Volatility Ahoy!

Hot inflation! - FOMC & NFP

Earnings this week from APPL, AMZN, LLY, MA, KO, AMD, LND, MCD, QCOM and more https://www.tradingview.com/markets/stocks-usa/earnings/

MONDAY

-

TUESDAY

German GDP***, EURO ZONE CPI YoY***, US CB Consumer Confidence***

WEDNESDAY

ADP Non farm employment change***, Manufacturing PMI***,JOLTS Job Openings***, Crude Oil inventories ***, FOMC Interest Rate Decision***FOMC Press Conference***

THURSDAY

Initial Jobless Claims ***

FRIDAY

US Average Hourly Earnings***, Non Farm Payrolls***, Services PMI***

For more, please visit www.duggancapital.com

Join us on Discord for live analysis and trading www.whop.com/duggancapital

Or find me on Twitter @timdug

If you would like to learn how to trade with this edge or find out more about our live trading room where we look at these setups, well give us a shout!

Equities

The week kicked off with a mixed bag of earnings results in the tech sector, as Google, META, and NVIDIA experienced significant fluctuations in trading. Despite this volatility, investors remained resilient, buying into dips amidst disappointing GDP figures, which came in at 1.6% compared to the expected 2.5% quarter-on-quarter growth, down from the previous quarter's 3.4%. Notably, market sentiment shifted, with expectations of rate cuts decreasing from six in January to just one before December 2024. Concerns also arose over the hot Personal Consumption Expenditures (PCE) data, which rose to 2.7% from the prior 2.5%. These data points underscored a narrative of accommodative Federal Reserve (Fed) policy, as investors speculated that the combination of high inflation and weak GDP growth would prompt the Fed to prioritize rate cuts in the medium term.

Looking ahead, the focal points of the week are the Federal Open Market Committee (FOMC) meeting on Wednesday and the Non-Farm Payrolls (NFP) report on Friday. Anticipating these events, trading activity is expected to be subdued on Monday and Tuesday. The upcoming FOMC meeting is unlikely to result in a change in policy, with interest rates expected to remain within the range of 5.25% to 5.5%. However, market participants will closely monitor employment figures throughout the week for any signs of weakness. Any unexpected downturn in job numbers could lead to market sell-offs, as it would require multiple weak readings before pricing in a response from the Fed.

As for the NFP report, the market sentiment remains nuanced. Historically, both positive and negative data have driven market gains, given the current narrative. However, with only one rate cut priced in for the year, a significant miss on the NFP figures could lead to market downturns.

In terms of the week's structure, Monday and Tuesday are expected to be quiet, with Wednesday likely to see increased activity ahead of the FOMC meeting. Investors will focus on the subsequent Q&A session with Fed Chair Jerome Powell, particularly seeking insights into the Fed's stance on rising inflationary pressures in the economy.

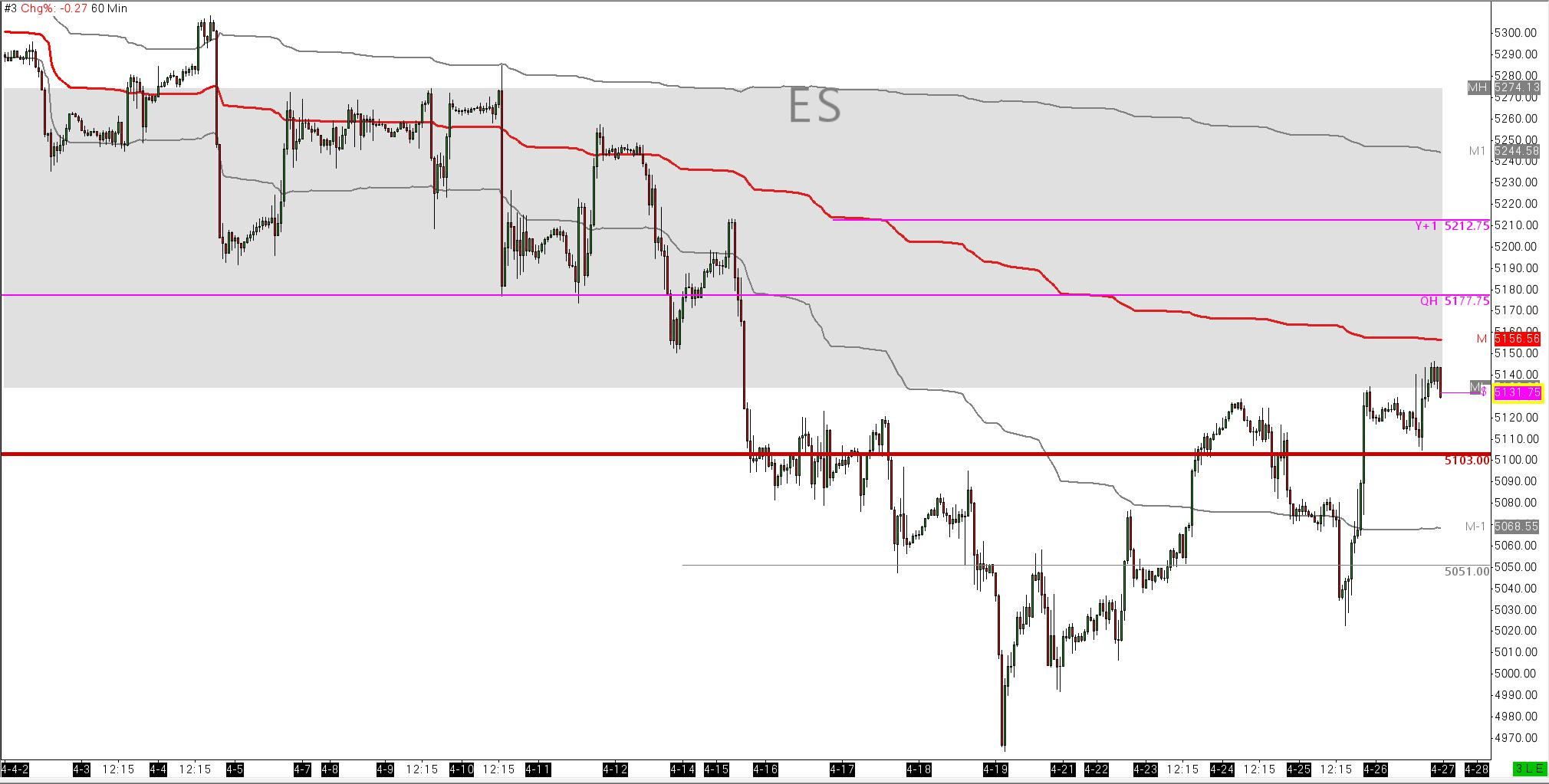

ES M24

Spooze has made a good recovery from recent lows, in the face of hot inflation data and poor GDP on Thursday and Friday. We started on the 14th April to auction down into the prior quarter's value area and will not complete this auction until we trade $4842. The bigger picture, however, is on the Yearly VWAP shown here. Any test of the Y+1 $5212 now should bring in confident selling, and I think the market will try its hardest to get back up to there. With a big week ahead, it is entirely possible that the market will overextend pricing to the upside. For day trades, this will be a great week but as we have seen with traders in Duggan Capital during the past months, you have to be fast to book trades rather than overstaying your welcome in longs or shorts.

On review of last week, the WPVA (Weekly Prior Value Area) traded beautifully, getting off to a strong start, flirting with the WPVAH (Weekly Prior Value Area High) at $5135, then retracing and completing the entire auction on Thursday following GDP data trading.

This week, my focus will be on monitoring trade on ES through the lens of the monthly VWAP. As depicted in the chart below, we currently observe an imbalance below the monthly prior value area, which is significant given that the market has spent nine days below this area. Additionally, noteworthy is that the highest traded volume price on the year is situated below the MPVAL (Monthly Prior Value Area Low).

My trading strategy revolves around identifying balance and imbalance in the market. When the market becomes imbalanced below a certain area, I look to sell rallies to upper resistance levels. Conversely, when the market becomes imbalanced above an area, I seek to buy pullbacks to supports below. It's a straightforward approach.

In this scenario, I anticipate ES attempting to rally back up to QH $5177.75 or Y+1 $5212.75. However, to activate a short against these levels, I'll be observing the following:

Speed: If the market swiftly reaches either of these levels and then stalls, indicating a lack of momentum, I'll consider initiating a short position to fade the move. Conversely, if the market ascends to these levels gradually and in a controlled manner, I'll refrain from taking action.

Daily VWAP: Should the market trade at these prices but fail to sustainably hold above the daily VWAP, I would look for opportunities to sell on a pullback to the VWAP or the daily value area low.

News Failure: In the event of a market rally driven by positive news, such as strong growth in NFP, reaching these levels and subsequently stalling would prompt me to sell rather than buy.

All of these trades will utilize 20-tick stops, emphasizing the importance of precise timing and managing tight risk parameters.

My DOW YM Data is corrupt at time of writing this and can not currently be used. I will update as the week goes on.

NQ M24

Price action on some Mag 7 companies like NVDA, META, and GOOG was fierce this past week. With 10% negative swings and rallies, dips were firmly bought. I don't see these buyers taking it easy anytime soon. This is why I'm looking for a large move further back up for NQ to test the Y+1 (Yearly VWAP + 1 Standard Deviation) level at $18314. This level is dynamic, and you must track it daily for movement. It coincides with Q-PVAH $18298. If the market reaches here, I think it's a great place for buyers of this dip to book some, if not all, profit and then reorganize the trade. This may provide a great day trade or short-term position trade on the short side.

Looking at last week's analysis, we did indeed witness a very early test of the QPVAL level at $17154.25, followed by a rally that hit my target of YVWAP at $17781.5 on Wednesday. After reaching this target, the market experienced significant selling pressure, retracing back to the WPVAL (Weekly Prior Value Area Low). Thursday even saw the market becoming imbalanced below the WPVAL. However, the market exhibited remarkable resilience following dovish GDP data, with buyers regaining control over YVWAP at $17781.5 as shown in the chart below.

This week, I anticipate a large upside target of QH/QPVAH at $18298, which coincides with Y+1, as discussed earlier. Trade activity at this level is likely to be technically overstretched, potentially leading to a rotation back down.

CL M24 WTI Oil

Oil has been quite tight through the month with spots of range expansion over middle eastern tensions. Zooming out on the picture, I’ve employed a monthly VWAP here and a 4hour bar chart to broaden out the view, while also zooming in from the daily bar chart. From this I can see the market clearly wants stay below the QPVAH $85.12S are and maintain the auction downward. I would like to see sellers go again at this price and take the market down to Monthly PVAH $80.34. The market should technically over the week go lower but not without buyers trying to keep us over the MPVAH. Selling may come in early in the week given the stale narrative of Israels 2nd counter attack on Iran not yet transpiring. I dont doubt it will raise its head again this week. Keep alert to the tensions coming back on the table with buyers to support this and then to rapidly then evacuate the trade.

Note: A small bit of information can be a dangerous thing. Please fill out your edge with sharper tools when looking to execute against any of these levels. For example, I use daily VWAP (ETH - Electronic Trading Hours). I also utilize prior day's value areas based on volume. This allows me to pinpoint extremely precise areas to interact with the market and manage risk. The settings of these tools can be the difference between reading price action correctly or getting it completely wrong.

If I can offer advice for this week, it would be to avoid overtrading. There will likely be some significant mispricing in the market this week, and you simply don't want to exhaust your resources before the real battle begins. I see this with traders I mentor all the time. They possess a great edge, yet they tend to have trigger-happy fingers. Instead of patiently waiting for the right trading opportunities, they often jump into trades based on anticipation, which can lead to poor decision-making and losses. Later in the week or session, they find themselves chasing losses and failing to utilize their edge effectively.

Imagine this week, you are walking onto a battlefield with only three bullets in your gun. Would you rather run out of ammunition and perish alongside the masses, or would you prefer to conserve your resources and aim for victory when the state of play becomes more apparent?

Exercise patience, observe, wait, and study.

My mantra is always- Waiting is Trading. Trading is waiting.

This is my favorite quote from The Art of War…

“Let your plans be dark and impenetrable as night, and when you move, fall like a thunderbolt.”

―Sun Tzu,The Art of War