Tesla's speedbumps

Sales are down, shares down

In this report. Price targets, sales numbers, market changes.

EV adoption promise.

We all get it. We are saving the universe and redcing our carbon emissions. Whats not to love. I’m in. Governments around the globe have adopted net zero carbon emissions targets, with the general plan to electrify transportation, logistics and move carbon heavy industry to be more accountable. Lets stay focused on the transportation area

EV adoption reality

I have driven 3 different EVs and one hybrid. I simply can not handle battery anxiety. It is no different than phone battery anxiety, except the need is a lot more fundamental to your life than phone and data acccess to the internet. My experience mirrors that of millions around the world and the sales numbers from 2024 dont lie. Read further in this article for more sales indicators. Everyone I speak to with an EV wants to wait fir better technology, better batteries, longer range.

Tesla's Health

Tesla, the electric vehicle (EV) giant, has undeniably reshaped the automotive landscape. However, its financial health presents a complex picture, influenced by market trends, competitive pressures, the public persona of its CEO, and crucial price dynamics. Let's delve into a detailed analysis of Tesla's financial standing, focusing on global sales, growth, one key emerging trend, and a critical look at price analysis suggesting a potential target of $300.

Recent Performance and Shifting Tides: Tesla's recent financial performance reveals a mixed bag. While the company has achieved remarkable milestones, it faces increasing headwinds.

Revenue and Profit: Q4 2024 saw Tesla report revenue of $25.71 billion, missing analyst expectations of $27.35 billion. Net income also declined. While full-year 2024 revenue saw a slight increase to $97.7 billion, this signals a slowdown in growth.

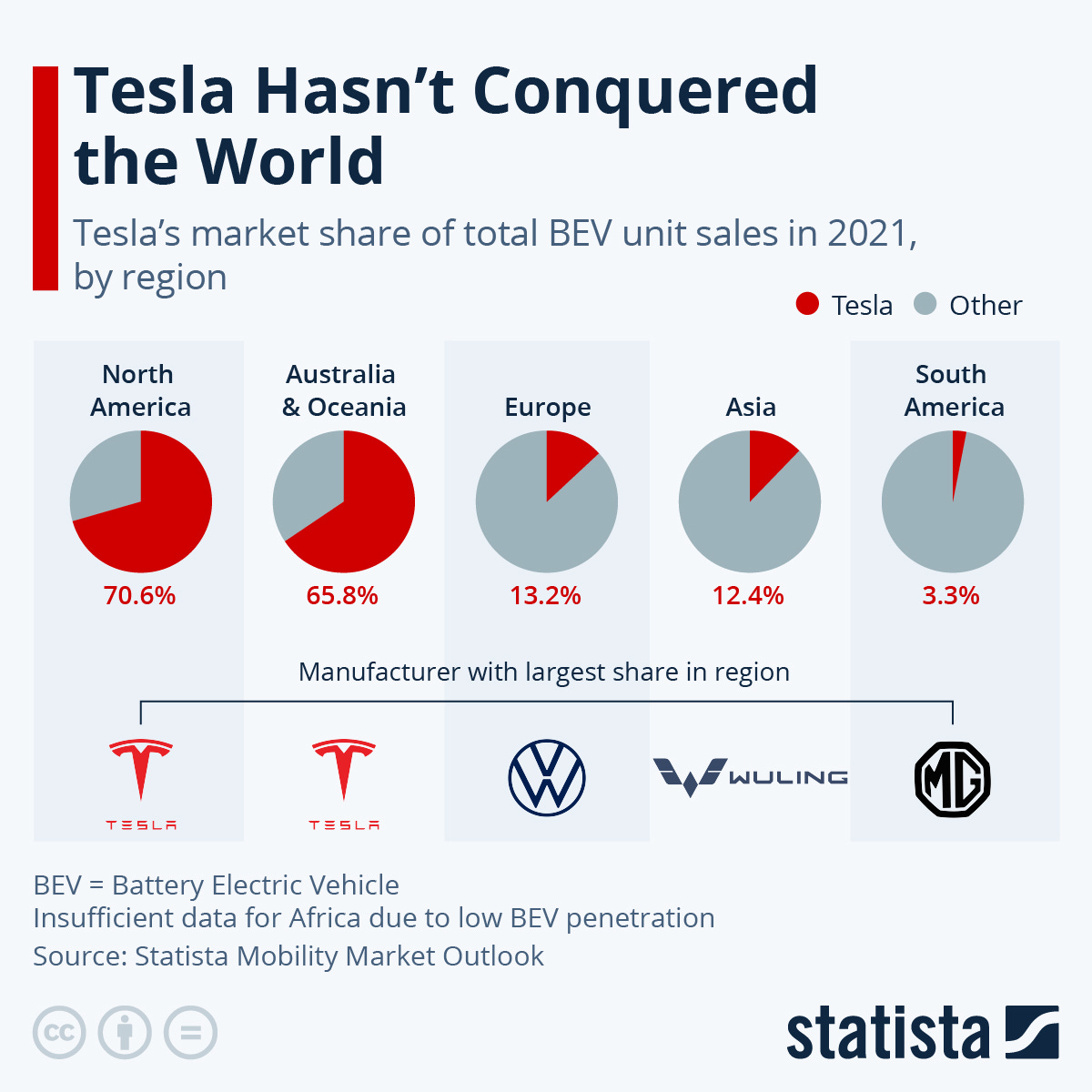

Deliveries and Market Share: Global deliveries in 2024 totaled 1.79 million vehicles, a 1% decline from the previous year—the first year-over-year decline for Tesla. This is a crucial metric, directly impacting revenue. While Tesla still holds a significant share of global EV, that share is under pressure from both established automakers and multiple emerging EV brands. According to the China Passenger Car Association (CPCA), Tesla's retail sales in China in 2024 were 657,102 units, ranking third in the Chinese New Energy Vehicle (NEV) market with a 6.0 percent share

Carbon Credit Revenues propping up numbers: Interestingly, revenue from selling regulatory credits (carbon credits) surged in 2024, reaching a record $2.76 billion, a 54% increase from 2023. This reliance on carbon credits raises questions about the long-term sustainability of Tesla's profitability model. What is Tesla worth if you X these numbers?

Global Sales and Growth: A Deeper Dive:

Tesla's global expansion has been a cornerstone of its success, but recent trends are showing dark clouds.

Declining European Sales: Tesla has experienced a significant decline in 2024 sales in Europe. Recent data reveals a concerning trend:

Total sales in Europe were down 47.7% year-over-year in January 2025, compared to January 2024.

France saw a dramatic drop of 63.4%, Spain plummeted by 75.4%, and other major markets like the UK, Netherlands, Norway, Sweden, Denmark, and Portugal all experienced declines ranging from 18% to 46%.

This decline can be attributed to several factors, including increased competition from European manufacturers offering compelling EVs, potential concerns about Tesla’s pricing strategy, and potentially waning demand after an initial surge in popularity. I cant help but thinking we are on iPhone version 2 or 3, when we know we should wait a little longer for better features.

The Elon Musk Factor: It's impossible to ignore the potential impact of Elon Musk's public persona on Tesla's sales. His recent appointment to US government- heading up DOGE- The Department of Government efficiency. His often controversial statements and actions have alienated some consumers. While quantifying the precise impact is difficult, it's plausible that potential buyers are choosing other EV brands due to concerns about associating with Musk and his sometimes-polarizing views.

The Hybrid Resurgence and EV Investment Rethink:

The EV market is evolving rapidly, and some automakers are adjusting their strategies.

Hybrid Popularity: Consumer preferences are shifting back to hybrid vehicles. While pure EVs were the darlings of the automotive world for a while, hybrid vehicles are experiencing a resurgence in popularity. Data suggests that in many markets, hybrid sales are now outpacing pure EV sales. This likely stems from consumer concerns about range anxiety, charging infrastructure limitations, and the higher upfront cost of EVs. Retail hybrid registrations grew to 11.5% through Q3 2024, from 9.5% through Q3 2023, according to Experian’s Automotive Market Trends Report: Q3 2024. Meanwhile, EVs increased from 7.7% to 8.2% year-over-year and gasoline vehicles declined to 70.4% this year, from 72.7% last year

Ford and VW's Strategic Shift: Ford and VW, who initially made significant commitments to all-electric futures, appear to be recalibrating their strategies. While they haven't abandoned EVs entirely, they are reportedly scaling back some of their aggressive EV investment plans. This suggests that these legacy automakers are recognizing the complexities of the EV market and the continued relevance of hybrid technology. They are likely trying to balance their EV ambitions with the current market realities.

Price Analysis and Target: Beyond sales and market trends, a crucial aspect of Tesla's financial health lies in its stock price dynamics. Based on a the daily price action, a significant imbalance down is now underway. This imbalance, coupled with poor sales and customer trends away from pure play EV, suggests the market will probe lower. My analysis points to $300 as the next area of market balance. This implies another 17% drop in price. I see us trading here pretty fast.

Financial Health Indicators:

Tesla's financial health hinges on key indicators: Profitability, though volatile, relies heavily on carbon credit sales, with sustained profits from vehicle sales remaining a challenge. Cash flow, while generally positive, fluctuates due to capital expenditures. Tesla's substantial debt, accumulated for growth, requires careful management for long-term stability. Maintaining sufficient liquidity is crucial to cover operating expenses and debt obligations.

Navigating a Changing Landscape:

Tesla's future depends on several factors: EV market dynamics, including the rise of hybrids, will significantly impact performance. Intensifying competition requires continuous innovation. Technological leadership in batteries, software, and autonomous driving is vital. Operational efficiency, supply chain management, and quality control are crucial. Finally, navigating potential price corrections will be key for investor confidence.

Conclusion:

Tesla's financial health is a work in progress. While the company has achieved remarkable growth and disrupted the automotive industry, it faces significant challenges. Declining sales in key markets, particularly the concerning drop in European sales, increasing competition, the rise of hybrids, questions surrounding profitability, and the potential for price correction, all contribute to a complex picture. Tesla's ability to adapt to the evolving market dynamics, manage its finances prudently and continue innovating will determine its future success. The road ahead is not without its bumps, and Tesla will need to navigate these challenges carefully to maintain its position as a leading force in the automotive industry. We will be watching.

Well, as we talked about on Sunday, Tesla getting hit hard in the pre market