Tariff town

The hot topic to watch

Highlights this week Wednesdays CPIs and Thursdays Initial Jobless as usual. Powell speaking on Thursday wont be any firework show. We do want to loosley monitor the Trump Powell relationship now however as the Trump is a ball of inflation waiting to happen. The Fed/ FOMC will not be happy about this as they are midway of lying down the sword they have been swinging on inflation over the last 2 years.

The week gone by has been a real macro blockbuster delivering on several fronts

-We have a US president that has told Netanyahu to bring the war in Gaza to an end by January 6th.

Poliotics in the US and potentially other parts of the world may now start to bring the tone further back to the centre and away from these polarised hard left or right stances.

The returning threat of Trump trade tariffs which will no doubt be a fountain of volatility over the next 12 months.

The return of the Trump tweets to the markets.

The Equities space has, as I mentioned in the previous report, loved a new impulse to the upside on the back of a Trump win. I shudder to think what equities markets would have traded like on a Kamala victory. If you are in any doubt over why she lost, this guy Clarkson Lawson sums it up beautifully.

The Powell FOMC 25 Bps cut was completely priced into the markets before Americans went to the polls. It was one of the tamer FOMC meetings I have seen, with the drama coming from Powell being asked if he would step down if asked. A good laugh for us traders.

With markets SO STRONG, it is not the environment to go looking for big shorts. If anything, we want to buy pullbacks to some HTF levels and near supports to work the continuation trade.

For me, we are getting a little overly expensive on equities here, but I’ve said that for 15 years .ie ES, YM, NASDAQ. I would rather sit on my equity hands and wait to buy deep value or short it when we have a suitable catalyst and the price sets up weak. What would be a good catalyst?

Trump comes in hot and heavy with tariffs on imports. Currently set to be 60% on Chineese goods and a flat rate of 10% to 20% on all other goods. Inflationary of course.

China invades Tiwan

China somewhat abandoning their stimulus run- extremely unlikely

Unemployment goes above 4%

GDP Prints a large miss.

All highly tradable events.

I think we won't have to wait long for a pullback which will fail to attract buyers. Given we are so expensive, I think smart money will wait for a double day drop or even a bad 4 sessions, before looking to buy deep value. As of Friday, Bloomberg notes that the Trump trade may already be unwinding. The street is now cautious to see if the new president will actually come in hot and heavy with tariffs as promised.

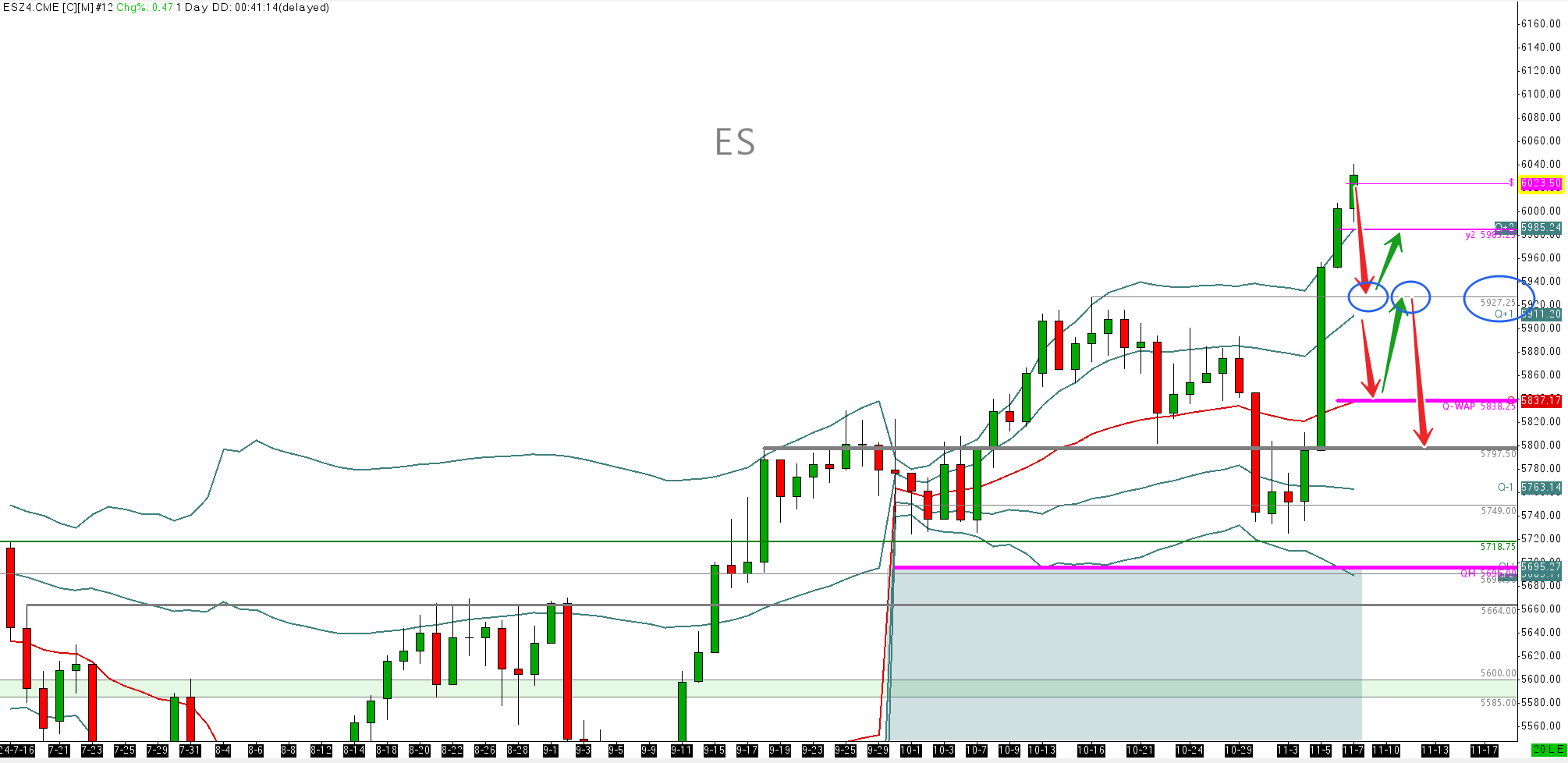

ES Z24

I like initial trade on $5927.25 as support For a long. Before we get that, I think an initial test on M+1 Will be a nice small long day trade. Ref 30 min chart below. Back on the daily, I also like an initial test of the Q-VWAP as long, however a 2nd test in 2 days I will not be a buyer a second time and will look to sell should it break down on the day 2 second test.

On the 30min chart, I like the long M+1 as mentioned, but a secdond test I will not buy and would rather let the market drop to buy the $5927 as mentioned above. I think that also will fail after about 4 to 8 auctions, and I will look to buy MPVAH $5884. I will like it more if MVWAP is also there at the same time. Overall, looking to play longs on these trades, rather than short into a strong market.

VIX

Keep in mind, the VIX is now imbalanced down on the year, so risk off assets are set to get hammered. This will include Gold, US 10year etc. This fits in with a view of more upside in equities to come.

WTI CLZ24

We are going down. Seasonally the market is weak for some key reasons that I cover with training I give on spread trading. In short, the largest participants at this time of year are not there to support price. We can never rule out a macro catalyst, which as we know can rally prices instantly, but now, we seem to have run out of these. The kitchen sink has been thrown at oil over the last 2 years and it has amounted to precisely nothing. As I will keep banging on, China demand is the demon that weighs down on price. Once the stimulus there starts to kick in and refinery rates start to pick up, it will stay this way. OPEC+ have even decided to postpone their reintroduction of supply as they had promised.

Oil enjoyed a temporary bid over the Y-PVAL $71.58s over the hurricane risk to Gulf of Mexico platforms and refineries, however this as usual was priced out within 24 hours as the hurricane dissipated. What we have seen however is WTI back within q-pval 69.90s and buyers supported this in spades on Wednesday yielding a $2 move away from there. One of my mentee traders in Duggan capital took down this entire move. Nice work.

I’m seller this week until it's obvious I shouldn't be ie. macro changes etc. Sell rips, leave the dips. Selling for me on a retes on M-VWAP. It will be hard to hold this down below M-PVAL. Buyers may want to come in on MPVAL $69.08s but I won't be one of them. My trade for the week is to short the market down to that support. Then sell it again on a pop from there on M+1/QVWAP.

GOLD GCE Z24

Gold has had an incredible year. +30%. With inflation seemingly under control now on its way back to 2%, its time to imagine that it can pull back quite a bit. The election of Trump back into office says one thing to the market, which is, it's okay to stay in US equities, so why stay in gold as a risk and inflation hedge? Well there are lots of reasons, but this is the dynamic I look at.

I see we continue to reverse in gold, while still in an uptrend. We are just taking a pullback.

You can clearly see from the chart below, that the monthly auction was an incredible short 3.5%. I think we only stay balanced here for a short time this week, then I'm looking for shorts for this to break down and get back to Q-PVAH