Entering the storm!

Covering front month futures of Bitcoin, DXY, ES, WTI Oil.

I had to take last week off to move to a new office space in the converted garage building at my house. The move took a lot longer that I thought, but Im delighted to finally be in and have a much better view of the Irish countryside from my desk now. Thanks to all my clients for bearing with me and your patience.

A short note on the Trump assassination attempt. I'll be brief as while it is disturbing, it is even more disturbing that this is how far the opposition will go in order to prevent Trump taking office. I don't have a view of politics other than that, I do not see Biden as fit in any way whatsoever to hold office now, or over the last 24 months, given cognitive decline.

When it comes to the markets, I am neither Irish (native born), American or from any country. I am simply a surfer. I work to see the waves coming from not so far out and then aim to surf some of the waves that I see developing or immediately about to break. All I need to do is stay on the board and not end up as ‘fish food’ (Point Break reference) SO with that, lets maintain a technical view. BE CONTEXTUALLY AWARE of the key support, resistance and the auctions that are taking place. These are the waves.

Bitcoin BTCQ24

Looking at what my forecast was on July 1st, versus what we got, it was a nice outcome. The market did indeed test the higher volume shelf $63395, then turned down for a -15.73% selloff to hit lower targets of $57790 and lower. A nice setup telegraphed by a strong dollar environment and the technical need for the market to come back down through average pricing on the year ie. Yearly VWAP. See the before and after charts below. With the US situation, it will be very difficult for me to predict or estimate precise price movements on most of these products. The one thing we can know for sure is that we will have raised volatility- meaning that price will be in exploration mode on most major markets this week.

What a trader can do in this environment is not try and pick tops and bottoms, but to be contextually aware of where average pricing is across the year, quarter, month and week. This will then allow you to see what auctions are trading, which ones are failing. If you are unclear about this terminology- please reference this prior post talking about how to trade imbalance

The Trade:

As mentioned, this week will be exceptionally strange given the Trump assassination attempt. We can reference the contextual balance however which is that BTC is now below its yearly VWAP. There may be a test of the Q-PVAL $62,305. The market will struggle to hold above here should it get there, unless we have a fundamentally deteriorating geopolitical picture in the US causing people to fly to safety.

I see buyers coming in first from the open this week to drive us back to at least $58,856 and potentially higher. Then we may spend the rest of the week NOT getting macro instability and the buyers dropping away.

In short: If you want to be a seller, wait for at least $60,000. If you want to be a buyer, get in early and look for the market to hold at Weekly VWAP tests going long OR Lean against the High of 22nd Feb 2021 $57790. (The downside target from two weeks ago)

DXY - Dollar Index

It would go against my macro trading education that the DXY sells down on the reopen, however experience tells me , the market will price in and then out what you think should happen extremely fast. So with that said, training says we price higher as a flight to safety over the Trump situation. Experience then tells me that, well, it's over and nothing happened. He wasn't killed, therefore, everything stays the same as it was as per the close on Firday. This is my consensus.

The trade - long for the first few hours of reopening, get a test of upper Q-PVAL $104.0995 area, then sell down for the rest of the month. What will happen is that a lot of scared money and dumb money will flood into DXY here, then get handed sick bags as there will be no material continued risk. Tread carefully so on FX. If the political situation escalates- DXY will not sit down. Look for balanced trade down through the yearly value area as per the chart below.

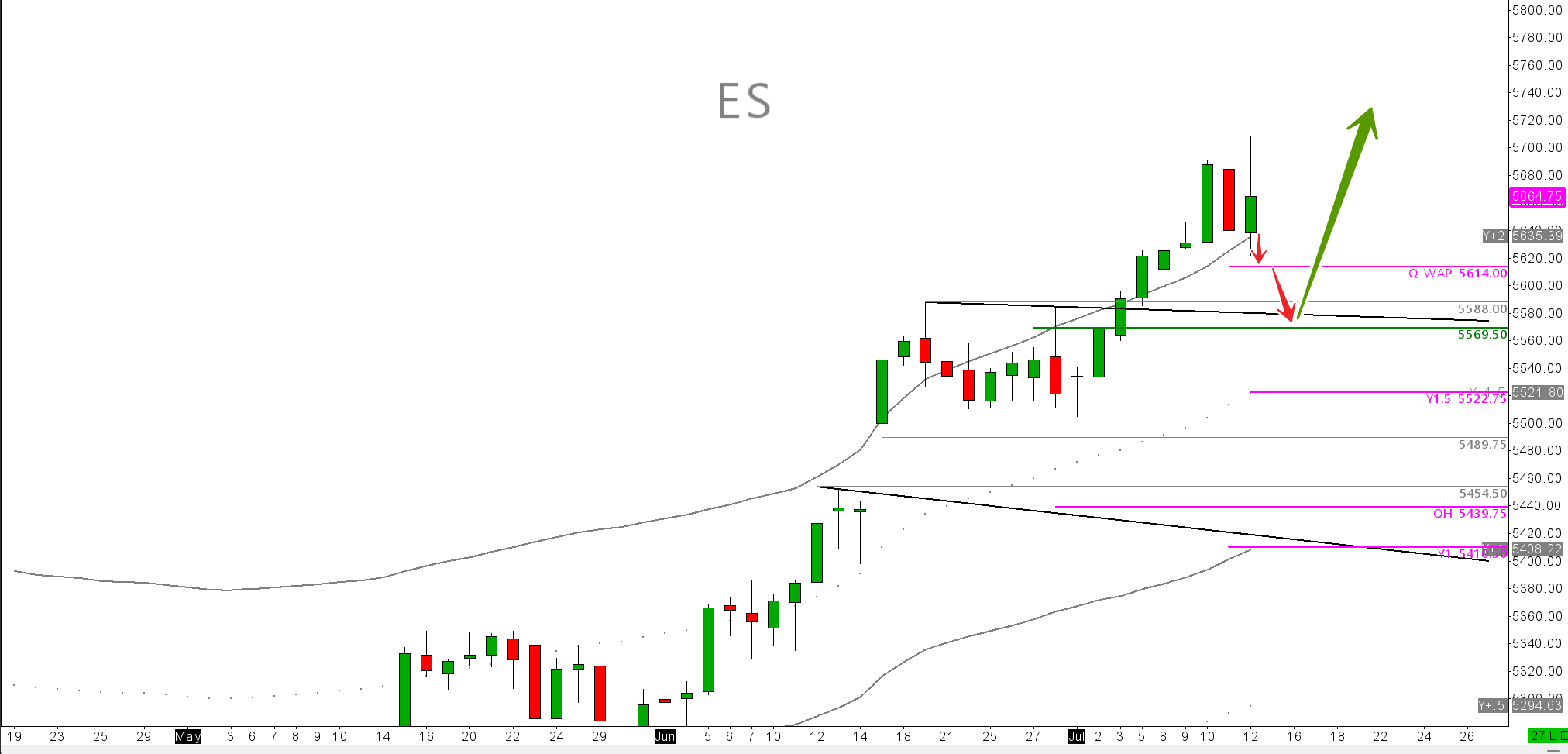

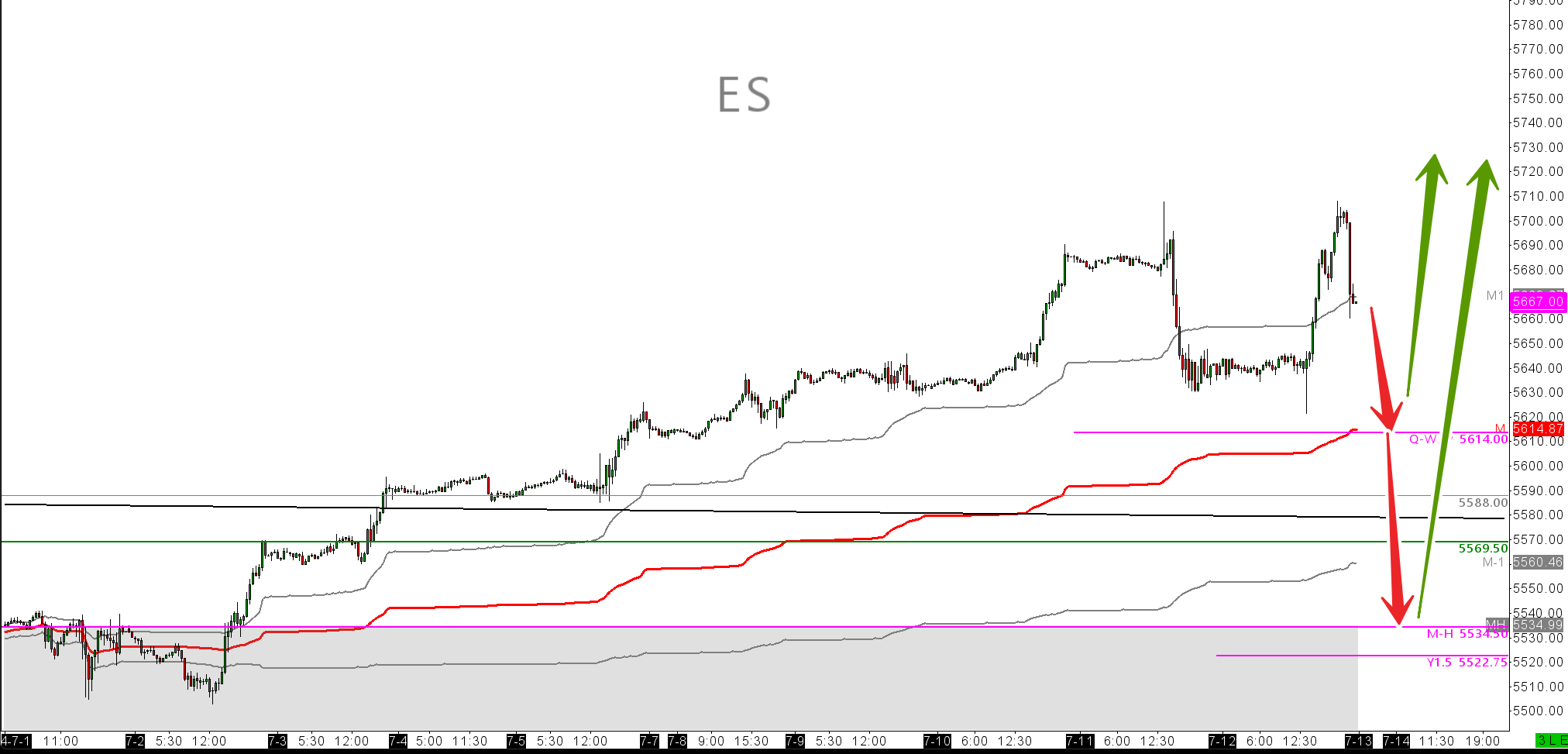

ES U24 Futures

Markets last week saw the CPI print they had waited for for 2 years and price on ES fell nice and hard. Buy the rumour, sell the fact. And that's what we have gotten. I'm less concerned with when the Fed will cut and more concerned with making money out of market moves. With that said, keeping technical about what we see, the market broke out of a 10 day trading range as per chart. We can't go against this type of breakout. I think we will pull back to M-PVAH $5535 and then reload the buyers confirming the breakout general area. Then rally higher. This guidance should hold for the week/ month.

The chart shows Im looking for a small dip on ES, down to test the trend and MPVAH, then rally again.

Should we not hold above MPVAH, we need to monitor for sellers to take us back under here and hold prices much further down.

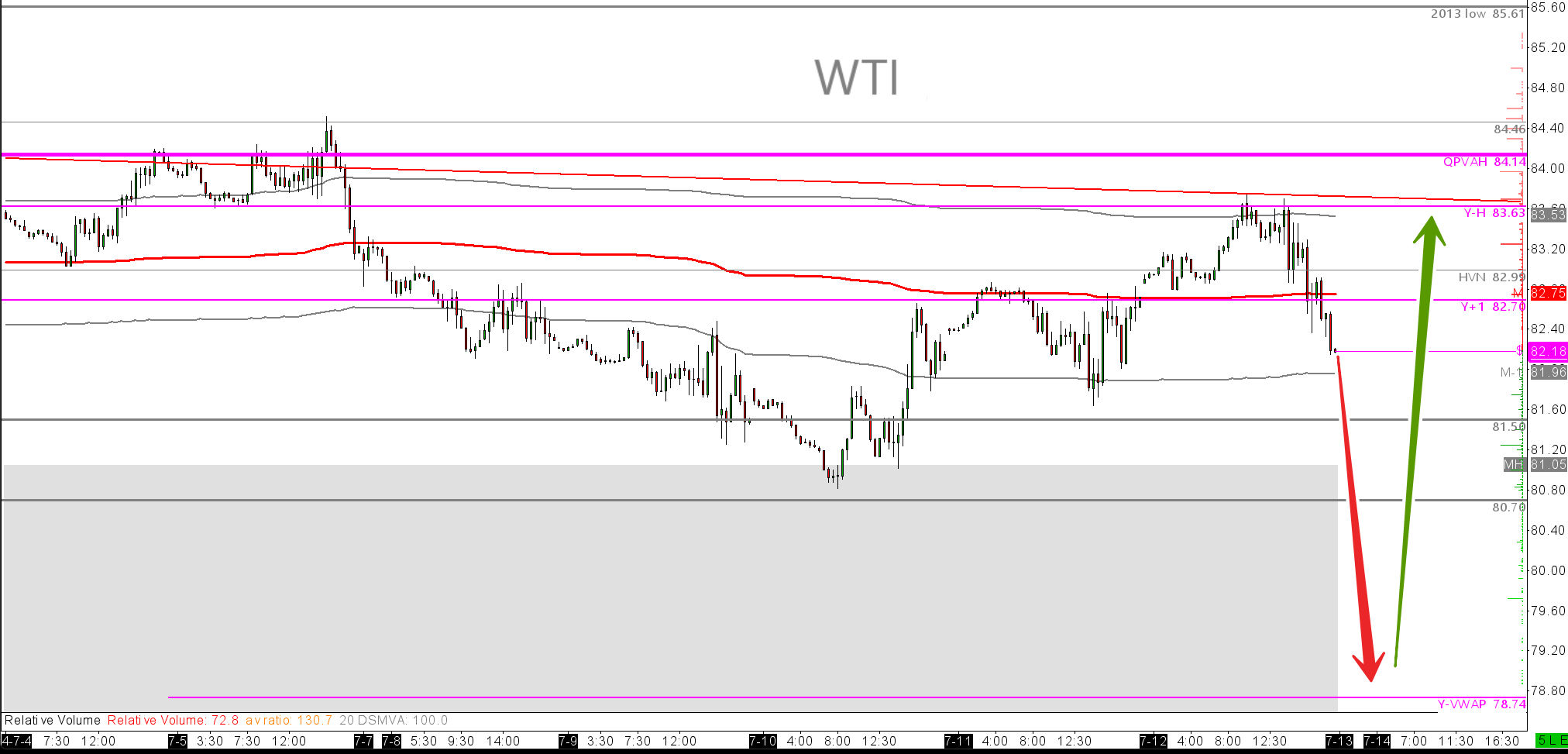

CL Q24 - WTI Futures.

The news out of China is that demand has slackened off quite a bit for now. Thus sellers are in the market for now. There is seasonal demand that should keep us elevated through the next 2 months between the $75 to $85 range.

Here is the current CFTC positioning report as compiled by John Kemp at Reuters.

We can see that Friday was indeed a great day for trading my edge. Oil tested the Y-PVAH from below and from trying to spend 3 days above $83.63 ie. Y-PVAH. When the market opened on Friday however, sellers took all they could at that price and sold oil down 1.91% from high of day to low. From open to close -0.83% Not a huge day, but an important day, signalling to me that we are now to rotate down through the prior years auction area quite a bit. I see a return to yearly VWAP on the cards $78.74.

Keep it calm out there. There will be a lot of volatility and you dont want to get shot dead before the market has traded around a bit first. Volatility will have your psychology all hyped up. This is when you are at your most vunerable as a trader. Try a little old mantra that I use most of the time in all parts of life. I always like to ask my self, What is really happening? Is anything really happening? And the true answer 95% of the time is

‘‘Nothing is really happening. Stay calm, wait.

’’