War wobbles

The doorstep to WW3?

Equities

Initial expectations of increased tensions in the Middle East were anticipated to cause a sharply negative open for equities while boosting energy, gold, and bonds. However, the opposite has occurred in the first 30 minutes of trading on Globex. The macroeconomic perspective regarding equities may be largely disregarded at this point, as we are witnessing a technical downturn. Data Thursday, US Initial Jobless Claims expected to come in at 214k. It's advisable to adjust trading strategies accordingly, as the market may re-position ahead of the report. A scenario where jobless claims surpass 214k could potentially trigger buying due to perceived FED read of rising jobless.

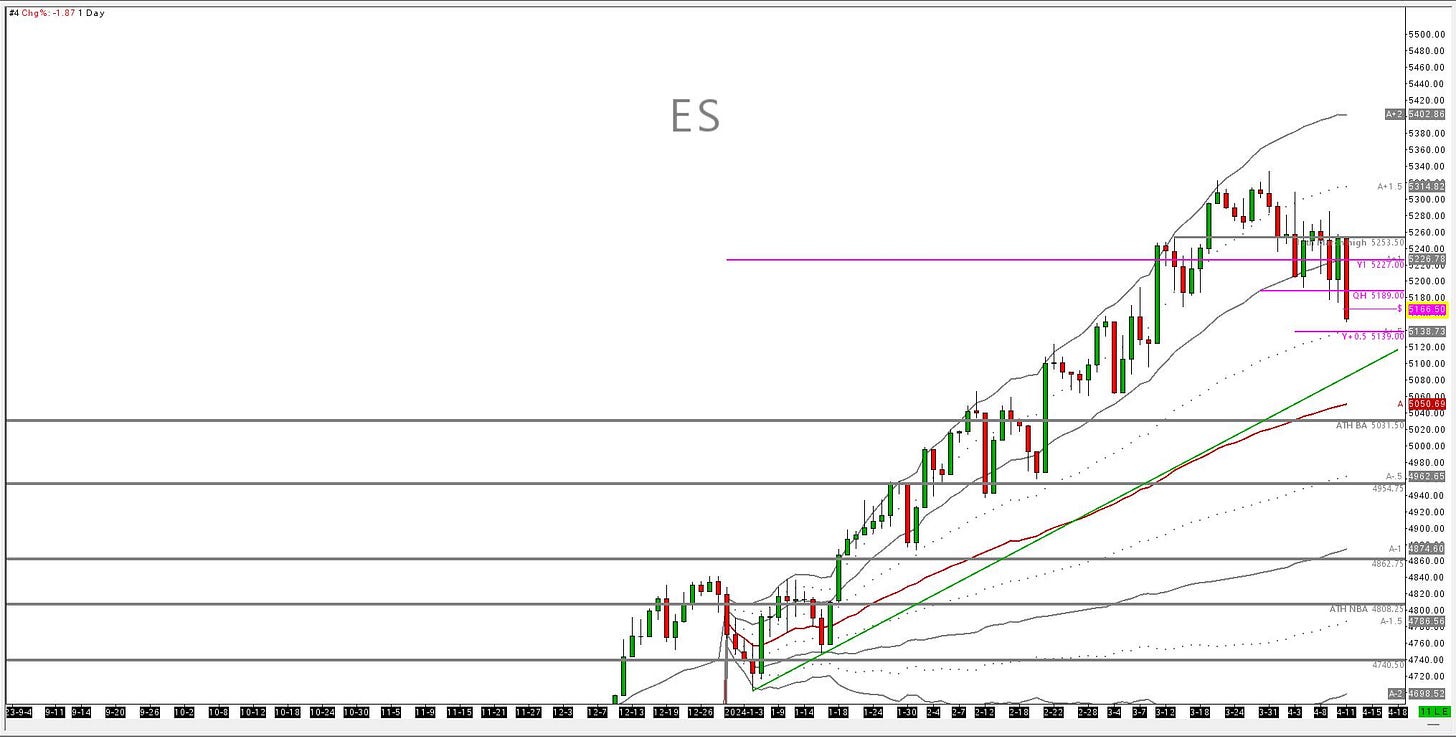

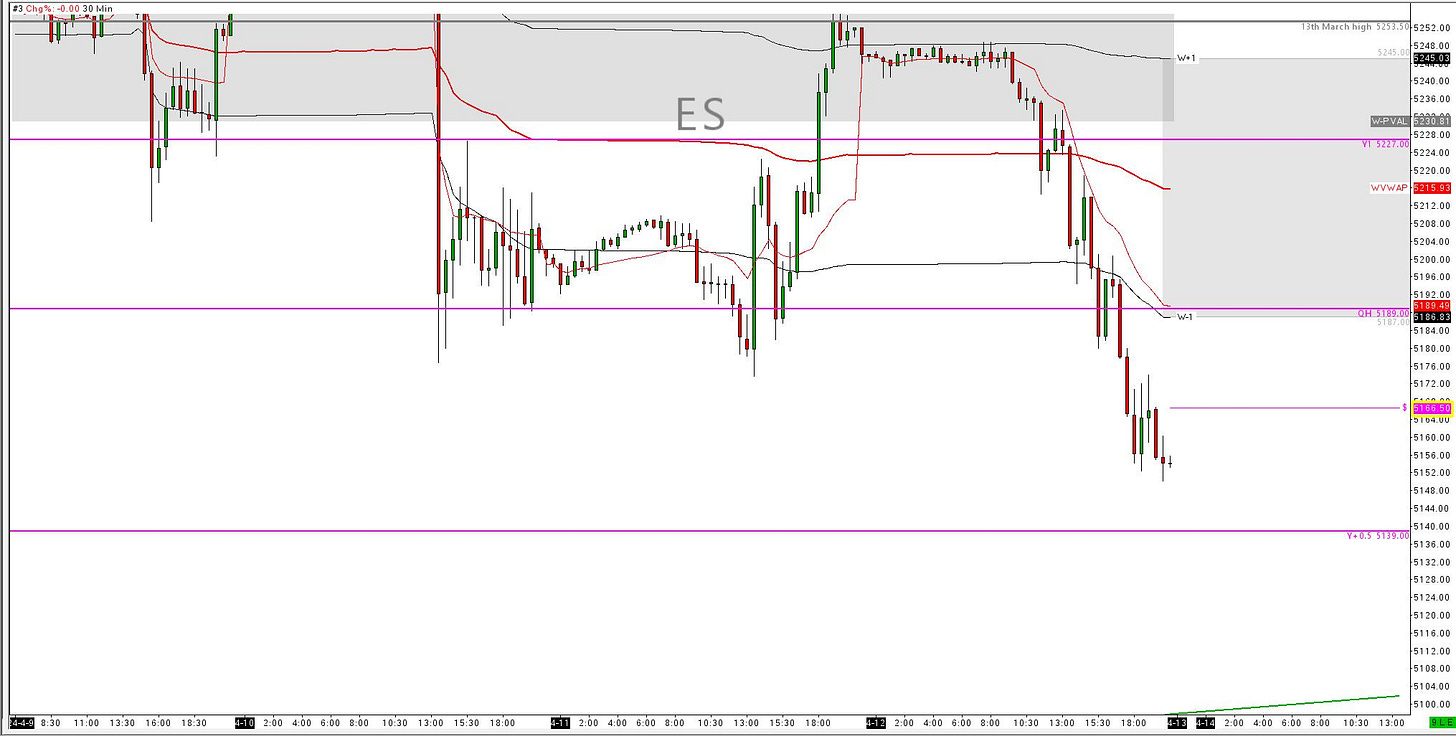

ES M24

The breech of Y+1 Supports at 5257 on Friday will open further downside looking for supports at Y+0.5 std 5138. For the market to move there, we will need to pickup sellers higher before selling down or need a macro catalyst. A test at upper resistance of Y+1 at 5227 will be meaningful. Because the best ops come from markets that reach too far, I like selling from just above Y+1 at the 13TH March hi 5253.50 or just below with risk above.

As we saw deep selling Friday, at least 30% retracement of that should be accounted for, thus putting us back above WPVAL 5186. We then look to resistance at the Y+1 5227. ES should hold rotational around 5227 with it providing a key point once we get jobless on Thursday. Downside targets YVWAP 5050, with the uptrend (green trend) on the year providing a pullback of 1 to 2 days before sellers reload around QPVAL 5186

YM M24

Dow has had enthusiastic selling earlier and deeper than ES and NQ. We can see a condition shift down on the YVWAP 38708 and down below KEY LEVEL 38499. Sellers are in control below YVWAP and a retest here will be sold.Sellers will initially have a go at 38499 however if before Thursday data, they may get lifted and have to try again at 38708. Be aware of a downside range with 38113 hi

As illustrated in the 30min chart, tight risk is not possible around YVWAP due to the magnitude of interest at this level. Where else can we look to put on suitable risk? The upper range in RED is almost confluent with WPVAH 39187 and this area look like a point of control for sellers to run out tired and ragged buyers. So expect us to reestablish inside of WPVA 38561LO TO 39187 HI through to Thursday pre data, then look for buyers to drop off at the upper range to drive the market back imbalanced down below 38113.

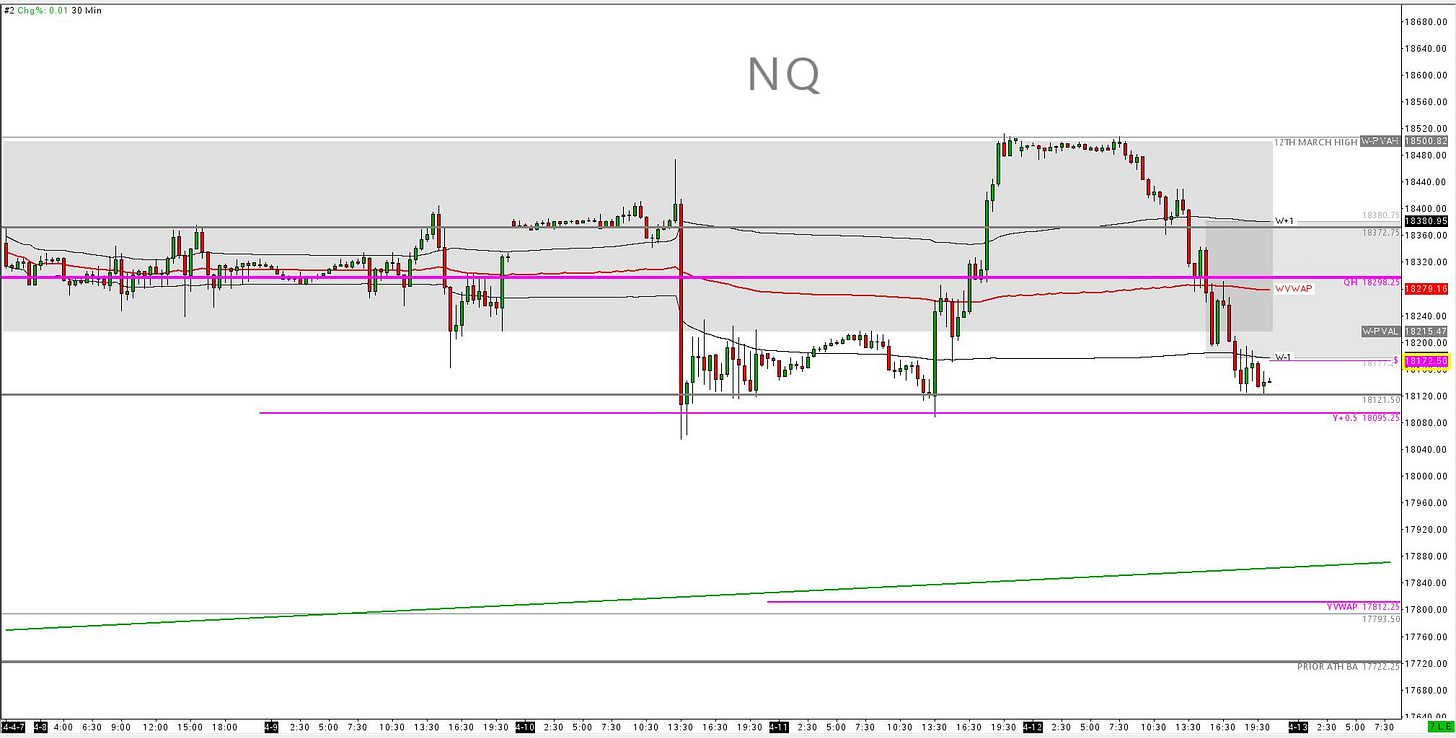

NQ M24

NQ is balancing well below the QPVAH 18298.25 Where we accept that the market is caught in an auction down scenario as the Dow was 2 weeks ago. With this understanding, we can see buyers lifting again from the 18121.50 and Y+0.5M however given the time acceptance and volume we have put in below QPVAH, I see sellers attempting to take over again at the level once we get Thursdays jobless data. Downside targets at YVWAP 17810.25.

It looks highly possible that the market will rotate fully within prior weeks value and attempt to explore higher, however given we now have a downside auction gathering more and more interest as per volume averages, I would be extremely vigilant in taking long positions if we do not close a day over QPVAH 18298.25. If we do, I would buy a dip AFTER we Put in a small base on this level ie. buy the pullback, however given the context of the Q auction, I see this as a B class trade currently. The A class trade looking for shorts against 18372

Energy

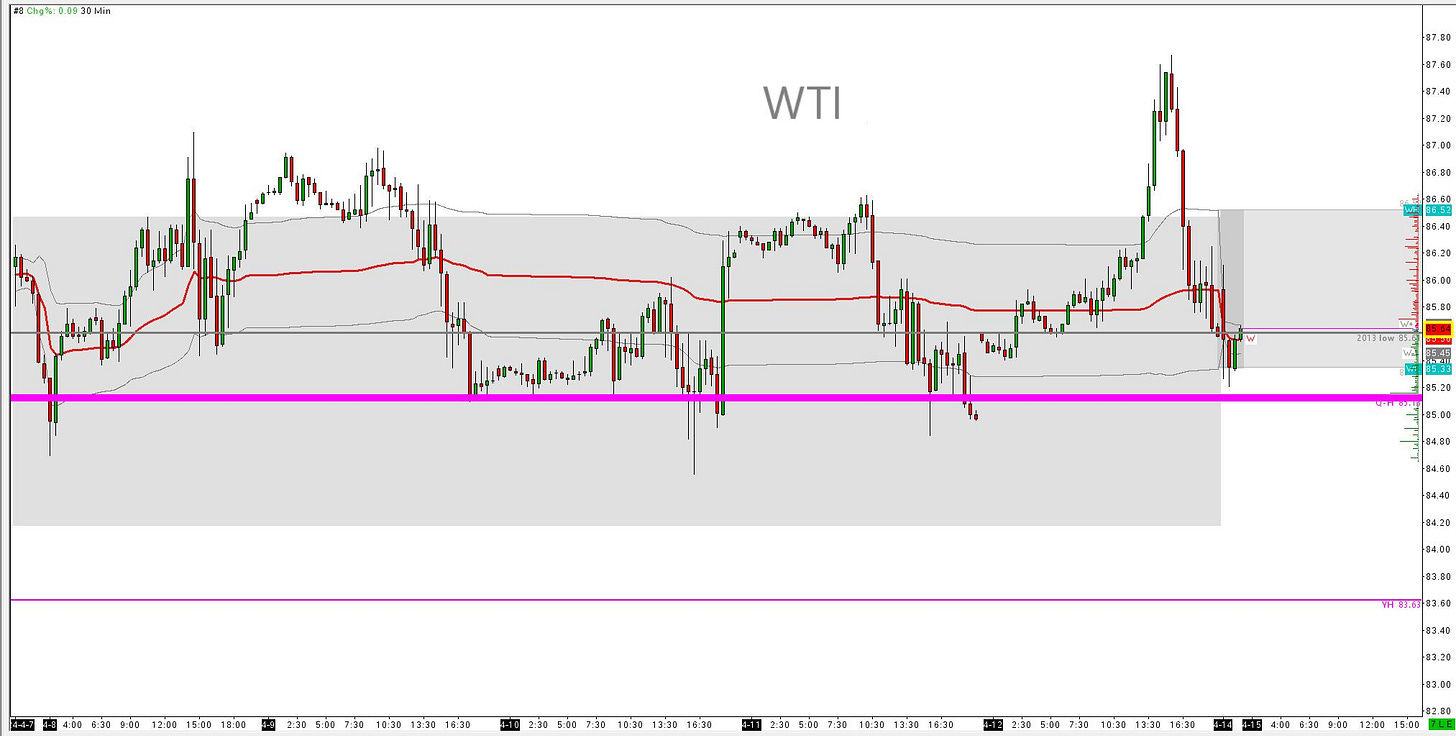

WTI – CLK24

In summary, we're currently experiencing a tight supply situation from OPEC+ alongside a decline from highs in US production, influenced by the Biden administration's re-election and inflation focused policies. The involvement of Iran presents a real risk to supply, considering the threat to close the Strait of Hormuz, a critical passage for about 25% of global oil consumption.

Despite this weekends drone attacks, the oil market hasn't shown a strong reaction, indicating limited escalation for now. However, the overall risk leans towards price increases. Any substantial reduction in tensions could quickly push prices below the current 10-day range. It's important to note that oil prices at these levels tend to contribute significantly to inflation, with fuel costs being a major factor in April's CPI.

The market seems hesitant to rally above the QPVAH 85.13s. The static YPVAH 83.63s appears to be an attractive area for buyers to re-enter and sustain the upward trend. Keep an eye out for a break of WPVAL followed by a short upon retesting, although buyers are expected to remain active around the 85s mark. Each breakdown below 85s has the potential to reach YPVAH 83.63. If this support level fails, buyers are likely to re-enter at 83.63s.

Considering these factors, the optimal buying opportunity for this week, in my view, lies at 1Y+1std 82.25(dynamic level ie. Needs daily tracking). Also buying at YPVAH 83.63. Upside targets 88.07 and 91.24

.Many thanks for reading. If you would like to join us live in our trading room on Discord, please visit www.whop.com/duggancapital with a 50% off voucher VWSTACK50

Or email hello@duggancapital.com to say hi