Dead Calm

May 6th 2024

In this report, ES M24 S&P500 and Oil.

Earnings this week from Berkshire Hathaway, Disney, Uber, ARM AIRBNB and Shopify

https://www.tradingview.com/markets/stocks-usa/earnings/

Data Calendar

Monday- FOMCs Barkin & Williams Speak

Tuesday - FOMCs Kashkari speaks

Wednesday - DOE & Nat gas storage

Thursday - Jobless and continuing jobless.

Friday - Michigan Inflation expectations & WASDE report.

I’m sitting down now on Sunday evening to look across the breadth of the week ahead. The weather has cleared, giving way to spring. Walking around the fields with my 3-year-old son at the back of the house, watching the breeze across the grass; it is easy to not think about trading. Easy to be removed from the collective mayhem of putting on risk. If almost 20 years of trading has taught me anything, it is the ability to slip in and slip out of my 'market mind'. I think the first 4 years of trading futures, this was incredibly hard to do. I always felt I was riding the new wave, constantly straining to interpret bond yield impact, Fed stance, OPEC quotas, NFP, reverse repo rates, and correlations that work until they don't. My hope is that this report serves as a calm cornerstone if not for anyone else, but for myself when approaching the next 5 days of trading that come every Sunday evening.

With that said, let's take a simple look again at what the market did and interpret what that tells us about what it may do.

Equities.

With the FOMC, it was baked in that there would be no change in the rate nor would there be much change in policy stance. So this left us with the gruel of picking apart Powell's sentiment and attitude when answering questions regarding what to do if inflation is on a crawl back up and to the right. In that, the talk about slowing the rate of run-offs, i.e., an underhanded way of tightening, was interesting. I think this is about as far as they will go regarding anything related to tightening or moderating policy as they try to land the ship at 2%. This landing strip seems very far away with FOMC members seeing the rate at 4.6% by the end of 2024, 3.9% by the end of 2025, and 3.1% in 2026. So 4.6% by the end of 2024. We are at 5.33% with the rate at 5.25% to 5.5%. So to bring the rate down to 4.6%, obviously, this is indicative of two, maybe three cuts of 0.25% left this year. We started out the year thinking it would be 5 to 6 cuts. With a hot economy, stocks not looking weak, 3 cuts seem like it would overstimulate the economy. Not something the FOMC and Fed would want to do. This is why I think 3 cuts are crazy, let alone 1.

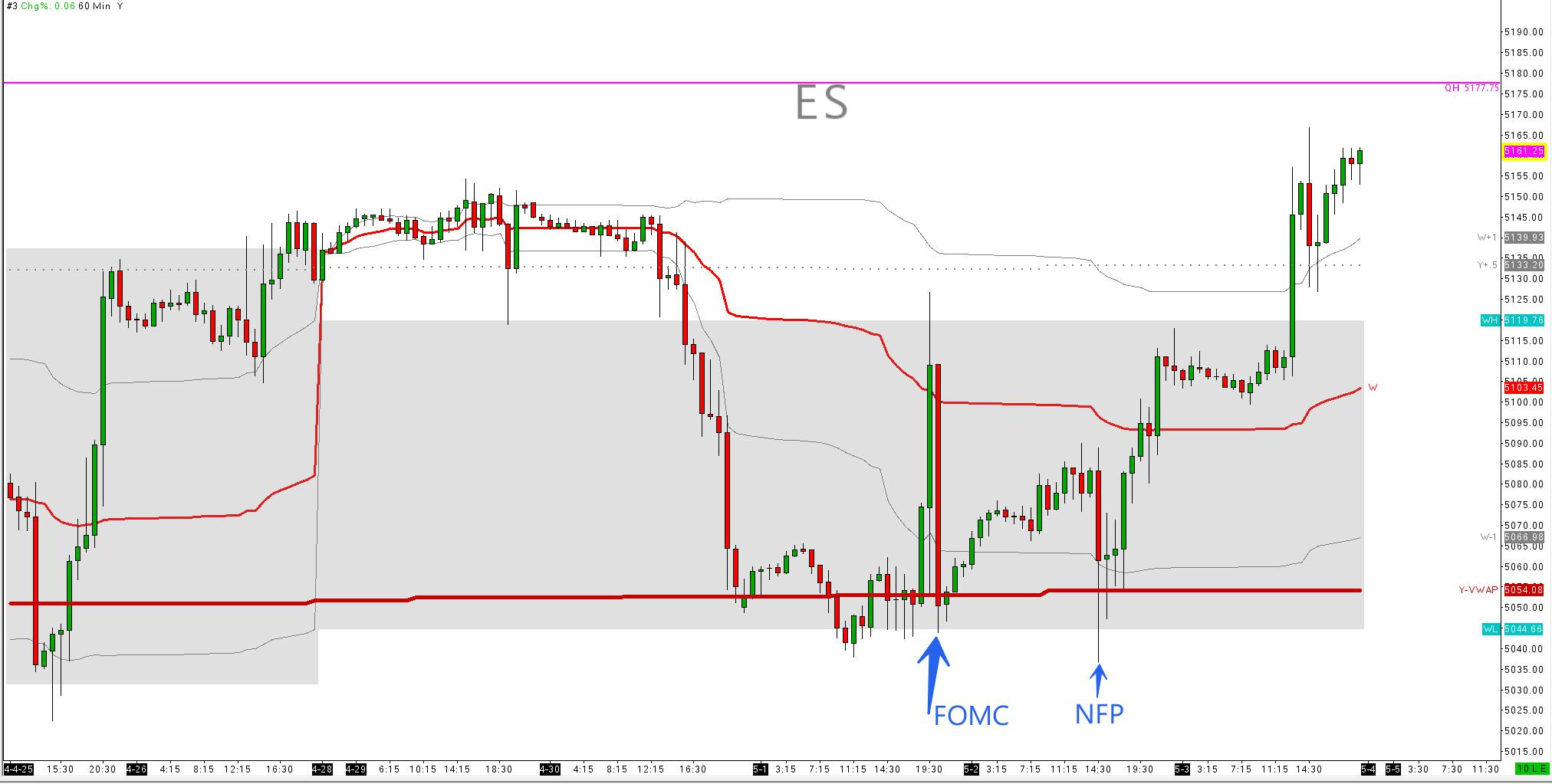

Yet, the market does what it does. There was no perceived weakness, and we had a nice yet unsustained bid up off the Year's VWAP to hit Weekly PVAH (Prior Value Area High), then straight back down before the close to Weekly PVAL (Prior Value Area Low). See 30-minute chart below. It seems fitting that the ES had pulled back to average pricing on the year to then pause, get the FOMC statement, then start to move back up. This, to me, says only one thing. RELOAD AND GO!…………..UP. Except for one thing to come. NFP two days later

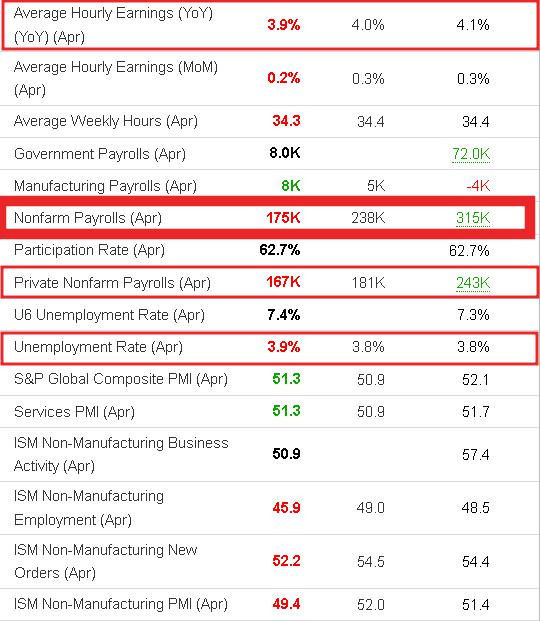

So let's look at why they would cut. Jerome said, 'An unexpected weakening in the labor market could warrant a response,' i.e., a cut. Well, NFP this week came in weak.

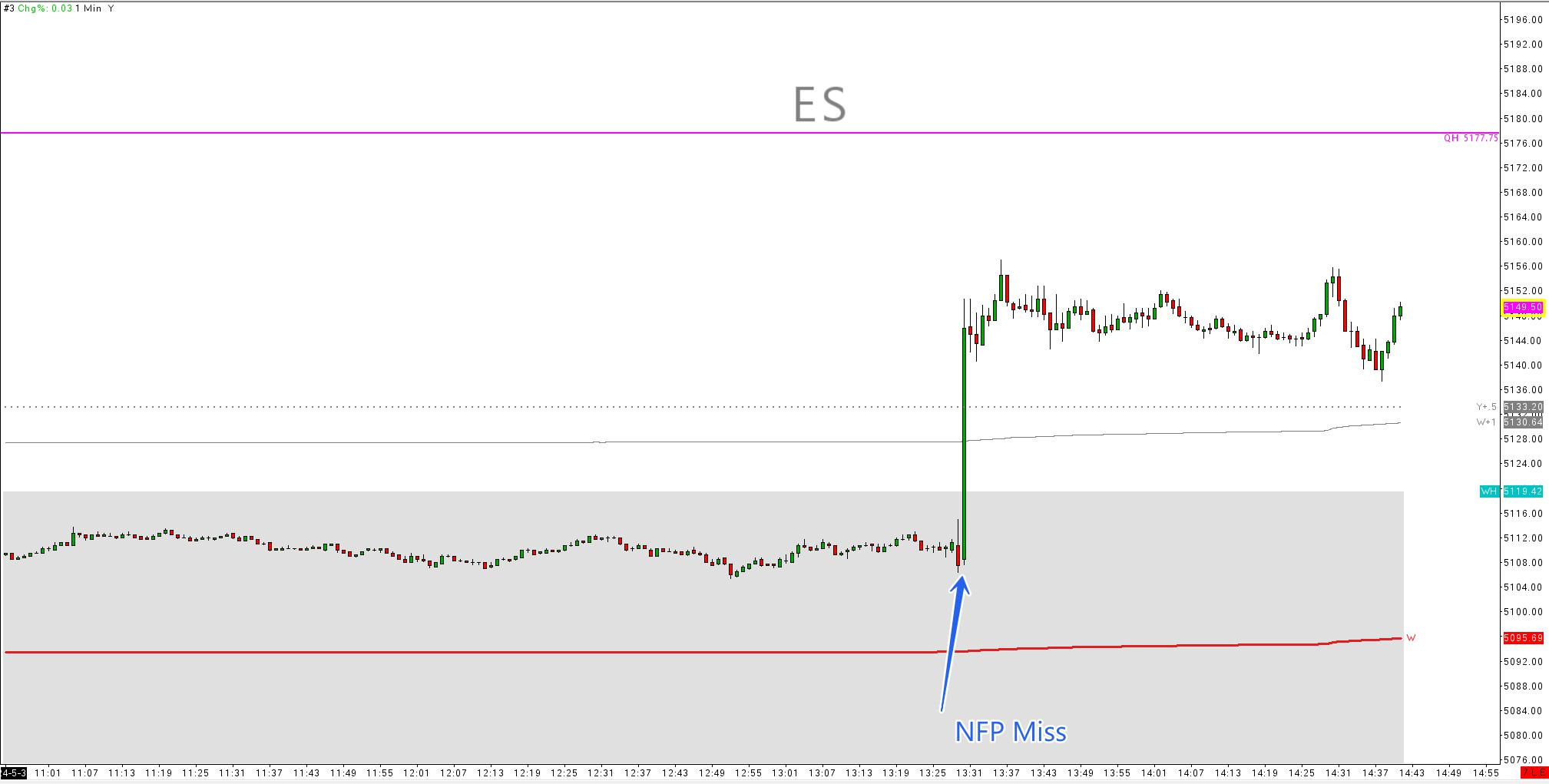

It was no prize for guessing what the reaction to the weak NFP was going to be. Up.

So now we come to this week. A largely quiet week. I think there will be a focus on Thursday's jobless data in light of the FOMC comments and the weak NFP. Will there be signs of a rising trend in unemployment? This will be bullish with FED protection standing by. In reality, there is always Fed protection. There is no such thing as bad news in these markets anymore!

ES M24

With the volatile week out of the way, we can see that ES clearly picked up a reload of buyers at the yearly VWAP from the daily bar chart below. This says to be that we keep on trucking up. Short term targets up are Q-PVAH $5177.75. The market should book some profits here. Then decide if it wants to auction down from this point, or blow out sellers and move to the more likely turn around point of Yearly +1 deviation. $5212.75. The latter being a great technical point for the market to turn down. But lets zoom in on the weekly as last weeks auction was great.

You can see in the 30-minute chart here, a wonderful technical display of the auction within the WEEKLY PVA (PRIOR VALUE AREA). I must repeat, the technical setup for these areas is extremely precise and must be checked regularly for the right time settings and tool settings. If you are off on any of the settings, it can be the difference of 5 times a day trader's risk.

The PVAL (Prior Value area low) was also bolstered by the Yearly VWAP overlay here. This week, WPVAH should be about $5141.00 and PVAL $5065.75. I will be looking for a well-timed buy at W-PVAH to then rally higher to Q-PVAH $5177 and hold this for the week. If this fails to hold on Monday without a test of the $5177s, this will tell me that the market is repricing down coming into the jobless. So, if we get a weak Jobs number i.e. rising unemployment, the market can rally from around the W-PVAL $5065s. I will keep a close eye on how we trade on Q-PVAH before jumping into anything, but I think it will most probably be too expensive a price for me to chase longs up there. I would rather attempt a short; however, I don't yet see that transpiring.

Energy

Opec+ Are likely to maintain the existing cuts of just over 2million bpd for another 3 months. As John Kemp from Reuters has said in his recent note-

‘‘The tightening of petroleum supplies and depletion of inventories widely anticipated at the start of the year has failed to materialise so far’’.

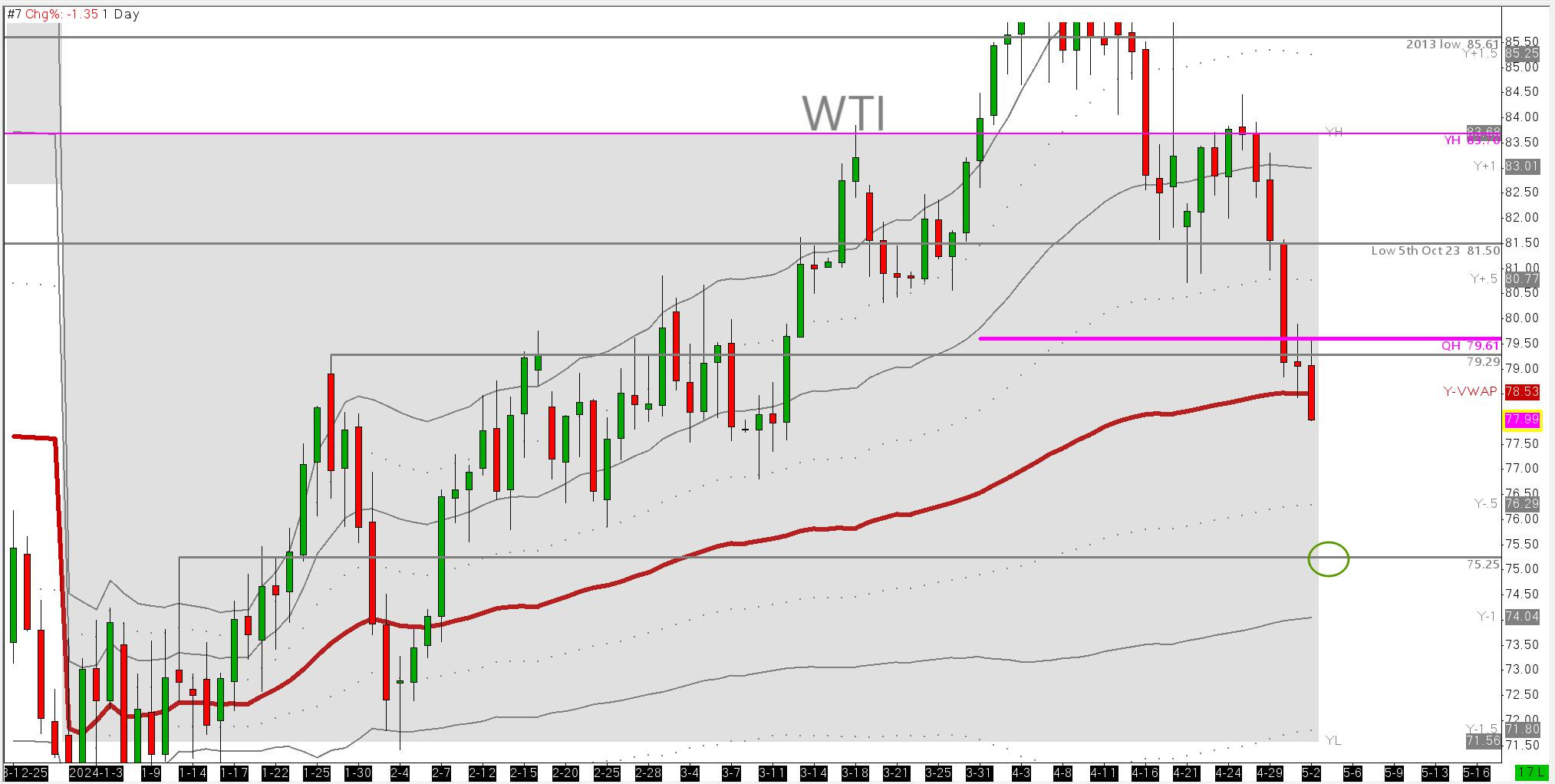

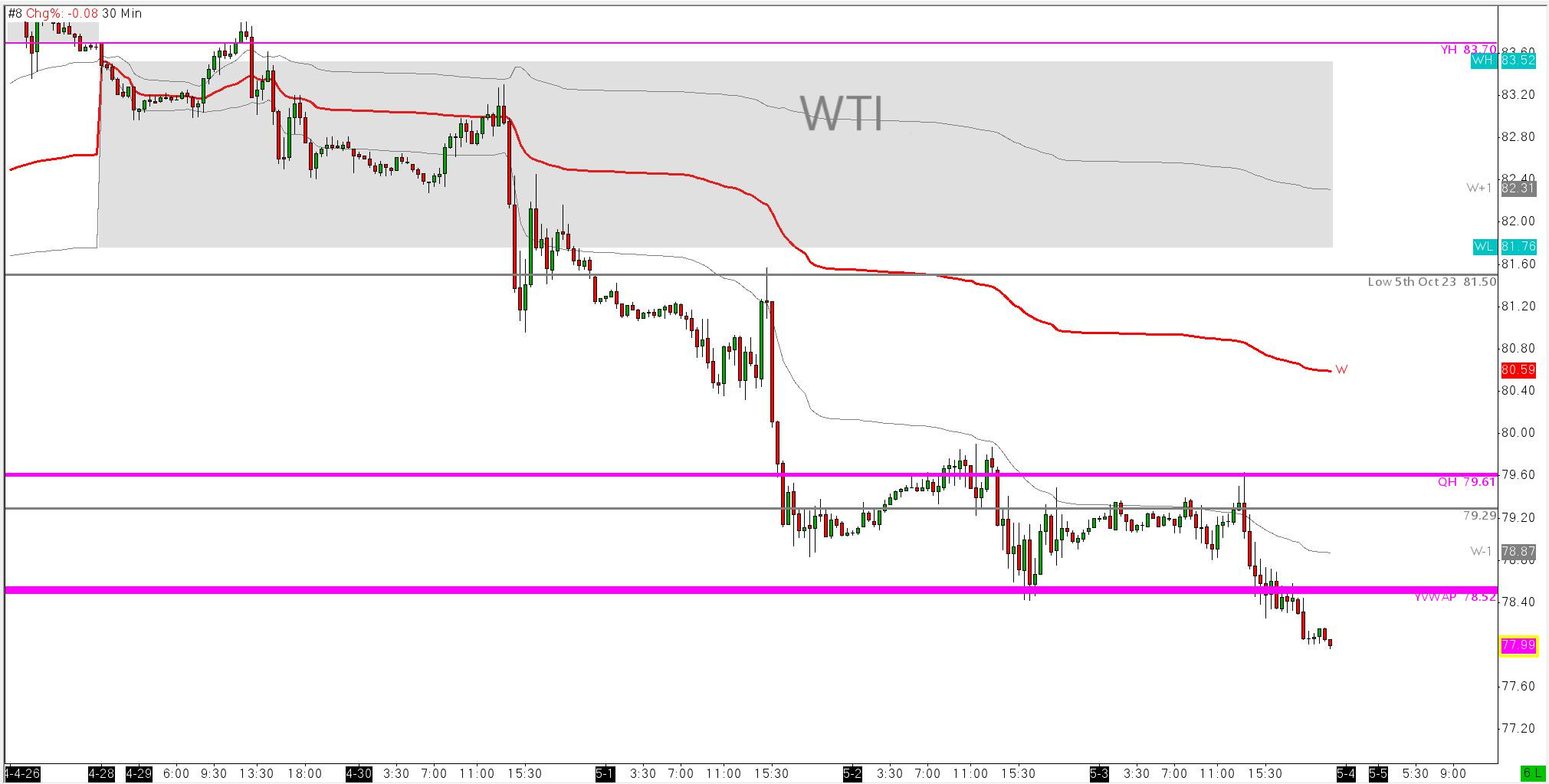

With the middle eastern situation having calmed down the Iranian front, we dont have any material risk to supply to sustain prices above the prior quarters value area high. Currently now $79.61s. This to me makes sense given there was a lot of geopolitical heat in the price. It does however leave the question of, well where then is value?

As most of the DC trading room know, oil was one of the great pleasures of trading for me this week, and then as is with trading, one of the great educators. Our plan from last week’s report was. ‘‘The market should technically over the week go lower’’. No great assumptions there with an extremely weak looking oil market.

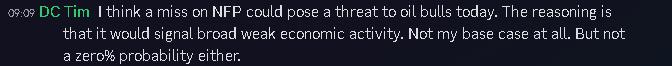

I was short this market most of the week. Overweight short the M/N Spread. This worked beautifully down to the Yearly VWAP target $78.53. When we got to this point, my plan was to flip to neutral wight long the M/N spread. Early signs of support here was misleading and I was eager to get overweight long. On Friday morning when we had not come in at 8am to see a bouncing oil market, the writing was on the wall. I wrote in the DC discord to the team

There was some interesting buying on Thursday, but the bounce did not happen and instead sellers took control swiftly on Friday at Q-PVAH $79.61 and brought us down to make new lows on the week.

This market is weak. Much weaker that I had anticipated. So for this week, I want to see one of 3 things.

Market fails to hold below Y-VWAP 77.99 and moves back up over Q-PVAH. Essentially washing out the early buyers on YVWAP like me, then going up.

We test resistance at Y-VWAP 71.99s area, maybe $79.29 the high of 28th Jan 2024, then go down for the week, to find buyers at $75.25 High of Jan 11th.

We lean against the weekly PVA structure which should be $82.31 hi to 78.87 low. If we struggle to hold the low, we short and hold the market imbalanced down.

So lets take it easy this week. Get some sunshine on our skin and be game ready for the opens and Thursdays initial jobless. Its not all about trading and sitting at the desk. We do this so we dont have to be chained to the desk, so that we can spend more time with the kids, riding our bikes or doing the other things that we love to do. Its when we get this balance right, that we can get our balance with the job where it needs to be!

More great insight, thanks...

Oil buying has come in. Be careful out here. Best play is o remain long the front time spreads, buying dips. If we can hold his posiionin over the next 48hours it will pay out.