Why spend the extra bullet?

Market over pricing cut

This week is the big one of the year. All eyes inside and outside of the financial world will be focused on The FOMCs rate decision. You don't need me to tell you that the widely held expectation is that there is a 25bps rate cut lined up.

Before I left on my trip, the pricing (as per the CME FedWatch Tool) was that it would be 25bps. The pricing has now moved to a 65% probability of a 50bps rate cut.

Personally I think this is insane, as it would almost be inflationary to bring such a heavy cut to start a cutting cycle. Last time I checked, national monetary policy was not something I have on my C.V. So let's see. But my plan is that if they do a 50bls cut, this will cause a rally in equities. If they do 25, we will have a smaller short rally followed by selling pressure.

With all of this said, I don't want to add to the FOMC/ Fed prediction rhetoric- what they should or should not do, what they might do, what this and that means. I just want to stick to where I see average volume acting as support and resistance, then take action when one of these fails to do its job. My style of trading is 85% technical, 10% macro. 5% I'm pretty sure I know what happens, so nothing else matters.

Please be aware that this FOMC will introduce a ton of volatility and levels in a lot of places will get blown out. So my read on the market will have to be updated several times this week. Not only will FOMC blow a strong wind on these markets, but the BOJ Meet Thursday/Friday, followed by Quad Witching on Friday.

Next week's report will be a more interesting one from the perspective that a lot of flows will have gone through the market. We will be able to sail in calmer waters.

ES Z24 SP500 DECEMBER CONTRACT

The market prices in 65% probability of a 50bps cut. Personally I think this is too much and that the Fed would only be inviting trouble to do such a cut. I can see where the market looks for this with recently wobbly employment data. Cutting straight to it, I think the market has been and is currently pricing in the 50bps cut. If we are to get it, the market should do a classic ‘’Buy the rumour and sell the fact’’. I.e the buying is done into the event, then when we get the confirmation of the expectations, the dumb money buys, while the large participants now sell on the confirmation, dishing out sickbags to everyone to puke out of their dumb longs. I have seen this too many times to ignore this as simply the way futures markets work. It is afterall 65% probably as per CME. This basically acts as a tool for what is priced in.

If we then look at this another way, if we get a 25bps cut, this will disappoint the market and we may see selling hit the markets faster than a 50bps cut. As you can see from the charts, either way, for me the market has to hit a new all time high up at the Q~+2 confluent with Y+2.

On the 30min chart, I am looking for that new all time high first, then pullback to MPVAH, However this may happen in reverse. We sell down to MPVAH first, pick up buyers, then rally to a new temporary all time high, then sell down.

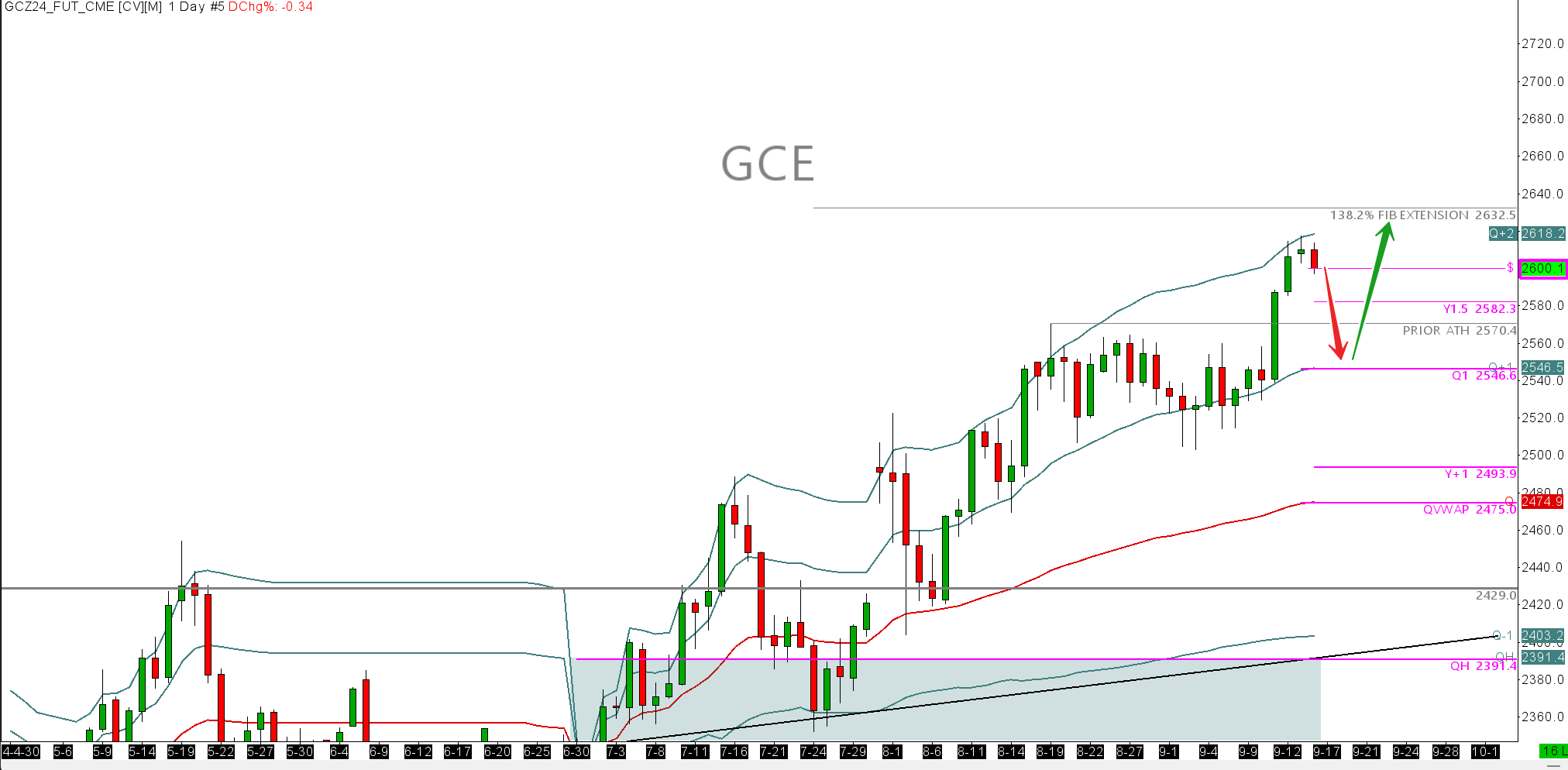

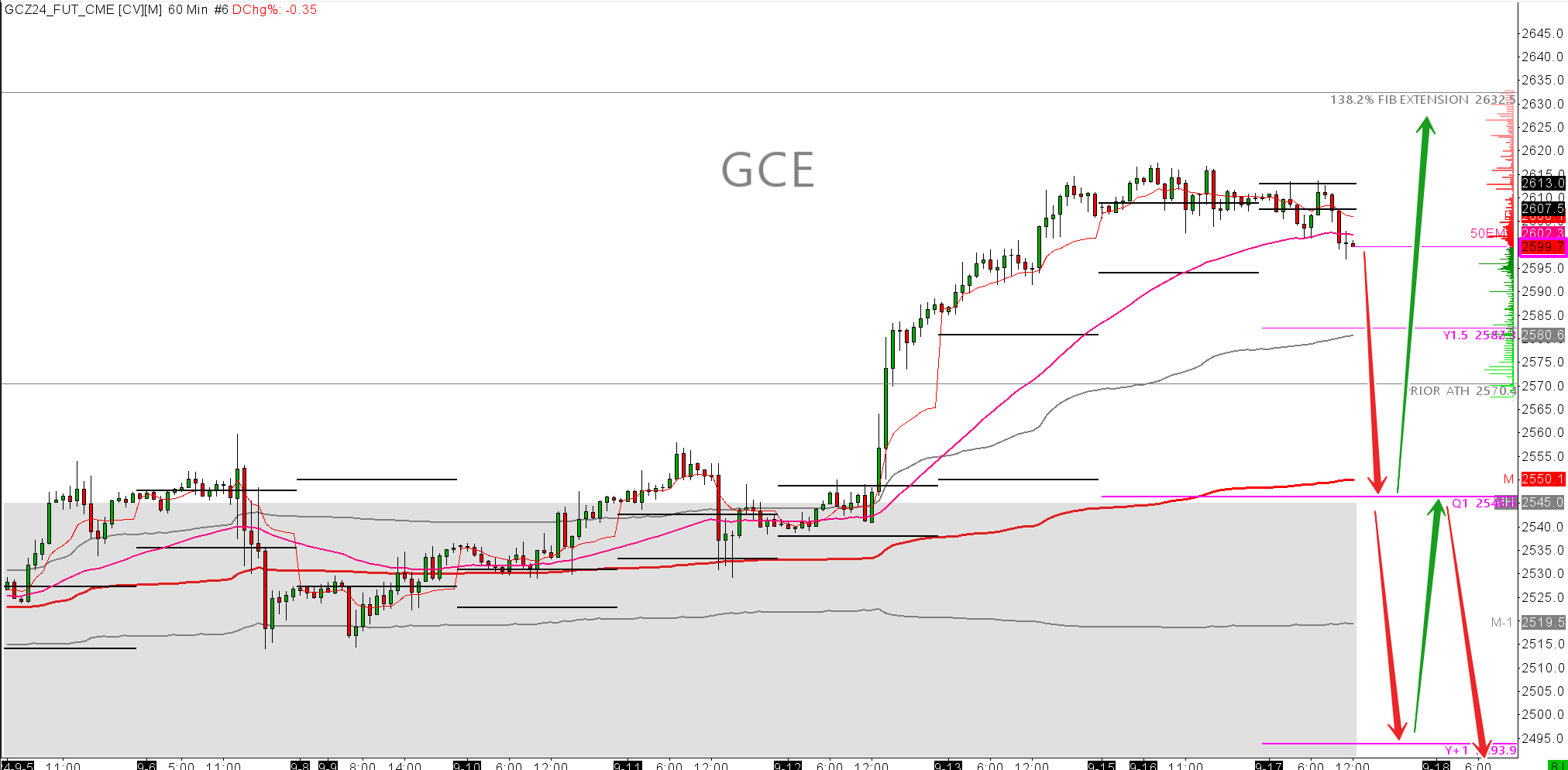

GCZ24 Gold December contract

Gold will be a very difficult trade over the data and presser. Personally I see the actual rate decision statement release as the great scalping opportunity that is over and done with very quickly. This event promises that the 30mins between the rate decision and the start of the press conference will be an incredible show of the market wiping out tons of dumb money and should see massive flows both on the bids and offers. Please if you operate intraday, do not trade this release. WAit for the press conference, but ideally, I would wait for Thursday to take better opportunities.

We should see a nice dip on Gold. This has been a great flight to safety from the higher inflation environment, however this may be coming to a close. This is not to say that now gold should crash back down, but it is to say that the driver and catalyst for Gold may change a little. The primary focus when trading gold for me is one simple thing. It is strongly correlated with the real yield. So should the 10 year US bond continue to rally, so will gold. I think it will, but the question is, how deep will the pullback be? Have a look at the charts for where I think this could happen. The largest op would be Q-PVAH Long $2391. I just think this value is so deep that we wouldn't trade there.

WTI X24 November contract.

While I have been away, oil has certainly been through the ringer. The spreads X/J has held up pretty well I have to say. Ultimately I think oil has been weak on the back of poor Chinese demand. Data out of China has been strange with several economists noting that it might be so bad that the ruling party is holding back very ugly economic data. The oil market however will have a better insight via usage and shipping data. So despite the Libyan situation, this is why we are down. I don't see this changing any time soon. I think the populous consensus is that global demand is dropping off a cliff and the forward demand curve is starting to flatten out on both the OPEC and EIA curves. Before September, each organisation had differning demand curves.

The trade on oil should be to wait for oil to re-test the Y-PVAL $ 71.57 to look for shorts and continue with the imbalanced down market. It may not be that easy. Looking to the 30mins, I do see there is an opportunity to buy oil as it makes it back up there. Personally this week, I am just taking some scalps and getting into spme front month cal spread positions with also some good buying ops on the X/J spread.

Sorry to be brief this week, but given the context of FOMC, it will be a week to be happy to get past, we can then identify some good posiotioning in the wake of larger flows yet to come.

You can join us live in the Discord everyday with live streaming of my charts and av feed. See what trades we are all taking and avoiding. Reach out for a free months access info@duggancapital.com

Have a read of this article from the FT on what will happen if its a 50bps cut. Worth a read.