Weapons hot!

Chinas economic bazooka- Israel stretching

Focus this week on Fridays NFP. The usual important precursor data on the run in will bring moderate volatility. This weeks jobs number is expected to be around the 140k marker, however some better followed analysts have it nearer to the 300k marker and I would tend to agree.

There is a saying that When China sneezes, the world catches a cold. In the last few reports I made reference to this over the state of oil prices and global manufacturing US, China and Europe. Well, when China shoots adrenaline straight into its arm, the world tends to jump out of bed dancing. And that is what we saw last week. China is injecting $142Billion of capital into top banks. This was a shot in the arm to say the least to equity and some commodity markets on Thursdays open. It was a simple trade to buy and sight of weakness in equities and ride it out. Our best trades this week were in RTY. We post trade fills daily in our room and discuss these trades in real time- before, during and after.

DXY Dollar Index.

The weakness is obvious even to Stevie Wonder. Yen has found new risk and China is unloading a ton of high grade sugar on the markets. Time for the DXY to take a back seat. There is no risk that will see flight into USD at this time. In fact, if anything, the big risk here is that there is a flight of capital out of DXY assets and into emerging markets. DXY held assets might not be so attractive. I hesitate to get any further into a DXY chat as the death of the world's only globally traded currency has much been talked about over the years.

As we zoom in on the days here, we can clearly see we are imbalanced down on the year. This picture is set to continue directionally with selling of rips to be done through to the end of year I think, unless we have a full on WW3 bringing Russia and Iran into wider conflicts. Watch this space. The DXY is telling us something.

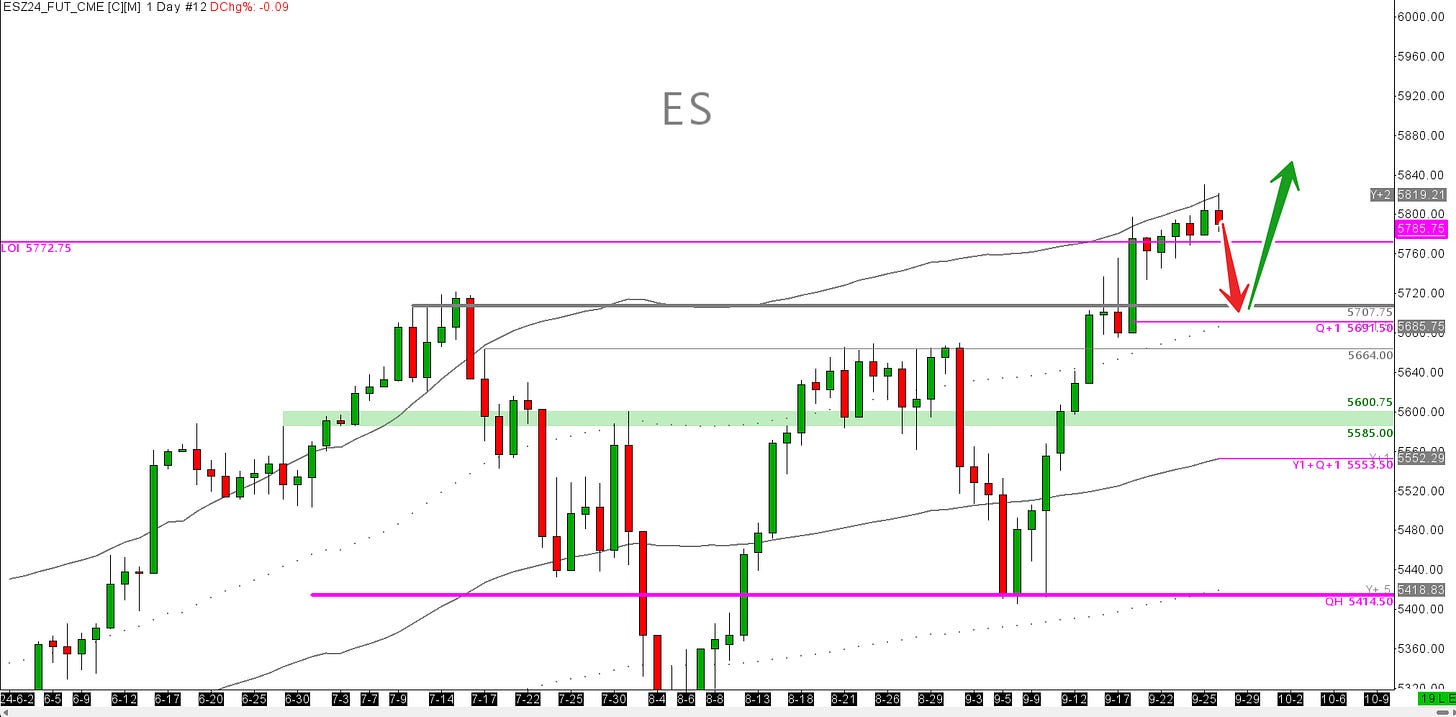

SS&P500 ESZ24

I see that the market is really pricing in a lot of positivity at the moment and so it should. I do always look to buy pullbacks intraday to get into these trades and I am always overly cautious about how high I am willing to buy such a pullback. Over the last 12 months, I have seen these markets not give very much of a look back/ pullback to allow us into the trades. I think this week however with NFP on the roster, I'll wait and wait and wait as I think the best value trade will either come early with a deep value pullback to the Q+1 area $5691 or it will wait until Thursday to do so. It is impossible to predict these things, but it is my job to be at my desk and awake when it does happen. As per usual we will be utilising every part of our edge to provide us with the best risk rewards entry. Look to M-vwap for good support. M+1 from the 30 min chart will have some initial buying, but it will be best left alone until Friday I think. $5722 was a hell of a level on 19th, 20th, 23rd, 24th. If we retest it, expect some initial buying. There is a 50/50 chance this will be all we get as pullbacks go.

Russell 2000 RTYX24

The Russell 2000 was a great market last week. I think it may be time for the market to calm a little before we get NFP. There is a goldilocks picture in terms of data and the RTY should benefit but overall China stimulus does not translate to the small caps in the way it does to the big caps. So it will be a bigger calming effect to hit the small caps this week with time to rotate back out of small cap into big cap stocks.

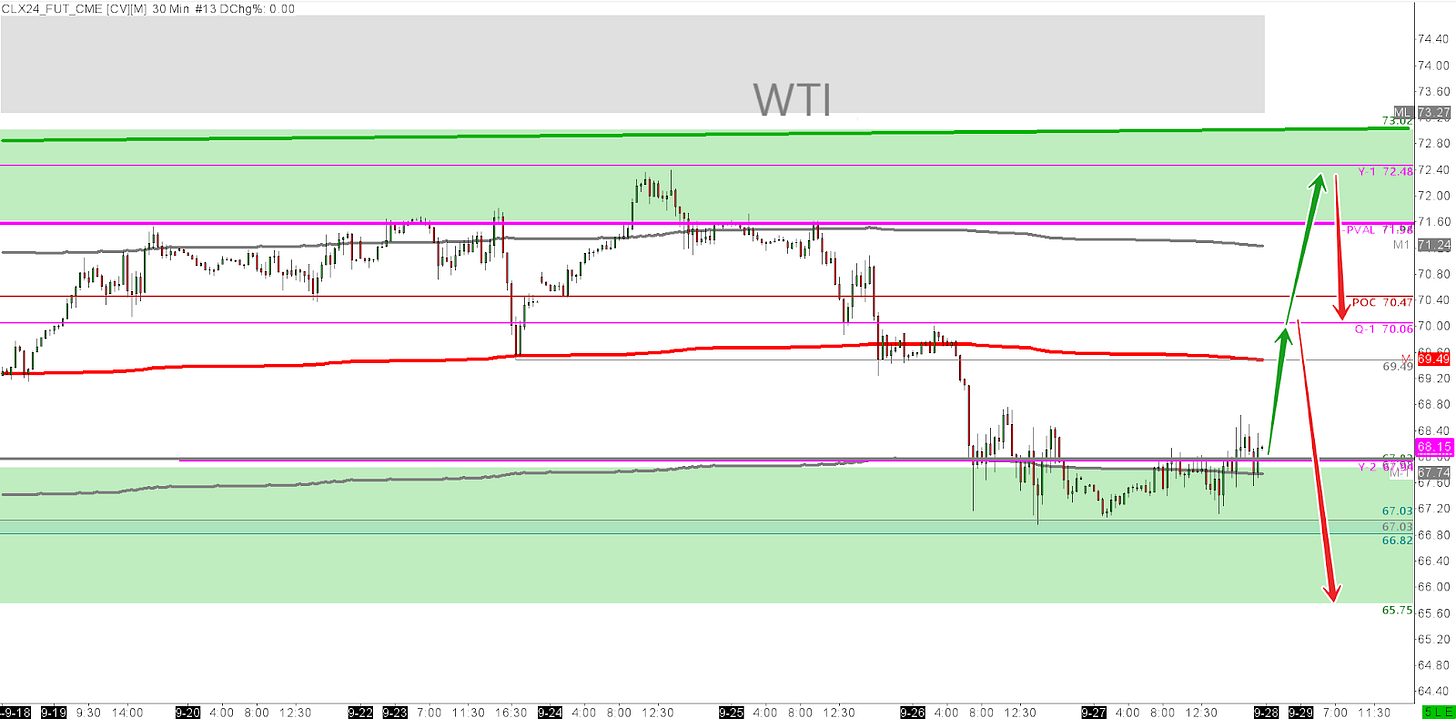

WTI OIL CLX24

We had a good spin last week on oil to hit the upper resistance again of the Y-PVAL $71.58s. Then the sellers did indeed come in hard and fast from there. I did say in last weeks report that I did like the upside, but to be cautious and attentive.

‘‘WE MUST HOLD ABOVE YPVAL 71.58S FOR THIS THESIS OF FADING THE MARKET POSITION TO WORK. NO EXCEPTIONS. Otherwise, we will sell off the $71.58s and go sub $68s before the week is out.’’

With the wash out now done on the YPVAL, We have opened the pandora's box of imbalance down on the Year. Not a situation to be a medium term holder of oil contracts. The direction of travel is firmly down. HOWEVER, with the assassination of the leader of Hezbollah over the weekend and the bombing of Yemen targets all by the Israelis over the weekend, the geopolitical risk has turned up a strong amount. As always with oil, it is the supply risk that is of great concern when it comes to war risk. Can supply lines be maintained? Can sea borne barrels make it to their destination? Can pipelines be safeguarded? This is what really drives price.

So we have to ask these questions when it comes to watching prices. The market will price this in and out extremely quickly. During the gulf war, the best bid in oil was gone and the new highs on price were abandoned by the market within 48 hours of the invasion. When the Huthis used drones to successfully attack Saudi refinery facilities on a Saturday,, the high was put in within 4 minutes of the reopen and selling was the best position for the rest of that week. Don't get caught on the dumb money side of price.

Enough chat.

Oil has been enjoying the $68s area as support since Q2 2021. With a last great test of this area in March and June 2021. Can we hold this area once more? Without this level of geopolitical risk, I would say absolutely not. With OPEC+ Abandoning the $100 price target and allowing more production, it wouldn't make too much sense. Lucky for us, we don't trade on anything making sense. We don't ask how the wave was formed, we just are ready with our board between our legs, ready to surf the wave.

We have seen support come in on the June 2023 lows, however we did not see a strong reaction from this area. I am going to wait to see how we reopen and how the Huthi and Iranian response shapes up before looking to take any serious trades in either direction. However, should we have a hot and fast rally, I will maintain selling against the Y-1 $72.48s and potentially the Q-1 $70.60.

NAT GAS NGX24

Nat Gas has had a hell of a month in September. I am going straight off a technical look here and I think we will hit the Y-PVAH $3.099 this week. Then some take back calm down type of selling can happen here to then rally back out over the coming month.

Its just another shift this week really. I think we are still feeling the effects of the release of the tightening cycle. Easy to see in the housing data but this may start to change as real rates will translate down over time now for buyers. Oil will be a hell of a market to trade this week Monday through Friday. It is late here. The kids are sick with the expected change of season coughs and bad chests. So Im going to head off.

Most of you have probably seen this Paul Tudor Jones documentary, but if you haven't, this is a must watch.