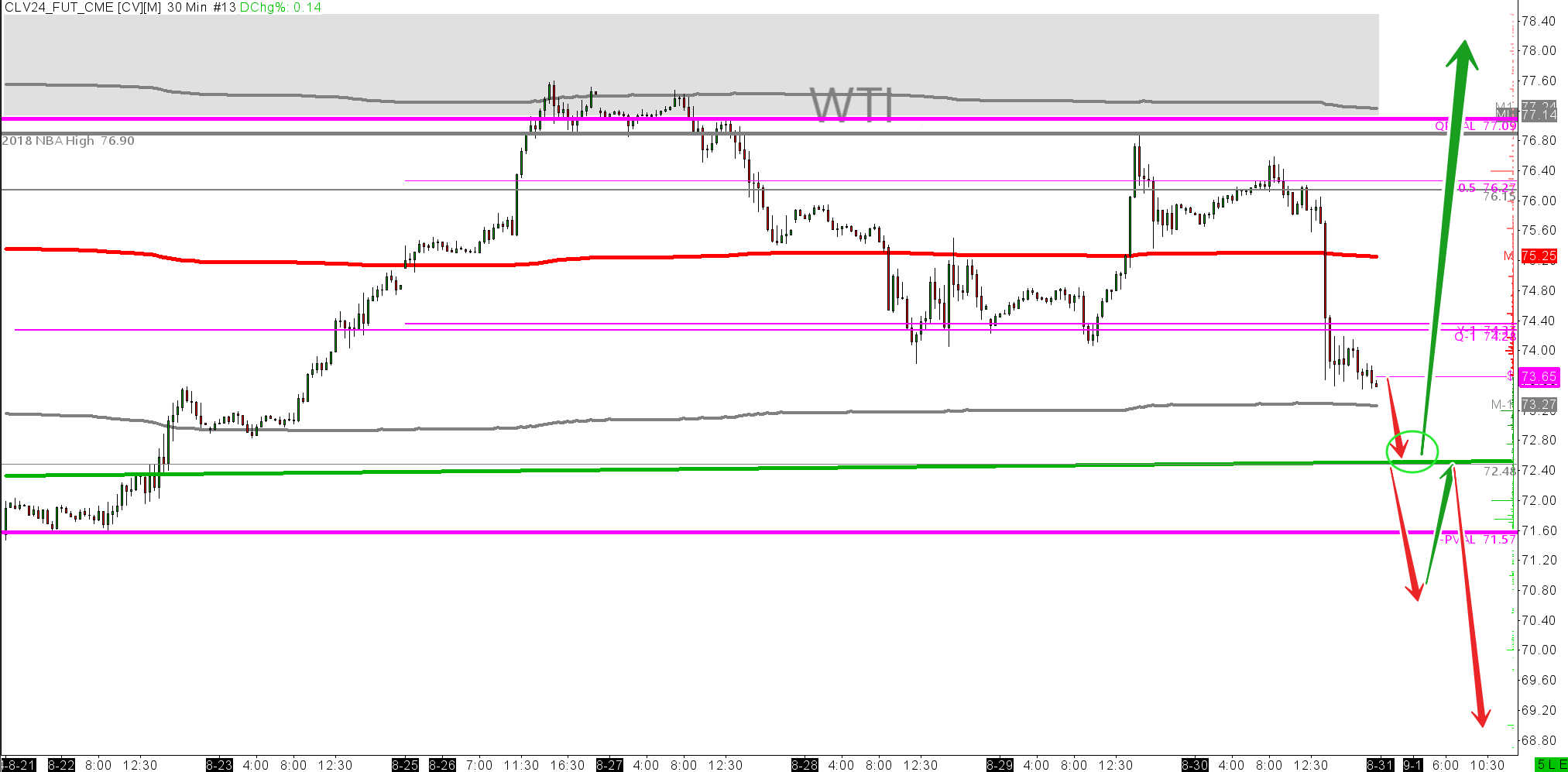

WTI Oil. CLV24

We have a division of Duggan Capital that trades energy spreads on Nat Gas and Oil. One of the major oil spreads of the year is lining up THIS WEEK. We are looking for Oil volatility to start to pick up massively throughout September. I have had a number of traders get in touch about this, please email us for info info@duggancapital.com

It is wild out here in energy. Between rallies on Hezbollah attacks in Northern israel, then in the same 24hrs, full production shut down of oil in Libya. Price rallied pretty hard Friday 23rd and Monday 26th of the week. From $73s to $77s. We went too far too fast. Libya production is not 100% gone. July production was 1.18million bpd, as of Thursday it is down to 700,000bpd. This may go lower. Please read here and here for a deeper understanding. But regards Libya, there is no improvement in sight at all for now.

All this said, we have been sold down quite hard from Monday's highs. It does not make any fundamental or technical sense, however what does make sense is that we drive into deep value to then rally out of. From the Q-PVAL $77.05 level. The market is balanced down on the Q, so the rejection here was to be expected. The only large supports that are next are Yearly -PVAL $71.57. So I'll let the news develop from here.

It is therefore a bold thing to call longs in front of a market that was down 3.15% on Friday, but that's what I'm doing. Lets see some scenarios on the charts below.

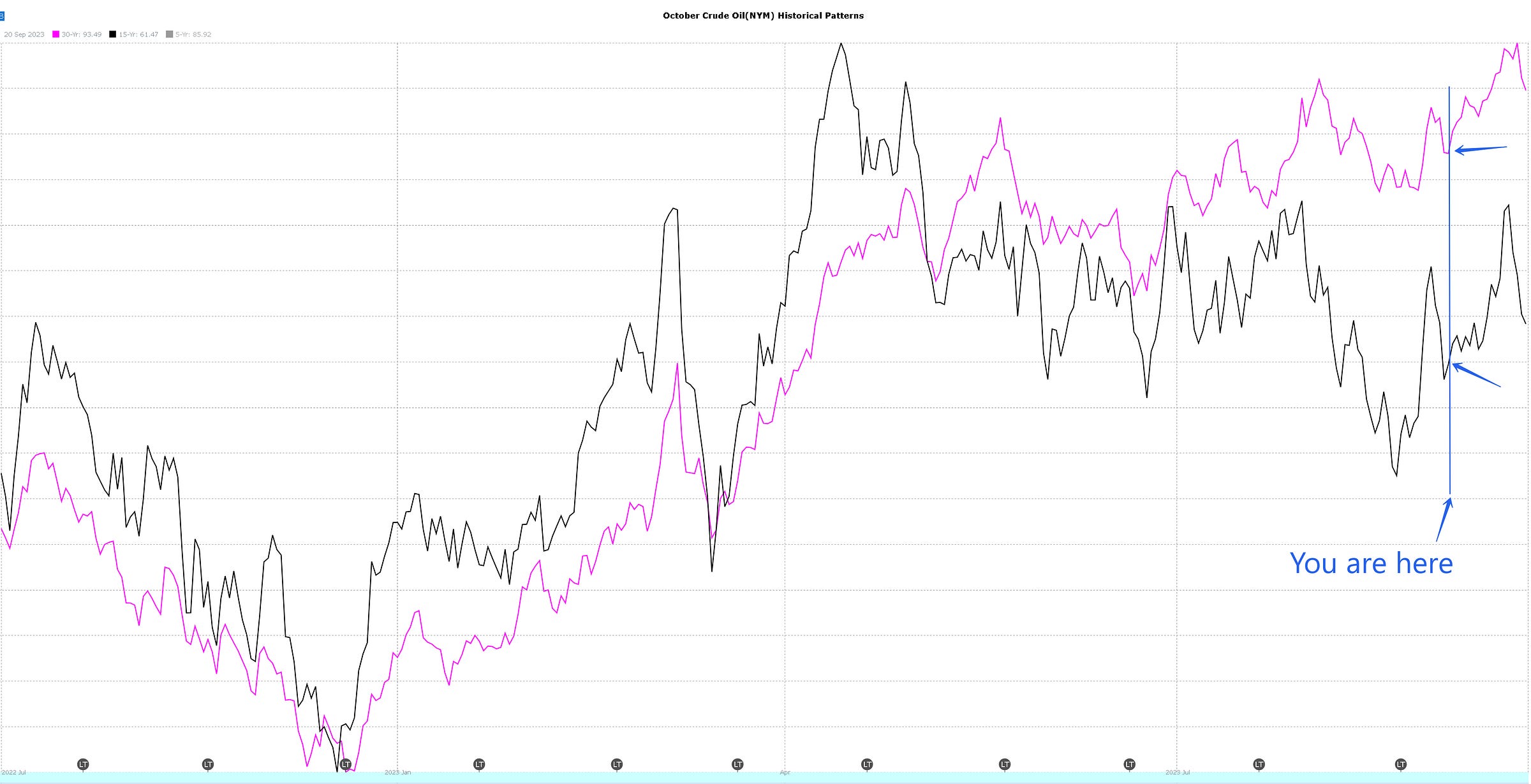

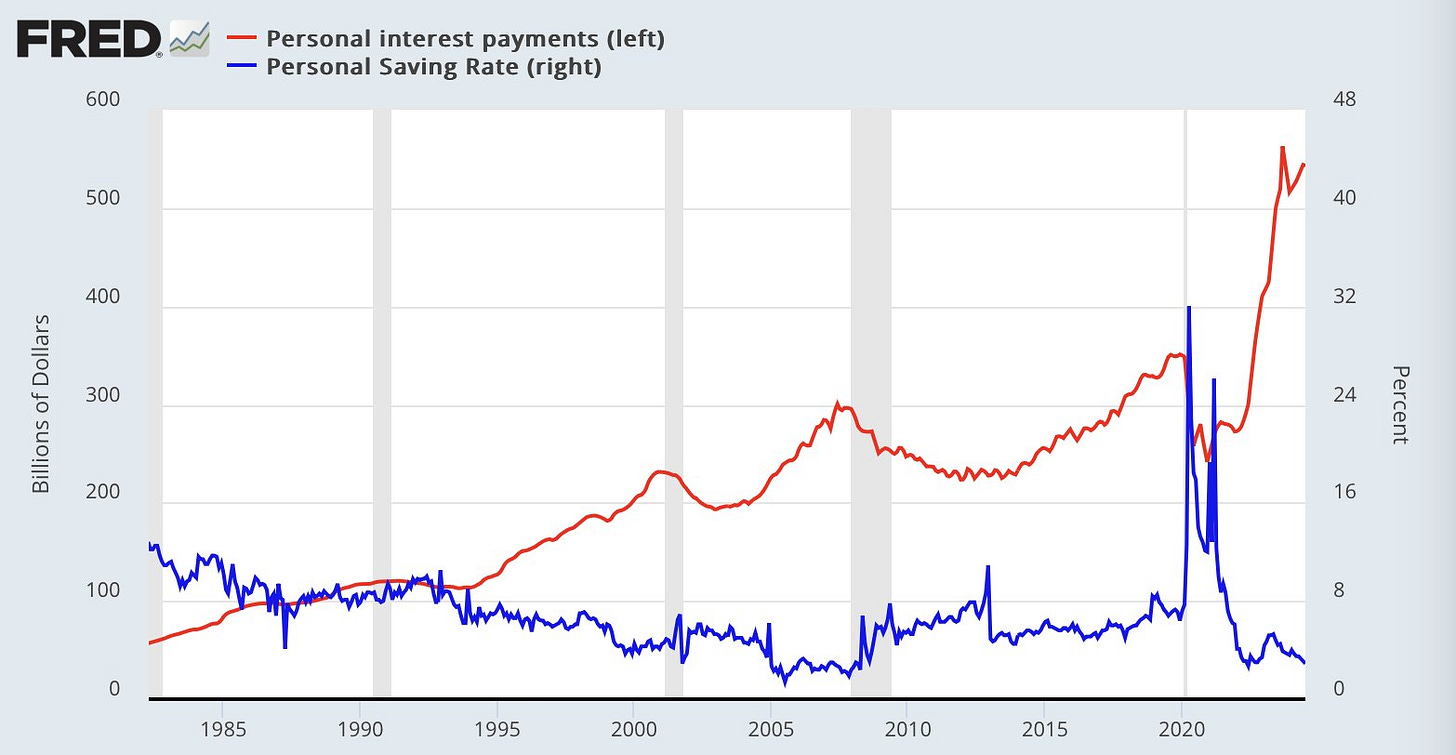

Some charts below that are pretty shocking to look at, but WHAT IS THE TRADE? There is none.

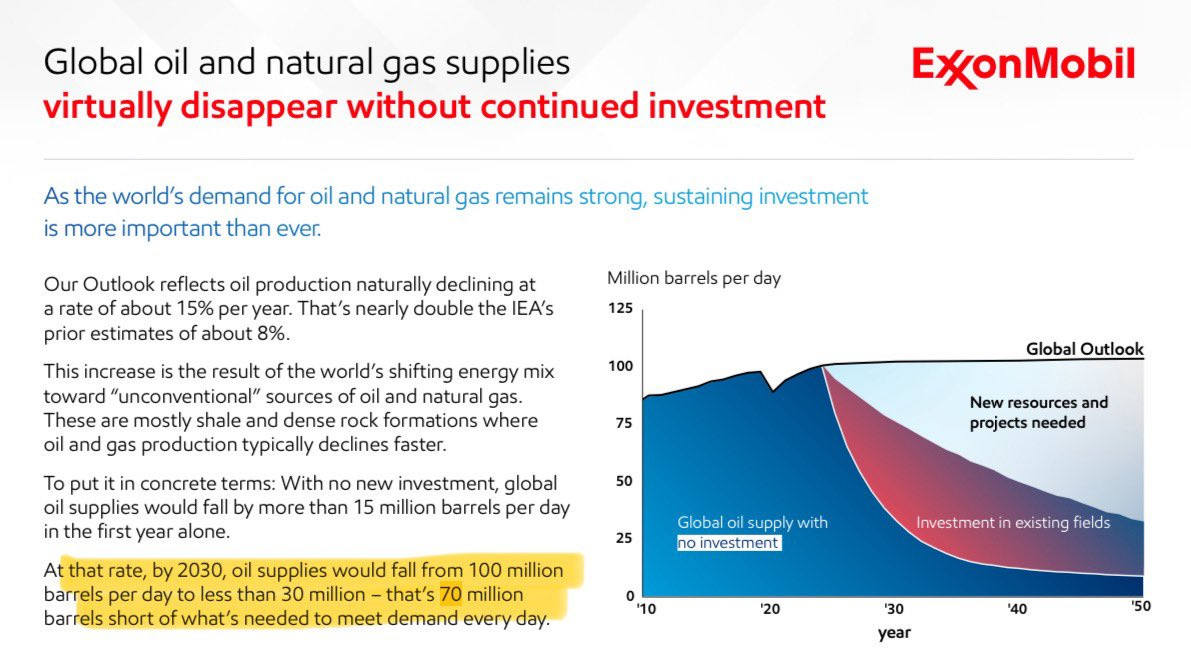

If you trade oil and are not against reading a report, then please read this Exxon Mobil report on global outlook to 2050- a compelling read and one that endorses what I have said for the last 3 years. The carbon free future translates to $200,$300,$500 a barrel of oil prices. Not lower and zero. Why? Well as demand starts to diminish over the coming years, the reinvestment picture for oil will get slashed drastically. With lower investment, you get lower production. So if you have a market where demand drops off slower than investment in production, you have a demand deficit. We will still need approx 100mbpd of oil in 2050, yet the reinvestment to 2050 will only be producing roughly 30mbpd. Meaning that oil will have a market supply deficit of 70mbpd. Strong stuff. This is why I remain long energy assets PBR 0.00%↑ PAA 0.00%↑ are some of my biggest holdings.

Okay folks. Some good weeks behind us and some great weeks ahead. We have to trade less, wait more. I will be travelling over the coming two weekends, so the reports will be issued on the Mondays rather than Sundays.

Be good out there. Something that we achieve each day by being live in the room together in Discord is that we get to come in fresh and see how the markets have been trading against news, data and sentiment, then we get to plan the trades for the day. Some setup nicely and some setup badly so we can stay out of them in real time. But for the ones that are beautiful, we have planned it, they set up, we shoot.

We plan the trade and trade that plan.

So what is your plan?

What is your edge?

Can you write it out clearly in one short sentence?

What is your risk profile?

If you can't answer any of these questions, then you need to change that as soon as humanly possible or reconsider if trading is for you.

Trading is waiting, Waiting is trading!

Tim