Hikes no more

Bounce or die/ Bounce and then die

Key Economic Data

Earnings this week from MSFT, GOOG, META, V, XOM, TSLA, MRK, CVX, ABBV, PEP, TMO, IBM, GE, INTC, BA, UPS, T, LMT, BA,

MONDAY

TUESDAY

Building Permits **

Manufacturing PMI ***

Services PMI ***

New Home Sales MOM **

WEDNESDAY

Crude Oil inventories ***

THURSDAY

Continuing Jobless Claims**

Initial Jobless Claims ***

PCE Prices*

Core PCE Prices *

GDP (QOQ)

Pending Home Sales

FRIDAY

Core PCE Price Index MOM & YOY***

PCE Price Index MOM & YOY

Michigan consumber data

CFTC DATA

For more, please visit www.duggancapital.com

Join us on Discord for live analysis and trading www.whop.com/duggancapital

Or find me on Twitter @timdug

If you would like to learn how to trade with this edge or find out more about our live trading room where we look at these setups, well give us a shout!

Equities

We have a massive Thursday this week for data and volatility. That said, last week was off to a shaky and aggressive selling start. With several FOMC and Fed members providing forward guidance that we may not get any rate cuts this year. The markets were not even waiting around for jobless data. The writing is on the wall. RATE HIKES ARE GONE! We are almost done with pricing OUT the remaining idea of 2 cuts this year.

Data on the inflation front came out hot, and this was enough to push liquidation across major indices. With oil prices set to move higher any day now, inflation risks are firmly to the upside, and rate hikes rather than cuts are getting priced into the market. We are starting to see in the last week a market that is pricing in just this, so that if and when there is a hike (maybe this year), the reaction will be a rally, rather than an offer down.

What helps with our trading is knowing where the average value is and where high and low value is on the markets we look at. High value is seen as prior value area high, low value (cheap) is where value area low is. Markets can get expensive and get more expensive, but they can also get cheap and go a lot cheaper. When we see these areas trade, we are at a key point for a market; it either chooses to auction back through the prior area of value, or it will get imbalanced. Only one of these two things happens. We don’t want to fight against the auction or the imbalance but rather run with it. Keep this in mind when looking at the following charts.

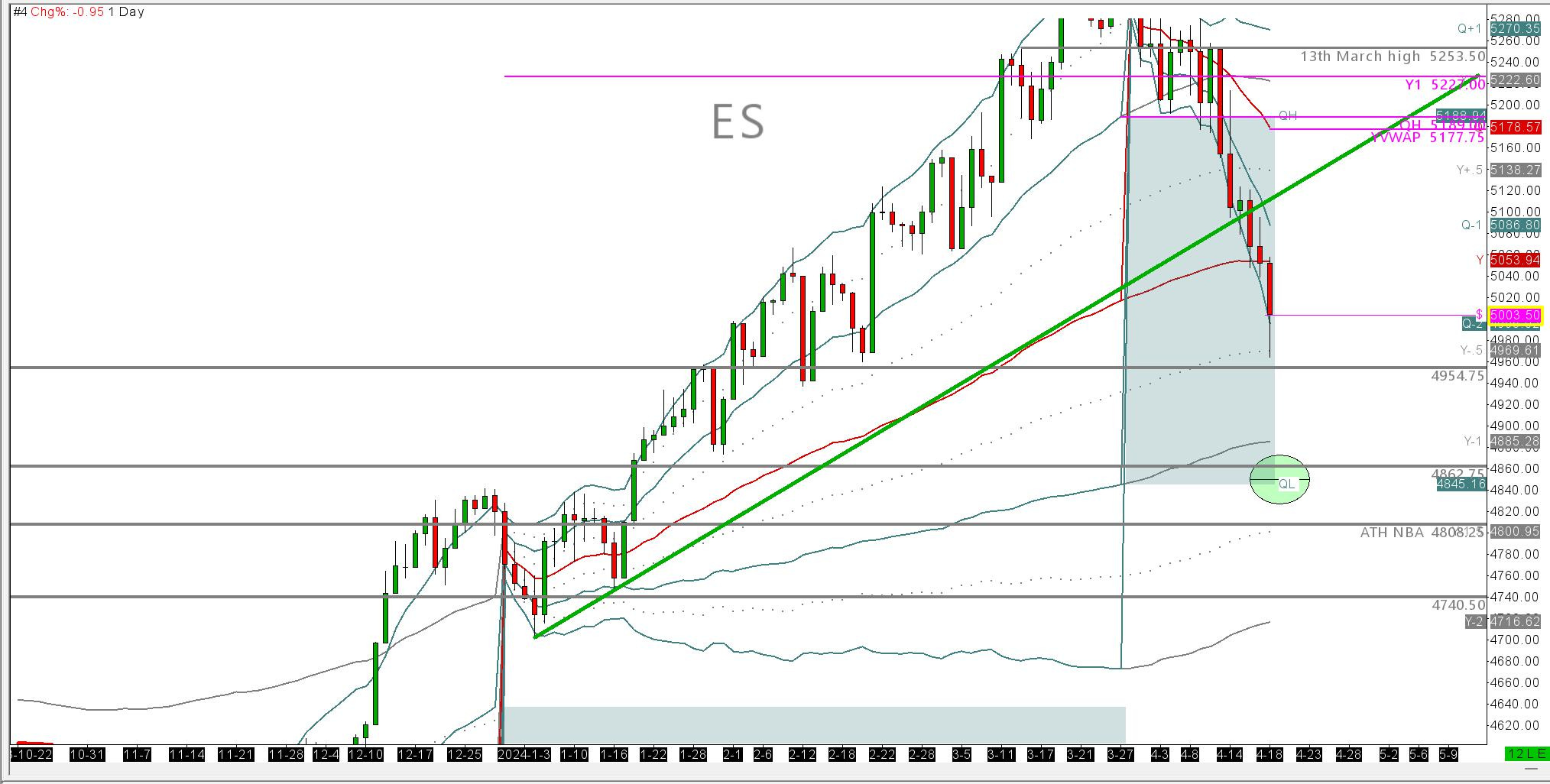

ES M24

There is a refined confluence of YVWAP $5177 and QPVAH $5189 in play for short sellers this week. I can't see the market getting over this, even if we get great data come Thursday. I see the Fed and FOMC members are giving more and more hawkish guidance, albeit slight and gentle; this should get more hawkish as the weeks go by. With that, good data probably will bring the buyers out; however, in my mind, they will get faded. Good data will only highlight the farce of cuts in the face of heating economics and high oil prices

As we can see from the 30-minute chart, the imbalance below the WPVAL last week started something that couldn’t be stopped. Liquidation of positions from leveraged money managers who had not been so long since the market top in 2021. I expect an early bounce in the equities complex led by ES, then a test of $5177s to $5189s area, then we sell on data Thursday and have 2 very bad down days with QPVAL 4845 as the downside target. A bid that takes us over $5189s will not be a bid I will be following. My downside picture plays out, or I get stopped for 20 ticks. Nothing else.

YM M24

The Dow seems to have completed the downside auction on its prior quarter faster than its peers. This is why I think that we may have a fantastic bounce at the start of the week to Yearly VWAP - $39648 but end up going imbalanced down to the QPVAL $37917

You can see that the Weekly auction area should be a good barometer for trade on the week. Don’t be afraid of selling Q or Y VWAP when we get over W-PVAH $38279.

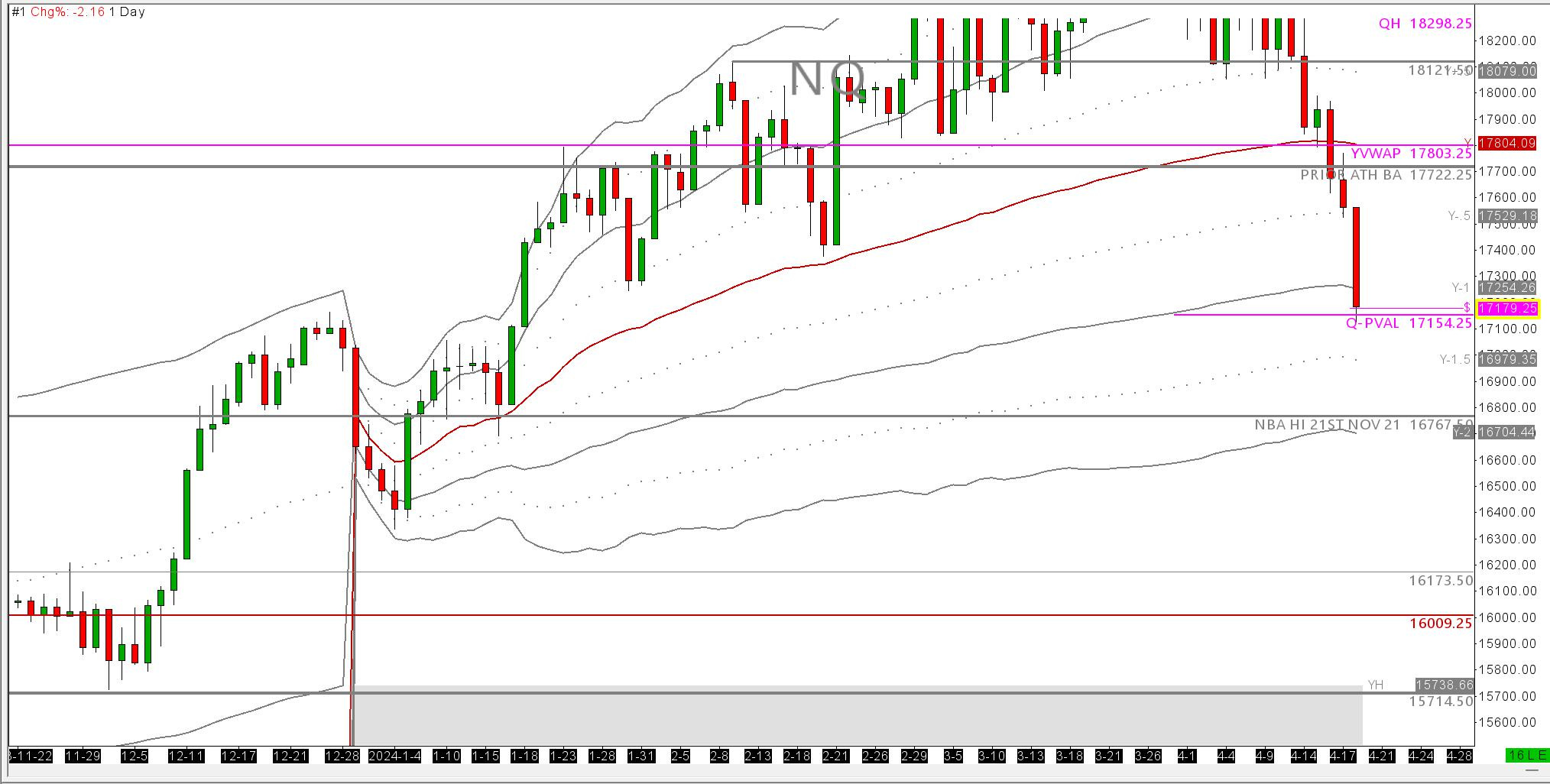

NQ M24

Tech is getting smashed to bits on the pricing out of any rate cuts in 2014. Buyers were handed their ass in NVDA on Friday with the stock down 10%. The price action has been just short of wild in NQ the past week. Like its counterparts ES, YM, I expect we may have a strong bounce to lead the week with selling then coming in later from high, around YVWAP or $18121. Remember TSLA and NVDA both have keen buying interest and will be on an early bounce Monday Tuesday not withstanding headlines.

Energy

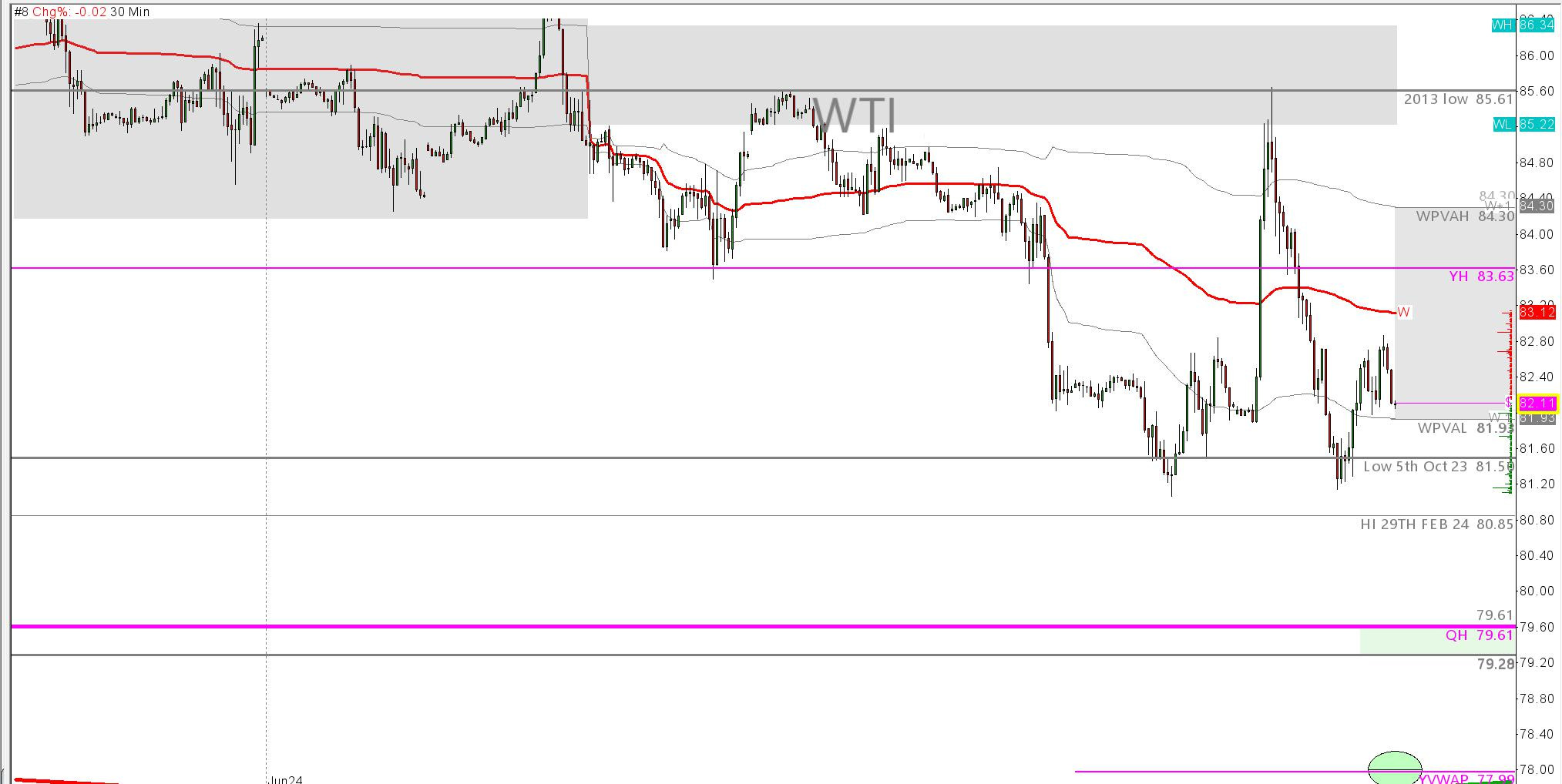

WTI – CLK24

Red-hot media coverage and chatter on the geopolitical tensions in the Middle East amounted to exactly nothing but more of the same for oil this past week. Explosions in Iran reported in the early hours on Friday brought in a large upside move in APAC trade to test last weeks WPVAL $85.22. The auction held imbalanced down.

The market simply will not be lured into non-sustained war/supply risk. In the daily bar chart, we are looking at the Quarterly VWAP and Q prior value area high $79.61s. This seems to be the largest target for the market to trade. There are multiple levels of interest, however, between here and there. For me, I would rather stand back and let the market try to take out all levels down to YVWAP $77.59 where I would normally see the largest amount of buying interact. I have drawn on the 30-minute chart where I would see buyers come in from.

Due to the instability, it is near impossible to game out the scenarios that could come, so let’s keep it simple and draw our attention to the technical.

Iran and Israel not throwing handbags at each other= back down to Q-PVAH 79.61 at the least. I would like to see the market capitulate back to YVWAP and then I would imagine a large amount of buying can come in.

Legal Disclaimer.

Tim Duggan trading as Duggan Capital is an Irish based trader and is a content provider and publisher and is not a registered broker dealer. By accessing Duggan Capital aka The VWAP report, websites and/or using

Duggan Capital services or The VWAP Report products and services, including without limitation an

any and all content available on or through the Service, you understand and agree that the material provided in Duggan Capital aka The VWAP report products and services is for informational and educational purposes only, and that no mention of a particular security in any Duggan Capital aka The VWAP report product or service constitutes a recommendation to buy, sell, or hold that or any other security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

Commodity Futures Trading Commission.

Futures and Options trading has Large potential rewards, but also a Large potential risk.

You must be aware of the risks and be willing to accept them in order to invest in the stock/Futures/options markets. Do not trade money you cannot afford to lose. This is neither a solicitation nor an offer to buy or sell stocks, Futures, options, or securities of any sort. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed via this website, and media referenced. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41–HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAINLIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING.

ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-

OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory or recommendations.

For more, please visit www.duggancapital.com

Join us on Discord for live analysis and trading www.whop.com/duggancapital

Or find me on Twitter @timdug

If you would like to learn how to trade with this edge or find out more about our live trading room where we look at these setups, well give us a shout!