Controlled Chaos

Repricing new waters

Thanks for reading! This newsletter thrives on your support. If you find value in it, please like, share, and subscribe to help keep it going. If you like these reports, please do like, share or leave a comments.

In this report: Downside done?? Mag7 price chart, Vix, inflation. Price charts for VIX, ES, YM, RTY, GOLD, BITCOIN

''Germany is back.”

German Chancellor-Friedrich Merz March 14th 2025

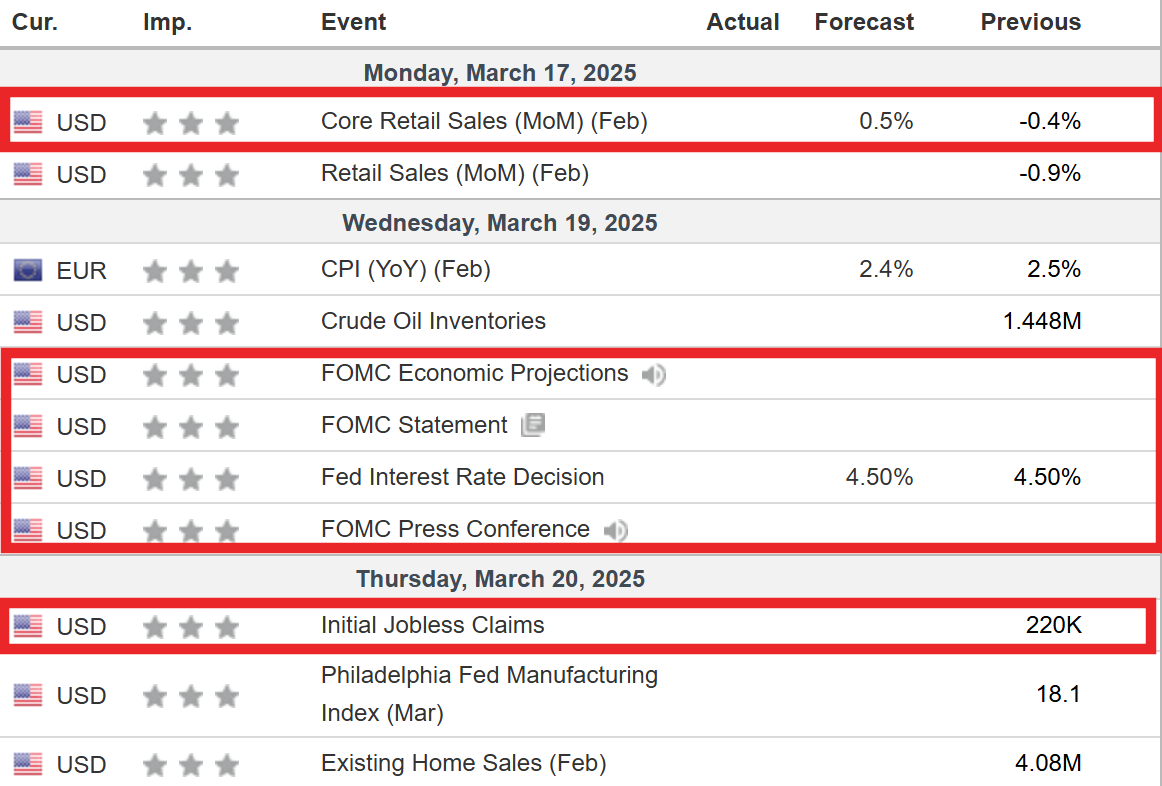

Calendar

FOMC ahoy! Expectations are for no change to the policy rate which is 4.33% with prcing moved to July for the next 0.25% cut.

Earnings

Nike NKE 0.00%↑ , Fed Ex FDX 0.00%↑ , Accenture ACN 0.00%↑ and Carnival corp CCL 0.00%↑ to come throughout the week, nothing of great concern to broader futures markets.

Articles

Germany’s Merz secures breakthrough on gargantuan spending plan

Worst German Bond Rout Since 1990 Prompts Selloff Around World

Video: S&P breaking down major trends.

What Is the Mar-a-Lago Accord?

US Inflation outlook

Gold prices are being driven by flows and central banks

Second wave of AI Factories set to drive EU-wide innovation

Macro

We will have an upside pullback this coming week driven by the German spending bazooka of up to €1 trillion in new spending.

Yes, a certain amount of this was priced in last week; however, a cloud of ‘when’ hung over the markets. Initial rejection earlier in the week by the coalition Green Party was then agreed upon on Friday. This acted as a tailwind for global equities. In the case of U.S. equities, they have broken uptrends and will meet heavy upside resistance at the levels I look at below.

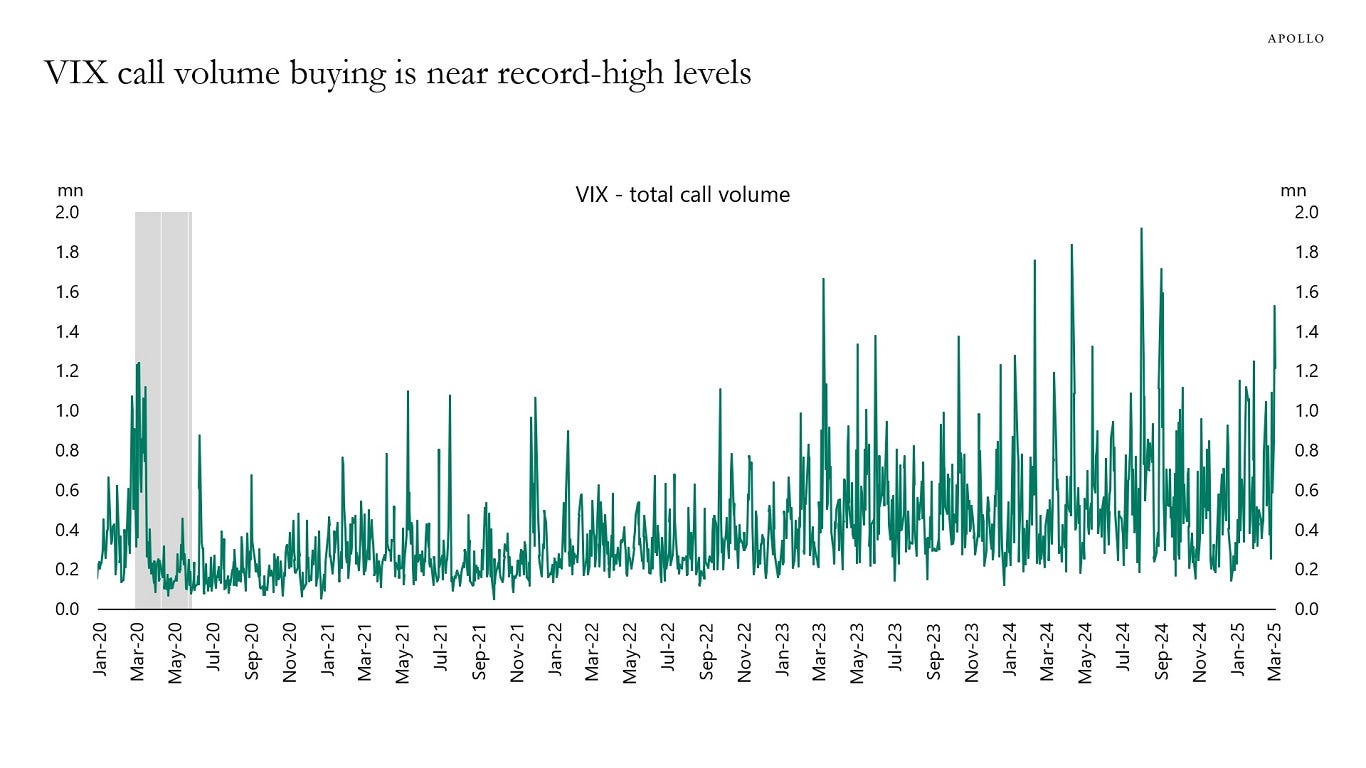

It is my view that we are in the middle, not the end of a strong correction in stocks. Seller of rips rather than buyer of dips. We have been monitoring Vix calls i.e long volumes have been moving much higher. I covered this move higher in my report ‘No guarantees’ 2 weeks ago-2nd March.

Just looking back at where the stronger liquidation on Mag 7 started, we can see that the miss on US Services PMI was a nice day for accelleration. One of 3 major inflections in this chart.

There’s a measured pace to this selloff—ES is coming down in a controlled manner, not the full-blown panic of COVID or Volmageddon where we would get 2 circut breakers in ONE SESSION, several times in the same week!. Traders and investors seem well-hedged with puts, so as we see false bottoms, some will start covering. But if we drop another 5-10%, those same players will begin lightening up their long equity positions and speed of decent picks up. In short—once puts get covered and the market keeps sliding, margin calls kick in! See VIX below

This is what happened

As an Irishman, I was interested to see our boy Micheál Martin not get beaten up in the oval office during the week. Trumps axe to grind is very much with the EU, rather than this Island. Micheál did well, walking the fine line of diplomacy and sales man. Highlighting that Aer Cap is the largest buyer of Boeing airplanes in the world outside of the US. There were a host of questions about the large trade deficit between the two countries and indeed this is where the nation held its breath, given that a change in tax policy for US companies in Ireland, would have an earth shaking impact on the 970 US companies in Ireland employing 378,000 people. In tech alone, EMEA HQs for Meta, Google, Amazon, Linkedin, Tiktok, Stripe and many more are in Dublin.

US inflation slowing

This week's U.S. inflation data came in softer than expected. Headline CPI missed at 2.8% YoY (prev. 3%), and PPI fell to 3.2% (prev. 3.7%). Markets saw a brief rally, with rate cut expectations shifting from June to July, however this was fully reversed within the hour and more downside printed. Powell gets a breather, but despite ES being 10% off ATHs, we're far from emergency cut territory—another 15% down would be needed. The Fed meets next week, with a 95% chance of no change from current 4.33% policy rate.

Counter tariffs/ Whiskey….not the whiskey.

The EU is firing back at U.S. metal tariffs with up to €26B in duties on American goods—steel, soybeans, beef, and yep, bourbon. In response, Trump’s threatening a 200% tariff on European wines. Meanwhile, Middleton Distillery (Jameson, Paddys, Powers, Redbreast, Yellow Spot etc.) has hit 100% pause on production.

Gold macro

On Thursday 13th, 2025, Gold per troy ounce, hit $3000. A nice time to see how ES minus Gold chart is looking. If you are long gold, you want this chart to continue to go down.

Trade

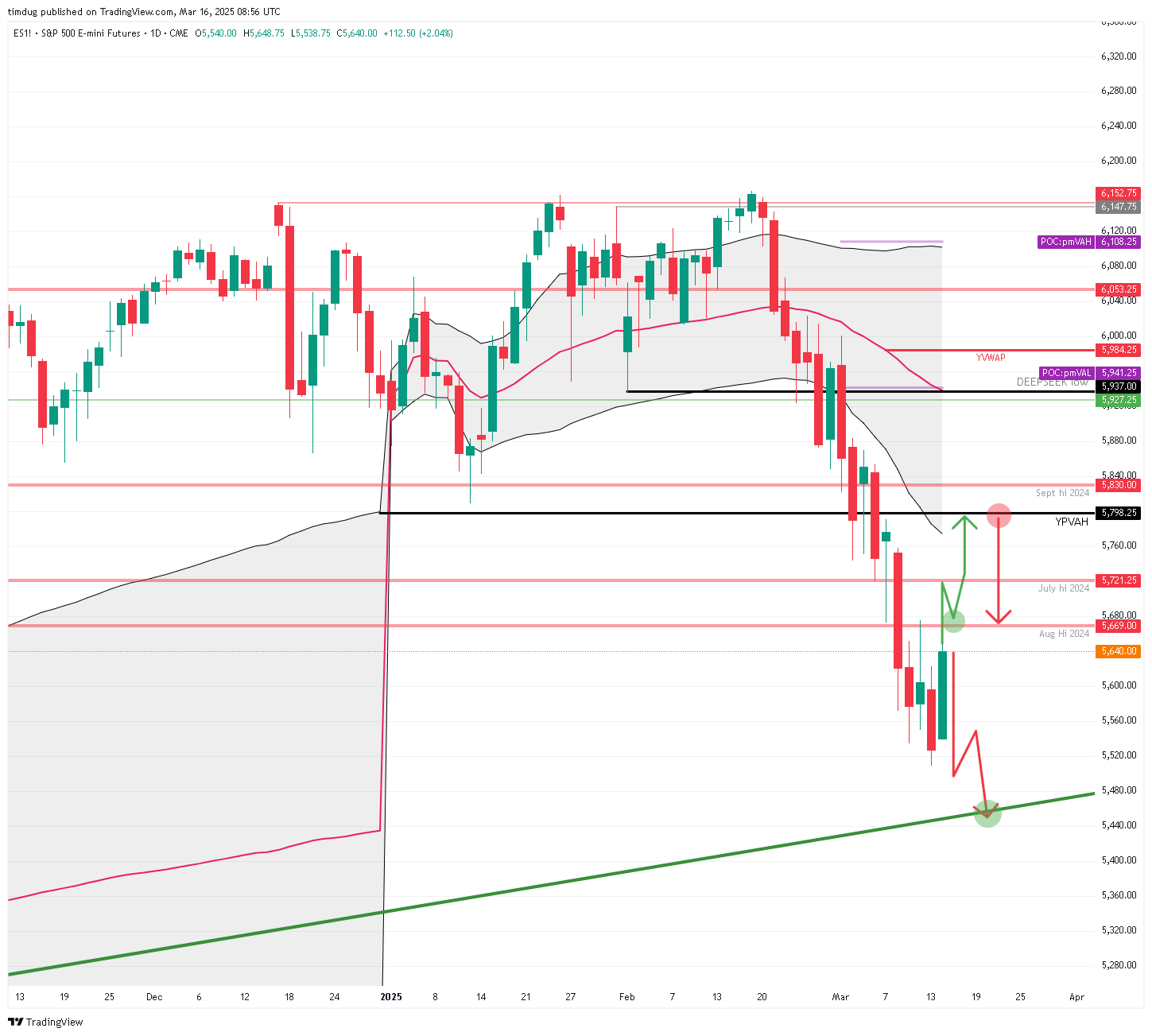

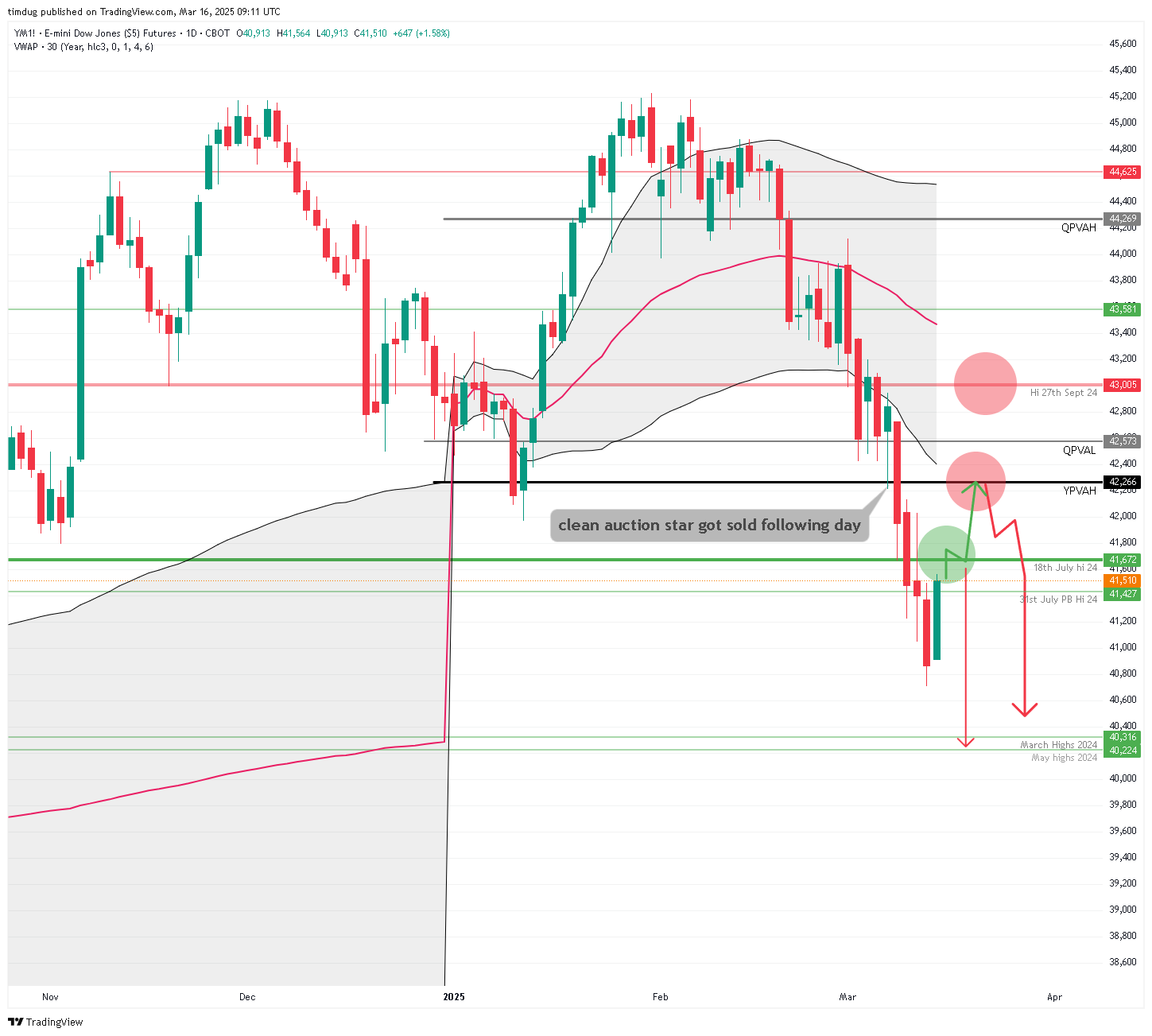

If you are concerned about equities, please be aware that we are auctioning down within each markets respective prior years auction. The probability of us auctioning to the prior low for me is 90%. How long will it take to get there? When will we get there, what are the pullbacks to fade to get down there? This is what I try to plot each week and why I write this report for myself.

Vix

ES

Selling at MVWAP may get lifted, with buyers pushing price to a more probable area for downside continuation at YPVAH $5,798’s area—a great place for sellers to reload. Watch VIX call volume here!

DOW

Pulling back here to YPVAH $42,266 seems probable to reload sellers for the first time, as we have not had what I call a clean auction start to the downside from here. The inverse was a clean auction start with this level acting as support from the low of the day on March 7th, which then got sold off the following day.

RTY

The Russell trade is wide and weak. Unlike the other equity indices, it has already completed a move down to pick up buyers at its respective YPVAL of $2,000. I would not look to sell anywhere in this locality, given the strong buying expected there. I anticipate a robust relief rally, potentially reaching at least the April 2024 highs of $2,167. Taking pot shots at shorts in that area makes a lot more sense. Depending on macro dynamics at the time, sellers may then get lifted, shifting short opportunities further up to QPVAH $2,339. Overall, this picture suggests staying long intraday until we meet upside resistance.

HOWEVER, being long or counter-trending is not my bag. We have seen weakness at the YPVAL—i.e., piercing—so I expect it won’t be long until these YPVAL buyers get handed the in-flight sick bag.

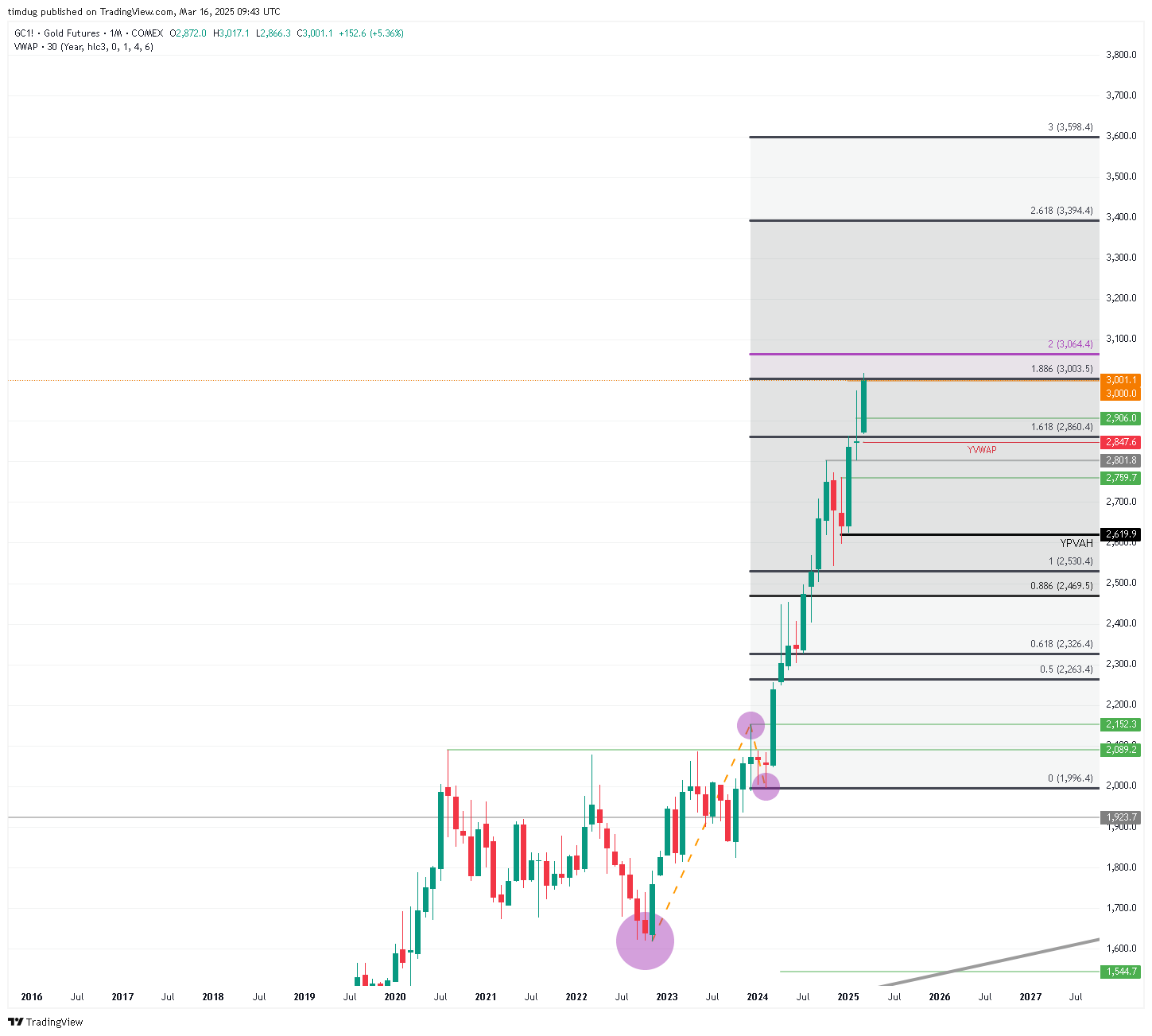

Gold

We have to talk about gold. I believe there’s more upside to go. With a pullback or without a pullback? Let’s see. Dusting off the Fib extension tool, it’s clear that rather than just hitting the $3,000 level—reached late in the week for the first time—we need to complete the 200% Fib extension at $3,064.

This would make more technical sense to me, as it could trigger a pullback to Y+1, where the imbalance to the upside will attract imbalanced buyers and algos. I have been waiting for a pullback to YVWAP for too long, thus missing out on the latest central bank-fueled rally.

Bitcoin BTC on CME

Trade on Bitcoin has time and time again shown that it simply IS NOT a risk asset. On every occasion, it has failed to be a haven. Even with a continually weakening DXY, there is no refuge. So let’s just give up that concept once and for all—it does its own thing.

That said, I’m taking the biggest VWAP view I know of and looking at it on the decade timeframe.

You can see that at current all-time highs, we have completed a 100% Fib extension from the November 2022 ‘Crypto Winter’ lows rally, which pulled back to the August 2024 low.

So, how to trade this? I’ll be looking for longs at Deca +1 $70,600.

Here is the monthly VWAP picture. This is not the type of market to have tight risk for multi-day or multi-week holds. Exactly why ‘diamond hands’ is the best working strategy—notwithstanding cross-exchange arbitrage being the best, but only accessible to sophisticated high-frequency trading shops.

Thats all from me folks. Wild times attract wild men and wild prices. Dont expect things to ease off at all this week.

Best

Tim