OPEC Done

OPEC+done & Jobs data ahoy

With a hot jobs data week, we dont need to look at earnings. But if you must, here is the lineup - no big caps this week. OPEC+ Summary below.

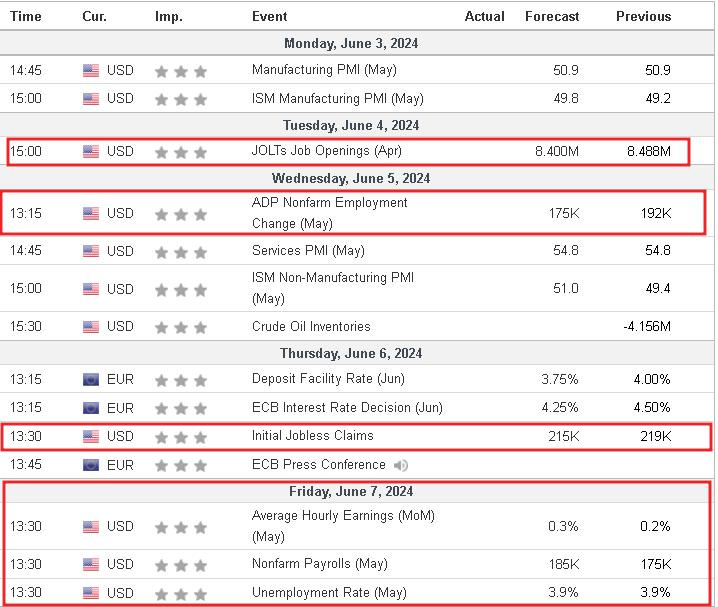

We see NFP come Friday, with plenty of volatility to come from JOLTs, ADP, initial jobless before then.

Schedule for the week

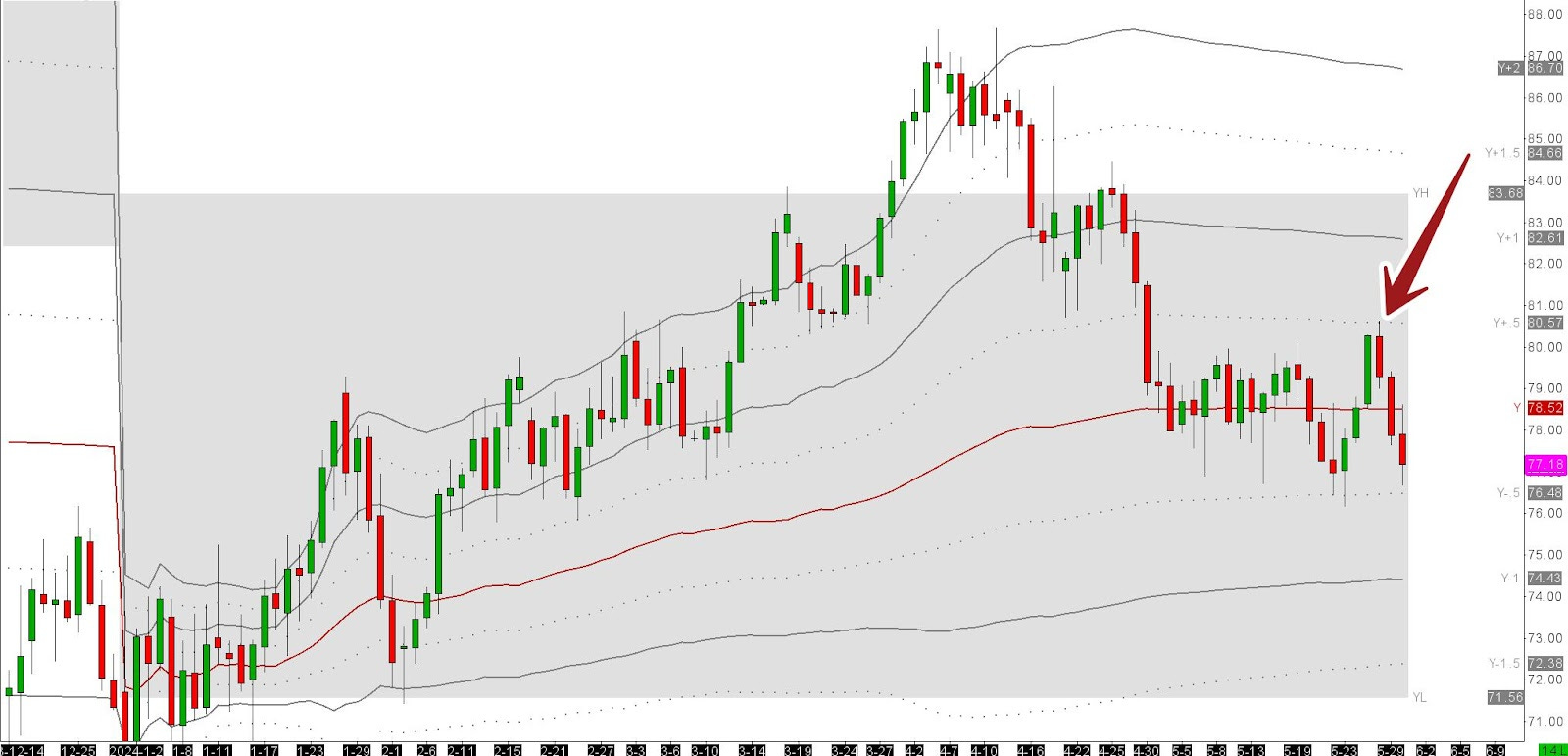

WTI

CLN24

If you were tracking your Y-VWAP, you would have noticed that we were rallying strong at the start of the week- Monday and Tuesday were trying to get ahead of The OPEC+ Sunday meeting and price in (and subsequently out) the expected extension of current cuts.

By Wednesday we were headed for and tested the Y+0.5 deviation $80.55 (at the time) to the tick. This was traded live in the DC Discord and held throughout the day.

We were interested in how much rejection could come for the week from there, but quite a few of the team traders (and young bucks) were on this that trade the same edge as me. A good day out for all and what a trade to hold!

The week as it traded as below.

Now to this coming week and use the Quarterly VWAP for reference.

I believe we have accepted a great deal into the Q-PVAH $79.61 and our short imbalance/ mispricing up to $80.62 last week was over done. We finished strong fro sellers and thus will rotate down to $73.26 over the course of this week.

Sunday has seen OPEC+ Meet and as anticipated they have agreed to maintain cuts through to 2025. What was unexpected was the schedule for rolling off these cuts. Scheduled to start in Oct 2024.

Here are the top takeaways:

Extension of Cuts: OPEC+ extended voluntary production cuts by key members, including Saudi Arabia and Russia, well into next year to support crude prices.

Rolling Back Cuts: The agreement includes a phased rollback of these cuts starting in October, earlier than some had expected.

Balancing Interests: Saudi Arabia is attempting to balance supporting crude prices with easing production restraints that some members, like the UAE, have opposed.

Market Impact: The cuts have been crucial in maintaining crude prices above $80 per barrel, despite recent declines due to economic uncertainties in China and interest rate concerns in industrialised economies.

Phased Out: The roughly 2 million barrels a day of cuts will continue fully in the third quarter of the year, then gradually phase out over the following 12 months.

Future Production: The deal includes adding about 750,000 barrels a day to the market by January under the new agreement.

Baseline Adjustments: The agreement temporarily resolves debates on member countries' oil production capacities and postpones the external review of baseline production levels to November 2026.

UAE’s Gain: The UAE received a 300,000 barrel-a-day boost to its production target for next year, aligning its proportional cut with other members.

Member Compliance: Ensuring compliance remains a challenge as some members, like Iraq, Kazakhstan, and Russia, have historically overproduced beyond their quotas. They have pledged to improve compliance.

Economic Context: Lower oil prices could benefit the global economy by reducing inflation but would hurt producer revenues, especially for Saudi Arabia, which needs high oil prices to fund its economic plans.

Roll offs on the cuts will be interpreted as bearish with more oil set to come onto the market starting in October. If you understand the contract expiry on oil, then you will understand that the additional supply will actually be deliverable by Oct 1st. Those contracts are already trading and will cease trading on the 18th of September 2024. That additional supply gets priced onto the market immediately.

THE TRADE: Personally, I would like shorting against Q-PVAH $79.61s should we get it, Im seeing that Q-PVAH is confluent with W-PVAH this week at $79.61, so this may be a fantastic spot to look at short. If it blows out above, see if that 30mi auction closes above. If not, then I like the short, if it does, we may need to step back and observe further. Above there, i would only look to short a rally up to Q-VWAP Now at $81.53. I was looking to short against that last week but it didnt trade.

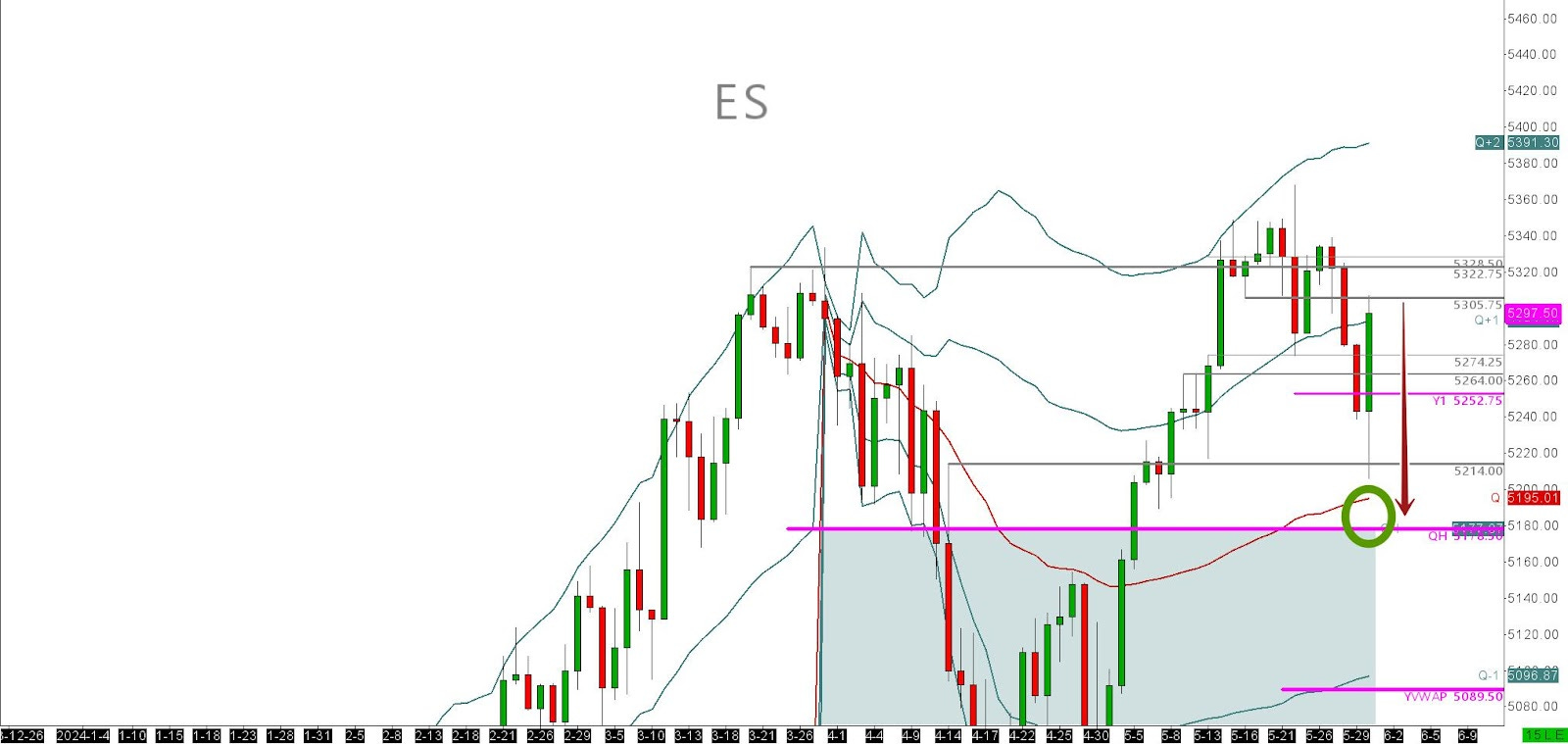

Equities:

ESM24

One of my takeaways from a few years in front of charts is that there is a lot of noise. Most of it is not in the price or in the volatility. The most noise in the market comes from the talking heads. We have trillions of dollars invested, 1000s of years of collective financial education and countless dentists having a punt at the market. But the one truth is price. The next truth is economic data. Everything else is chat.

This is why I like using VWAP. It gives me what price the market has marked exactly as the average price for a specific time period.

With that, I will not go on about CRE Risk and how the market is going to go up until the fed actually cut etc. I will only talk about where I see average support, resistance and how the market is balanced up or down on that specific time period. Then we can go with the balance for direction and look for sympathetic supports for balance up and difficult stretched resistance points for balanced down.

The ES is firmly balanced up….for now. Both on the Q and the Y timeframes. This tells me that the longer more durable trade is buying supports. Shorting the ES has never been a timeless trade. Just ask Warren for gods sake!

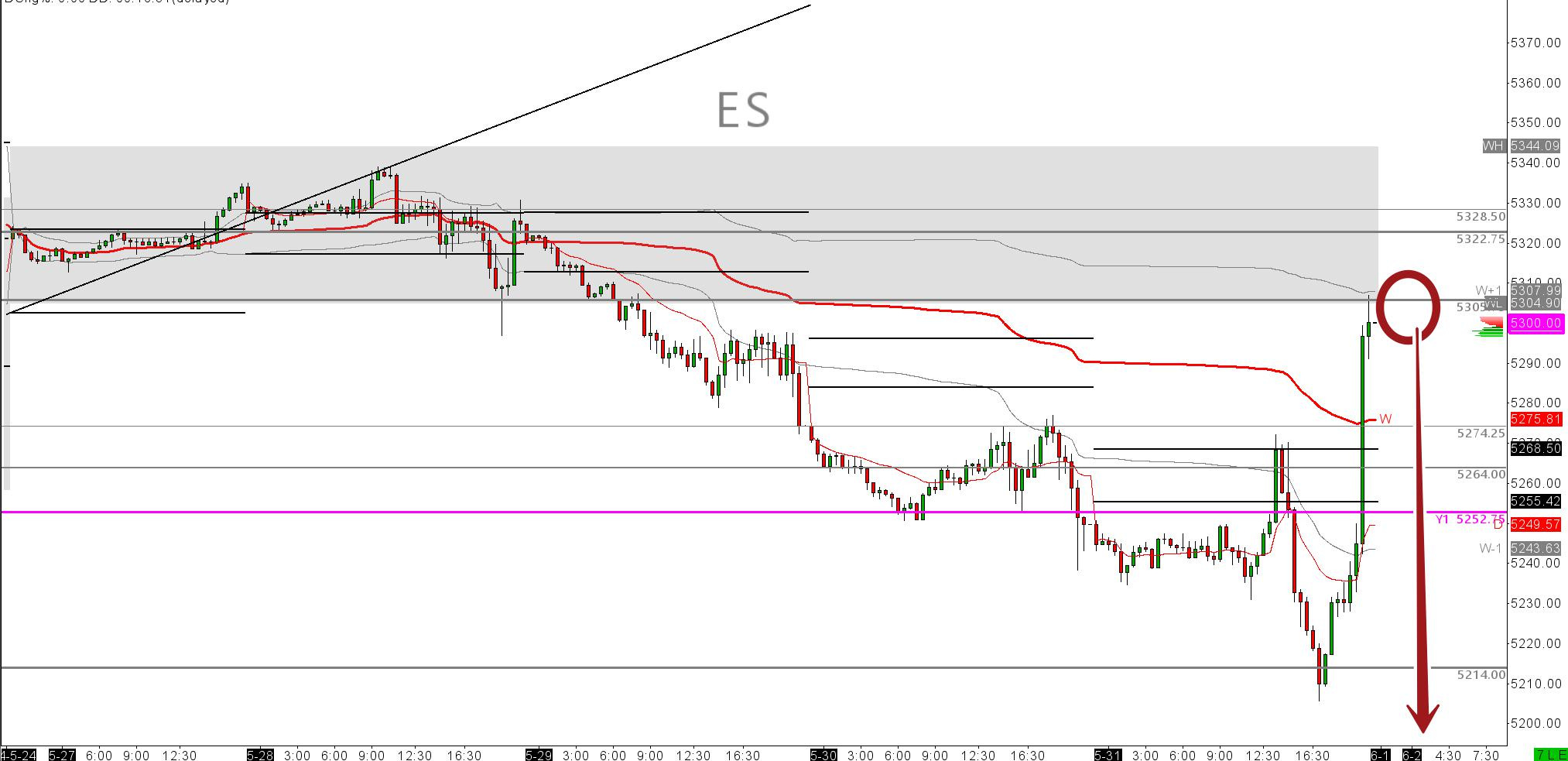

We have however sold down on ES since the initial jobless claims beat 2 weeks ago. On Friday, the market decided late in the session to find good supports on the $5214s, however it stopped dead at the W-PVAL $5034 and the closed.

The Trade:

In my opinion, ES should fail from this level and spend the rest of the week working its way down to the Q-PVAH $5178s spot to pick up the buyers again. If we manage to get over and baseline on Q+1 $5297 area, This will tell me that the market is over doing it yet again and to stay away from shorts. Perhaps the highs earlier in the year around $5322S might be appealing for shorts.

Its a big week, lots of data and the market will want to wait for NFP Friday before doing anything rash.

With that in mind, I see the market trying to price in the upside to $5322s by NFP, Then we need a hot beat NFP to invite sellers. If we get a weak NFP, I think we can dial in for higher highs well above $5322. At that extended point I wont be looking to run into the firing range of buying high.

Targets for the week already hiit on WTI CLN24 $73.31. We are resting on our laurels. Some in Duggan Capital are still short the NOV24/APR25 Spread. Exits planned at latest for this Friday.

Hope everyone is doing well out there sitting on their hands for the big ops coming.