Everything is fine

Okay to trade

I said buy the dip last week. The market dipped, we loved it. A few of the guys in the room loaded up and got long. The benefits of trading live in the room.

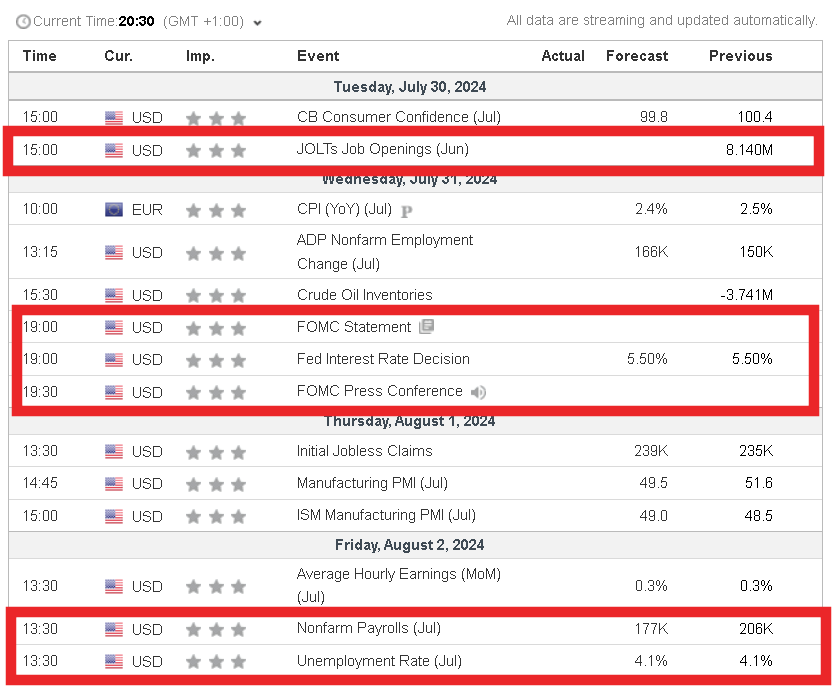

A big week ahead starting Wednesday. Big tech earnings this week from $APPL, MSFT, AMZN, META,, AMD, INTC.

The highlight being the FOMC rate announcement on Wednesday followed by Fridays NFP Jobs report. For me, this FOMC is not the one. Don't get me wrong, there will be volatility, miss pricing and repricing risk and expectations. Market pricing is dead set on a September rate cut, which is my mind is not going to happen.Don't get stuck fighting tight ranges Monday and Tuesday and Wednesday pre FOMC in equities and FX.

For a no bullshit training module on VWAP and highertimeframe vwaps, how to trade them, the patterns, what they mean etc, have a look at this training module.

Here is why I think there will be no cut. GDP is good. Last Thursdays QOQ GDP 2.8% BEAT on 2% prior 1.4%. Let those number sink in. What about this says the wheels are coming loose? Initial jobless claims also on Thursday last, 235K MISS on 238k expected. A drop in the number of those claiming unemployment benefits. Stocks taking a week of a pullback from stomping new all time highs. What about all of this is weak? Unless we get a terrible NFP this Friday, cuts are off the table.

Then if we look to the inflation date, U.S Core PCE Price index YOY 2.6% BEAT on 2.5% expected, prior 2.6% NOT A RISE ON THE PRIOR - INLINE.

EVERYTHING IS FINE!

So now you see where I'm coming from. You can cut this a thousand ways, but I'm not interested. This is just simply the data. The plane has landed.

The argument for a cut is robust. Jerome has stated that what actually keeps him up at night, what he mulls over in his head constantly is this.

The thing I'm thinking about in the middle of the night is always this balance we have between not wanting to if we ease too early, you know, we can undermine the progress on inflation. And if we wait too late, we can undermine economic activity. We can undermine the expansion to. The FOMC.- Jerome Powell.

Okay, enough chat. Lets get to markets.

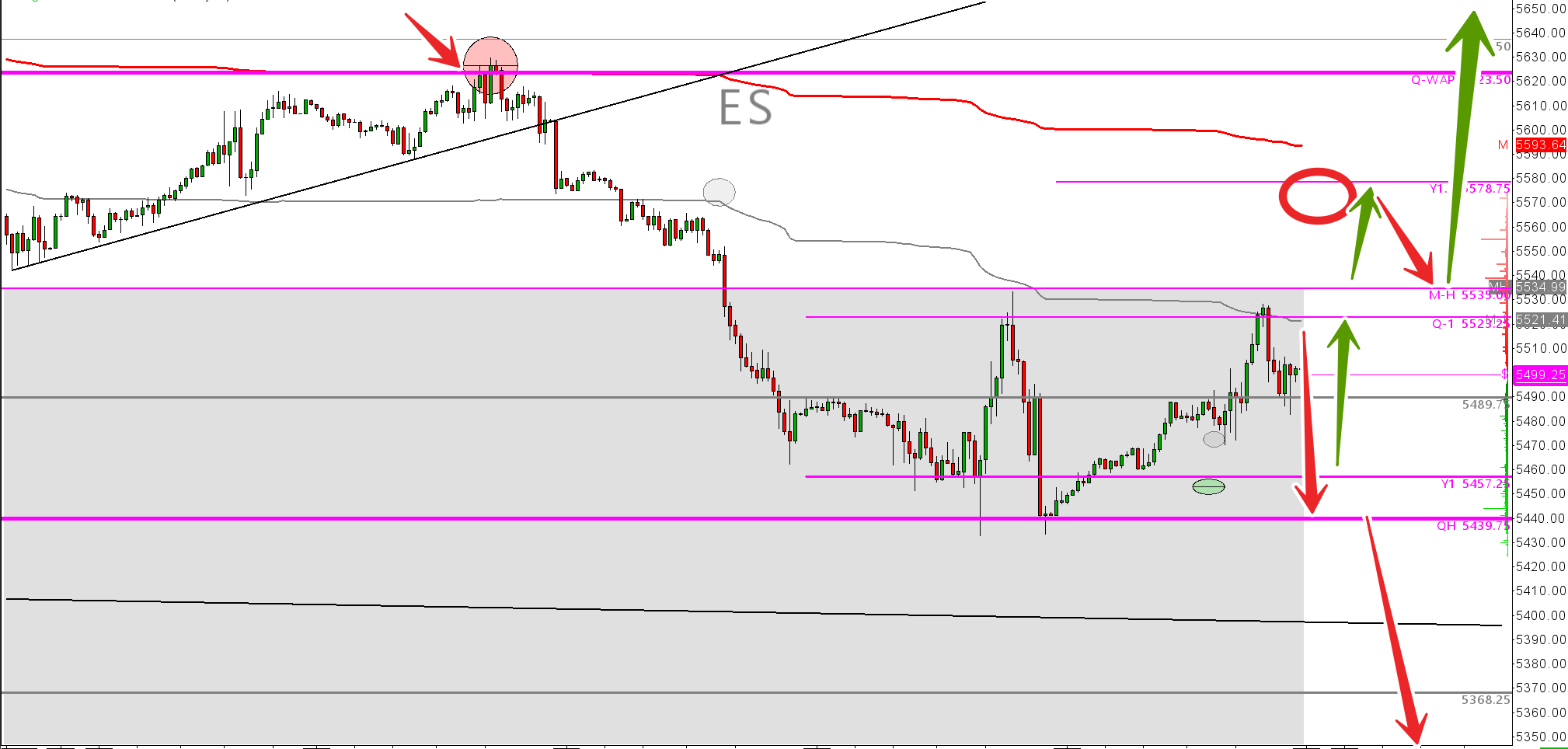

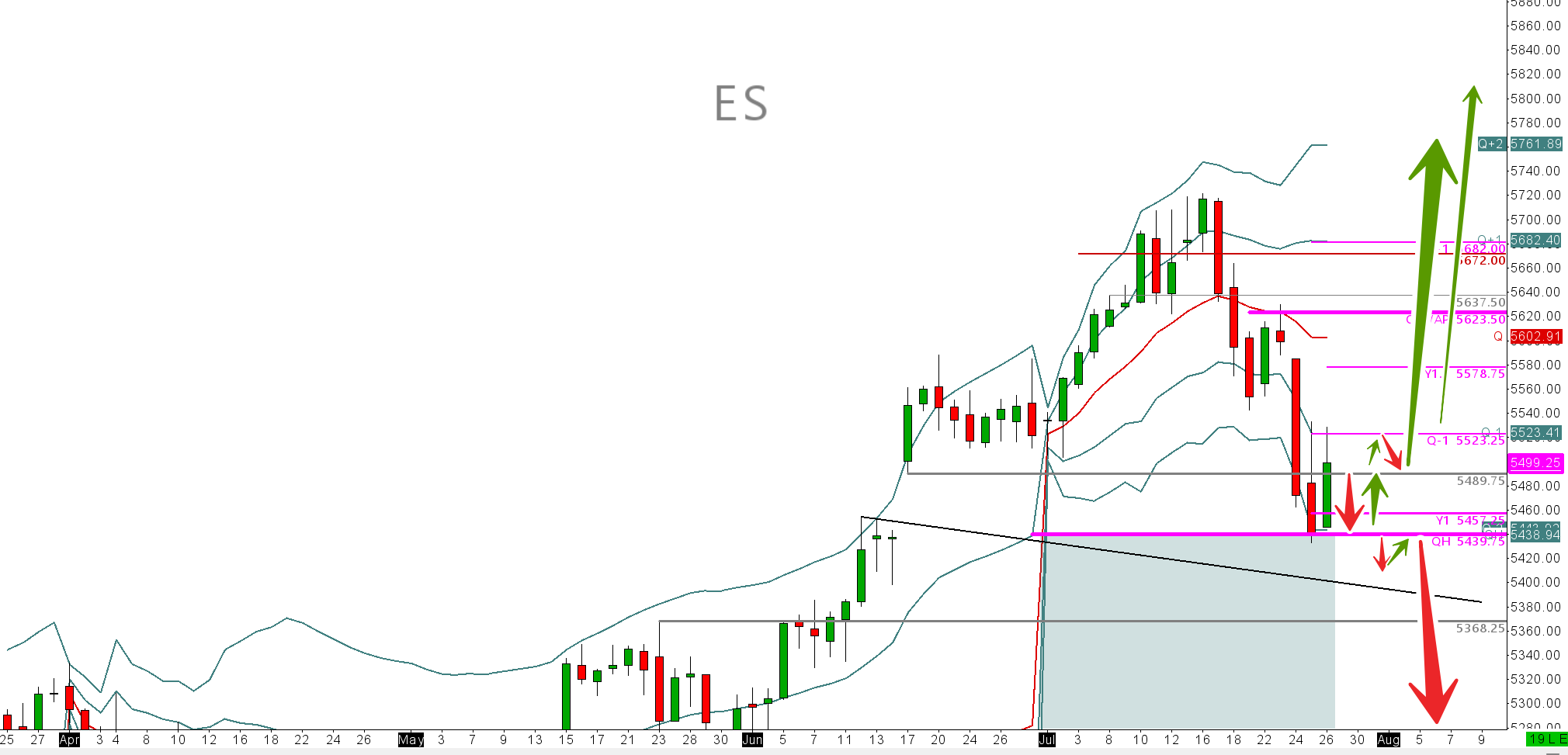

S&P500 ESU24

This week, I'm taking a spread view on ES as I think its such a big week, that markets could go either way. All we have is average pricing on key time periods. I'm looking at the Year and the Month VWAPs in this weeks report for ES.

Last week was an incredible week for the VWAP report. Please do go back and have a look here at what we could see versus what we got as per below. LOOK AT THE SELLING POINT ON THE Q-VWAP TEST. Look at the test of the M-PVAH, market going balanced down. More on balance later in this post.

I'm looking for those tight ranges Mon, Tue and the larger part of Wednesday. Once we get the FOMC data and presser on, we should have more volumes come in.

Due to the large selling down to Q-PVAH $5439 last week, then a neat turn around on a dime at that price, this week, I'm looking for that test of imbalance up to continue. I don't have to wait for any market events to tell me that average pricing is incredibly imbalanced up. Since we just got a check -go- continue at Q-PVAH, I think the market will rally no matter what from last weeks lows- as foreseen last week. A failure of this to happen is too big of a deal to simply shrug off. If we break down below Q-PVAH, This market is TOAST! But from my experience of trading HTF-Higher Time Frame VWAPS for 6 years, this tells me to be long long long until I get puked out of the turn about areas i.e.. Q-PVAH. $5439

TRADE:

Stay out of potentially crappy dead trade Monday and false breakouts. Tuesday, there may be a run for a breakout pricing in no change from FOMC. If we get this, it increases the likelyhood of a reversal come Fridays NFP.

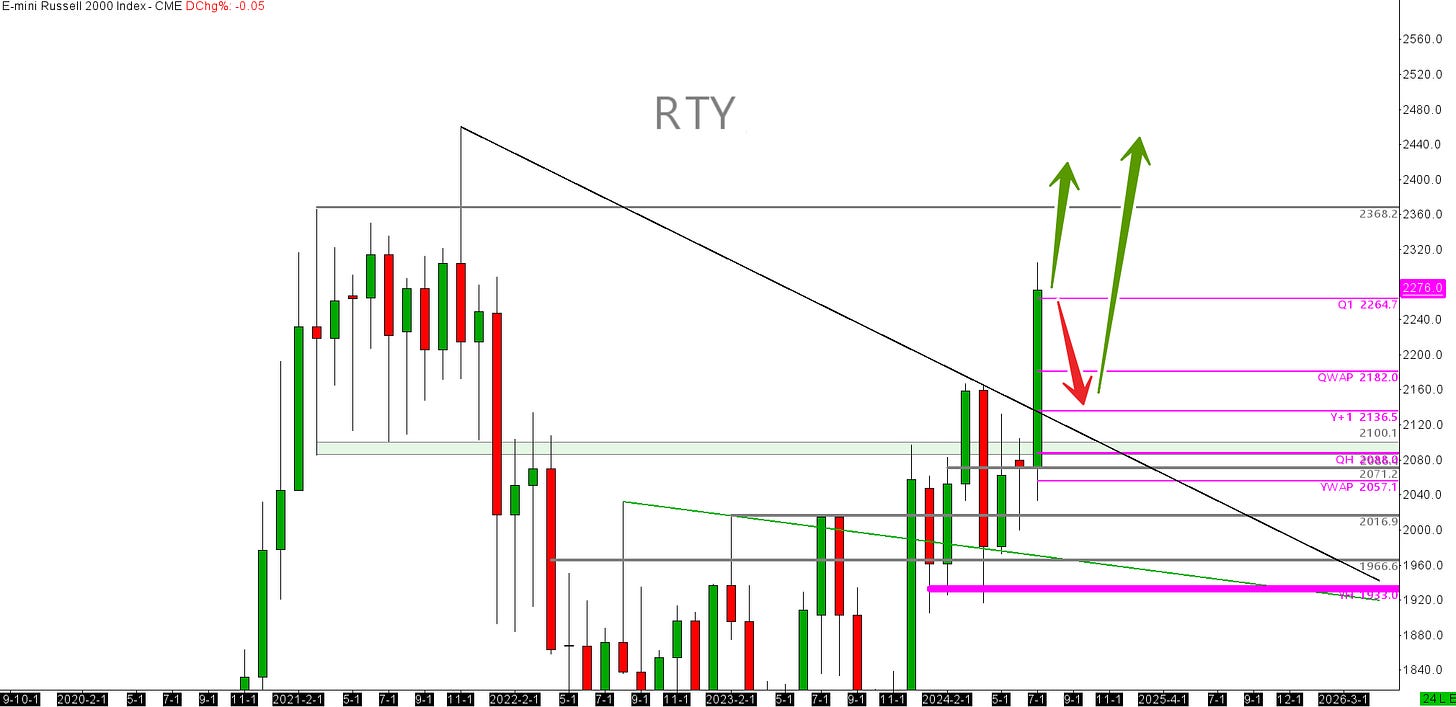

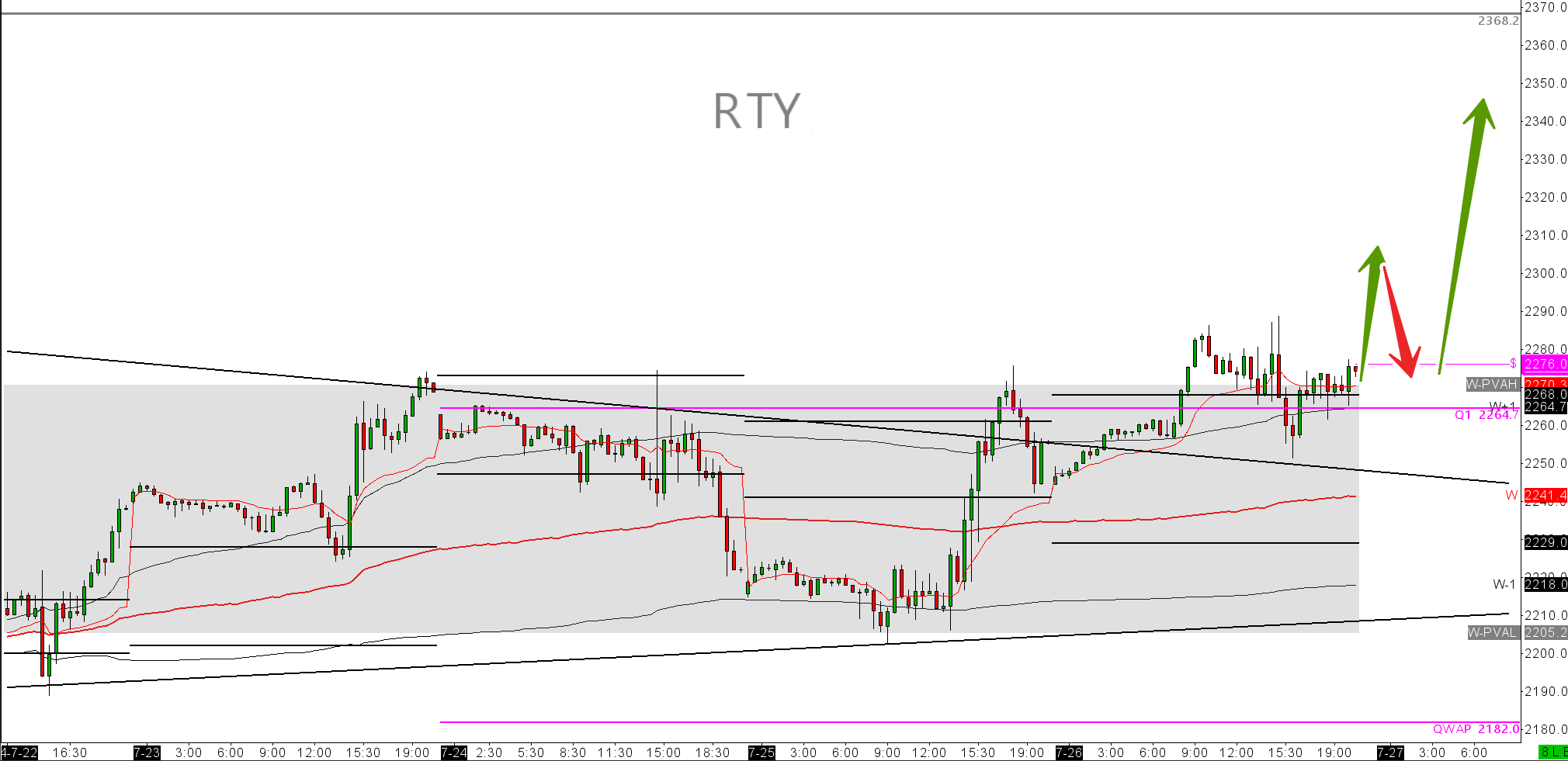

RUSSELL 2000 RTYU24

During last two weeks, as mentioned in last weeks report, we saw a large rotation from Big cap, S&P500/ DOW, into Russell 2000. In the last 15 days, we are up 10.15% on RTY. ES is down 3.35%, DOW up 2.09%. You tell me what that is if its not rotation? Is this a sign that my uber bullishness in SP500 is apprehensive? Well all of my analysis is speculative until I see balance or imbalance hold or fail. This is when I get off my ass and execute. Keeping it tehnical on RTY, we have a lot more to run. Look at the monthly bars here.

Look now at the market bidding up from the Y+2 deviations. THIS IS UBER AGRESSIVE BUYING.

The buying that came in on the monthly value low and how we sit poised above MPVAH $2270.6, ready to claim higher prices. Stay long RTY.

ENERGY

WTI OIL CLU24

The current woes for oil are myriad. China closing down imports is nothing to overlook and indeed for the last 2 weeks-2x reports, that it exactly what we have been looking to drive market pricing down. We got it. For me, now the next legs is.......more down. On Tue, Wed, Thurs, Friday, we probed below Q-PVAH $77.09 and all underneath Y-VWAP ie. Average pricing for 2024. This tells me all I need to know. So much trade below average price on the year= acceptance below= more down. I'm sticking my neck out here a good bit, but I am going with a market that closed the week BELOW Q-PVAH. We need not look further that Y-VWAP, however if you want more, please refer to the pennant on the year. Sell on the red line, buy on the green. If you wonder about the breakout direction on the pennant, its also down. Have a read on the pennant pattern 101 here. Not something I really trade, but chartists love it.

https://www.strike.money/technical-analysis/pennant-pattern

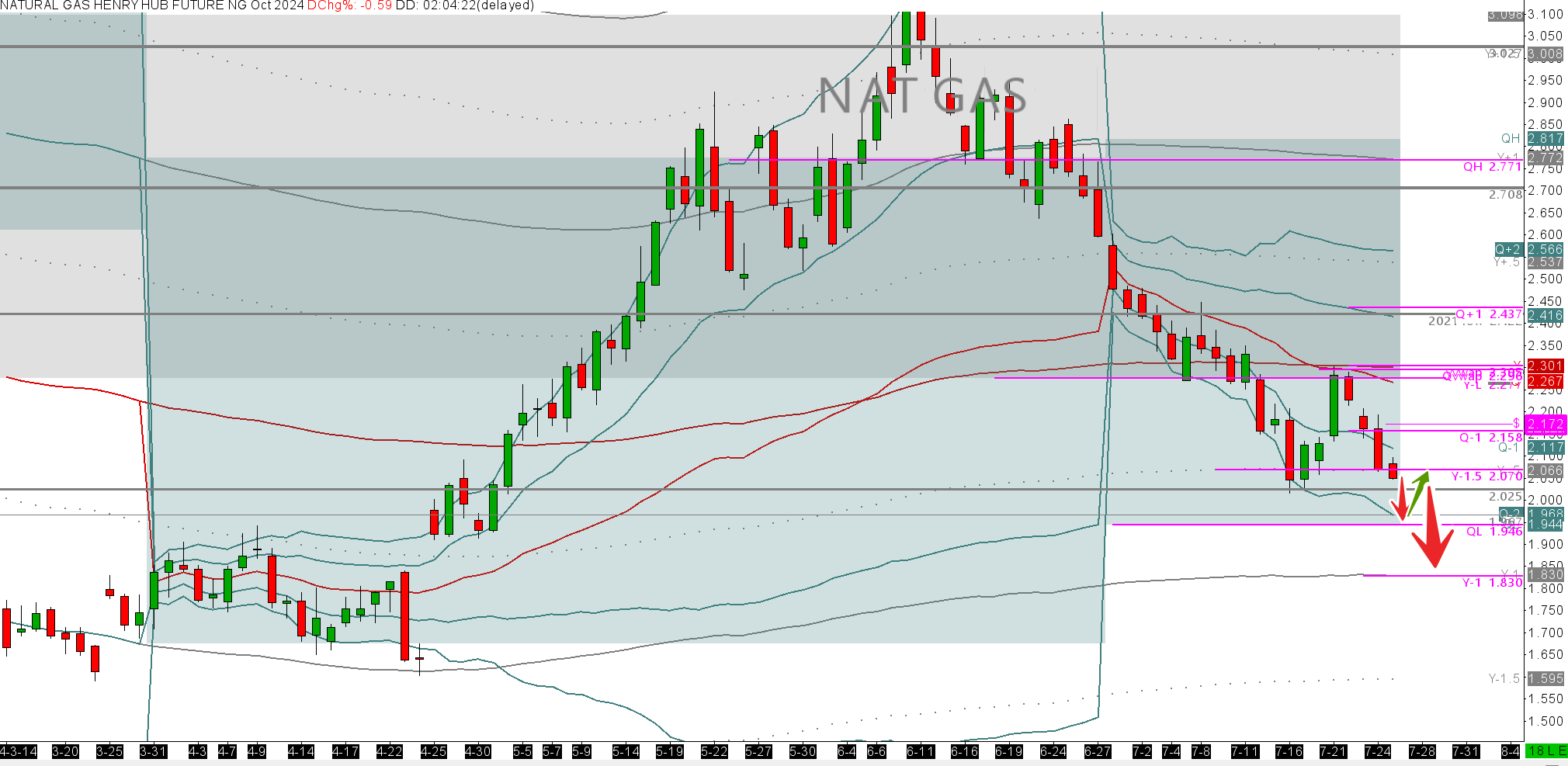

NAT GAS NGU24

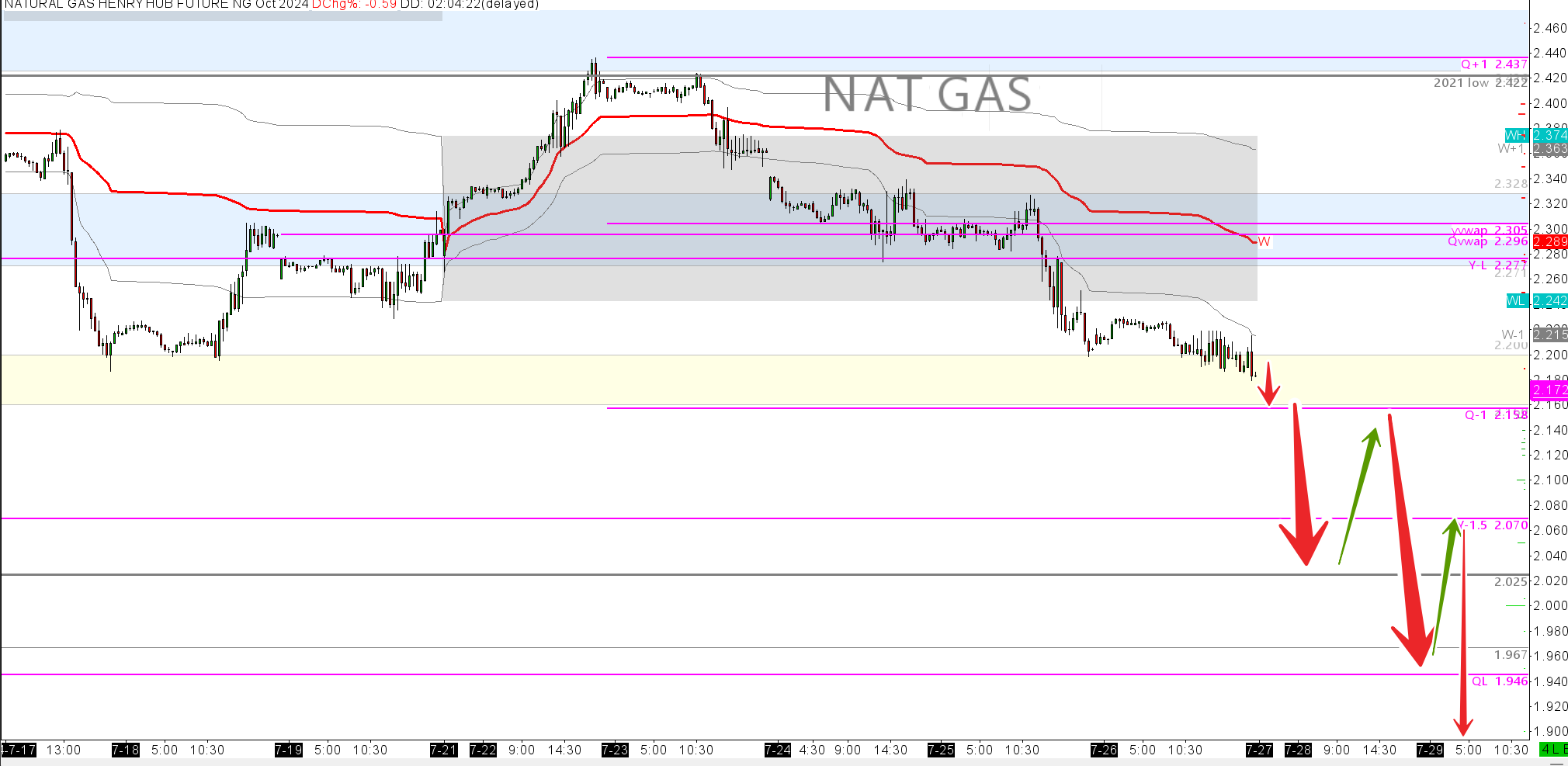

Shout out to the traders in my room that have been short NG for at the the last 30 days. Here is a simple one. I'm not going to claim any awards or stickers to say it, but NAT GAS, is balanced down ie. Trading down through the prior Q auction value area. We must trade the Q-PVAL $1.946. Check the balanced down on the daily bar chart with Q-VWAP on. The difference between balanced and imbalanced is:

If we are trading down through i.e. inside a prior value area or indeed up through - this is balanced. The market has traded here before. Old ground. The current case of Natty on the Q timeframe. If we are trading outside of a prior value area, then we are imbalanced. We are OUTSIDE. New/ Fresh trade outside of a known auction/ value area. Simple.

Here is a 30min chart. Note how once we shot outside of the prior weeks are and went IMBALANCED, There was trade in the same session trying to reclaim it and a distinct rejection and lower prices. We don't fight against balance and or imbalance. The difficult thing, is that there are 4 key timeframes. What is your timeframe? Stick to it, don't deviate.

That it folks. We had a great weekend here with the kids. Visiting a strawberry farm with a 3year old and 16month old is good fun if you haven't done it. God knows parents are always looking for the next gig to keep them happy. Piper (The 16month old) within 5 minutes, was covered in strawberry juice while her brother was busy at work cramming his basket of goods.

For paid subscribers, I'm going to be releasing more audio content as the week goes along. Some market recaps and updates as to price action. I wont be on the desk Monday as its scheduled to be quiet. Keep to your risk profiles out there. If you don't know what that is, send me an email. If you do, then you know hat it is you need to do to be the trader you want to be. Stop paying it lip service and just bloody do it. Stick to your risk and live forever.