Waiting for bad data.....

will it ever be bad again?

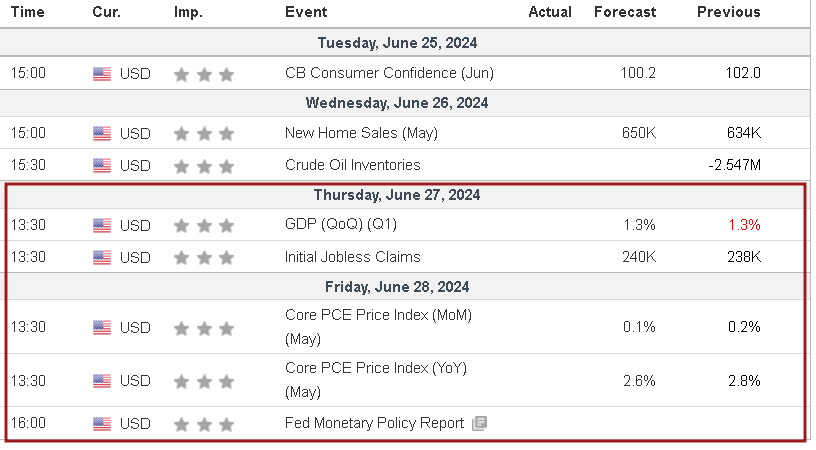

Waiting for bad data…will it ever come? I dont think so. Focus this week is on Thursday GDP prints out of the US. The bulls will obviously want a good reading here to stave off any chatter of stagflation OR hard landing etc. Keep in mind however, these markets have gone up on poor/ higher jobless and down on good/ lower initial jobless. Will it be the same for GDP? Its all a guessing game as to Fed interpretation of the data. This is why 1+1= chicken.

Equities

ES U24

The bulls are not only in control, but they are in hog heaven I would say. Data is close to absolutely perfect for slamming high upon high. The one small crumb under their mattress however may have been last week's Service PMIs which came out a strong bUSWe have see a weakness of small amounts come into Equities on the back of this, however the DOW has seemed to hold onto a good strong amount of buying in contrast to the ES, NQ and RTY.

I have outlined on the daily chart my concept for what is happening. Basically we are getting trapped back inside of Yearly +2, which may lead to a move back down to pick up buyers at Y1.5 or even lower at Y+1 and Monthly PVAH. It will all depend on the GDP results to come this Thursday.

ENERGY

CL Q24

Energy is now in the aftermath of an oversold OPEC+ and the sellers have officially used up all the sick bags. Buyers are in control and demand is NOT as weak as anyone had been trading on the back of. The much rumoured death of oil has been grossly over done. We will continue to print higher on this run.

My concept this week is that we have a solid rally from any good higher timeframe base. Such as the Yearly VWAP.. Q-PVAH is also a good candidate. Trade guidance as below. As always, please utilise daily vwap as a strength or weakness filter to the general day and monitor the market above or below daily PVAH or PVAL. These are tools that I teach my traders to use when it comes to timing the entry and sometimes the exits or stops. They provide you with a robust blueprint for where, when and how to put on risk. This is what we cover each day in the DC Discord and this is precisely why we charge a fee for this.

NAT GAS

NG N24

Nat Gas is interesting at the moment if we have a look at the trade on the Quarterly auction. The market had a very strong seasonal bid through May, in anticipation of the summer season and air conditioning/ BBQ etc demand.

Looking at 30 years of lookback data, we can see that she has traded almost perfectly against the analogue.

I expect that we simply can not hold anymore over the Q-PVAH $2.771, and now with the market opening below here this week, a test of that level should be sold, providing a great risk reward trade for the market to trade back down to average value on Q, around Q-VWAP $2.359

I am being brief this week as I am actually off today for lack of interesting data, but will be back on the desk tomorrow. Focus this week is for sure on Thursday trade. Please be mindful that the markets may want to wait for Thursday's data in order to provide the catalyst to sell down on these markets. Oil however will, as always, do its own thing….and thats why I love it.

As always, only take the good trades…….Keep it tight.

Trading is waiting, Waiting is trading.

If you are interested to learn more and develop your edge, please check out our courses on the Duggan Capital website.

3 Month Alpha VWAP course. 3 months at £275 or £825 one of.

12 Month Alpha Edge Course. 5 days free trial £250per month or £3000 one off.

4 Week Alpha Pro Course. 4 Weeks intensive learning.

All courses include full access to the DC LIVE video trading Discord which is normally $200 US per month.