The New World

Europe gets serious on security

In this report: European structure problems , A.I Military investment, bond markets react, tariff impacting U.S states, trade charts on Euro Index, Bund, S&P500, Dow, Nasdaq, Gold.

“This is not an army against NATO, it can be a good complement to NATO. The times when we could rely on others are over, this means nothing less than for us Europeans to take our destiny in our own hands if we want to survive as a Union. This means, in the long run, Europe has to become more capable to act” Angela Merkel- Nov 2018

Just as I was finalising the report, Trump announced he was considering banking sanctions and tariffs on Russia until a ceasefire is reached.

About 90mins later, the markets got a response out of Putin. Oil was probably the most responsive market on this breaking news pairing back 1,6% ($1.11c) in 3minutes and some of the days persistent gains.

Calendar

Highlights: Tuesdays JOLTS, EIA STEO, WASDA report, Wednesdays OPEC Report, CPIs and Thursday PPIs and jobless data.

Earnings

Nothing of huge interest this week AVGO 0.00%↑ COST 0.00%↑ HPE 0.00%↑ DLTR 0.00%↑ announcing.

Macro

The long awaited age of unified European security starts

The new world will starts today. Europe led market sentiment Tuesday, as the Euro surged against the U.S. Dollar, spurred by plans to boost European defense spending by €800 billion over the next four years—an initiative led by Germany that has already propelled industrial giants such as Heidelberg Materials (+13.5%), Bilfinger (+19%), Hochtief (+15.4%), ThyssenKrupp (+13.6%), and Rheinmetall (+5%) [AP News]. Bond markets around the world have responded with parabolic moves, translating to overall higher yields.

This could not have come at a better time for Europe as the bloc generally has been stuck in stagnation, arguably since the global financial crisis. Underpinned by a shrinking workforce, growing savings and reduced investment, the latest lash of higher energy costs on industry incurred from turning off Russian gas.

In September last year Mario Draghi authored a deeply searching paper ‘The future of European competitiveness’ setting out to identify how Europe will build on its strengths to grow in 3 areas to achieve comprabable and competitive growth, at the stark danger of being left behind.

Skills/ Education

Decarbonisation and competitiveness

Increased security and reduced dependency

So what is in Europes way?

Lack of cohesion on regulatory and integrated policy thinking.

Europe is wasting its common resources

Coordination on industrial activity.

The return of Trump to the table and the soon to be replaced NATO has been just the wake up call to turn plans into action. In summary, bureaucracy is killing the European project. The main comparison mechanisim in the report is EU v US. Some interesting statistics are brought to the front. Here are a few key charts and quotes below.

If you were ever wondering how important Ireland is within the EU!

The EU is entering the first period in its recent history in which growth will not be supported by rising populations. By 2040, the workforce is projected to shrink by close to 2 million workers each year.

With the world on the cusp of an AI revolution, Europe cannot afford to remain stuck in the “middle technologies and industries” of the previous century

Even though EU households save more than their US counterparts, their wealth has grown by only a third as much since 2009.

Between mid-2022 and mid-2023, 78% of total procurement spending went to non-EU suppliers, out of which 63% went to the US

When we look at A.I in the new world ahead (military A.I spending section below), it is important to see how we are ‘fit for purpose’ on a global comparative scale. A key reason for lower rates of investment in 5G is Europe’s fragmented market. For example, there are 34 mobile network operator groups in the EU and only a handful in the US or China, in part because the EU and Member States have tended to view mergers in the sector negatively. Europe must meet its broadband infrastructure development with as much vigor as it is the military investments. This fiefdom of not only coms networks, but also energy providers, lending rates (mainly mortgages) and food distributors MUST END.

There is too much disparity of consumer goods and services pricing in what is supposed to be a singular economy.

US Tariffs

Meanwhile, escalating U.S. trade tensions have intensified as the Trump administration imposed 25% tariffs on Canadian and Mexican imports and an additional 10% tariff on Chinese goods, prompting retaliatory measures from Canada and China (impacting $155 billion in U.S.-Canada trade) with further actions expected from Mexico. The White House given automakers a 1-month reprieve. Adding to the global economic reshuffle and has then broadened out this stay of execution to its original April 2nd data which was pulled forward to Tuesday 4th March, causing earthquakes across markets. TSMC announced a planned $100 billion investment in the U.S. over the next four years to secure semiconductor supply chains and mitigate U.S. overreliance on Taiwan-made chips. This will put to bed any bull thesis there remained for Intel stock. These developments are driving volatility across commodities, industrials, and tech sectors, while reshaping investor sentiment and global trade flows.

AI and the Future of Warfare: How the U.S., Europe, and China Are Reshaping Defense

The race to integrate artificial intelligence into military operations is accelerating worldwide, with the U.S., Europe, and China investing heavily in advanced technologies. The U.S. Department of Defense (DoD) is ramping up AI spending, with $4.9 billion allocated for AI and autonomous systems in its 2025 budget. This push reflects broader trends, as global military spending hit a record $2.24 trillion in 2022. The growth subsector areas read like a more sophisticated Terminator movie.

Trade

Broadly speaking, I think with put protection at a near all time high, people are making money in this turbulence and will want to hold onto that. If so, we will see much lower equity prices from the get go and have a fast unwind on equity indicies.

EURO INDEX FUTURES $6E

There is much better structure in the macro and in FX now, al be it, late to the table for the breakout rally for Euro, we would clearly now be buyer on dips than seller of rips. The Eurozone is ready to spend and flex some fiscal muscles. Despite this strength, I expect a counter move pullback in DXY this week which may provide a pullbackk on Euro to YPVAL $1.06635 area to buy. Detail as below.

German Bund FUTURES 10year FGBL

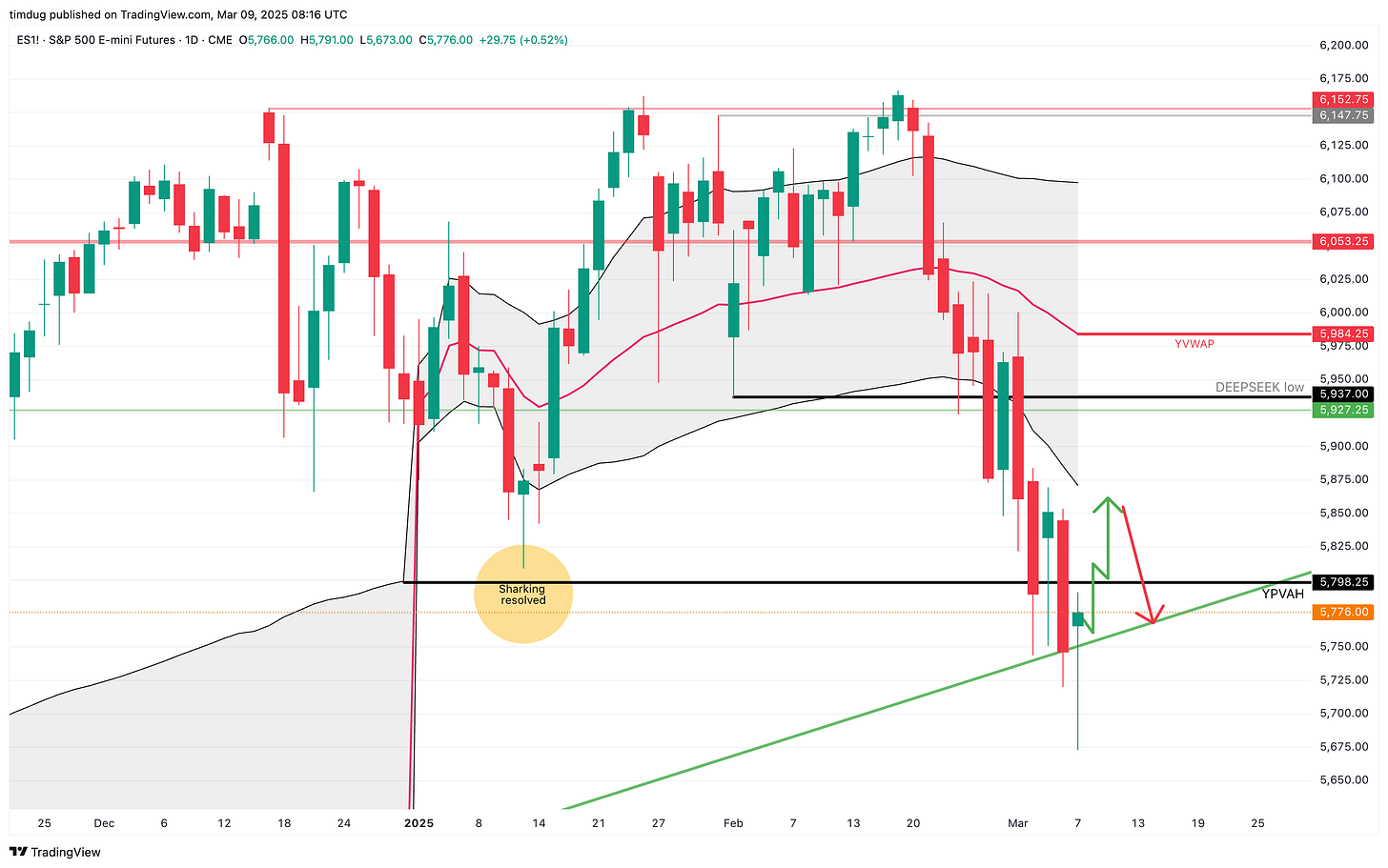

S&P500 FUTURES ESH5

Sharking of the YPVAH $5798.25 a expected from last weeks report and a few months ago, got resolved. When we shark a level, we leave unresolved trading/ poor high or low area. When we come back to test the same levels, we have the expectation the level will break with momentum. This is what happened last week. Looking at VIX expiry contracts, the spot market VIX is trading above the 3 month forward contract. This tells me that while traders have been long VIX in this downturn at some of the highest levels ever. Look for strength to fade as the market pulls back up to Y-1 currently around $5850, however this shifts daily.

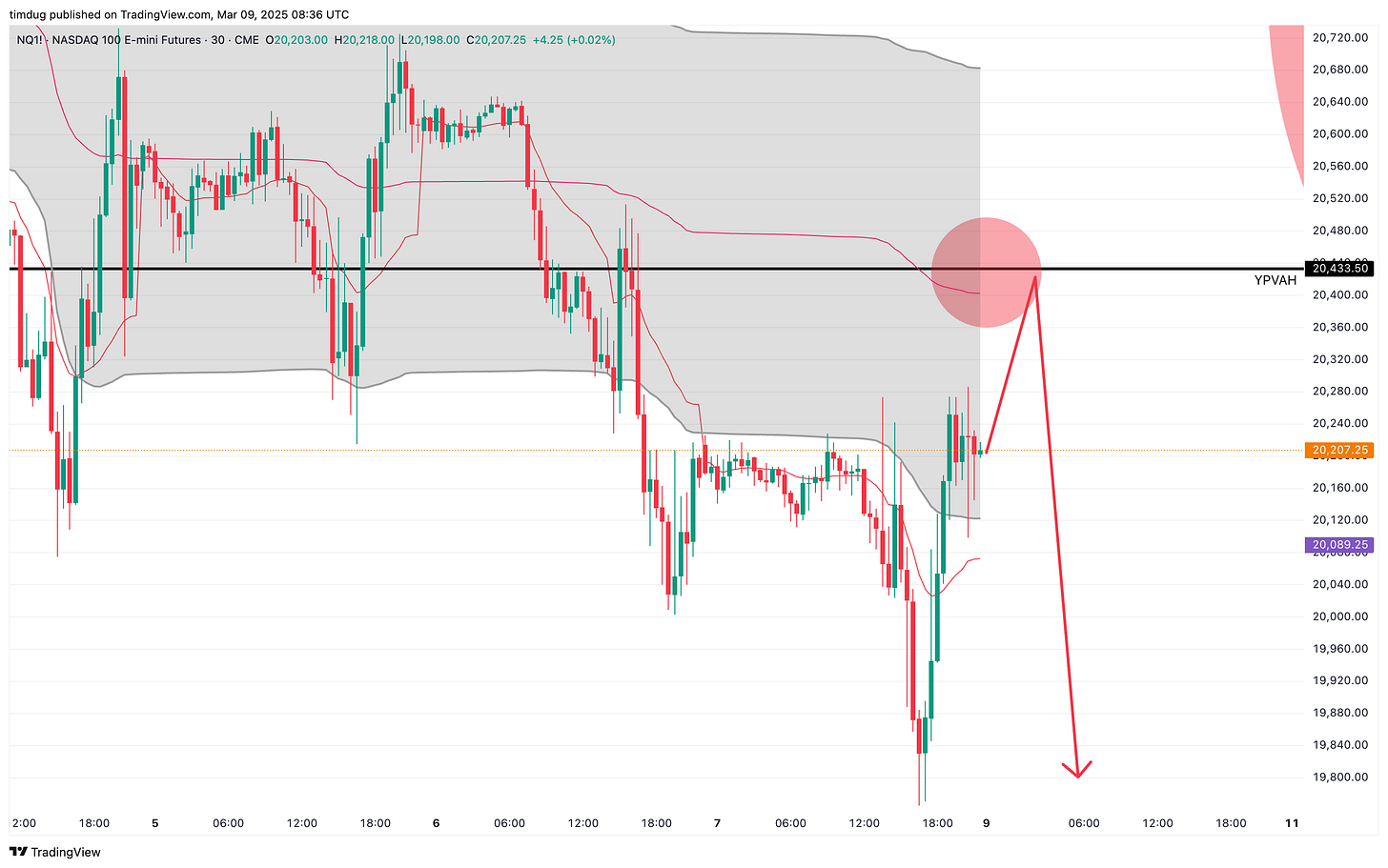

Nasdaq FUTURES NQH5

NQ is now balancing back inside of Yearly prior value area. This will attract sellers to auction is as far down in the prior auction area as possible. I see that buyers will want to do what they do and rally last weeks dip back up to Y-1 $20,788s. This is where sellers may want to start to slam the bids. There is another spot for sellers to look at- YPVAH $20,433.50, so I would also be mindful of weakness here early in the week. If the dip buyers are not showing up to rally the market open on Monday hard, they will get abused at this level.

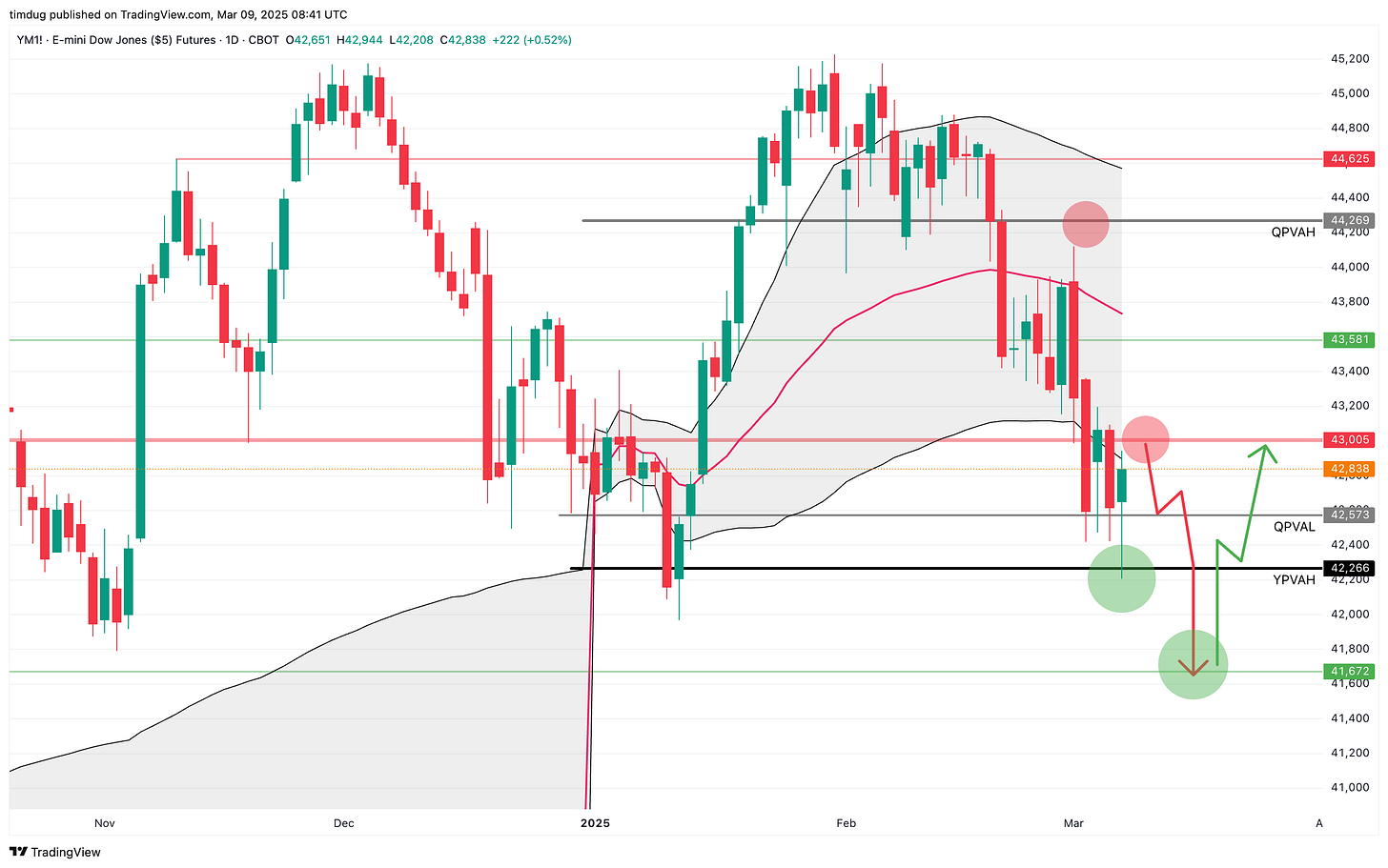

DOW FUTURES YMH5

Dow has found buyers last week at YPVAH, A big level. I would be hesitant to sell in front of buyers who loaded up there. So there is dissonance here for now = NO TRADE. I would prefer to monitor the monthly picture and how we rotate and balance on that to look for a trade. $43,000 Looks to have a nice interest from sellers last week. Look for this to continue or get lifted in the week ahead.

GOLD HCM5

The push to AND over $3000 is much talked about, however is yet to be seen.

Nat Gas

These are testing times for all market participants with little respite in sight. A big theme that came up in several conversations this week in the Duggan Capital team and with others was our ability to matabilise the macro news cycle. If you plug in to the news cycle and trade accordingly, you can get psychologically chewed up and spat out. We need to be able to maintain contextual awareness while also staying sane, getting enough sleep, not chasing false narratives and not getting married to ‘views’ that can get unwound in seconds. There rapidly becomes no solid footing, looser risk parameters and too many trades.

Take it easy, you are in control of how the news and macro affects you, no one else. So the conversations were about digesting enough to stay contextually aware, instead of sticking the news hose pipe in your mouth and trying not to puke. Its hard. It kills a lot of traders and their books. So take it easy out there, unplug a little more rather than less. Remember you need a lot of clear thinking space in your head. This IS DIFFICULT. In no way is this easy for anyone.

Keep it tight because Trading is Waiting. Waiting is Trading.

Tim