Oil Squeeze

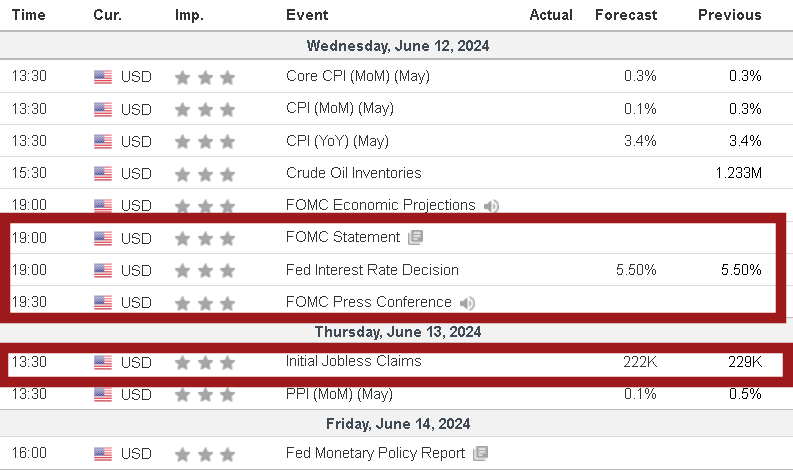

FOMC ahead

Hot Wednesday upcoming with FOMC to drop. The base case is no change for the June meeting. Expect things to be relatively quiet until then. Oil will trade in its own world

Energy

CLN24

The highly anticipated meeting of OPEC+ Last Sunday did not disappoint at all for oil traders. The outcome was bearish on the front of it. More oil to return to the market from OPEC+ group countries starting October 2024. We sold down pretty hard from the get go. I was writing last week that the market may want to try to test some upper levels like Q-PVAH before tanking, but alas it was just straight selling pretty much from Monday's open.

Here was the thesis chart, targets hit on Q-PVAL $73.31 on Tuesday 6:30am GMT

And here is what we got on the weekly VWAP. You can see that the $73.31 target was all done for the heavy selling with buyers stepping in at the W-1STD to bring price back up to W-VWAP and $76.22 the high of 25th Dec 2023. The market can stay imbalanced as it is nopw over hte W-PVAH and rally to $76.90S But at that level, I would find it hard to see oil rally further.

The Trade:

I like longs from and above W-PVAH $75.72 with Day and W-VWAPs to support pullbacks. If these fail along with W-PVAH, Then I will look for shorting pullbacks. Best short for me would be an upper test of the Q-1 Deviation and $76.90.

But there is an overly large amount of short positioning in oil at the moment which we can see from the chart below. I’m all for people talking and trading short squeezes, especially as we see the return of Roaring Kitty and GME, however, I have never traded a short squeeze in Oil, given that the market dynamics are already layered with so much narrative, it simply is a narrative and not a trade.

Yes, sellers will most definitely get lifted BUT what is the trade. Long from what price at what specific time with what specific risk? So we monitor how the market moves around technical levels to see where sellers get puked or where they are not reloading, and where buyers are taking control.

In this week's market, sellers are getting lifted above W-PVAH $75.74 and buyers will look to reload control from a retest around there. I'm thinking that the sellers will try hard to take back control at the Q-1 which is also resting at the 2018 NBA High $76.90. Providing good confluence of technical levels. I then expect sellers to run us back down to at the least $73.07 Q-PVAL.

EQUITIES

ES M24

With FOMC to come this Wednesday, its will be hard to nail any sharp and exact levels for trades at this early point. Here is where I see current support on ES, with the market currently balanced within the prior Weeks value area. I think today and until we get to FOMC, equities can continue to print lower, with ES supports coming in at hi 21st March 2024 $5322 and $5305.75 with ultimate protection form the Y+1 currently $5273.

Currently, it feels like something is up with the data. Jobs data is strong, with NFP coming in a beat 272k on 185k. The unemployment rate rising to 4% is not good, however ES Loves it. Why? Well the market wants to move higher because the jobs market is strong and it's still pricing at least 1 rate cut in 2024 if not 2.

Then if data continues to print bad ie. rising unemployment and rising jobless, then Daddy Jerome will step in and cut. So it really doesn't pay out to get bearish AT ALL in this environment. We need to worry when the market does not go up on bad data or good data. The time to get bearish will be when a cut is actually imminent.

As always, keep it tight,

Wait for the trade.

If you are interested to learn more and develop your edge, please check out our courses on the Duggan Capital website.

3 Month Alpha VWAP course. 3 months at £275 or £825 one of.

12 Month Alpha Edge Course. 5 days free trial £250per month or £3000 one off.

4 Week Alpha Pro Course. 4 Weeks intensive learning.

All courses include full access to the DC LIVE video trading Discord which is normally $200 US per month.