The Great Industrial Reversal

Party like its 1950

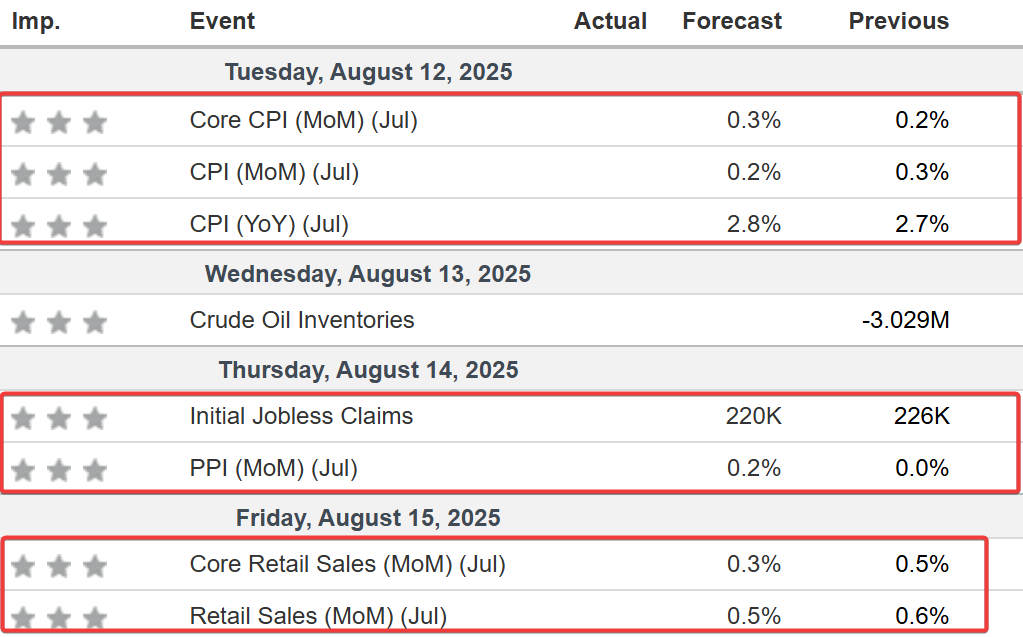

In this report: When was America great, how it imploded and why they want it back. I have said since May that high frequency data will start to breakdown come end of August/Early September. If there is no breakdown during August/September in Jobless figures and CPI stays calm, this rally will know no upper limit.

Articles:

Trump tariffs kick in at highest rates since Great Depression

Investors game out market reaction to Fed chair replacement favourites

Swiss gold industry in crosshairs after US tariff debacle

Wall St Week Ahead Inflation data to test stocks as some investors brace for rally to pause

Calendar & Earnings

Earnings

Mon: N/A.

Tues: CAH, CRWV.

Wed: CSCO.

Thurs: DE, AMAT.

Fri: N/A.

Views

The S&P500 IS The Mag 7. And when we are in an A.I. golden bubble, the rally is justified. The top 10 stocks account for 76% of the market weight, i.e the total market’s value - the highest level ever recorded.

As I have, you too might think this is insane, unsustainable, but the opposite is true. A.I is getting overly priced in, with Palantir trading at 100 times earnings. Thats 100 years forward earnings is what it currently trades at.

Margin levels are increasing at a rapid rate. Since the liberation day dip, retail have bought ungodly amounts. Now purchases are into buying on margin. Where you can buy 50% on margin. You can see from Finra- the regulating body, that margin levels are on the rise. This is the point where we move from leveraged to over leveraged. The thing is that this is not a tradeable piece of information, just an observation. This can continue until interest rates move higher. And with the current market expectations for rates to move lower, this rally can go on a lot longer.

So in short, the tariffs are actually the sideshow. A great distraction from the A.I. bubble and liquidity.

Macro

From Golden Age to Rust Belt-and Why Bessent Wants It Back

In the 1950s, America was the factory floor of the planet. Europe and Japan were in ruins, the Soviet bloc was sealed off, and China was still a rice paddy economy. By 1950 the U.S. was turning out half the world’s industrial goods and holding most of its gold and capital.

Detroit built cars, Pittsburgh poured steel, Boeing made planes, RCA sold you the TV to watch them fly. Unions were strong, wages doubled between ’47 and ’60, and the U.S. ran monster trade surpluses -selling far more to the world than it bought. This was the so-called ‘Golden Age of Capitalism’-the period MAGA nostalgia points to.

But even with this level of prosperity, life was far from perfect for all. The spoils were not evenly split. Racial, gender, and class barriers kept plenty of Americans from sharing in the boom, civil rights were suppressed, and McCarthyism made sure dissent stayed underground. For the white, unionized, working-class voter, life under Bretton Woods, was about as good as it ever got. This backed the strong dollar, where you could convert $35 for 1oz of gold from The US treasury.

The 1960s - Cracks in the Wall

By the mid-’60s, the math was turning:

Vietnam War spending bled gold reserves.

Great Society programs widened deficits.

Germany and Japan were back online with new kit and leaner costs.

The dollar was overvalued -fixed at $35, expensive versus foreign currencies, as U.S. inflation climbed.

By the late ’60s, foreign central banks started cashing in their dollars for U.S. gold- de Gaulle’s France being the most famous country where they demanded full conversion of all their USD for Gold. He even sent the French navy to go pick up the gold.

1971 - Bretton Woods Blows Up

The Gold Reserve Act said the Fed had to keep at least 25% gold backing for every dollar in circulation. By mid-’71 the ratio was 22%- below the legal minimum.

The world had recovered, was selling goods and oil to America, and stacking dollars. Then they wanted gold instead. U.S. manufacturing was already under the hammer from automation and early offshoring. And with globalisation revving up, the choice between paying an American $5 per hour or a Thai worker $0.25 cents per hour wasn’t hard for a corporate CFO.

On August 15, 1971, Nixon slammed the gold window shut. No more dollar–gold convertibility. The dollar was now fiat, free-floating, and free to finance deficits forever. Wall Street replaced Detroit. Finance replaced factories. The dollar became a weapon, not a promise. ‘The Steel belt’ rapidly became The Rust Belt.

Late ’70s - The Rate Shock That Broke Industry

By the late ’70s inflation was running wild. In May ’79, Thatcher hit the UK with rate hikes - 12% to 14% in June, then 17% by November - to “squeeze inflation out of the system.”

In August ’79, Paul Volcker took the Fed chair and brought the sledgehammer. Fed funds at 11% on entry, near 20% by 1981.

The fallout:

Exports died-strong dollar made U.S. goods expensive.

Imports flooded in-dirt cheap in a super-dollar world.

Projects, infrastructure, and industrial investment? Gone.

Labour unions smashed, unemployment spiked.

The Rust Belt went from a political metaphor to a map of shuttered factories. By 1976 the U.S. posted its first sustained trade deficit since the 1800s (-$6.7bn).