The Bond Bash

Risk-free rates rising

If you like this report, PLEASE do like and share.

In this report: Gold & Swiss Franc in depth C.O.T analysis, More tariffs, Apple gets bitten and what Bonds are trying to tell us.

Articles

US House narrowly passes Trump's sweeping tax-cut bill, sends on to Senate

Why gold prices are forecast to rise to new record highs

XRP debuts on CME futures

Trump to announce $25B funding for Golden Dome project

Trump tells Netanyahu to wrap it up

Japan's super-long bond yields soar to records as market frets about demand

Global Bond Rout Worsens as 30-Year Yield Surges Past 5%. Government Debt Isn’t a Place to Hide

Australia's Unrealized Gains Tax Will Be A Lesson In Economic Suicide

Harvard v Trump: takeaways from university’s legal battle over international student ban

Revolutionary innovations propelling growth

View

It is my view, there is one last good push up left, before markets get back near highs on the year and start to look incredibly expensive relative to risk off markets. Exact prices for ES as below in TRADE section.

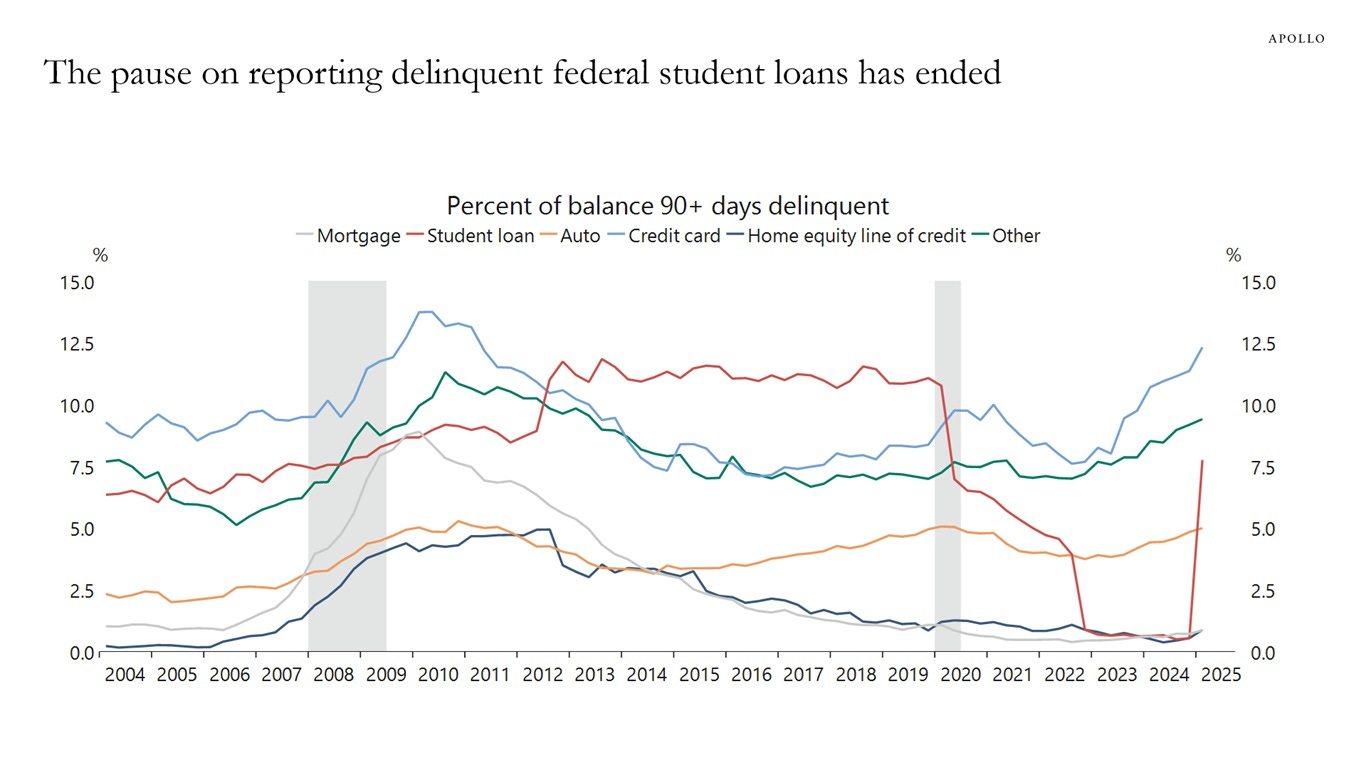

Bulls are bulling. Belief in U.S. exceptionalism may have faded, yet the dip buyers from April 7th S&P500 Lows are in fine fettle +20% off lows. Beneath the calm waters, however there are risk off currents at work, the clear signs of trouble are from rising bond yields, which I think will fade and normalise in the coming week. The picture I want to see is 2 weeks forward, to see if there is reacceleration in bond yields and how are equities handling the next thrust of buying with matched appetite for higher risk-free rates. To breakdown what I mean.

What Rises When 10Y and 30Y Yields Rise

Mortgage rates (15- and 30-year fixed)

Auto loan rates

Credit card APRs (indirectly, over time)

Corporate bond yields

Bank lending rates

U.S. government borrowing costs

Bond market volatility (e.g., MOVE Index)

Value and financial stocks (e.g., banks, insurers) — selectively

Treasury yield curve steepness (if short end lags)

Consumer Impacts

Higher monthly mortgage payments (non-fixed)

Reduced home affordability

More expensive car financing

Higher credit card interest over time

Lower bond prices in retirement accounts (401(k)s, pensions)

Slower wage growth or hiring (as borrowing costs for businesses rise)

Better returns on new fixed-income products (CDs, annuities)

The ‘Big Beautiful Bill’ passed in The House of Representatives during the week is extremely worrying. It will increase the nations’ debt burden in giving tax relieve to corporates and high earners.

Democrats blasted the bill as disproportionately benefiting the wealthy while cutting benefits for working Americans. The CBO found it would reduce income for the poorest 10% of U.S. households and boost income for the top 10%.

"This bill is a scam, a tax scam designed to steal from you, the American people, and give to Trump's millionaire and billionaire friends," Democratic Representative Jim McGovern said.

Is it possible that inflation does not show up? Is it possible that higher bonds rates don’t affect consumers?

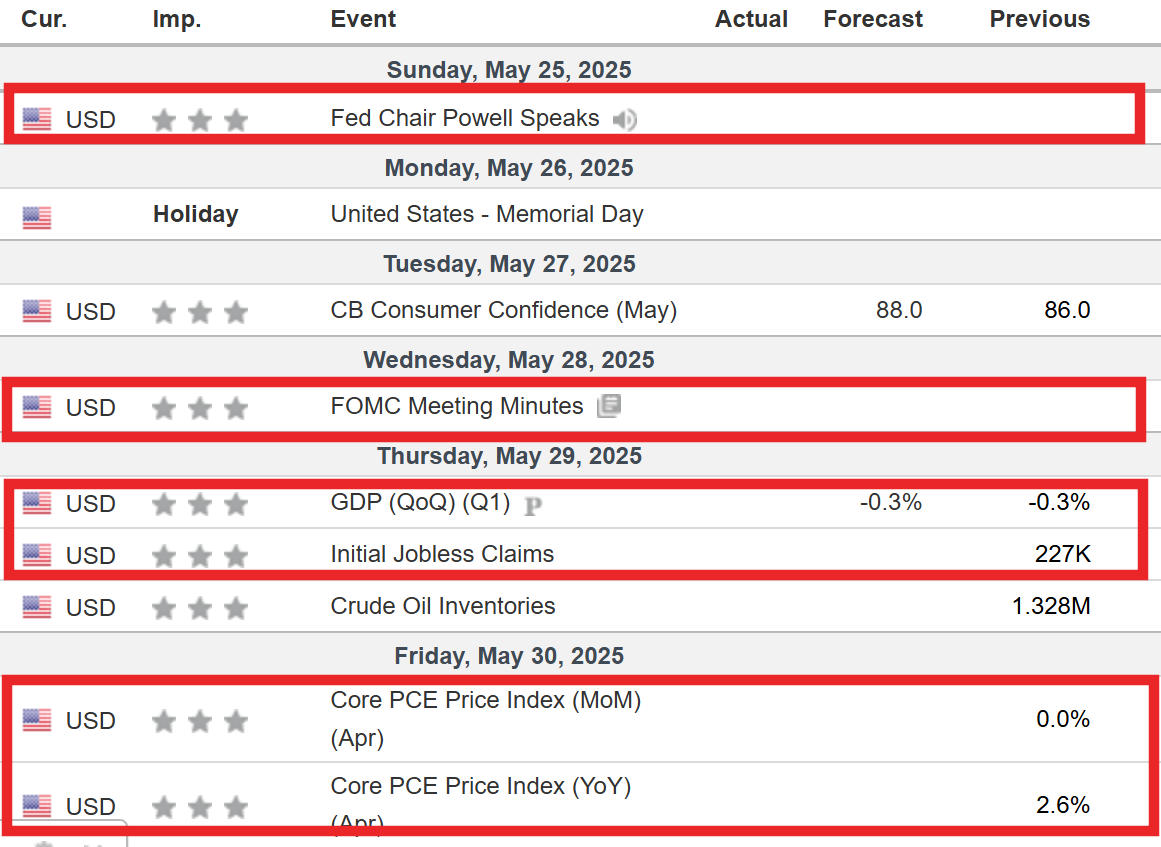

Calendar

Market holiday with electronic trade open on Monday. Memorial Day in The U.S. and Spring Bank Holiday in The U.K.

Despite what will be a slow start to the week, volatility will ramp into Wednesday/ Thursday. Max focus on NVDA earnings Wednesday & Friday’s PCE readings from The U.S. I can see a situation where we drift up through the week into a decisive Friday for markets.

Earnings

NVIDIA announcing Wednesday will be fun with market impact. I don’t see a scenario where this comes out a miss, however the devil is in the detail of forward projections and margins, rather than headline EPS or REVS.

Mon: N/A.

Tues: PDD.

Wed: CRM, SNPS, NVDA.

Thurs: DELL, COST, MRVL.

Fri: N/A.

Macro

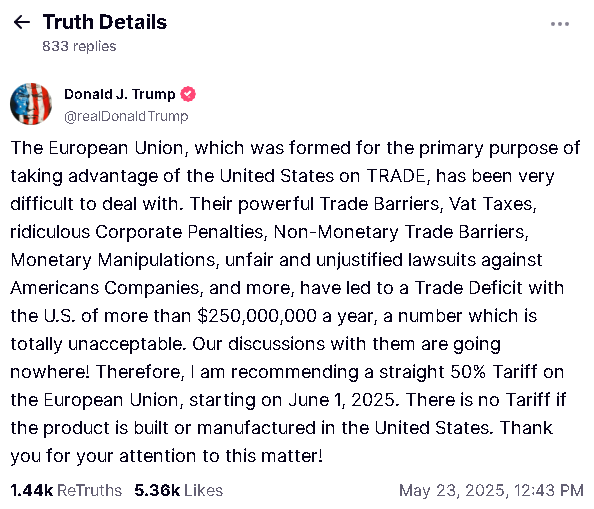

A shake down of the 6-day run in stocks came on Friday. The weight of 50% tariff from U.S. on E.U goods priced into the markets. Tim ‘Apple’ Cook and co. also came under fire when Trump gave the ultimatum that Apple either manufacture iPhones in U.S. or get slapped with a 25% import tariff on the devices. The S&P500 then setup for the long play I highlighted in last week’s report TRADE section, YVWAP Long. They bought this dip.

In the background, risk off assets (Bonds, Gold, Swiss Franc are a go. A non-typical picture. Buy everything?

Have a read about the alarm bells that ring from Bond world both in U.S. and Japan. This picture speaks to a situation where half the market-retail are long stocks and risk assets, while a different cohort are long the protective assets. Interesting to look at the Utility sector ETF XLU which is also a protective ‘Risk off’ asset, compared to an SP500 tracker fund. Utilities are being bought up just as much as stocks.

The Flash PMI report from last week was interesting

''Manufacturing input inventory holdings meanwhile showed the largest jump on record as firms sought to safeguard against further tariff related issues.''- in reference to what was discussed last week, manufacturing have indeed front-loaded inventory at all-time record levels.

TRADE

ES

The long from YVWAP from last week setup on Friday’s low of day. Will this hold to rally to QPVAH? I think so.

DXY

Wellness check please? The rot continues, and so it should. Flight to 6E Eur and 6S Swiss Franc is healthy and alive. More DXY Downside expected. Target down $97.569

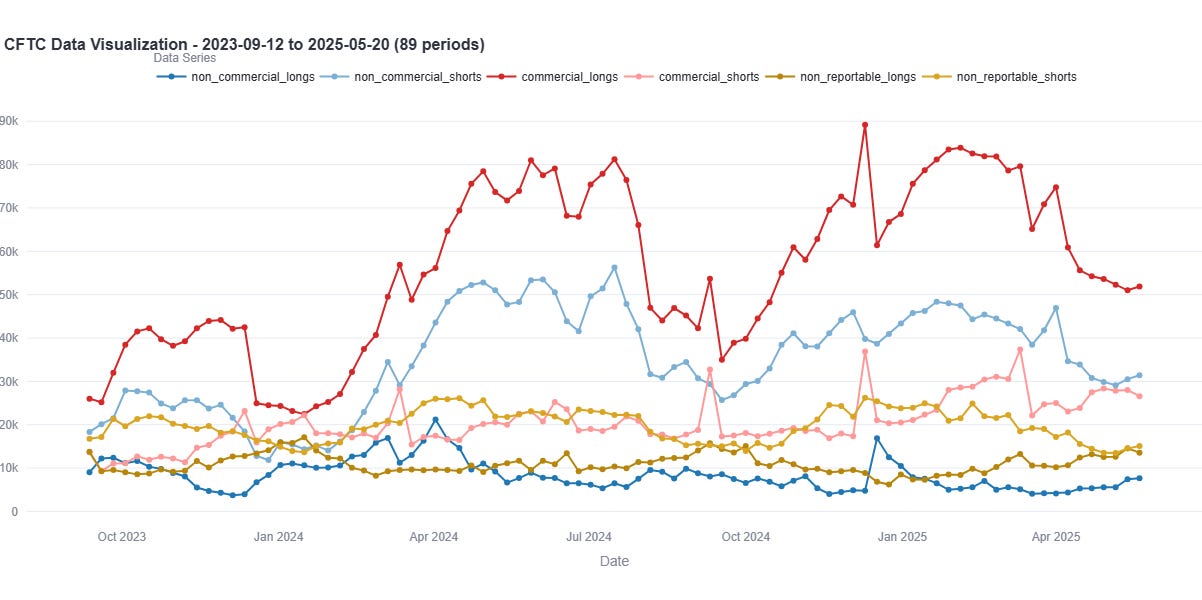

Swiss Franc 6S

Target up $1.29780. Commercials are positions off of extreme crowding, however non-commercials i.e. large specs are still quite short in the 75th percentile over the last 10 years. What is interesting is that small specs are in the 85th percentile, long-crowding here-Large specs v small specs. A pullback on 6S during the week could cause a puke from small specs.

Seasonally, Large specs/Non coms, are above the all-time average short, but well below the 2024 levels.

Small specs seasonal positioning i.e. for this time of year are above the all-time average long and well above the 2024 levels.

Gold

We missed the best swing entry on this pullback on the Duggan Capital desk. We are more enthusiastic about a YVWAP pullback than +0.5 but in saying that, I have bought more bullion during the week. With a long term investment horizon, I am not price sensitive and willing to buy more through up to 40% pullbacks. Trading this on futures intraday, however, it is a completely different approach. Basically 2 polar opposite execution approaches. There was a beautiful IPB setup on Monthly VWAP on Thursday, which we did trade.

Let’s look at C.O.T, despite what you might think, there is little evidence to say large participants are crowded in the slightest.

From the crowding tool above, we can see large specs are underweight, long in the 30th percentile over prior 10 years data. Seasonally, they are also below last year and their 10-year average position. So who is long? China and every central bank, I think. It’s a physical-driven market at the moment, so it’s not surprising to see participation low in futures, yet if you talk to any physical dealer, they will tell you they are crazy busy with bullion flying out the door. Shout out to my boys in Core Bullion dealers in Dublin, Ireland.

For example, using our in-house proprietary software (thanks Max), we can see that total market participation in Gold futures in at the median value.

ZW Chicago Wheat

The picture on C.O.T in ZW Chicago wheat futures is pretty crazy. We feel there is a massive puke on the cards!

We are seeing crowded levels in the 90th percentile all time. Furthermore, we will publish C.O.T on this next week, as I think it needs another week to pullback from strong levels. In the meantime, we are monitoring for supports at Y-1 $520’2 and areas highlighted in the 30-min chart as below.

Okay, that’s all for this week. Last week I published that we have a great partnership with NewSquak whereby subscribers to The VWAP get an extended trial of the full service package, including live news audio AND a 30% off the first month. You will however need to contact me directly for the coupon code. Please do get in touch.

If you liked this report, PLEASE, PLEASE, PLEASE do like and share it to help out this community.